Top 10 Chart Patterns Every Trader Should Know

by: @colibritrader

Chart patterns are one of the most effective trading tools for a trader. They are pure price action and form based on underlying buying and selling pressure. Chart patterns have a proven track record, and traders use them to identify continuation or reversal signals, open positions, and to identify price targets.

In this article, we will show the top 10 chart patterns that every trader should know. The first part will reveal the reversal patterns and how they are used.

DOWNLOAD THE ADVANCED CHART PATTERNS PDF

Reversal patterns (PART I)

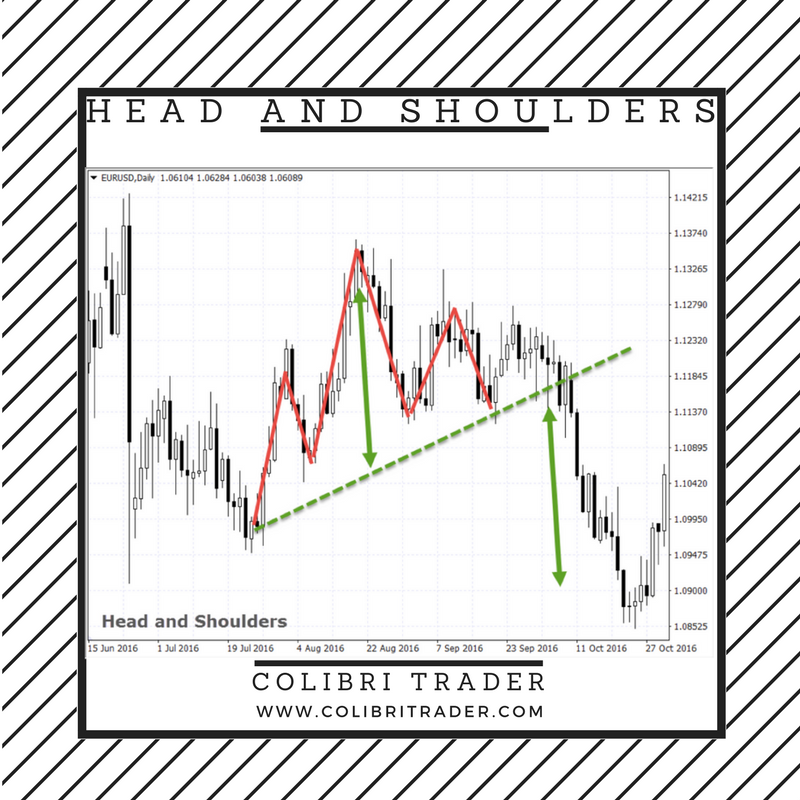

Head and Shoulders

Head and Shoulders is a reversal chart pattern, that indicates the underlying trend is ABOUT TO CHANGE.

It consists of three swing highs, with the middle swing high being the highest (red lines on the chart).

After the middle swing high, a lower high occurs which signals that buyers didn’t have enough strength to pull the price higher.

The pattern looks like a head with a left and right shoulder (the three swing highs), and that’s how it got its name.

The neckline connects the two shoulders.

IMPORTANT: Break-out below the neckline is considered a selling signal, with a price target being the distance from the top of the head to the neckline (green arrows).

If the Head and Shoulders pattern occurs during a downtrend, the same inverse pattern (with three swing lows) is called an Inverse Head and Shoulders pattern.

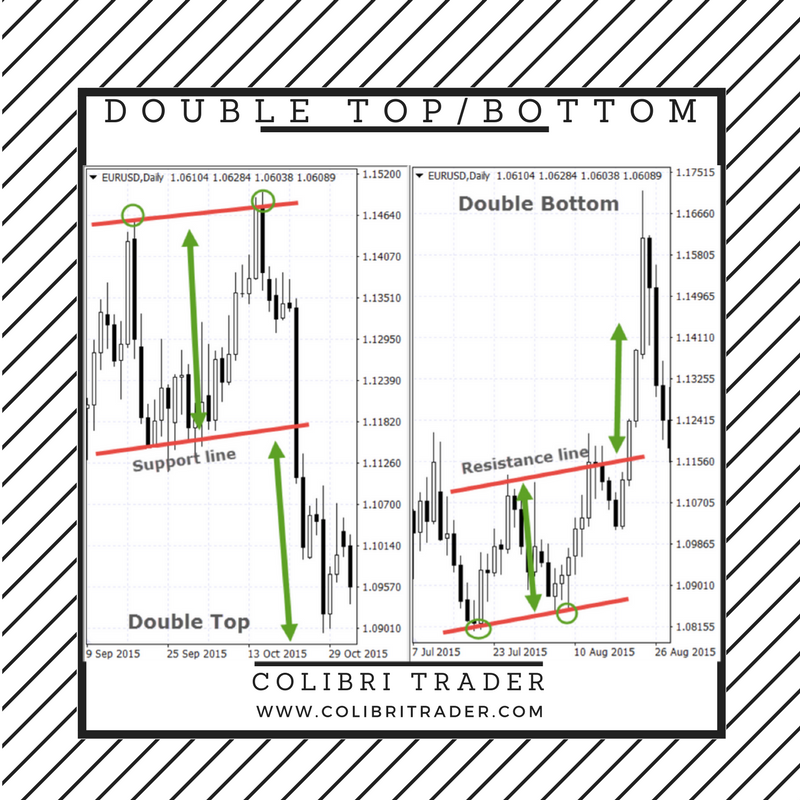

Double Top and Double Bottom

Double Top and Double Bottom are another reversal pattern, occurring during BOTH up- and downtrends, respectively.

A double top, as the name suggests, has two swing highs at about the same, or slightly different price.

It shows that buyers didn’t manage to push the price higher, and a trend reversal might be ahead.

PRO TIP: The trigger signal for opening a sell position is the break of the support line, with the target price being the distance between the top and the support line of the formation.

A double bottom pattern is the opposite, with two swing lows.

Sellers didn’t have the power to move the price downward.

The trigger signal is the break of the resistance line, with the target price being the distance between the bottom and the resistance line.

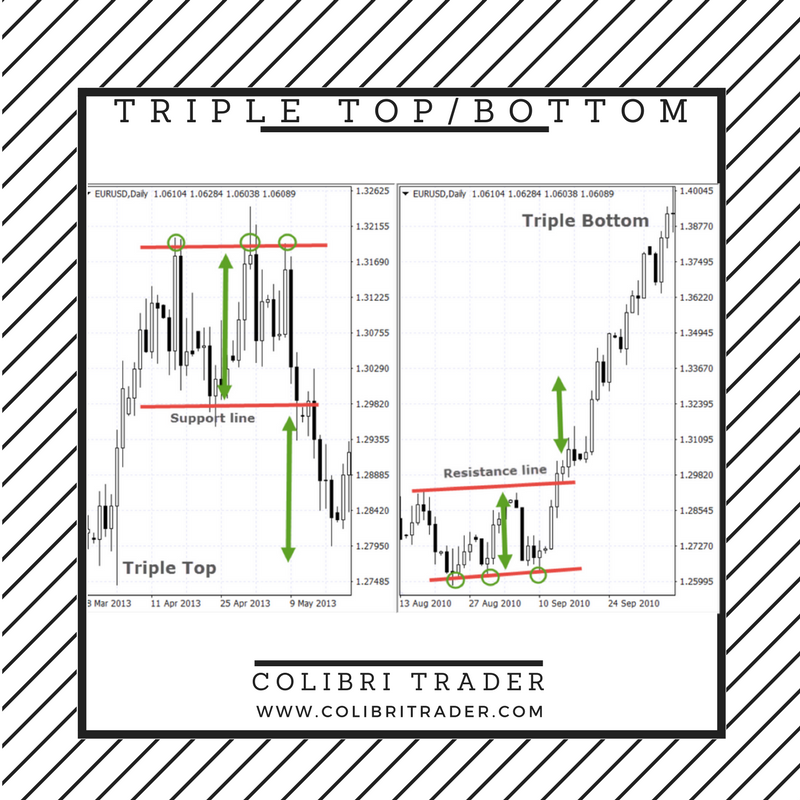

Triple Top and Triple Bottom

Triple Top and Tripple Bottom formations are basically the same as Double Top and Double Bottom formations.

Both are reversal patterns, with the difference that Triple Tops and Bottoms have three swing highs and swing lows, respectively.

PRO TIP: Trigger signals are again the break of support and resistance lines, with target prices being the distance between the top and support line (for Triple Tops), and bottom and resistance line (for Triple Bottoms).

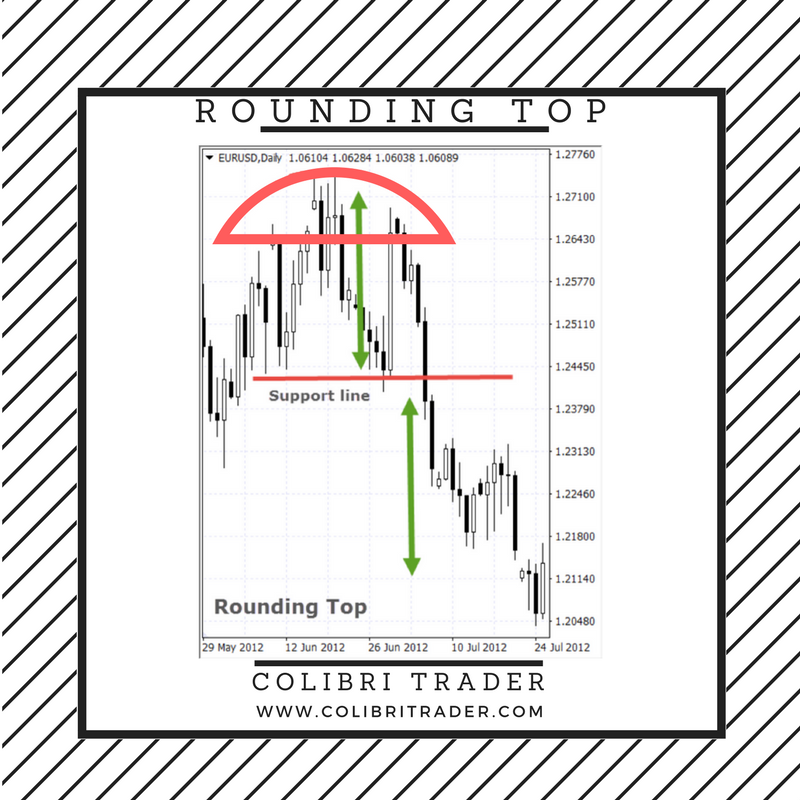

Rounding Top

A Rounding Top pattern takes a little longer to form than the other patterns mentioned in this article.

It shows a gradual change of the sentiment from bullish to bearish.

The price forms gradually a „rounded top“, as can be seen on the chart.

IMPORTANT: The trigger for entering a short position is the break of the support line, with the price target equal to the distance from the top to the support line.

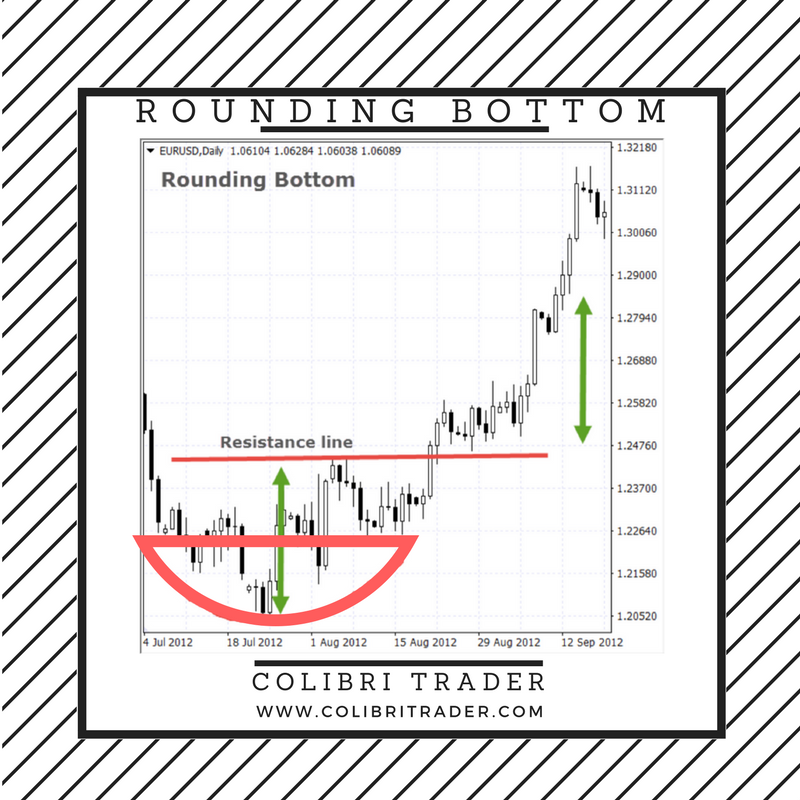

Rounding Bottom

A Rounding Bottom is a Rounding Top flipped vertically.

The price made a gradual change from the previous downtrend, indicated by a „rounded bottom“.

PRO TIP: The trigger signals are the same as by the Rounding Top, i.e. the break of the resistance line.

The price target is the distance between the bottom and the resistance line.

Continuation Chart Patterns (Part II)

In this part, I will reveal the most popular continuation chart patterns. Continuation patterns are as important as reversal patterns. They are more suitable for a different style of trading- trend following. While reversal patterns are good for contrarian traders and swing traders, continuation patterns are considered to be great for finding a good entry point to follow the trend. The next few patterns will reveal a new angle to trading with you. I will start with the first one, which is the rectangle:

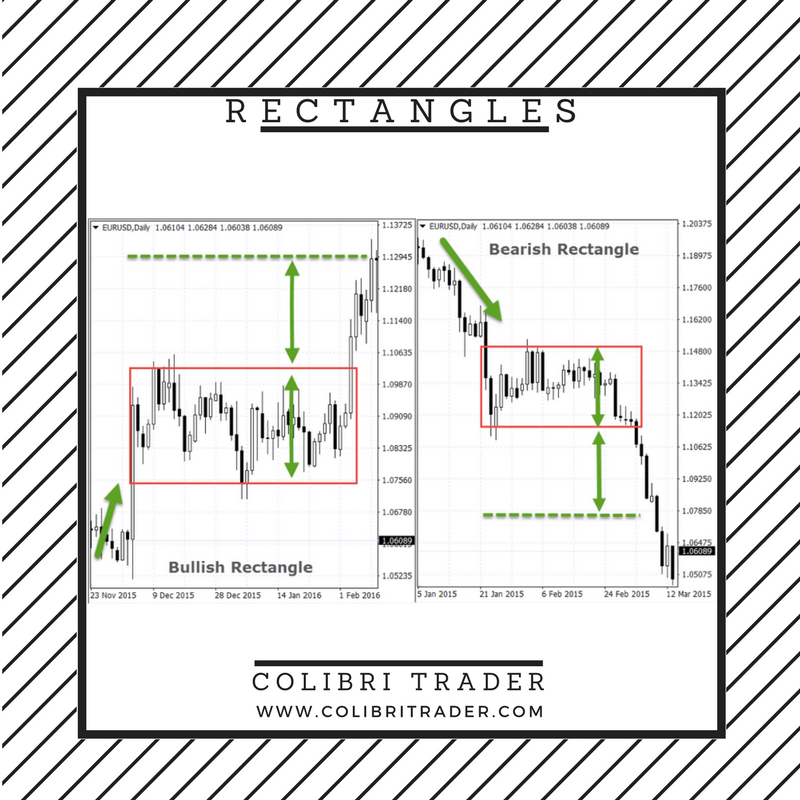

Rectangles

A rectangle is a continuation pattern, which means it confirms that the underlying trend should continue.

It is divided into bullish and bearish rectangles, depending on the underlying trend.

A bullish rectangle appears during an uptrend, when the price enters a congestion phase, during a sideways trading.

The price will likely break out in the direction of the preceding trend.

PRO TIP: The trigger signal is the break of the upper line of the rectangle, with the price target being the height of the rectangle.

For the bearish rectangle, the opposite rules apply. It forms during a prevailing downtrend when the price enters a congestion phase and trades sideways.

This means the trend will most likely continue downwards, with the break of the lower rectangle line.

The price target is again the height of the rectangle.

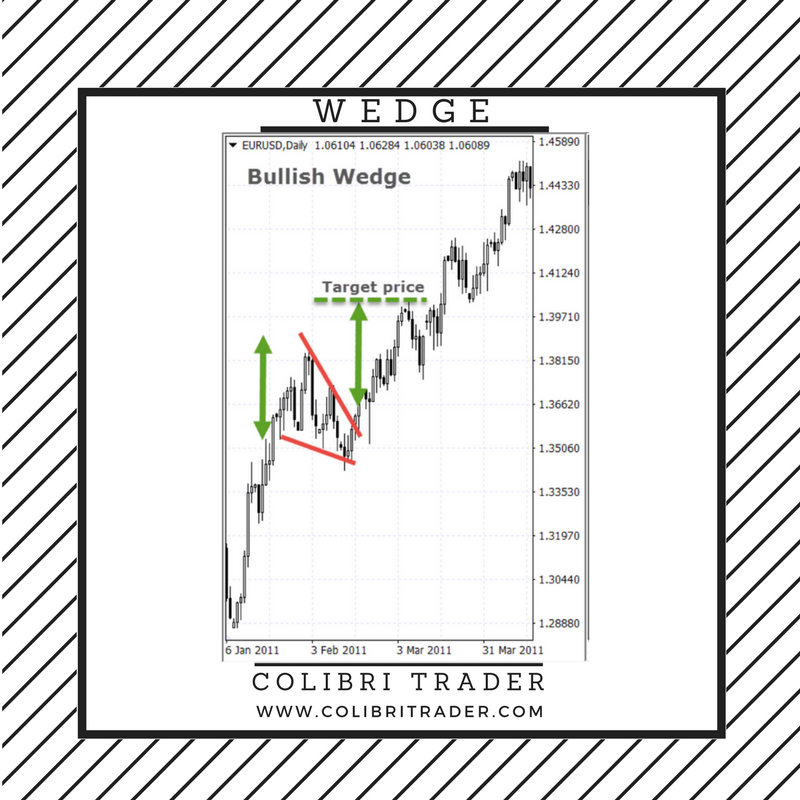

Wedges

A wedge is another continuation pattern.

A bullish wedge forms during an uptrend, as the price trades inside converging trendlines.

These converging trendlines imply that sellers are trying to push the price lower, but don’t have enough strength to win against the buyers.

Ultimately, the buyers win and the price breaks through the upper trendline, indicating that the uptrend will resume.

PRO TIP: Target prices are calculated as the maximal height of the wedge, which is then projected to the point of break-out.

A bearish wedge is similar to a bullish one, with the difference that it appears during downtrends, and the slope of the wedge is up.

Converging trendlines are again showing that buyers interrupted the downtrend, trying to push prices higher.

A break-out through the lower trendline indicates that sellers won the battle, and the downtrend is resuming.

The target price is, like by bullish wedges, the maximal height of the wedge which is then projected to the point of break-out.

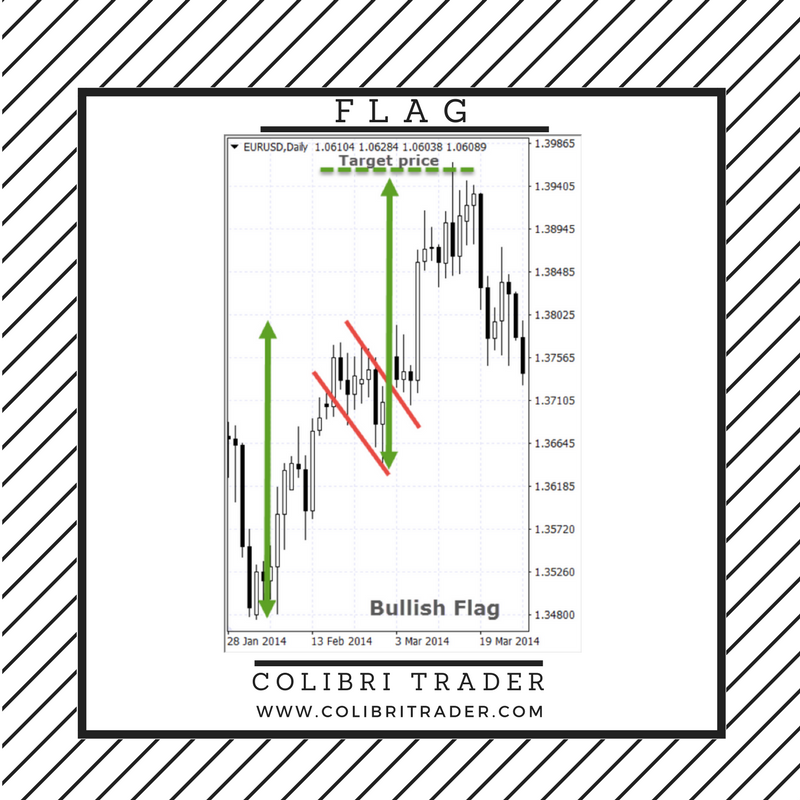

Flags

A flag is very similar to a wedge, with the difference that the trendlines which form the flag are parallel, and not converging.

A flag pole is also a part of the flag pattern because the target price is measured in a different way than by other chart patterns.

Flags can be bullish and bearish, with a bullish flag shown on the chart above.

A bullish flag forms during an uptrend, with parallel trendlines above and below the price-action, which form a downslope.

PRO TIP: A break-out above confirms that the uptrend is resuming.

A bearish flag is pretty much the same as a bullish flag, with the difference that it forms during downtrends and has an upslope.

The price target is measured as the height of the flagpole (green arrow) to the top of the flag, which is then projected to the lowest point of a bullish flag (or highest point of a bearish flag).

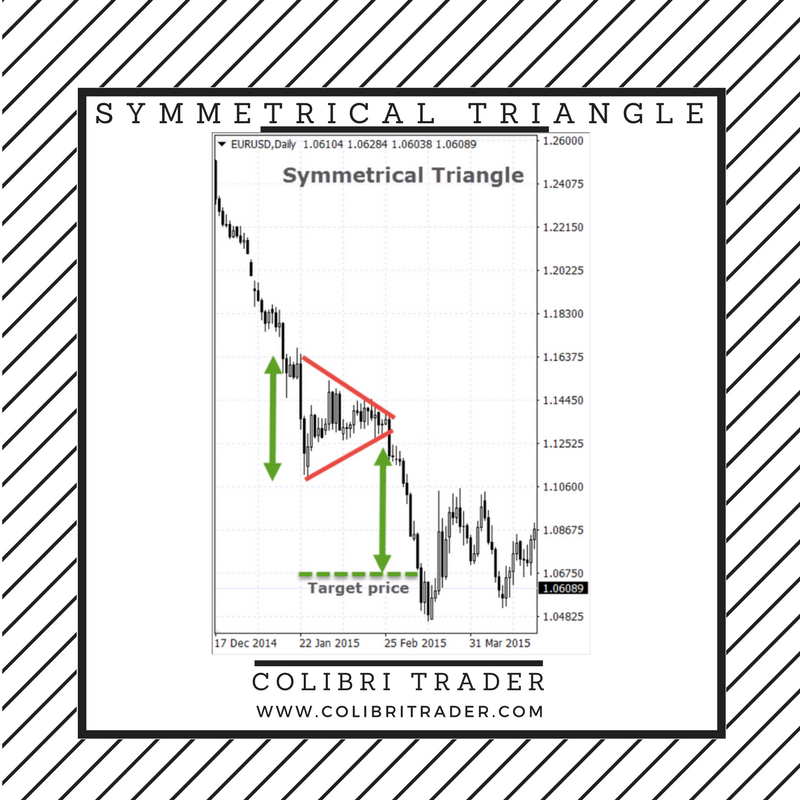

Triangles

Triangles can be ascending, descending, and symmetrical.

All three types of triangles look pretty much the same, with the difference that ascending triangles have a flat upper trendline, and descending triangles have a flat lower trendline.

A symmetrical trendline is the most common, and forms during both up- and downtrends.

It has converging trendlines, just like a wedge pattern, but the slope is neither pointing up nor down.

PRO TIP: The breakout point of the lower trendline during downtrends confirms that the downtrend is resuming, while a breakout of the upper trendline during uptrends confirms the underlying uptrend.

The target price is the height of the triangle, projected to the point of the breakout.

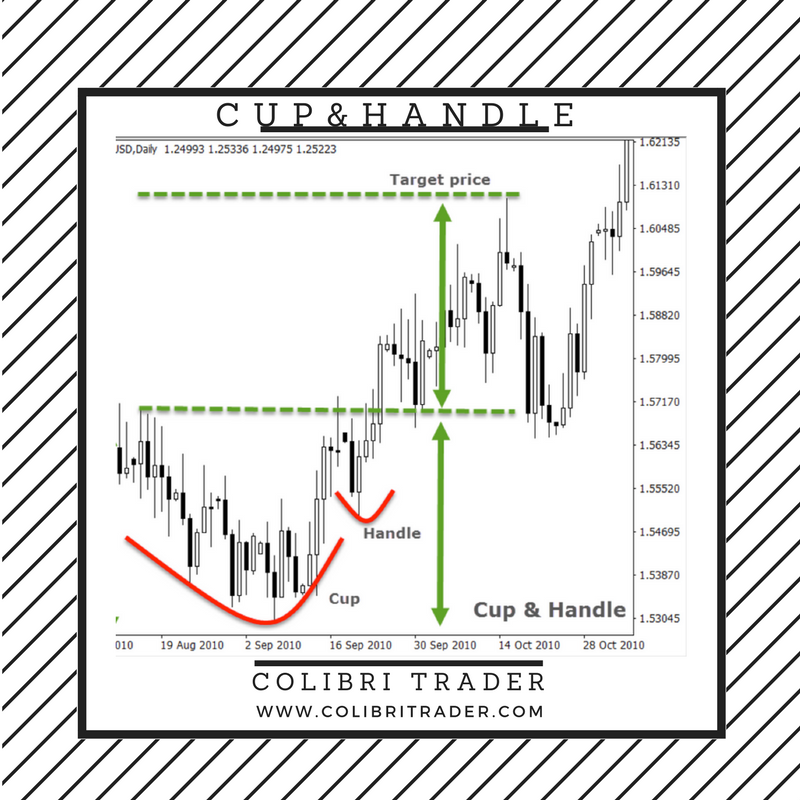

Cup and Handle

A Cup and Handle pattern is a Rounding Top pattern with an additional pullback (the handle).

It is a continuation pattern that shows that in the middle of an uptrend, the sellers tried to push the price lower, but the sentiment is again gradually changing from the sellers to the buyers.

Additionally, a pullback occurs as the last attempt of the sellers to dominate.

After a break-out of the resistance line (green dotted line), the target price is calculated as the height of the Cup & Handle pattern.

An Inverse Cup & Handle pattern appears during downtrends, and the inverse rules of a regular Cup & Handle apply to it.

Top 10 Chart Patterns Every Trader Should Know (CONCLUSION)

I have written this article with the main aim to show you another angle of trading.

As can be seen, these chart patterns might help you determine trend direction, but you should not rely solely on them.

I have covered the major 10 chart patterns every trader should know.

I believe that these are the most important ones, but if you feel like I have omitted an important one, please share it with the rest of us in the comments below.

Once again- as I have outlined in my previous articles, you should take everything with a grain of salt.

No indicator is good by itself or the trading system is successful enough if placed in the wrong hands. You should find what works for you and stick to it.

P.S.

Curious about my trading style?

See why I am hooked on Supply and Demand.

P.P.S.

If you are interested in learning more about some of the most popular trading indicators, you can check them out here:

MACD

ATR

RSI

STOCHASTIC

BOLLINGER BANDS

Got questions? Fire ‘em over to: admin@colibritrader.com

Thank you. Very good references.

My pleasure. When was the last one you have seen and on which currency pair?

chart pattern is ok but how to decide entry exit stoploss and target.it is missing.

This would have taken a long time. I have my trading strategy explained step-by-step in my trading course. Let me know if you have any specific questions

Well explained. Concise without the ‘frills’. Thank you.

Thanks mate! Let me know if there is anything else you need clarifying or a topic you want covered 🙂

Is there any easy way to recognize round top, round bottom, cup & handle pattern in the chart?

The only way is the one described in the article 🙂

Sir can u throw some light on AB=CD pattern ..regards

Check out my Elliott Wave article 🙂

How about Broadening Channle its a continuation or reversal pattern group ?

imho, it could be both, although most people are considering it as a continuation pattern

Which indicator or strategyto identify early reversals for bottom or reversal in stock or market / or to which levels a bounce back probability will go in stock when it reverse from bottom. Thanks for wonderful article.

Hi Vishal,

I am using strictly price action. If you want PM me at admin@colibritrader.com if you have more concrete questions. It is usually always to go with the trend as opposed to try to pick bottoms and tops. Let me know if you have any other questions.

Colibri

your site it is very usefull thank you

Thank you!

All pattern