USDJPY Trading Setup

USDJPY Trading Setup

Dear traders,

The past week was not really rich in price action trading setups. I have been monitoring DAX for a short entry, but in the end have not taken it. There is some bearishness in the price action of this instrument, but still hard to take action against the trend. It could be a minor/major turning point, but I prefer to see a stronger resistance level around before going against the trend.

USDJPY Trading Setup

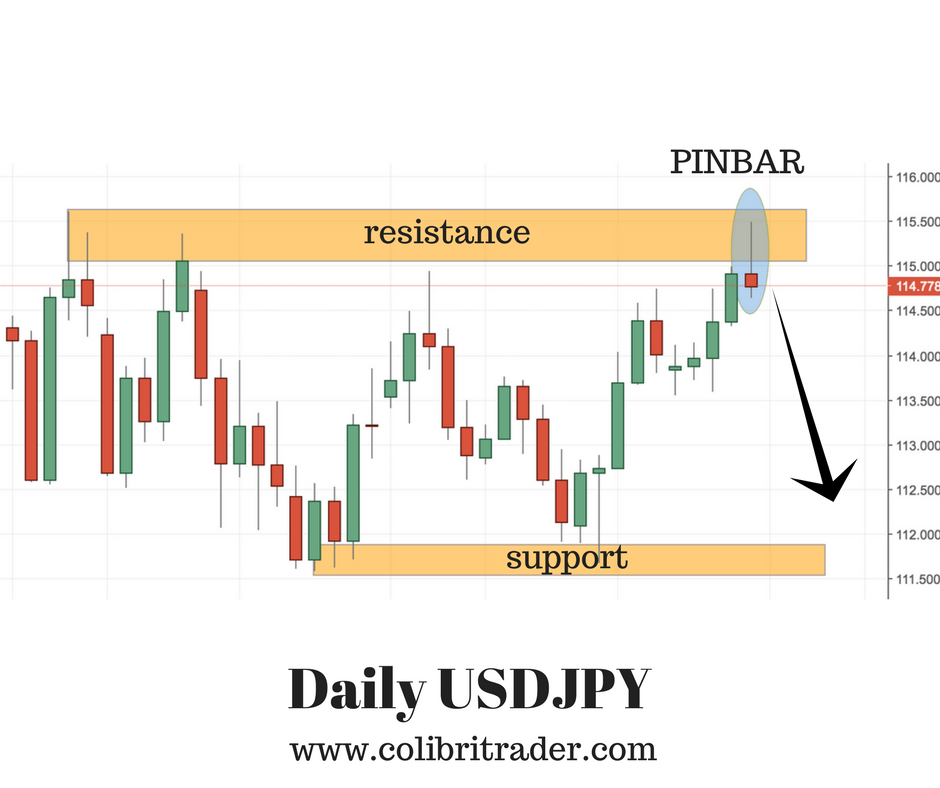

My eyes are looking at the USDJPY today. Seems like this pair’s got most of the characteristics for a short-sell. The price has reached the level of 115.50, which looks like a level that has been tested a few times. The sellers definitely outnumbered the buyers and pushed the price down. It could be the case this time too! I am also looking at the daily pinball that was formed on Friday. Depending on the intraday confirmation, I might go in a short trade. If I do so, I will be looking to enter at around 115.00. My stop-loss would be placed just above the pinbar at 115.60. My first target will be the level of 113.50. The next level I will be targeting is 111.50.

Happy Trading,

Colibri Trader

Regarding the DAX I noted the bearish harami on the daily chart (March 2) but the DAX does make you second guess your trading as it is such a bullish index. One major gap below that usually gets filled perhaps consolidation around this area 11844

Bullish at bullish markets 🙂

Dax open today : I have learned much by this GAP up.

I had been monitoring the DAX for a short signal, this is a trick the human mind will play on the untrained.

Instead of looking for a long entry as inline with current trend he or she will fixate on a short ? (Human nature)

I noticed a support zone being formed around 11955 to 11915 a mear 40 points this is nothing for how the DAX can move so in a sense “IS” a low risk long entry with SL under this !

All that is needed is the trigger candle or combination of.

As course outlines watching the 4 hour would have shown several pins and bull engulfing patterns.

One could then surmise that support has been put in and that buyers were willing to risk their money.

Retail traders cannot form pin bars like that.

There is the trigger, “the price action story being brodcasted by the market”

Including the gap up which is 250 point from support and a risk of 50 points this would net the astute a 5:1 RR not bad.

Lets give the example 50.00 / point the theoretical result 12,500.00

While this is complete hindsight I feel I have the right to post this as I am not a professional trader yet, and still in deep observation mode … if I was I would be booking a nice holiday right about now 🙂

Hi Dan,

Great summary! One should be careful with DAX, because no matter how alluring it seems, just try to put yourself in the position of a loosing trade. When do you get out, how long will you keep it running before cutting it out. You need to have those Q&A in your head, so when the time comes, you can react objectively and not emotionally. You can check out some of my older articles on trading discipline or having a trading diary in the trading psychology section: https://www.colibritrader.com/psychology/

HiColibri,

Thanks for the psyc … link great stuff well written will work on getting through them imp stuff ! 🙂

Thanks for the nice words!

Dear Colibri and readers,

I have spent time analysing the Dax chart especially the recent support area created around 11920 area.

I’ve flipped from daily 4 hour 1 hour to 15 minute and back many times including weekly.

I’ve come to realise what trading really is and not what most traders think. Not to demean it’s complexity but in simple terms, “only look for longs in rising markets and only look for shorts in a falling markets”.

Little seeds that were planted from your course, seeds that will reap big benefits in future.

It wouldn’t surprise me to learn that most traders still do the opposite.

Instead of focusing on technical analysis or chart analysis it could be that our focus would be better spent on the psychological analysis of candles and their formations. Real analysis that matters and that could keep you out of bad trades, in effect to help decipher the markets language.

Annotating many charts to help retrain the subconscious to know what to look for on the entry and exit side.

I’m finding exits a different subject all together.

Thanks

Very deep thoughts! Thanks for sharing them with the rest. I believe that you are on the right way of trading. Just keep on looking for the answer in yourself. Regarding the trend- the trend is your friend:). As you can see from my trading course, there are ways to minimise losses and maximise profits- I believe that’s where profitability in the long term stands

Bullish at bullish markets

Yes forgot to acknoledge this very important statement

Will always remenber this now cheers

Hi Dan,

Thanks for sharing your thought here.

As what master colibri wrote, after a while trading is all about patience, not about thinking.

-Harry

Hi Harry and Dan:) Yes- this is exactly about patience! Thanks for the big words Harry- glad that have impressed you to such a high level.