USDCAD Trading Idea

USDCAD Trading Idea

by: Colibri Trader

Dear traders,

The trading ideas from last time have performed quite well- especially the USDJPY. It is going closer to the second price target. GBPJPY has been locked in a range-bound market, but still if you have placed your stops where my stop is, you would not have been stopped out. Indeed, you would be in profit. On the other side, my Sunday analysis has proven quite solid and now we can see EURUSD going closer to the resistance area at 1.0800. Still, there is no sign of reversal, but I would be extra careful around this zone. AUDUSD is showing some signs of reversal around 0.7740. I am still not shorting this pair.

USDCAD Trading Idea

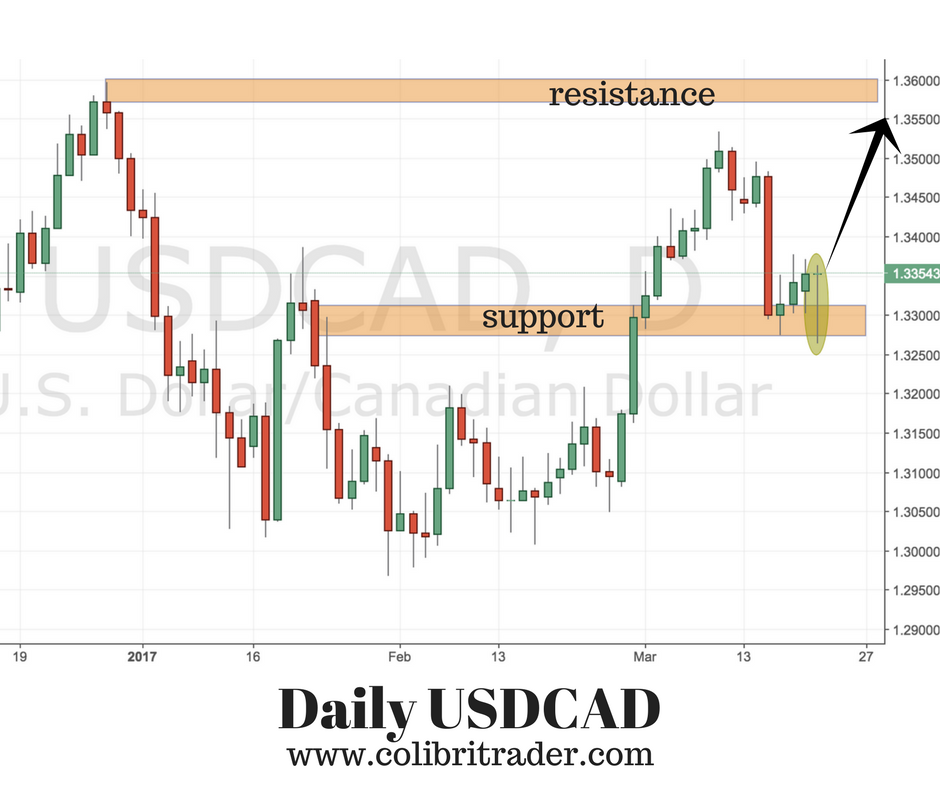

Today’s trading idea is coming from USDCAD. As you can see from the screenshot, there has been a daily reversal candle formation. It is a bearish rejection or a pin bar. I will be looking to go long around 1.3330. My stop-loss would be placed just under 1.3260. My first target is the level of 1.3420. My secondary price target is the level of 1.3595.

Happy Trading,

Colibri Trader

Hi Colibri,

USD/CAD

I’m long at 1.33604 with a SL @ 1.33393.

The pin is def a substantial rejection. A one candle reversal it seems, so happens to be 50% of the up move so perhaps a healthy pullback then trend continuation.

Be int to see what happens thanks for posting

Hi Dan,

You are only using a 21 pip SL? My original idea is slightly different- I hope you are not taking all my ideas for granted. I hope you to make your own trading analysis- especially after taking the trading course. It is important that you have enough room for a trade to breathe. Also, make sure you are careful with this USDCAD because the daily candle is a bullish rejection. Just saying 😉

Hi Colibri,

The trade was taken based on that strong pin bar crossing “back up” through 50% fib level.

I might add this was taken on a sim account, as I have very little exp trading forex.

The trade went well until the reversal. I moved my SL to break even yesterday after seeing the bearish candle on 4 hour.

I was stopped out and I don’t mind, I can always jump in depending on price action.

Sure I also learn a lot from Dan’s postings here. Not only Dan’s analysis, but his positive attitude and mindset towards trading not as gambling. Thanks Dan!

Cheers Harry

Don’t be afraid to also share your thoughts or analysis, we can all learn from each other.

If you do I can give my unbiased input

The more you share, the more you learn!

Have a nice weekend everybody!

Thanks 🙂 see you next week

USD/CAD

USD/CAD

I see a very good trend trade possibility here, one that could last for months downward.

Monthly pins

Weekly engulf

Daily climactic move downward

Have a look fella’s, do your own analysis and feel free to comment

🙂

Hi colibritrader

USD/CAD

Under observation for any price action that falls below 1.326.

This is the 50% level for the bull bar that was last week Feb.

Should this take place the bear camp could start gathering momentum

I’m just in hurry up and wait mode atm.

Hope you all had a nice Easter break.

Hi Dan,

This could be the case. Or, the Daily pinbar that has formed could be, as well! You should be careful with this one, because it looks to be locked b/n support and resistance atm

Hi colibritrader,

Now that another day has passed, I am better equipped to comment on this pair.

The Bull Engulf was something to pay attention to and thus to wait for confirmation.

Confirmation came in the form of that pin AND it respected the 50% zone/area of that Bull Candle.

This is actually a textbook long setup, and “why” I didn’t see it this way ??

I would love to know how to automate this signal as it is a good one.

Question: Why at the 50% area of either event areas or bull or bear candles do we see price action getting confirmed and traders profiting from ? Hope i made sense here 🙂

Thank you for your replies, I look forward to them all.

Hi Dan,

Thank you for the great questions. I am sorry for the late response, but just came back from an Easter holiday. This was a very good setup, which I missed, as well. It ticked all the boxes, even the intraday setup on the 4H was looking great. There was a nice pinbar that formed on the retracement. I am not sure about a way to automise- in general it is possible but whether the result will be as good is a different question. Usually, the 50% is an area that a lot of Fibonacci traders are looking to enter into positions. I hope that clarifies a bit your question:)

Hi colibritrader.

Thank you for your reply and glad to hear you had a nice Easter break 🙂

Yes textbook great odds.

That reminds me of a question, is there a way to find out how consistent any pattern is in % terms.

How would one do this ? Xcel or some other program ?

For example at a guess this pattern I described could have more than 50% positive expectancy as long as it’s taken in alignment with trend.

Kind Regards

Hi Dan,

That takes a lot of time and effort. I have done this for EURUSD, which you can find here: https://www.colibritrader.com/most-detailed-eurusd-historical-analysis/

The problem with that is that first it takes a lot of time and second, it is hard (and could be expensive) to find the data. I hope that helps 🙂 I hope you had a great Easter, too:)

Hi colibritrader,

I downloaded that a while back and it was VERY detailed.

I guess it comes back down to “risk mangement is king” everything else is secondary

Thanks for your reply 🙂

That’s great Dan! Risk management has always been a KING! When it comes to successful trading, nothing beats it:)

Hi colibritrader,

USD/CAD

Look at it go … I have learned yet another thing, be ready to be wrong.

That bull engulfing candle that started this whole uptrend, then the pin that formed after the Bull candle.

This combination I have now etched into my memoriy. I have seen it a few times now. Have never seen it in any books.

Commenting only here

Cheers

Hi Dan,

That could have been a great trade. The Bullish engulfing started the move, there was a second confirmation by a pin bar, as well. Great trade all in all. My humble opinion is that the best book is your own experience- not anyone else’s!

Hi Colibri,

Looking at this pair, it’s at an interesting level.

No bearish rejection signals yet, weekly candle is small (still early in this week) and daily inside occurring.

A bearish break of 1.2467 would be quite beasrish unless a fakeout occurs.

Sharing a few open thoughts on this pair.

NOTE: “”Absolutely no signal either way “”

Good on you to those that rode this one down, a great trend trade !

Tell us if you did

Hi Dan,

I am not in the USDCAD pair. However, you can read this article, in which I was waiting for a short entry:

https://www.colibritrader.com/technical-view-upcoming-week/

It was the 2nd on June and the bearish engulfing pattern nicely formed at a minor resistance zone. I took a small short back then, but nothing major. Definitely did not see this big wave coming 🙂

Hi Colibri,

I’ve seen it happen many times were I decided to close a trade because it looked like it was turning against me only to see carry on further.

I remember someone telling me that a particular trader never scratched thier trades. In fact if every trade were to be left to stop out it could be that many more trades would go on to make extra profits.

I wonder if this could be true as a rule.

I wonder if any one has done the studies.

My oil trade got stopped out, next …..

Hi Dan,

I completely understand that. I am not sure about a study like that, but it might be worth checking in some of the financial journals. I am sure it could be a great thesis for a Phd 🙂 The oil and audjpy trades did not really turn out as expected…

Hi Colibri,

Price is at a nice flip zone but still not enough bearish rejection.

One to monitor

Cheers

http://fxpro.ctrader.com/c/LcBpn

Yes, I agree. As I said, I am monitoring it. But definitely one to watch mate! I am expecting it to re-test the 1.2400 mark and then I will see how it behaves around those levels.

Hi Colibri

Went long @ 1.258 expecting a move back to 1.250 SL under that.

Cheers

See what happens, daily bullish bullish

Hi Dan,

I would be more cautious with USDCAD. I believe that if we are to see a major reversing point here, it will take longer. I am waiting for the price to go below 1.2400 before considering any trade. Just my 2c:) at the moment not

Hi Colibri,

The price move up has allowed me to move SL a little higher than entry, so low and behold in a free trade now.

No one knows what will happen next but if it keeps moving higher I am following my process and that’s all that matters.

Seems like you have to replicate animal instincts and not human in this game of trading.

IE:

A lion or reptile that lies in wait for the opptimum opportunity to strike, does not strike until the time is right

That was well spotted! One that I missed:).

Regarding the animal instincts, there is a book called animal behaviour- I recommend it:) but yes, we are definitely like a lion waiting for its prey. Keep waiting 🙂

Hi Colibri,

Still long from 1.258

R coming up @ 1.275

Am a bit surprised at how it has moved up consistently

Hi Dan,

That was a good one! Looks like you have done a decent trade there. I would not be surprised if I see some selling around 1.275, but if this will change the direction is another question, which I am not sure about

SL hit @ 1.268 100 pips

Perhaps moved it too close, I guess you never know

As long as you are in green, it is OK. If you lost the belief in the trend, you have done the right thing.

Hi

Yes in green +936.00 aud

I feel I did the right thing considering no one knows what will happen next. Could even enter again if signal presents.

The thing to keep in mind (as note to self) is there will always be another opp.

!! just have to wait for it !!

🙂

That’s great Dan. Sometimes, you need to take profits, stay aside and re-evaluate! You are always doing the right thing, as long as you are following your pre-defined plan!