What is a mental stop or 7 questions that beginner traders ask about stops in general

What is a mental stop? Seven questions that beginner traders ask about stops.

So, what is a mental stop and why I have decided to write about it?

As you are probably aware, I do very often receive e-mails asking me things from the world of trading.

Last week, I received a very interesting series of questions in an e-mail, which I have decided to put down into an article.

In my belief, the best way to make a difference in this field is if you really answer the questions that traders are asking themselves on a daily basis.

Mental stop is one of those questions and that is why I have decided to write about it.

-

What is a Mental Stop Loss?

Mental stop loss is that stop that you are supposed to have in place, but you usually don’t. Mental stop loss is one of the biggest detriments to successful trading.

This is also the level that you are bound psychologically to get out of a losing trade.

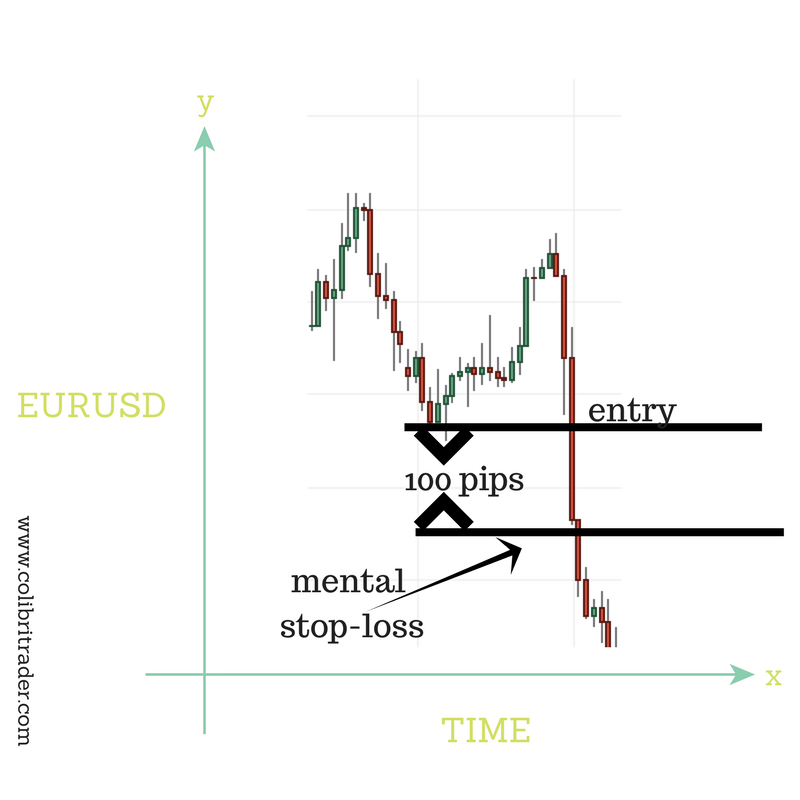

Example: Let’s imagine you place a long trade on the EURUSD at 1.1000. Your mental stop loss is at 1.0000, which is 100 pips below.

In case EURUSD trades against you and falls down 100 pips (as shown above) you are obliged to close your unsuccessful trade and limit the loss to 100 pips only.

Unfortunately, human nature is more complicated than that.

When you are losing 100 pips, you start hesitating if you are not exiting your trade too early. That is when you start asking questions and postponing your exit trade. That is when you start breaking your own rules.

Think for a second!

Was that trade according to your trading plan?

Mental stop loss is that order that you promise yourself that you will use if price hits a certain psychological level. But do you ever trigger that order?

Beginner traders are usually very hesitant to use hard stops. In fact, they are the best place to start with if you are looking to build a successful strategy.

Now, imagine you have the choice of deciding if you should take a loss and stop a position manually or have a pre-defined stop-loss level. Which one would you have chosen?

-

What is the difference between Mental Stop Loss and Hard Stop Loss? Please include Pro’s and Con’s of both Stop Loss types.

So, what would you choose? Mental or hard stop-loss?

First, let’s define what a hard stop-loss is.

Hard stop-loss is that stop loss order that you predefine when taking a trade. You usually simultaneously enter the parameters of the stop-loss order when placing the trade.

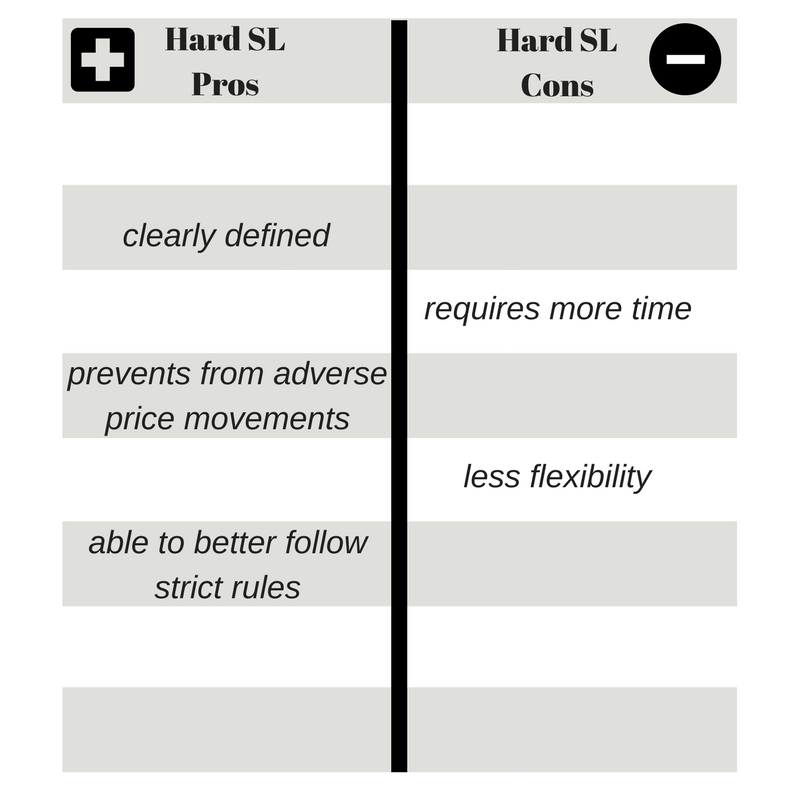

Therefore, a hard stop loss eliminates the need to constantly monitor price action. It stays there for you to protect you against unexpected price movements. So, what are the pros and cons of mental and hard stops. Check out the table below for a quick summary:

-

Based on your experience as a Prop Trader, do institutional traders using mental stop loss rather than hard stop loss are better off? If yes. Why they are using it?

That is a very good question, indeed! A lot of traders that are considered to be institutional traders do not use hard stop-losses.

They have specific trading strategies, mostly long-term ones and are very-well trained. Imagine if you have an enormous capital base and you are extremely experienced.

In that case (if you are an institutional player), you will probably not need a hard stop-loss. Also, you are probably not using any leverage and can afford to cover much wider swings than the average retail trader.

Remember: as a retail trader, it is better to employ hard stop loss strategies than rely on a mental stop, which might never get executed!

-

Many traders are afraid of Stop Loss hunting. Please give more explanation regarding a trader’s mindset about “stop loss hunting”. Is it a myth or not.

That is another very good question. Although, a lot of people believe it is a myth, I do believe that some brokers are using such practices to take out traders of potentially profitable positions.

I do believe that in case you are afraid that there was an unfair slippage, you should always ask the broker to provide you with a Bloomberg screenshot, so you can see what was the highest/lowest level that the price went to.

That’s another very good reason to use a few different brokers, so you can compare execution and diversify amongst their execution policies. I personally use a few difference FCA regulated brokers.

-

If you agree with Mental Stop Loss, how do you apply it on real trading examples. Since a Swing Trader can’t be in front of a computer for 24 hours to monitor the charts. (Specific strategy)

I do have my own specific rules for that. Although I wish to be more concrete, it won’t be fair for all of the students that have taken my course. I do walk traders through the steps for placing a stop-loss in it.

I do use most of the time a hard stop-loss and only very seldom mental stop-loss (after I am already profitable). You should be limiting your potential loss by utilising a hard stop-loss, especially if you are just starting in this field.

Mental stop-losses are for the very experienced traders and also people/institutions with a lot of capital; they are also for traders not using any leverage in their trading.

In order to protect yourselves against adverse market movements, hard stop-loss is the best way to limit your risk.

Don’t forget that your capital is your only asset, so you need to make sure you protect it as much as you can!

-

If you do not agree with mental stop loss, please give us some reasons about it.

Beginner traders, should use hard stop losses.

Beginner traders should have precise rules written down and follow them meticulously.

Trading should be taken seriously and treated as a business. The moment you lose your concentration, it gets out of hand.

-

What about trading style? Who should use mental stop-loss? Day traders or scalpers? Can a swing trader use “mental stop loss”?

As probably most of you are aware- scalping is not a type of trading I am really into.

The shorter the timeframe, the riskier the trade.

In this sense, it would be great to use hard stop losses in all circumstances, but usually high-frequency scalpers don’t really use them.

That is another reason why I don’t find this trading style (scalping) particularly appealing. You can probably disagree with me, and I would be happy if you share your experiences, especially if you know any successful scalpers.

Regarding swing traders (I do consider myself as such), they should use hard stop losses and have a clearly pre-defined trading plan. There is nothing more detrimental than not being sure how to react when things go wrong.

In such circumstances, a trading plan is essential.

I hope this article about mental stop losses and hard stop losses has been useful, especially to the beginner traders. If you still have any questions, please do not hesitate to ask me or comment in the section below.

Happy Trading,

Colibri Trader

p.s.

Have you checked my recent article on “Trendlines and How to Use Them”

Alternatively, you can have a look at this article and download my free Loss Calculator from there

If you want to see how I utilise mental stop-losses, check out my Professional Trading Course

Very informative and well explained . I really love the way you explained sir

Thanks Singh!