USDJPY Trading Analysis 15/09/2022

Dear traders,

Last time I was discussing DAX and GBPUSD.

DAX has continued its downfall.

Here is an update on it:

Looks like a big bearish engulfing candlestick pattern was printed this week.

The bearishness still prevails.

Here is another update on GBPUSD.

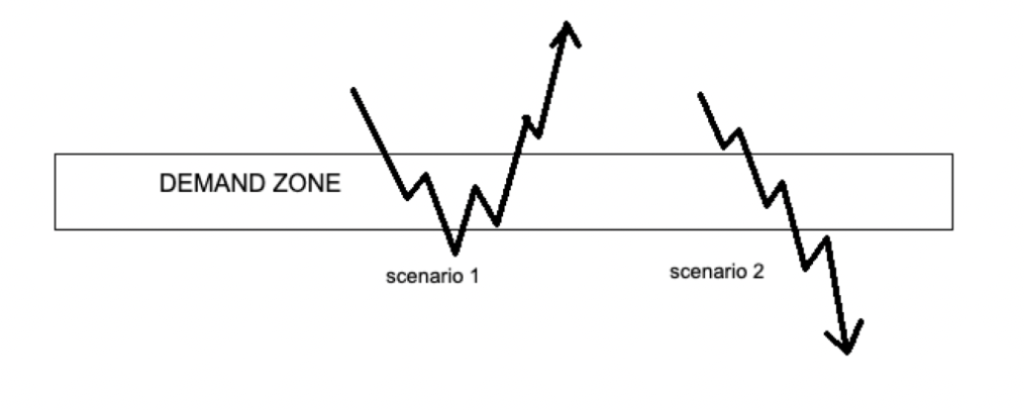

Remember the two scenarios, which I wrote about 🤔

Here they were:

And here is where GBPUSD is now:

So, this is definitely covering scenario 2 from the above illustration.

The question is now, can GBPUSD go any lower.

I believe so.

There are all the bearish signs there and the fundamentals are favouring the bears, too.

Before further ado, let’s have a look at today’s trading analysis.

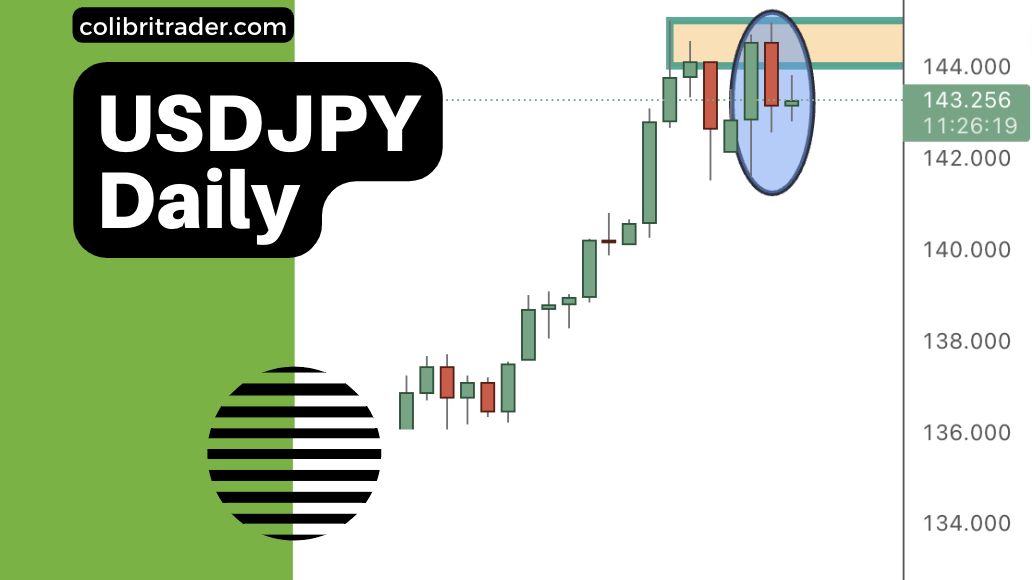

USDJPY Trading Analysis 15/09/2022

Today, I am looking at USDJPY.

There is a minor supply zone.

The pair has printed an inside bar on the daily chart and seems like all of the signs for a reversal are there.

But then if everyone thinks that this pair will reverse, this leaves us a little room for imagination.

If I have to be completely objective, there is an uptrend and the price is only showing a little sign of bearishness.

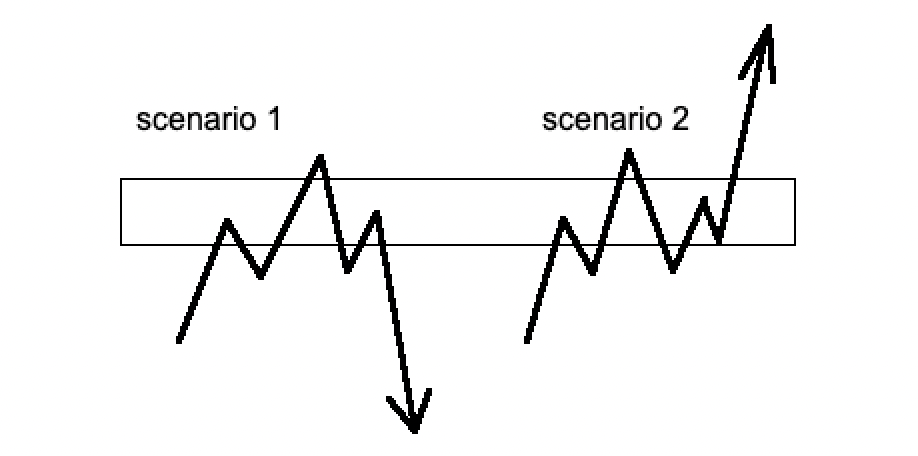

This means that we can either see a reversal or a continuation.

If I had to draw it, it would look something like that:

Looks like that we are not in a very clear ground.

From here, I would be looking for any sign of bearishness or bullishness on the lower timeframes.

I will be looking for a bullish engulfing or a pinbar on the 4 hour chart supporting an advance or a retracement.

Then, based on that I will take any action- be it bullish or bearish.

Happy trading,

Colibri Trader

P.S.

Have you read my recent article on How to Make Money Day Trading?

P.P.S.

Here is an article on How to Grow a Small Trading Account.