What Are the Biggest Reasons Why Traders Fail

There’s no unified statistical database of failed traders.

But, when opening a brokerage web page, you can often see a disclaimer like the one below.

Such dreadful data of losing accounts should give a glimpse of what the trading industry is about.

Actually, if you google deeper, the consensus from the web is over 90% of traders fail.

Let’s clarify something here.

What does it mean to fail in trading?

One way of looking at it is losing so much of your funds, making it impossible to grow your trading business.

Once you lose all your chips, you can’t bet, and you’re out of the table, period!

Another way to fail is simply to give up.

You can’t take it anymore!

Trading is too painful!

Markets just feel unbearably complex, like an untamable beast.

You can feel all this, but it’s the decision to stop whatsoever that makes it a definite failure.

If left unattended, several reasons may lead to failure in trading.

Let’s look at them below.

Wrong expectations

You should be concerned if you started trading to “make a quick buck” or “give it a try.”

People with this kind of attitude usually end up in that 90%+ of the losing majority.

Trading is a multifaceted skill, requiring a theoretical base and proper practical and mental habits.

Sure, novices can make some money from a random trade.

However, the odds won’t be much different from various forms of gambling.

Why bother with brokerage paperwork or figure out how to use the trading software?

Just go indulge yourself in roulette and blackjack; bet on horses, dogs, whatever.

Professional traders, though, aren’t gamblers.

It takes skills to turn odds in your favor in the markets consistently.

Think of high qualifications jobs 👇🏽

Commercial pilots need 1500 flight hours to start working.

After studying law for seven years, one can become an attorney.

Surgeons study for over ten years before treating patients.

And then a dude wants to get rich in a few months by buying and selling currencies or indices.

Isn’t that insane?

Give yourself enough time, don’t expect quick results, and treat trading like a business.

Only in this way, the failure in trading is less likely.

Poor risk management

Look, you can have the best trading strategy, equipment, and funding and still go bankrupt due to neglecting risks.

For example, in 1995, a highly experienced trader Nick Leeson caused the oldest UK merchant bank to go under!

The guy was betting on seemingly low-risk, overnight trade.

But, an earthquake happened, dragging markets lower and causing losses to the trade.

And that was the beginning of the end.

The world is uncertain, and black swan events happen.

Otherwise, why just not go all-in anyway?

Doesn’t make sense, right?

Pro tip: Even with a 90% (!!!) winning rate, there’s a statistical certainty of 3 losing trades straight over many attempts.

Three losses will wipe you out if you bet over one-third of your balance on one trade.

A complete idiot always risking 1% on trade will likely last longer in trading than a know-it-all genius always betting big.

No trading plan

Suppose you’ve got the right attitude to trading and can control risks.

Why would traders fail in that case?

Betting small for a long time without a competitive advantage may result in death by a thousand cuts.

So, there must be something that turns the odds in your favor.

Such an edge will cause your net P&L to stay positive after at least 50 trades.

How to find the edge 🤔

Through trading plan!

You need a structure for everything you do in trading.

Do you know in detail your entry criteria?

What needs to happen to exit the trade?

Actually, that’s just the tip of the iceberg.

The source of a setup you’d consider taking is a carefully collected watchlist.

On the other hand, the watchlist results from methodical, repetitive research.

Can you fit these processes into your daily schedule?

The trading routines should become like brushing teeth in the morning, effortless.

Then you’ll be able to free up mental energy for refining your edge.

Information overload

Most traders go through a stage of absorbing as much theory as possible.

And it’s normal – you need a theoretical base to choose an approach that resonates with you the most.

However, it becomes counterproductive when traders look at too many variables.

You might have a reason from one source to go long when the other method shows a conflicting reason to go short.

That’s why to make money consistently in trading, you’re not supposed to be overwhelmed by data when you trade.

In different industries, it takes between 40% to 70% of the information you think you need to make a quality decision.

You will never have all information in financial markets, so learn to deal with the realities of trading.

Otherwise, analysis-paralysis will spoil even a profitable trading strategy.

No development plan

Do you have a blueprint for your professional growth?

Markets evolve, so traders need to improve along.

Have you ever found yourself following a trading strategy, making money, but at some point, it stops working?

Often traders fail because they keep doing the same things, expecting different results.

Albert Einstein defined it as insanity!

That’s why you should plan when to review your trading performance and adjust your approach.

Also, good-old practices and drills are essential to traders’ growth.

At some point, routine “screen time” contributes less and less to traders’ skills development.

Think of professional racers; they don’t become what they are by only commuting back and forth.

They push themselves, adding challenges to a track and honing every little part of their driving skill.

What about traders?

Deconstruct your whole process into small elements and practice each.

Manual backtests help traders accelerate skills development.

Create a long-term plan for your practice sessions – give yourself a chance to stand out from average traders.

Otherwise, your trading career is at risk because “average traders” keep losing money!

Lack of resilience

A common reason for failure in any field is a lack of grit.

It’s the ability to keep going even when everything seems not working out.

People often just give up too quickly.

Although, it doesn’t mean doing the same thing over and over again is always right.

For example, you may struggle trading pullbacks in trending markets.

Don’t push it – try trading breakouts, change a timeframe or even look into another asset class!

Trading is like art.

If some color doesn’t match, you don’t want to abandon the whole painting.

Maybe it’s your palette or the way you hold a brush.

Moreover, such a reason causing you to ditch art altogether is ridiculous, isn’t it?

It takes years and many setbacks to become good at anything.

Winning traders just had enough resilience to pass those years.

The Best Ways to Avoid Becoming a Losing Trader

There are so many details contributing to whether traders fail.

It’s far from only a trading plan or a strategy.

You need to become the person that makes money consistently.

How do you become one?

Three things.

- Environment

- Mentor

- Structure

The three address any possible reason for ending up a losing trader.

Apprenticeship has worked incredibly well for nurturing professionals.

In the Middle Ages, the idea was to put a novice (apprentice) to work for a master for around seven years.

What’s special about it?

Let’s say a youngster wanted to learn bakery.

He’d get hired by a master, put in his bakery full time, and get daily hands-on experiences guided by a professional.

So, there was a live environment (dough, oven, etc.), a mentor (master) to copy, and the structure – the mentor would help to make sense of everything.

Similarly, we should get live exposure to markets and copy the mentor’s mindset and habits in trading.

Quality trading courses provide structure, connecting the dots between market events and what the mentor does.

Trading Course

A course should provide a solid reference point while you’re learning to trade.

You need to grasp many concepts, which can be overwhelming, especially in the beginning.

You may come up with some ideas and try them out in the market.

Will you have enough conviction, though?

It’s helpful always to double-check if it makes sense according to the course curriculum.

Following a course designed by a trader that consistently makes money in the market is powerful.

The very fact that somebody is successful using the materials you’re using will boost your confidence tremendously.

On the other hand, a good course usually offers some time-tested trading strategy to start off.

Don’t invent the wheel!

Moreover, the author of the quality curriculum should be accessible to answer your questions.

We’re all different, and sometimes even seemingly obvious trading concepts need more clarity.

Thus, live support is beneficial on your trading journey.

Finally, a good trading course saves you time sifting through tons of irrelevant information on the web.

How do you control losses in day trading?

Day trading can be intense, with losses accumulating fast if not controlled.

To deal with losses effectively, define your risk per trade before entering the market.

The fixed risk will prevent blowing up the account with a couple of losses.

Also, you’ll have a clearer market judgment enabling you to execute your trading strategy flawlessly.

Often traders ignore the times when they open positions.

For example, a trend-following trading strategy doesn’t work when the market is ranging.

And forex momentum traders should sit on their hands when the western world is on holiday.

Makes sense?

Trading at appropriate times is crucial to avoid losses even before they happen!

Next, let’s look at the specific ways to control losses in day trading.

Pending orders

The first and the main way to control risks in almost any trading strategy is a stop loss.

The “stop-loss” is a general name for an order that closes a position in either direction to avoid losing more money.

Technically you’d use a sell stop for a long trade and a buy stop for a short trade to cut losses.

How does it work?

A stop order is triggered when there’s any transaction at a specified stop price.

This results in an instant order to buy or sell an asset at the available market price.

We should always try to put the stop loss at a price that invalidates the trading idea.

Here’s an example.

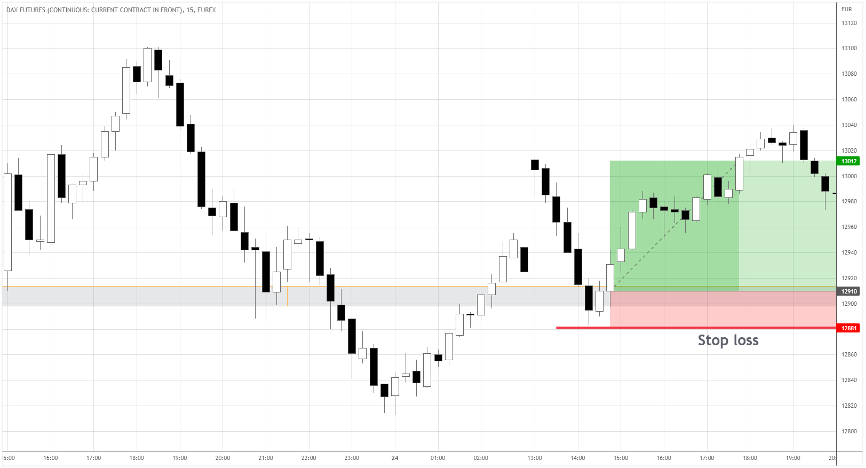

Suppose we buy DAX off the demand area around 12900-12910.

The market going below the last swing (see the red line) would invalidate the setup.

So, we set the stop loss at 12881, below the black candle’s low.

Stop limit– just another way to cut losses

The downside of a discussed stop market order is a possible slippage.

If the market moves very fast, we may not get a fill exactly at 12881 but a few points lower.

A stop-limit order can help with that.

Similarly, we set a stop price, but the limit order will be activated instead of a market order.

It’s up to us what’s the lowest price we’re willing to exit (in case of a long trade).

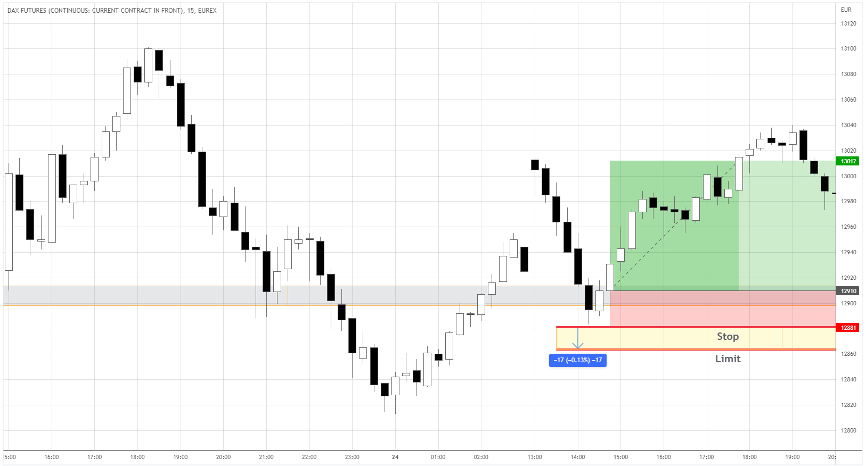

For example, let’s apply the stop limit to the same setup in DAX.

The lowest limit is at 12864, 17 points away from the stop price.

If the stop price is triggered, we’ll automatically set sell limits at any price within 17 points range.

Traders should use stop limits if the market is liquid and choppy and usually dances around before continuing the impulse.

Otherwise, you may not get a fill at all!

Considering the DAX example, if there are no buyers within the yellow area, the sell limit will stay untouched at 12864.

Alternatively, you can use a stop limit to reduce the risk of slippage when opening a position.

Hard and soft stops

Using stops based on different logic can significantly improve a trading strategy.

A “stop” doesn’t necessarily need to be a pending order.

Some traders use mental stops – if the market does a specific action, the trade is closed manually.

A pending stop loss is considered a “hard stop” as it’ll close the trade instantly once the stop price is reached.

The “soft stop” is a condition, if occurred, gives the reason to exit the trade.

Here’s an example.

We’d close a long Hang Seng trade if the 15-minute candle closes under 20745.

The hard stop will let us out if the price plummets straight to 20681 in less than 15 minutes after the entry.

In the long run, a soft stop can help improve the risk-to-reward ratio of a trading strategy.

Position management tactics

Get creative with how you approach risk.

A scale-out strategy can turn potentially losing trades into breakeven or even profitable ones.

What is scaling out anyway?

It’s a position management tactic where you close a trade partially when some criteria are met.

For instance, suppose we shorted the Microsoft stock in the image below.

We could cover half of a position once the stock approaches 264.5, the potential demand zone.

Or we could have an additional signal – a small body candle around the scale-out area.

Scaling-out half of the position in the chart above would make about one risk.

If the market hit the initial stop loss afterward, we wouldn’t lose anything on trade.

Know when to get away from the desk

Some days a trading strategy just isn’t suitable for the market environment.

Other times, you may not be at your best.

Feeling unwell, distractions, conflicts, or simply a bad mood can affect your trading performance.

Both cases usually result in losing streaks that could be avoided.

That’s why your trading plan should include rules to limit your access to trading when something isn’t working out.

For example, if you have two losses in a row, take a break for 30 minutes.

After three losses straight, don’t trade until the following day.

Also, limit your daily risk in percentage.

For example, once you’re down 2%, you’re done for that day.

Following such rules is quite challenging at first.

But that’s what it takes to preserve your capital and have another day to trade.

Avoid trading during news releases

When major news is released, the market is hardly predictable.

Usually, price action clues pop up 30 minutes to one hour after the release.

If your trading plan isn’t specifically designed for trading news, opening positions right after the announcement is a gamble.

Why?

It’s almost impossible to manage risk – the volatility is overwhelming, and liquidity is unstable.

Look at the chaos in EURUSD at the Fed interest rate decision.

In such an environment, stops will likely be executed at much worse prices than intended.

Also, because the moves are wild, finding a proper place for a stop loss is hard, resulting in unfavorable risk/reward.

Instead, avoid trading the first hour after the release.

When the market subsides, you can calmly place your bets.

And don’t worry about skipped initial moves – almost always, the news moves the market for days afterward.

P.S.

Did you check my most recent article on Breakout Trading? Be ready to look outside the box when we look at different trading examples.

Thanks Atanas . Great updates.