USDJPY Trading Analysis 07.03.2022

Dear Colibri-lings 🧙🏼♂️

The trading analysis from last time did not manage to get enough buyers excited.

I was waiting for the price to come down a bit and then form a bullish candlestick pattern 📊, but alas.

What happened instead was that price just pierced through the demand zone and did not leave much to the imagination.

There were a few bearish opportunities for the price action trader.

Initially, there was an inverted pinbar candlestick pattern.

Here is what I mean:

Then, there were a couple of bearish engulfing patterns on the 4H chart.

Here is the first one:

And here is the second one:

None of those were boding well for the bulls, but if you were shorting, you probably are sitting on some very decent profits now 🤑.

Let’s have a look at another currency pair now.

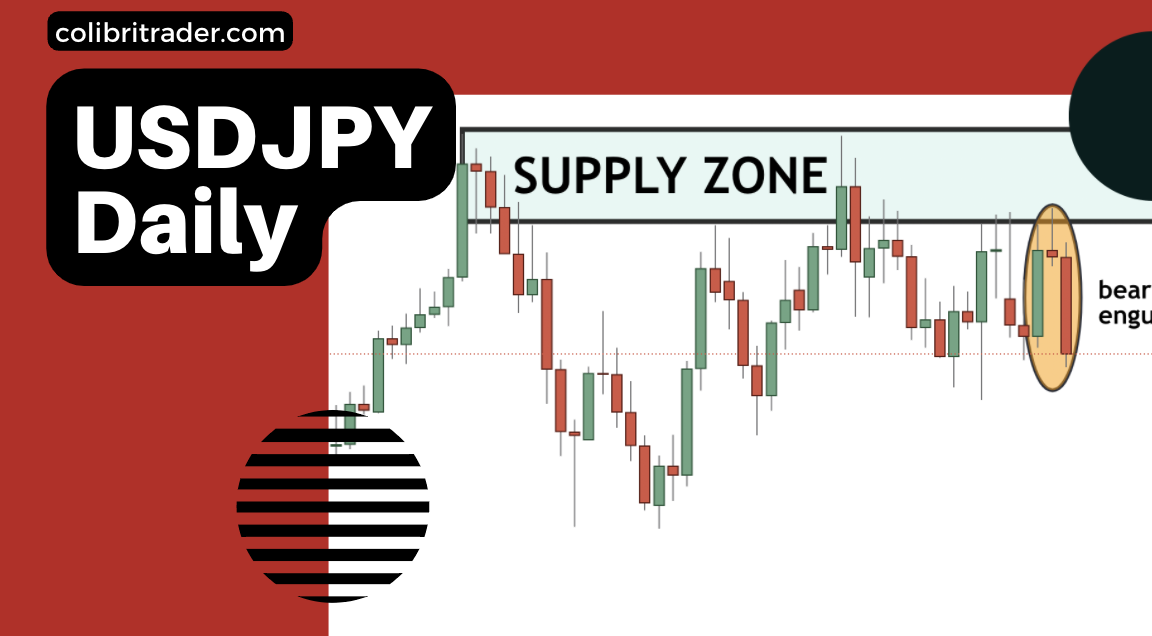

USDJPY Trading Analysis 07.03.2022

I am currently looking at the USDJPY currency pair.

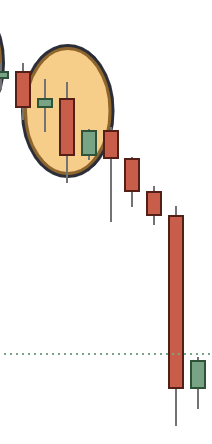

There is a bearish engulfing candlestick pattern just under a major supply zone .

Here it is:

I would ideally like to see the price re-testing the 116.500 one more time.

But alternatively, if we see a pullback towards the 115.00-level and then a 4H bearish candlestick confirmation, I might consider shorting.

The next meaningful level is the 113.500 barrier.

Therefore, if the risk:reward is good, a 150 pips might be a decent ride🎢 to test.

Let’s wait and see what the price holds for us.

Happy Trading,

Colibri Trader

Have you checked my recent article on the 7 Pullback Strategies and How To Profit With Them?