Trading Price Action or The Extraordinary Benefits of Knowing When to Quit

Trading Price Action or The Extraordinary Benefits of Knowing When to Quit- CONTENTS

by: Colibri Trader

On trading price action and quitters. Quitting is for losers… or is it?

Most of your friends or even competitors will tell you that you need to be perseverant. If you put in the extra hours of work and keep on trying you should succeed.

The message “Don’t quit” is everywhere we turn around. It is so prevalent that it has already become a cliche.

If all you needed to succeed was to “not quit”, then why do people or organisations less motivated than you succeed.

If it was so clear, why do individuals less skilled than you learn how to win faster?

In my opinion, it means understanding the nature of quitting and probably means that you need to start quitting much more often than you do right now.

What is Price Action?

Although this article is written for price action traders, it could be equally well appreciated (hopefully) from all types of traders. So what is price action?

For the majority of you that are following my activity online, you should know that I am a price action trader.

Price action concentrates on using the price as the sole indicator and does not consider fundamentals and other lagging indicators. Price action trading or also called naked trading is the most pure form of trading.

It is also considered to be amongst the hardest ways to trade the market. As it relies on simple concepts like Support and Resistance and Candlesticks, it is utterly important that the trader knows how to precisely use those tools.

There are other tools that price action traders use like Fibonacci Levels, Trendlines, Money Management, etc. Although this article is about price action, the purpose is not to concentrate on those. In case you feel the need (or lack the knowledge), please read about them before you proceed with the rest.

Here is a clean chart that is used by price action traders:

Here is the same chart that is clustered with indicators that is usually used by non-price action traders:

I have seen charts that have much more indicators than the above one, but the purpose is to show you the difference between trading price action and a non-price action trading.

In the end, it is your choice, but I have taken the path of the price action trader.

Should You Quit Trading Price Action and Move to Another Strategy

Back to the main topic- should you quit trading price action and move to another trading strategy?

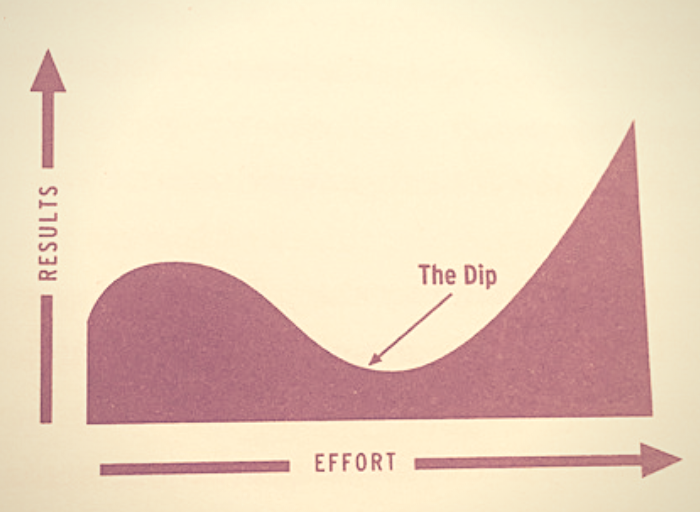

As referred by Seth Godin, almost everything in life worth doing is controlled by the “Dip”. At the beginning, it is fun. No matter what you practice- golf, piloting a plane or trading, it is interesting. It is even addictive to a point.

Over the course of the next few weeks, months, years the “Dip” happens. It is the period between the starting point and the mastery of whatever your undertaking is. In our case, this would be trading. Have a look at the image below:

The “Dip” is the difference between an amateur trader and an experienced trader. Usually only 5% pass through the “Dip”. That figure is purely based on my experience, but also the official data point in this direction. For more on that topic, you can check my article on the 4 Levels of Trading Experience.

So, should you quit price action trading? It is not an easy question. In my opinion, if you are skipping from one trading strategy to another, this won’t lead to anything good.

All good traders have realised early enough that sticking to what works and cutting everything else is a key to profitable trading.

In order to become a profitable trader, you should concentrate first on money management. It does not matter whether you are a price action trader or any other type of trader. Money management is the starting point and should be with you at all times.

Let’s imagine that you quit price action trading and move on to another trading strategy. Based on the above information about the “Dip”, you will most likely go through a stage, where you are learning the strategy. It is fun and looks interesting in the beginning; you could even make money with it.

How long before you “hit the dip” is the main question you should be asking yourselves. Would you skip to another trading strategy again? How many strategies you will change before you quit or come back to price action trading or whatever the trading strategy you were using was.

Most people just quit when it is most painful and they stick to a trading strategy when they can’t be bothered to quit. Does that sound like you?

It is easy to be a CEO. What’s hard is getting there!

Should You Quit Trading At All

Should You Quit Trading At All

That is a very logical question. Or, should you not start trading price action or any other trading style at all. Before answering that question, another set of important questions should be answered first.

Are you ready to sacrifice your personal life and regular habits and become a dedicated student of the markets; are you also able to support yourself even if it takes 5 years before you become profitable; are you willing to sacrifice so many years to find out in the end that your teeth were not cut out for that profession?

If you are still with me, probably you have a chance in price action trading or trading in general.

I can guarantee you that the majority of people when they see a long article, they will drop reading after they have covered 25% of the text. Probably another 50% will reach mid-point and they will call it a day.

The real winners are the ones that can reach the end and make the most of it (if of course the text is worth reading). Let’s not forget that the “Dip” creates scarcity and scarcity creates value.

If there are too many people starting the process and too many finishing it, there is probably no value at all in the end. So, think twice before quitting or when quitting, because sometimes quitting might be the right thing to do, as well.

How Long Should You Keep Trading Using Price Action if You Are Losing

That is another very logical question. Even if I pretend to have the right answer, I would probably be misleading not only myself, but others too.

This in my opinion, is a question that has no straightforward answer. Is price action trading the right trading strategy should be the first question to ask. If your trading has shown it is, then you should stick to it no matter what.

If you don’t feel like this is your type of trading, you’d be better off quitting price action trading before you have started it. Just to give you an idea about price action trading and the way I use it, have a look at one of my videos from my trading course:

Coming back to the main question- how long you should continue using price action trading if you are losing. Based on my experience, price action trading was a success from the very beginning.

It does not mean I have not tried other trading strategies. It does not mean that I was successful in the very beginning. In fact, it took me over 2 years before I started to see some hints of consistency.

I was also making the typical mistakes of the beginner trader- jumping from one strategy to another every two weeks. I have been following a lot of trading blogs and forums and it did not really help improve my trading results.

The only thing I was not doing right was learning how to deal with losing streaks. It sounds simple, but in practice is extremely hard.

I was quitting trading strategies and moving to new ones because I was too weak to realise that what was causing my losses was actually my inability to cope with losing streaks and not the trading strategy itself.

So, should you quit trading price action if you are in a losing streak?

It really depends on the stage you are in. If you have been trading profitably with price action and you are just experiencing a losing streak- probably you should quit trading and take a break, as opposed to quitting in general.

If you have never been profitable with any price action strategy, probably you should quit. It is hard to say and it will depend from one trader to another.

Based on my experience, in most cases one and the same strategy could be used profitably by one trader and not-profitably by another. It really depends on the trader and the money management skills he/she posses.

What’s Next?

What you should do next? By now, you must have a good expectation of how to answer the question if you should quit trading price action or not. If not, it means that you are in the very early stages of your trading career.

In this case, maybe you should start by reading some of my previous articles on that topic or trading in general. Some of them are:

Candlesticks are Pure Price Action Trading

10 Questions Price Action Traders Ask About Price Action Trading

One of the Most Common Candlestick Patterns in Price Action Trading

Trendlines and Price Action Trading

Price Action Trading and Support and Resistance

Three Real Life Examples of Price Action Trading with Support and Resistance

The Way I See Price Action Trading- My Trading Strategy

This is just a small list of the topics that you should cover before maybe re-reading this article again. No matter how experienced you are, take a moment to reflect and consider if quitting is for you.

In case you have any questions or hesitations, you can always e-mail me. My door is always open for the knowledge-thirsty student of price action trading and the markets. My e-mail is: admin@colibritrader.com

Happy Trading,

Colibri Trader

Thanks Colibri,

I will maintain trading is easy it’s the trader that makes it hard.

If one just learns to “wait” sit quietly and be patient they will be more than 50% there. The other % is the P/A knowledge which can be learned via your course which doesn’t take long to go through and learn to be honest.

This should definitely not be called trading it should be called “waiting for opportunities” because trading exemplifies some sort of glamour it’s not about that AT ALL !

Overtrading happens to those that don’t wait plain and simple, the patience required is more than most can muster hence the % of success in trading is less than 5%

Hi Dan,

You cannot have explained this better!

All the great traders make their money in two ways:

1) Waiting for the best of trading opportunities

2) Waiting for a winning position to accumulate to a larger winning position

Period.