WEEKLY TRADING ANALYSIS- BREXIT WEEK

WEEKLY TRADING ANALYSIS- BREXIT WEEK

by: Colibri Trader

This week will not be your regular trading week. We are having trading weeks, in which the volatility is so low that we don’t even want to look at our screens. But this week will stay in the history books… Trust me! The event of the month and probably of the year is BREXIT- whether UK will leave or stay in the EU. This event will bring unprecedented volatility (already has been experienced by a few of us) that would be unequal to any other event from the recent past. So traders- BEWARE!

Not only the GBP-related pairs and FTSE100, but also all other major trading instruments. I have nonetheless prepared a weekly analysis for the ones amongst you that are courageous enough to trade before the 23rd. So, here it is- my weekly trading analysis.

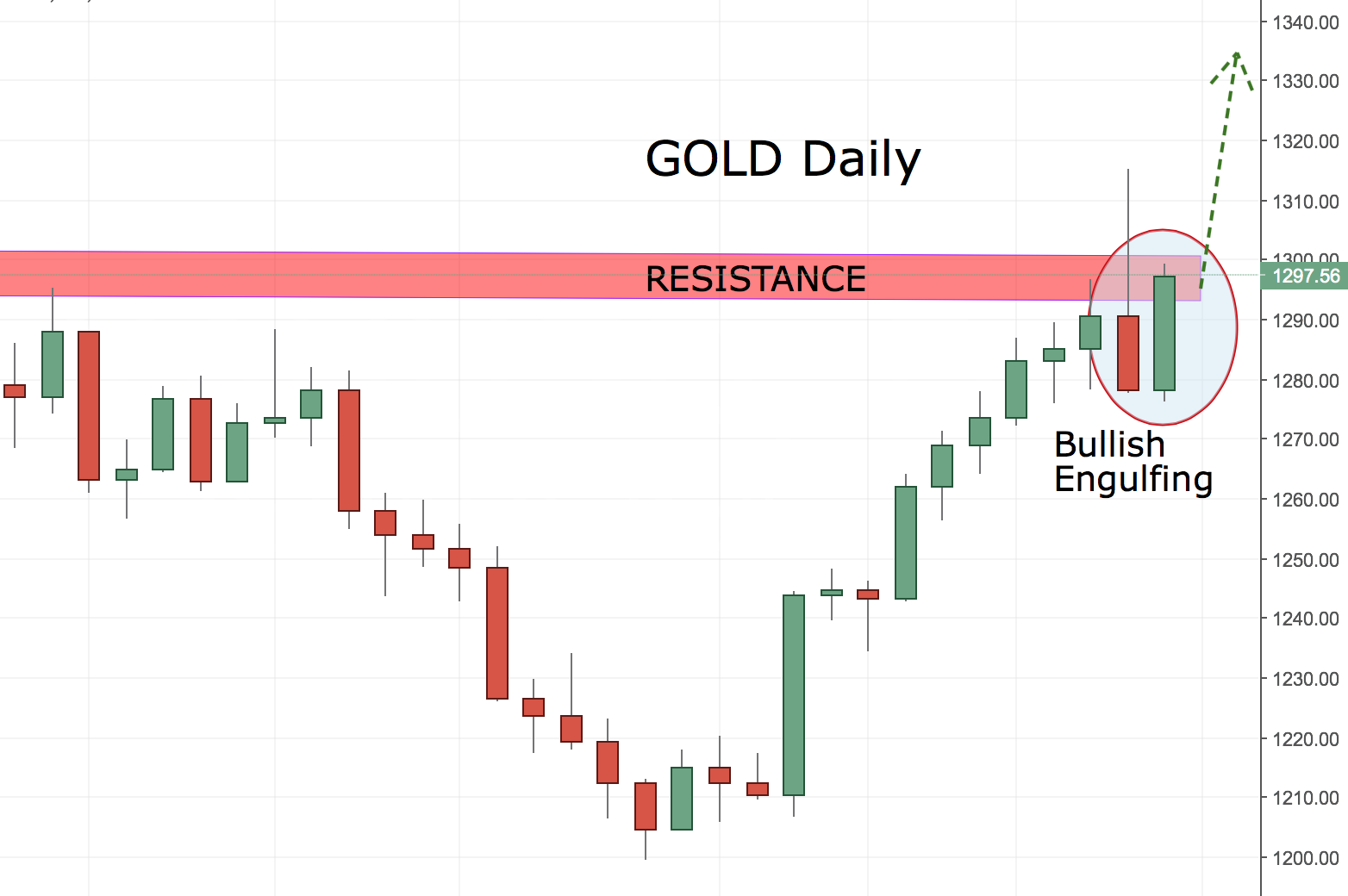

The first trading idea is a LONG GOLD trade. For the ones of you that have trades my previous Gold trade- you must be very happy. For the ones of you that have not read about it- you can do it HERE. It has been a great bullish week for this metal. Have a look at the chart below:

As you can see above, the price target from the previous trade was reached. Now, we have bullish engulfing trading signal. I am probably not going to trade this one, since it is just below the resistance area. I reckon in the long term we might see a lot more gains for this metal. For now, I will be more conservative.

In the next trading chart, I am looking at the Silver market. There, I am noticing a bullish formation, as well. I am not going to trade this signal, as well because of the same rationing as above. The resistance area is very close and we might see a small correction before more gains. One way or another, Silver is on my watch list and I will be closely following it on a daily basis and if my intraday system shows me a good entry point, I might consider taking a small silver trade. Have a look at the chart below:

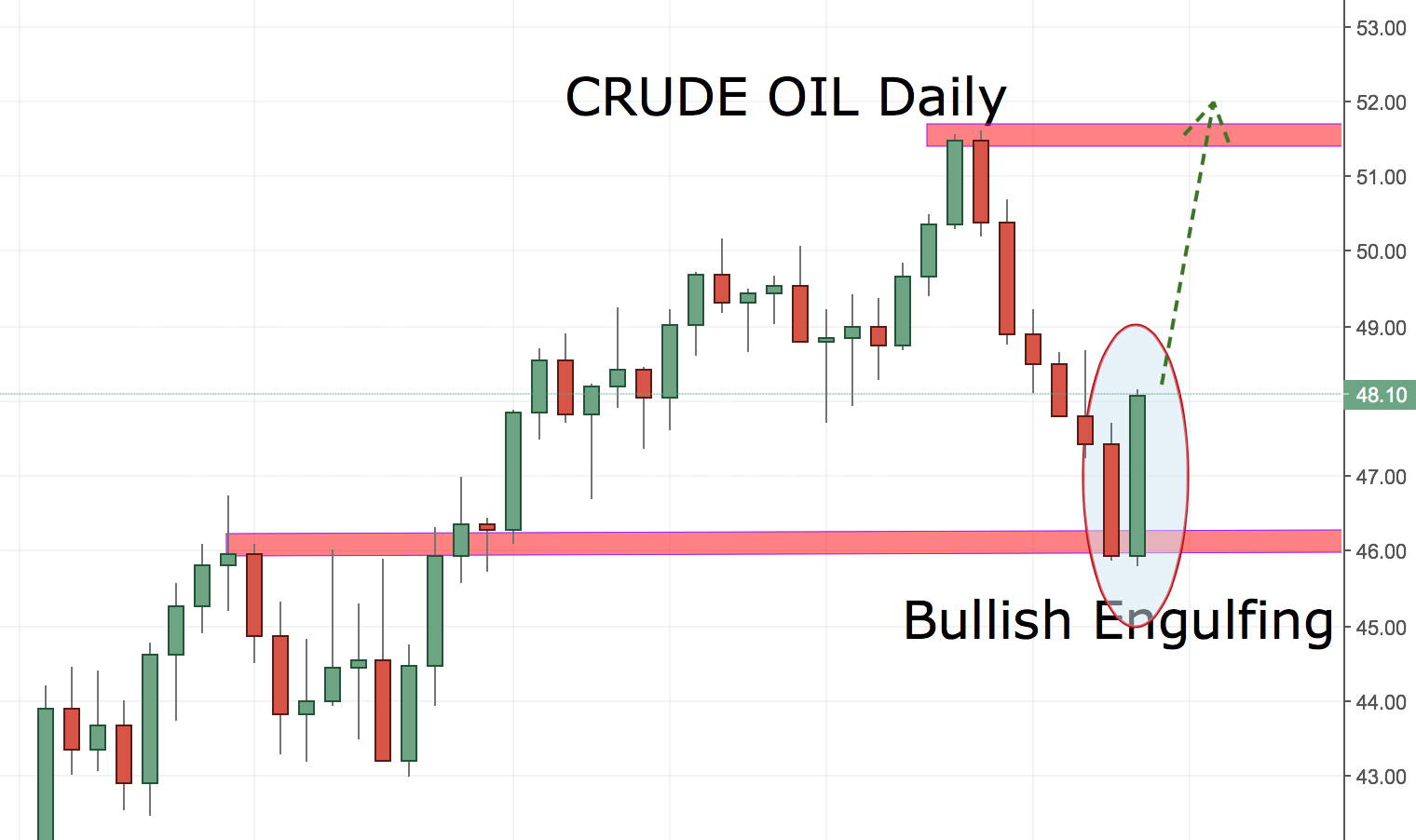

The next trade is coming from Crude Oil. Crude oil has made a small correction in the previous few trading sessions. The last one though was marked by a lot of long enthusiasts. There is a bullish engulfing pattern that formed on Friday, which means that buyers are not going to let down this instrument. I am seeing this as a bullish opportunity and a long trade. This bullish candlestick pattern occurred just above the imminent support level at 46.00, which makes the signal even more significant. Here is the chart:

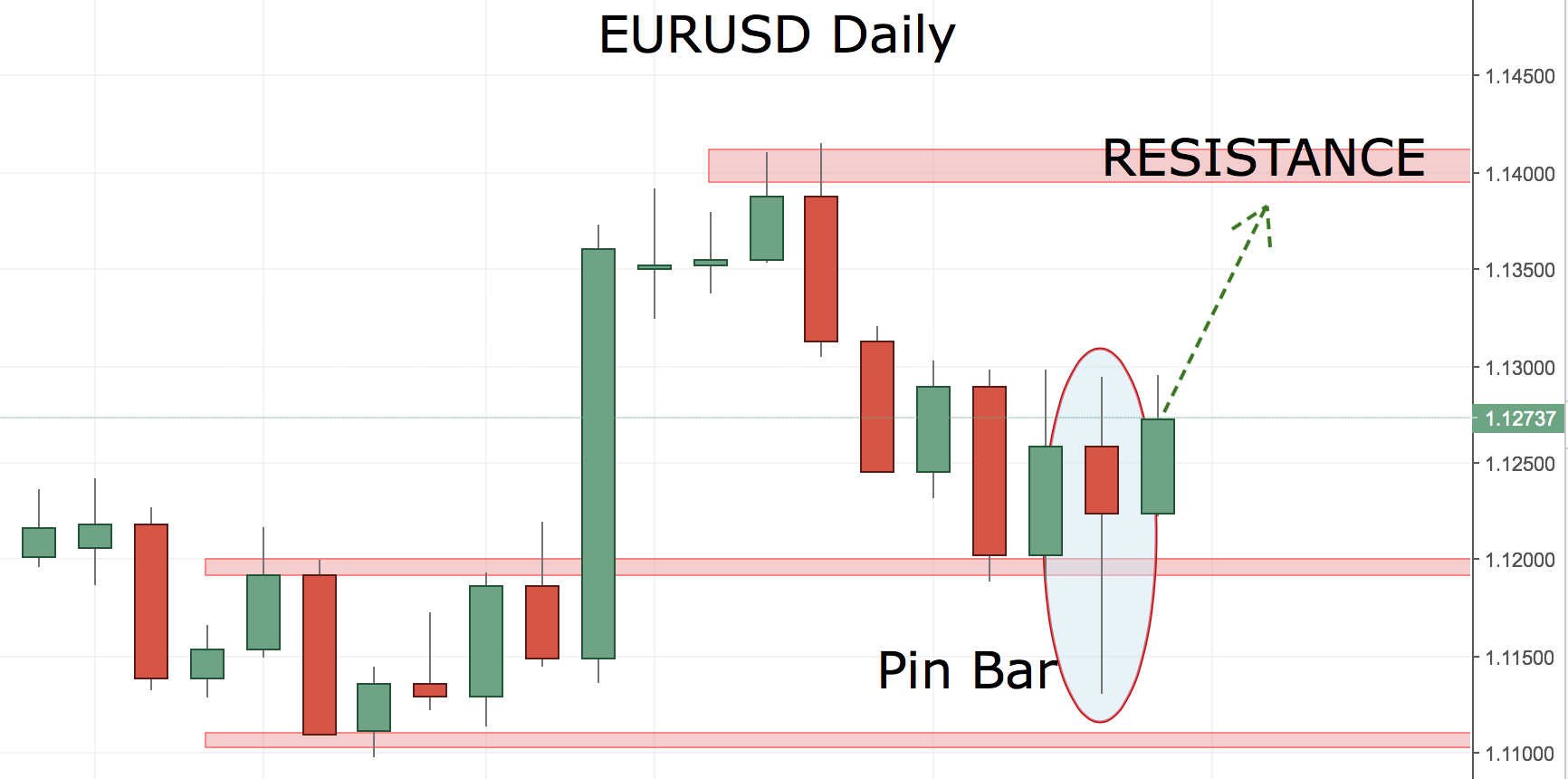

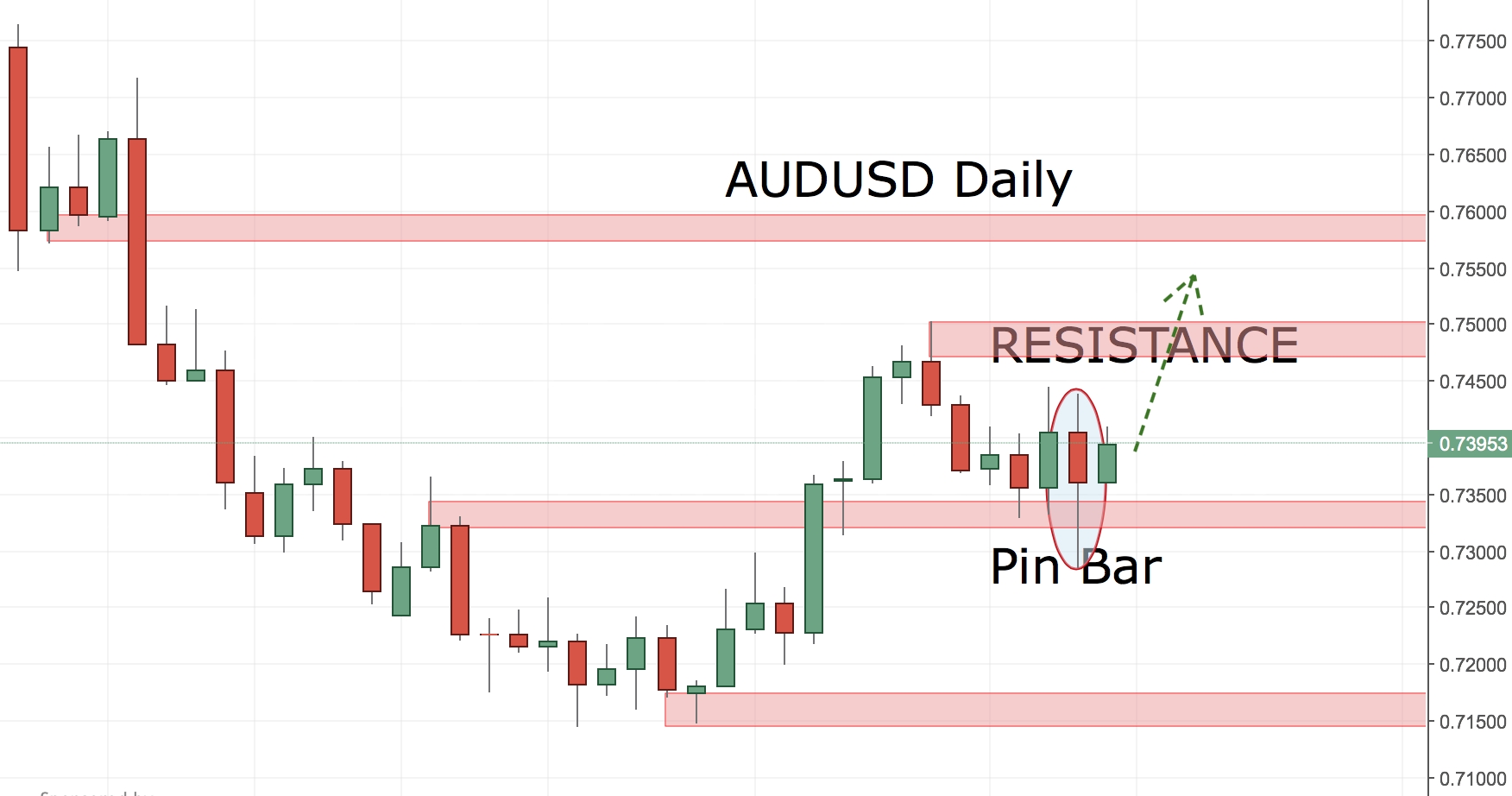

The next two trading signals are coming from the FOREX market. We can see clear price action trading signal from both of those trading ideas. The first one is the EUR/USD and the second one is AUD/USD. The charts look like twins. We do have daily pin bars on both of those charts. The pin bars coincide with a minor support areas, just below where they have formed. These are bullish signals and look even stronger when the overall environment is taken into consideration. Here are the charts:

CONCLUSION:

From the above analysis we can see that a few very good setups are in place. It will be hard to say whether the market will behave reasonably in the week ahead. It will be more of a storm than a smooth ride or at least that is how I see it. My gut feeling is telling me to just stick to price action and ignore all of the noise around BREXIT. My common sense on the other side is pulling me away from the trading pit. What could be the prudent path of action will be shown by time. For now, I believe I might stay on the sidelines until the 23rd. Then, I might take advantage of intraday opportunities being led by the Daily timeframes and my Price Action Method for minimising risk. Let’s see where this trading week will take us…