What Causes the USDJPY and DJIA Direct Relationship?

What Causes the USDJPY and DJIA Direct Relationship?

by: Colibri Trader

The Forex dashboard shows around twenty-six currency pairs that change in value every single day. The two currencies that make the pair reflect the strength of their respective economies.

While I do favour price action when it comes to my trading, I cannot ignore other forces surrounding the Forex trading environment. This article aims at explaining a correlation so obvious that every retail trader has probably already noticed it. Yet, few understand what it is about.

The DJIA (Dow Jones Industrial Average) and USDJPY enjoy one of the most powerful correlations in trading. Before going into more details, we need to lay down the rules of a correlation.

There are two types of correlated markets: direct and indirect ones. To have an idea, the CAD and OIL enjoy a direct correlation. They move in the same direction.

On the other hand, the USDCHF and EURUSD pairs enjoyed an inverted correlation. It was especially strong as long as the SNB (Swiss National Bank) held the peg on the EURCHF pair at 1.2.

However, there’s a saying when trading the financial markets: a correlation holds true only until it is broken. Market forces come and go, the financial picture changes and flows change direction constantly in search of the best possible yield.

The U.S. Dollar and U.S. Equities

To explain the direct correlation between DJIA and USDJPY, one needs to start from the U.S. dollar’s role. In the last few decades, the U.S. dollar’s index and the DJIA index enjoyed a relatively high correlation: over 35%.

It means that over 35% of the times they moved in the same direction. The key here is the time element: we don’t talk about an intraday correlation, but one that stood the test of time.

What is the reason for the dollar to correlate with the American stock market? The answer comes from the differences in the world’s financial market. That is the interest rate differences.

Because the U.S. dollar is the world’s reserve currency, fund managers, and large institutional investors always allocated part/parts of their portfolio to U.S. equities. But, to buy U.S. equities, one must pay with dollars.

To pay in dollars, one needs to have them… or, borrow them.

Imagine you want to buy dollars to buy U.S. equities. The obvious answer is that you’ll borrow in the currency that pays the lowest possible interest rate. Right?

That’s why investors turned to the JPY (Japanese Yen). For decades now, Japan fights a terrible economic environment: deflation gripped the economy.

Moreover, it faces an aging population and it is about to lose a third of its people in the next few decades. Facing such issues, Bank of Japan was poised to slash interest rates. And, to keep them there for a very long period.

As such, the funding currencies for buying U.S. equities were currencies with a low-interest rate: the JPY and the CHF (Swiss Franc).

Quantitative Easing and Negative Interest Rates

To make the situation even worse, Japan embarked on a huge quantitative easing program, that still runs to this day.

Moreover, it runs a negative interest rate. But, the same problem is elsewhere. Eurozone and Switzerland have negative interest rates too.

So where should investors park their money for the much-needed yield?

You guessed right: in the U.S. equity market.

When investors want to buy U.S. equities, they borrow in JPY, as, historically now, the interest rate is low. Next, they change the JPY in USD, to pay for the purchase of the stock.

So, the US dollar is bought today, while the JPY is paid back sometime in the future. That makes the USDJPY pair moving higher.

The same thing happens when traders get out of the U.S stock market. They sell the stock first. And repay the JPY loan next. As a result, the USDJPY falls at the same time with the DJIA or other US stock indexes.

Financial arbitrage these days reflects the impact of these decisions in markets almost instantly.

Conclusion

Financial markets’ correlations are tricky. This is especially true when currencies are involved.

Various factors influence currencies, from the Federal Reserve’s interest rate on the dollar to the state of the global economy. From the monetary policy in the major economic jurisdictions to the investor’s risk appetite.

What’s even more important is that the correlation degree changes in time. For example, for years, the DJIA and the USDJPY moved almost tick by tick. That meant one point higher in the DJIA was met with one pip lower on the currency pair. And so on and so forth.

But, such a strong correlation degree existed only until specific conditions existed. For example, a monetary policy change for a predetermined period.

The moment those conditions were removed, the correlation degree changed. The correlation didn’t disappear, but it changed.

Instead of one hundred percent, it may be now sixty percent or lower.

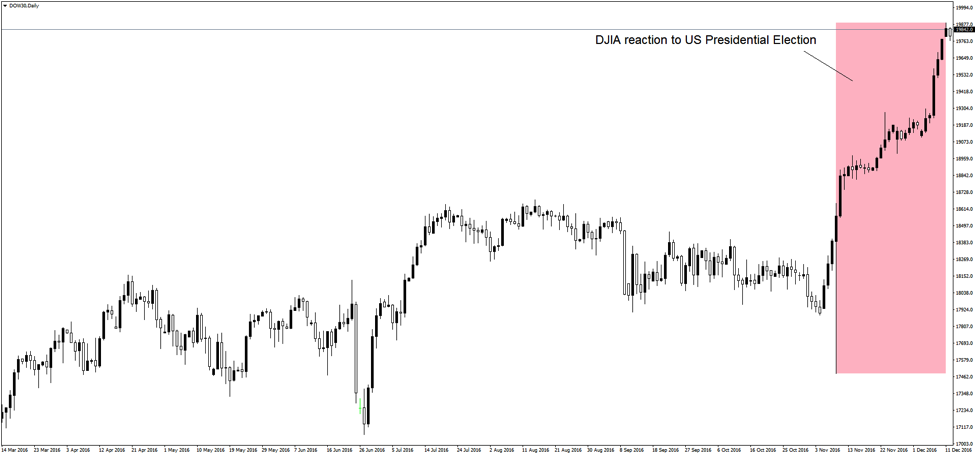

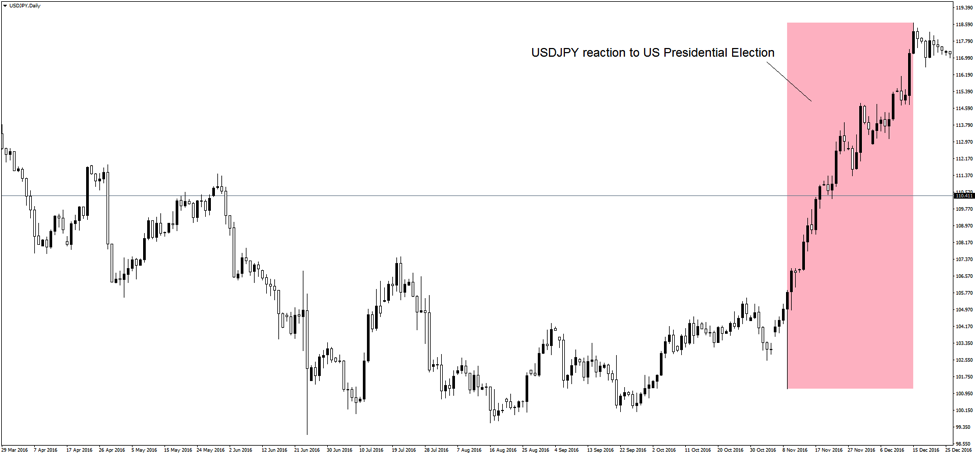

The time horizon is important too. The initial reaction to the US Presidential Election outcome was the same.

But, what followed was different. The USDJPY consolidates for the last nine months or so, with a bearish tendency.

It dipped from 118 to 110 at the moment of this writing. In the meantime, the DJIA enjoys all-time highs almost every day, knocking at the 22k door.

What changed? Is the correlation broken?

As far as I checked, the JPY interest rate didn’t check. And, if everything stated in this article is true, then why isn’t the USDJPY responding with higher rates?

Again, time is everything. It is like trading Forex on the monthly chart. You may be right in your forecast, but if the market consolidates for twelve candles only, you’ll need to wait a year until the right move starts.

To sum up, as long as the JPY interest rate remains at low levels, investors will borrow in JPY to fund US equity purchases. Providing all other variables stay unchanged, this would translate into higher DJIA and a higher USDJPY.

Happy Friday,

Colibri Trader

Don’t forget to check my latest GBPJPY Trade Setup

and also How to Build a Successful Money Management Strategy