Weekly Trading Recap and More

Weekly Trading Recap and More

Last trading week was an exciting one for trading. Trading is not always easy, but some weeks are just as good as textbook examples.

Weekly Trading Recap and More- Last week I did take two trades. The first one was hit because I did placed a very tight stop-loss- just about 45 pips. It was probably a mistake, but at the same time, I have minimised my risk. Placing stops is an art by itself, so maybe this time I did not get it right. The good news is that my other trade- USDCAD went even better (faster) than expected. I went long around 1.3170 and the price went up to 1.3437 before closing at 1.3375 on Friday. This move was a quick one- over 200 pips! I start feeling a bit hesitant about the pair, since there is a pin bar on the daily and just before close, I have cut 75 % of my position.

I still believe that USDCAD’s move has a bit more potential to the upside, but the pin bar is already giving me a red flag. On the other side, the EURUSD trade from last week (the stopped-out one) seems more bullish. There was a bullish engulfing pattern and looks like 1.0500 area has attracted a lot of bullish interest.

Weekly Trading Recap and More- The pairs I am looking at in the new week

DAX ???

The trading setup that DAX is showing is more bearish than bullish. There is an inside bar that formed on Thursday’s daily candle. The only obstacle here is the strong bullish trend, that I am not really willing to go against. There is probably some pips to be made in a contrarian trade, but I will not do anything for now. I might be looking for an intraday setup and then could do a more speculative short-term trade.

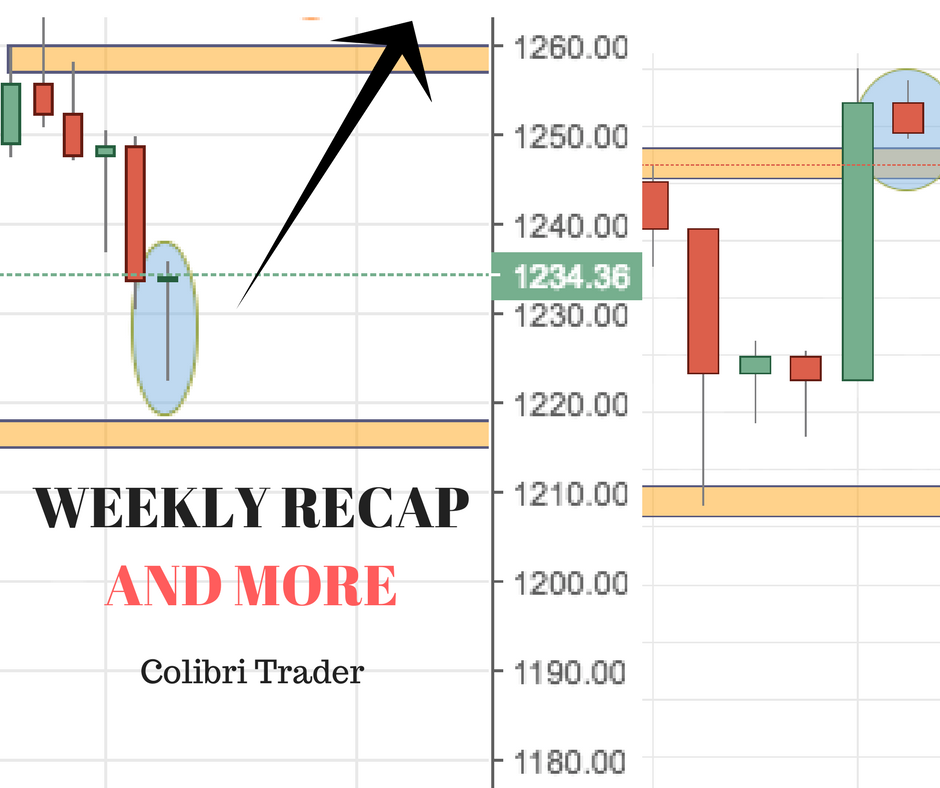

GOLD ???

Happy trading,

Colibri Trader

P.S.

If you have not yet check out my recent article on MACD, please do so HERE

I find it quite revealing that you will not take a short trade on the DAX.

It seems trend means a lot to you, as it should to all of us. But perhaps the importance is often over looked by many. What would have to happen for you to see that the trend has indeed changed for the DAX

IE Weekly bearish engulfing candle or monthly ?

Cheers

Appreciate your posts

Very good question! But isn’t that Weekly bearish engulfing candle going to be against the trend? A very important factor here are support and resistance lines. Also, as you have seen in my trading course, I am looking at the lower timeframes for confirmation and fine-tuning. No trader is perfect, as no trend is perfect.

Hi Colibi,

I’ve noticed that in the past most of your Dax analysis has been on the long side which you were 100% correct.

In this Dax analysis you mentioned that even though we had the inside bar and could make money on a contrarian trade but the trend was still up so +1 for you as we retraced then back up again.

Now I am seeing that we are either in a consolidation mode or a distribution mode for something to take place whether we are witnessing the build of a top we have to wait and see.

Obviously the very high needs a close above it as a start of an uptrend continue.

I’m doubtful in fact I think that the candle pin on March 16th.

I think the highest we’ll get will be to the 50% of that pin area

It will be interesting to see what kind of candle forms “at” that level “12170 ”

As always i will remain unbiased and trade what I see, price action only !!

I’m wondering if you’re next Dax trading idea will be a bearish one ? 🙂

Cheers Dan

PS Daily forming what looks the beginning of a falling three pattern

PPS Question: the fact that the dax did not retrace deeper to the 11700 area and only to the 11850 area does this then mean the dax more bullish because of a less deeper retrace ??

Hi Dan,

Great observations here. As I said last time, I am not really seeing anything on DAX now. Also, remember that we are not in the business of “expecting” or “guessing”- we are in the business of reading the price- once we see it, we take action, but not before that. Try to stay open-minded and grasp what the market has to give you, when it gives it to you!

Hi Calibri,

I will take your comments on board and stick to the task at hand even though we need add a tad of being anticipatory it’s always important to wait for confirmation I fully agree thanks mate.

Dan