Top 5 Essential Books to Accelerate Your Supply and Demand Trading Journey

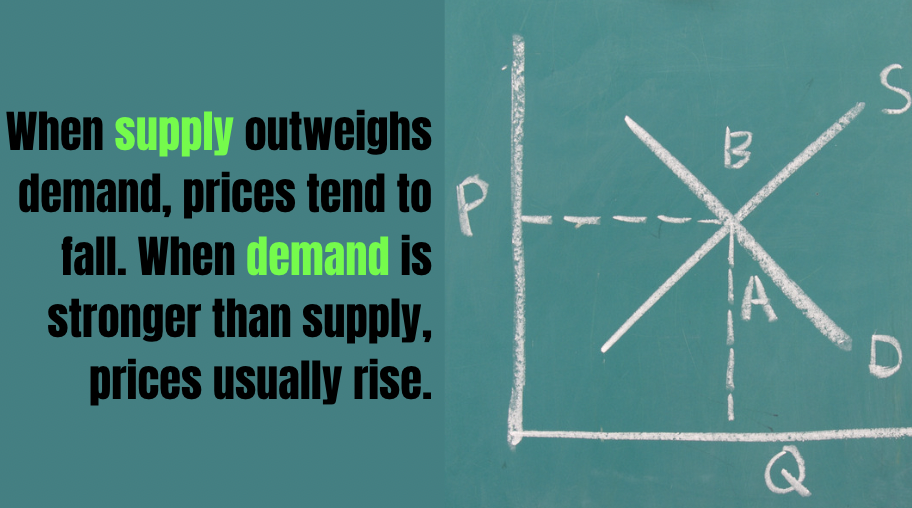

At its core, the financial markets are driven by the perpetual push and pull between supply and demand zones.

Supply refers to the amount of a financial instrument that investors and traders want to sell at certain price levels.

Demand indicates how much buyers in the market wish to acquire at various prices.

When supply outweighs demand, prices tend to fall. When demand is stronger than supply, prices usually rise.

By studying historical price charts, skilled traders can identify the specific price levels where supply and demand is likely to be strongest.

Understanding market supply and demand provides numerous advantages for traders:

- High probability trade entry and exit points: Key areas of supply and demand imbalance provide higher odds trading zones to enter or exit positions.

- Market structure analysis: Analyzing the sequencing of higher highs/lows, and lower highs/lows reveals the current bias and direction of markets.

- Powerful risk management: Defined supply/demand zones provide logical stop loss placement areas to minimize downside.

Now let’s explore the top 5 must-read books for mastering supply and demand trading.

1. Trading in the Zone by Mark Douglas

While less focused on specific trading strategies, Mark Douglas’ iconic book emphasizes the crucial mental aspect of trading success – controlling emotions and beliefs to make objective decisions. Understanding supply and demand aligns perfectly with Douglas’ principle to “think in terms of probabilities” instead of certainty. By defining key supply and demand zones, traders create a rule-based framework for making high-probability entries and exits.

Key supply and demand concepts covered include:

Other key topics include defeating self-sabotage, rigid thinking, and unrealistic expectations – critical mental obstacles for all traders. Packed with insightful questions and practical exercises, Trading in the Zone guides you to develop the discipline and mindset mastery needed to thrive across all financial markets.

Key Concepts Covered: Trader psychology, risk management, developing an edge, mental discipline

2. Naked Forex: High Probability Techniques for Trading Without Indicators by Alex Nekritin and Walter Peters

Naked Forex takes a back-to-basics approach – stripping away complex indicators to reveal how core supply and demand dynamics drive currency market prices. Co-authored by FX specialists Walter Peters and Alex Nekritin, this book trains forex traders to identify and profit from dynamic supply and demand imbalances with clarity.

Key supply and demand concepts covered include:

- Defining market participants and decoding their order flow footprints

- Finding confluence between price action patterns and supply/demand zones

- Executing breakout strategies by spotting order flow shifts at key zones

Packed with chart examples across short and long-term timeframes, Naked Forex provides an expert masterclass in pure price action analysis focused on core supply and demand fundamentals.

Key Concepts Covered: Supply and demand analysis, order flow strategies, trading breakouts, risk management

3. The Ultimate Price Action Trading Guide by Atanas Matov

Written by price action expert Atanas Matov, this practical guide reveals proven strategies to identify and trade dynamic areas of supply and demand on any time frame. The principles covered form the core of Matov’s popular price action trading course training traders globally.

Specific supply and demand concepts covered include:

- Finding confluence between support/resistance levels and footprints in market structure

- Combining indicators with price action to gauge supply/demand intensity

- Executing reversal and breakout strategies focused on areas of order flow imbalance

This is undoubtedly your go-to guide if you want a thorough education in visually analyzing the markets through a supply and demand lens.

Key Concepts Covered: Price action analysis, market structure, technical analysis, supply and demand zones, trading course

4. SUPPLY AND DEMAND TRADING: How To Master The Trading Zones

Written by supply and demand trader Frank Miller, this practical trading workbook delivers step-by-step techniques to profit from dynamic supply and demand zones. Miller combines his unique Extreme Range Candlestick (ERC) analysis with innovative flip zones strategies to pinpoint high-probability trades.

Specific trading tactics revealed include:

- Identifying hidden flip zones representing sudden order flow shifts using ERCs

- Executing margin squeeze trades combining simple candle patterns with supply/demand dynamics

- Ultra-precise techniques to target, enter and manage trades around the most lucrative supply and demand zones

If you want a deep dive into current best practices to trade modern markets dominated by algorithmic order flow, this is a must-read supply and demand trading bible.

Key Concepts Covered: Trading zones, market structure, entry and exit tactics

5. Mastering the Trade by John F. Carter

John Carter’s Mastering the Trade examines the unique supply and demand indicator TTM Squeeze. This special indicator combines Bollinger Bands and Keltner Channels to identify consolidation periods signaling big price breakouts. Trade entries and exits can then be fine-tuned using key support and resistance zones representing areas of order flow imbalance.

While less focused purely on supply and demand analysis, Mastering the Trade incorporates these core dynamics into its technical toolkit.

Additional concepts covered include:

- Using volume, momentum and other indicators to confirm supply/demand trade signals

- Innovative chart pattern strategies based on supply and demand dynamics

- High probability breakout techniques taking advantage of order flow shifts

This book suits more advanced traders looking to uplevel their technical analysis game using cutting-edge supply and demand indicators and strategies.

Key Concepts Covered: Indicators, technical analysis, quantitative methods

Conclusion: Master Supply and Demand Trading from Beginner to Advanced Level

Understanding supply and demand forms the foundation of all financial market movements.

While trading indicators come and go, mastering the core principles of supply and demand provides a timeless market edge across all instruments and timeframes.

Whether just starting out or looking to advance your analysis, studying the techniques revealed across these definitive books will transform your trading.

Take the next step now by getting started with our Supply and Demand Guide to Trading to further accelerate your progress.

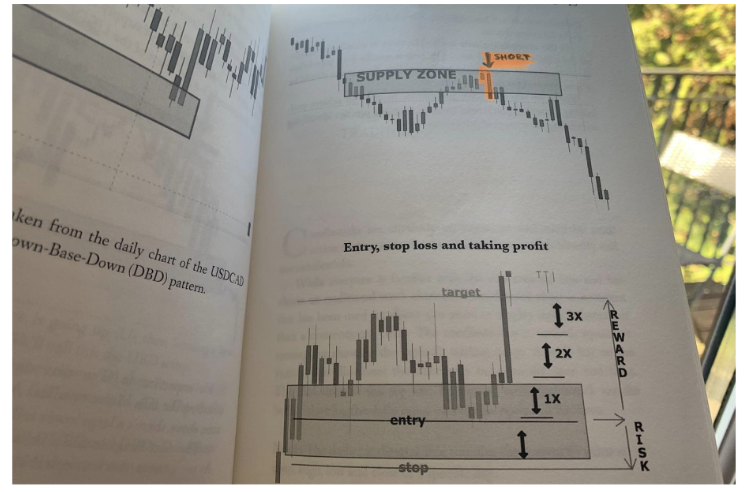

This is just one page from my trading manual. This is probably one of the best ways to minimize your risk while maximizing the possible return. This is the so-called IBWT pattern!

Happy Hunting Traders!