What is Copy Trading?

What makes copy trading worth your attention?

The world of financial markets offers many profit opportunities.

Although, for a long time, the playing field threshold has been too high.

Why?

High minimum deposits, exorbitant fees, burdensome paperwork, and lack of information closed the doors to the financial market for most people.

As internet technologies developed, it became easier to open a trading account, fund it and start trading.

Many stock brokers don’t even charge commissions anymore!

Forex and CFD brokers have been particularly active in advertising their services.

Finally, the industry reached the point where you can choose: go to Starbucks or open a brokerage account!

Just a few bucks, and you’re ready to place your first trade!

Still, don’t confuse the accessibility with the ease of trading.

There’s a reason brokers must put a disclaimer such as “80% of traders lose money with this broker”.

The craft of trading is still very challenging.

We know that the majority loses money in trading.

What if we could replicate trades of the profitable minority?

That’s where copy trading comes in handy!

Read on 👇🏽

Contents in this article

The copy trading solution

Initially, people followed winners through email signals and chat rooms.

Then, companies focused on copy trading came up, such as Etoro, Zulutrade, etc.

So, nowadays, a special platform brings professionals, amateurs, and passive investors together.

Profitable traders are motivated by generated fees from the profits of their followers.

At the same time, the “copiers” don’t mind sharing some profits for the ease with which they can make money.

You don’t need to know about the technicalities of trading to generate a decent income from copy trading.

Still, due diligence and understanding of basic metrics are required to pick traders you’re comfortable with.

Makes sense?

Let’s look at how copy trading works and how to benefit from it.

How does copy trading work?

Once you’ve signed up with the copy trading provider, you’ll be able to invest your money in different kinds of products.

There are three main types of platforms

- Manual: it’s up to you what trader to follow and what positions to copy. Sometimes it’s called social trading.

- Semi-automated: you see all the positions of the trader you follow; you can pick specific trades or auto-follow whatever position your trader takes.

- Automated: you follow a trader or a portfolio with all trades being automatically copied.

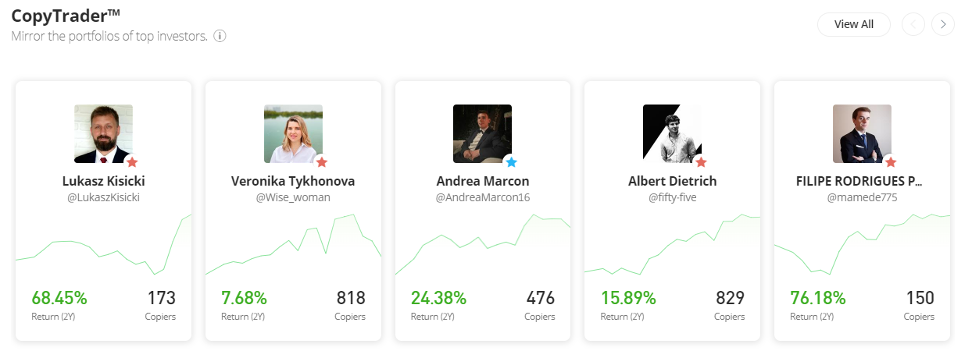

For example, you can copy a specific trader with their unique strategies.

Here are some examples 👇🏽

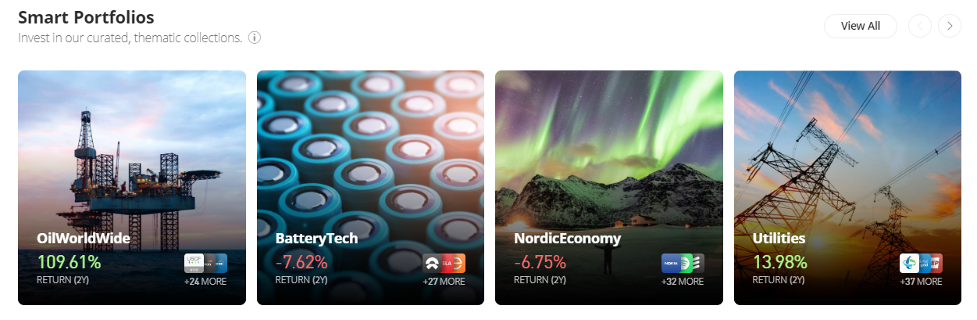

Or you can choose a thematic portfolio, where the algorithm picks assets according to defined criteria.

When choosing where to park your money, you should check several metrics and plan how much to risk on an investment.

Also, use common sense, e.g., it’s not the best idea to bet on the hospitality industry when the pandemic is looming!

Risk management in copy trading

You can have enough capital, follow brilliant strategies and still fail to make money.

What’s the reason?

Poor risk management!

No trader, portfolio, or strategy is profitable 100% of the time.

That’s why, as an investor, you should allocate your funds wisely.

In copy trading, you can decide what percentage of your capital to commit to an investment opportunity.

Let’s say you have $3000 capital and set the risk of 10% for a particular trader.

If the trader commits 5% of their portfolio on a trade, the same percentage will be applied to your risked capital.

In our example, you’d risk $300*0.05=$15 on the copied trade.

If you’re a total beginner, you should stay conservative with your allocation.

Start by risking 10% on each trader or a portfolio.

The diversification will help you to stay in the game and make modest returns in different market environments.

When you get experienced in analysing stats and handling risks, consider focusing your funds on fewer investments.

Copy trading stats

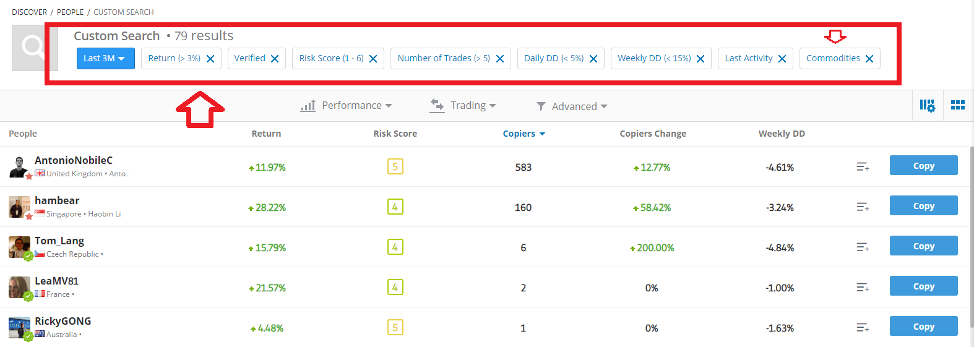

Before you choose a trader or a portfolio for investing, study their performance metrics.

Depending on your risk tolerance and goals, your suitable readings’ values will vary.

Let’s look at these metrics one by one, taking Etoro as an example.

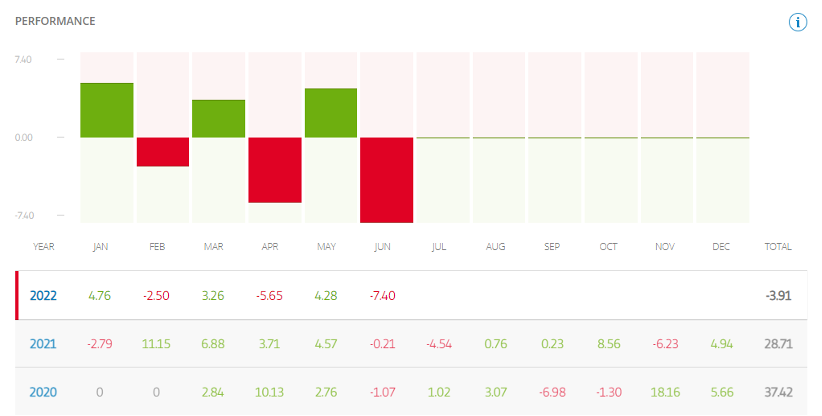

Performance

The first what you’ll see is a trader’s monthly performance.

It’d be best if there is at least a couple of years of data (excluding the current year).

In this way, you’ll have a clearer view of what to expect.

For a medium-risk strategy, a 30% annual return is a decent number.

So, stay objective!

Finally, a warning sign would be a month with a loss that’s significantly bigger than the best profitable month.

In that case, even if you still like the overall performance, ask the trader about the reasons behind such a slump.

Risk

Here’s arguably the most critical section to consider.

Your first task as an investor should be protecting your capital

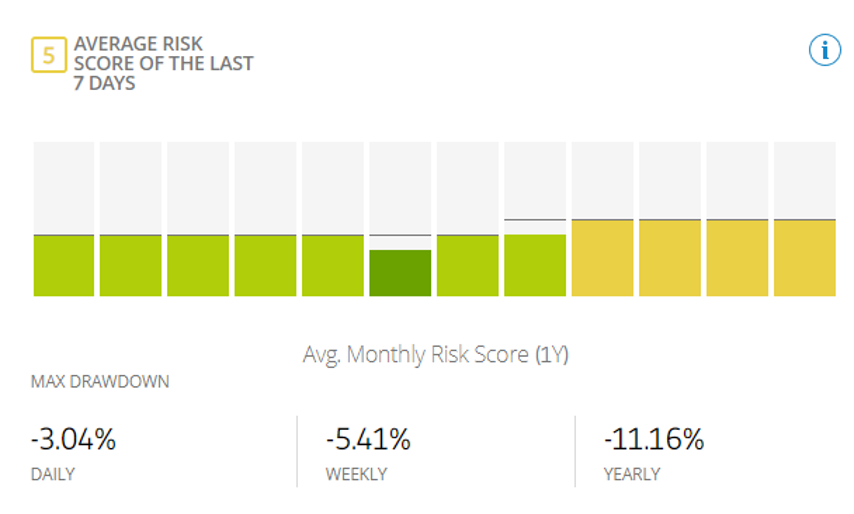

One of the copy trading services came up with the “average risk score” – a risk indicator that ranges from 1 to 10.

The reading is based on leverage, portfolio volatility, and their correlation.

Don’t stop at general figures, though!

The drawdown shows the peak-to-trough maximum decline in portfolio value.

For instance, a 10% yearly drawdown means that historically a portfolio was down 10% somewhere during the year.

You should be most interested in the yearly one as it’s the most representative.

Trading

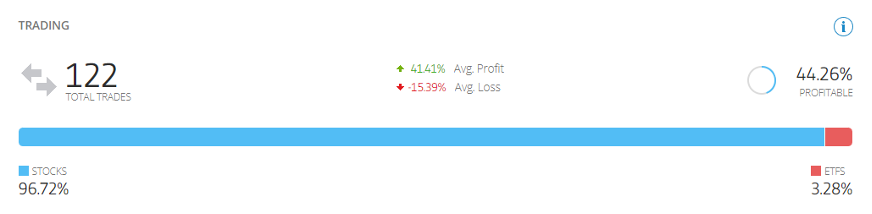

This section shows the number of trades taken, the kind of asset in percentages, and the average profit and loss.

Generally, traders should have at least 50 trades for other statistical values to be reliable.

The assets traded can tell you how much volatility to expect and when.

Consider how the P&L will fluctuate during the earning season if most positions are in stocks.

Average profit and loss can tell you about the character of the traders’ equity curve.

If the strategy is focused on a high risk-to-reward ratio, expect longer losing streaks and then significant returns within a short time.

Conversely, an emphasis on a winning rate avoids deep drawdowns, providing consistent but modest gains.

Additional stats

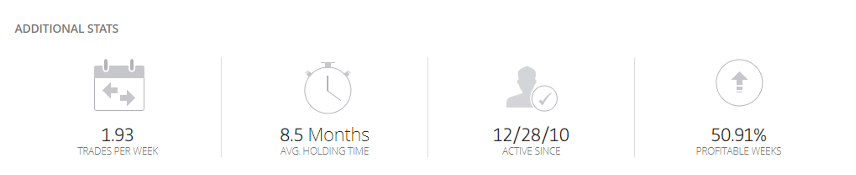

This section can help you to conduct the copy trading smarter.

If you decide to copy specific positions, the average holding time and weekly trades can put things into perspective.

How exactly?

Let’s take the stats above as an example.

Suppose you see a position that’s been running for, say, seven months.

Probably it’s not the best idea to copy it as the profit potential is likely already exhausted.

What if a trader loads up with ten trades within a week when their average is 2?

It might not be a good sign!

Performance chart

The equity chart of traders is helpful in timing when to start copy trading.

Just like in the asset chart, there are highs, lows, times of momentum, and pullbacks.

The best strategies draw a simple chart – it starts in the left down corner and ends in the right upper one!

It would be prudent to begin copy trading at one of the “dips” in equity.

How much money do I need to start copy trading?

If you have an extra few hundred dollars that you’re ready to lose, you can join copy trading.

The Etoro platform sets the minimum deposit at $200 to start copying traders.

Other prominent providers like ZuluTrade and FBS require only $100 to participate.

The other side is you can’t expect to generate decent income dollarwise with just $200.

Instead, you should see it as a practice account.

A little risk money will help you take your venture more seriously.

How about the demo?

A tiny live account is better than a classic demo, where you’ll feel too safe to learn efficiently.

Do futures trade while the market is open?

Okay, what if you’re a profitable trader yourself, can copying others still be useful?

Copy trading can also be helpful in taking advantage of the volatility when you sleep!

How so?

Most futures trade 23/5 on CME, from 6 PM to 5 PM (ET), overlapping with the NYSE during the regular session.

Although the electronic session works almost around the clock, the best time to trade is during the regular session.

Traders often spot many trading setups in futures while NYSE is open when checking the charts on the following day.

However, the time difference makes it impossible to tap into those opportunities.

As such, Australians and Japanese can’t trade US futures during the volatile hours comfortably.

When US markets open, traders in the eastern hemisphere are supposed to get ready for bed, not for trading.

Conversely, Americans aren’t convenient trading futures at European and Asian openings.

What’s the solution?

Find a profitable futures trader to copy and forget about missed entries!

Such as the one below.

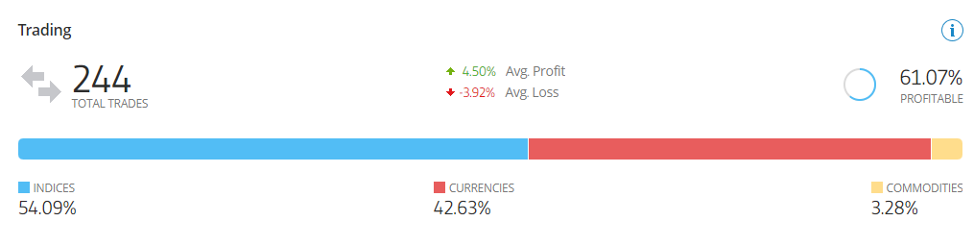

In the example above, the percentage of traded assets shows that more than half of all trades are in indices.

Similarly, you can find a trader who focuses on commodities.

You can filter your search by showing only those from the time zone of the market you want to take advantage of.

Conclusion

Copy trading came up as a result of innovations in retail trading, helping anybody to mirror the performance of professional traders.

At the same time, mature traders can have a new revenue stream from copiers.

Professionals may also benefit from copying others focused on different instruments, thus “outsourcing” and diversifying the trading strategy.

The service providers make it incredibly easy for the general public to join – the minimum deposit is, indeed, minimum!

Navigating a copy trading platform is enjoyable as the interface is user-friendly.

You can also analyze the critical stats while sifting through hundreds of traders and strategies.

Thus, there’s no reason not to profit from copy trading in the long run.

So, get your due diligence and common sense ready, and you’re good to go!

Happy trading,

Colibri Trader

P.S.

Want to overcome emotional trading? You should stop trading at these levels, and instead use Smart Levels, prop trader reveals

P.P.S.

Here are every trader’s 9 major pros and cons to trade LIVE vs. PAPER. They will make you think twice before placing your next trade