The First Trading Week of September and What I Have Learnt From It

In the first week of September I took a few trades.

I managed to place trades on Dow Jones and GBPUSD.

They were based on my day trading strategy.

As the majority of my followers know, I do trade with 70% of my equity long term and with only 30% of my equity short term.

Those trades are based on one of my trading accounts that has 30% of my equity in it.

#1 Dow Jones Trade

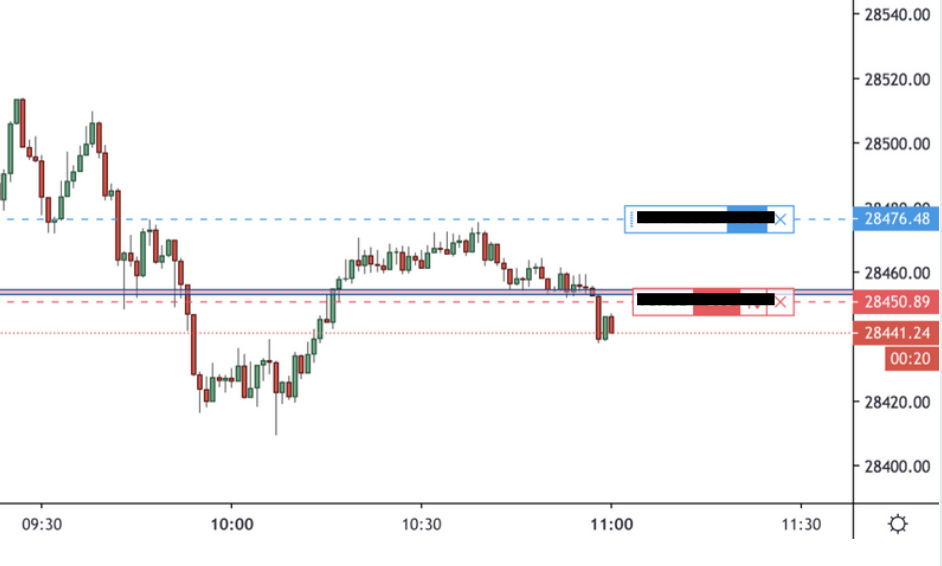

I shorted the Dow during the European session on the 1st of September.

My entry level was around 28456. My stop loss was only 20 pips above at around 28476 (as you can see from the screenshot above).

I was looking at the level of 28320 as a potential target but was ready to take my profits earlier if price showed me a negative sign of reversal.

All in all, I was ready to act fast in this fast moving market.

Next thing you know is price hesitating and moving slowly in my direction.

At this time it is still to early to say if the trade will be successful or not.

As a trader you need to be patient enough and wait to see where price will go.

It is still too early to move my stop loss.

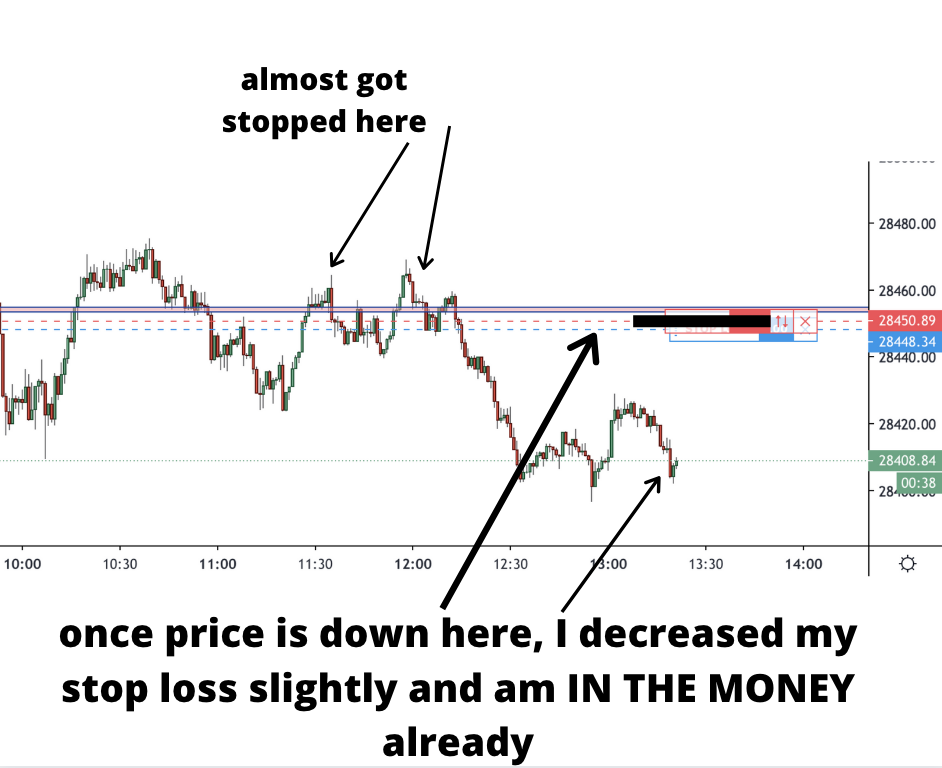

And before I know it, price is already gaining momentum.

In the Money

Two hours into the trade, I have already moved my stop loss to below my entry.

This means that I am in the money and even if I get stopped out, I will not realise a loss.

The place where every trader wants to be.

This is a risk-free trade at this place pretty much (unless the broker slips me of course).

What happens next???

The selloff I have been expecting for some time now finally happens.

My target is at 28320 and I am closing my position before it bounces back from the major support level.

This was a very decent trade, which originally risked around 20 points and made almost 140 points.

The risk:reward ratio on this trade was a phenomenal 1:7.

#2 Missed Opportunity to Go Long Dow Jones

You cannot get into all the trades possible.

Sometimes you miss them, so you need to move on.

I just wanted to share with you my thoughts behind an unrealised trade.

When I closed my short position, I was thinking of entering into a long trade, since the price was rebounding off a major support level.

Funny enough, this was a level which was even more important than the level I shorted the same morning, but I did not take the trade.

I was getting emotionally tired with my initial trade and wanted to take a break.

Sometimes I manage to take both sides of a move like this one but at other times I just miss them.

Was it a mistake?

Probably, although I was not be too harsh on me.

I still had a great trade and was grateful for what the markets offered me on this trading day.

This brings me onto my next trade this week.

#3 Dow Jones Trade Number 2

In the next trade, I will walk you through Dow Jones again.

This time it is a LONG trade.

In this trade I risked only 14-15 points.

This is a very low risk considering the trade is on Dow Jones.

My initial target was around 28900.

As you will see later, this was a very conservative target considering where Dow went next.

My target was reached very quickly just after I moved my stop loss above my entry.

I exited this trade at around 28900 for about 140 points profits.

My risk:reward on this trade was 1:10.

Another phenomenal return!

I usually risk 20-40 points when trading the Dow, but this trade was taken in an extremely fast moving market and allowed me to place a very tight stop loss.

#4 Cable (GBPUSD) Trade

I have taken the next trade off a major resistance level from the 1 hour chart.

I usually do not trade before an NFP announcement, but this trade was ticking all of my other boxes.

Here is a chart of how the cable chart looked like.

I was waiting to see more reaffirming signs of the trend continuing.

We had a scenario of a downtrend, retracement and a continuation.

Here is the next step: adding a stop loss

My risk on this trade is about 20-21 pips.

I was targeting the level of 1.3220.

It took some time before momentum was gained.

At this time the NFP was still pending.

I cannot lie to you and will share that I was hesitating to close the trade pre-NFP.

What happens next will tell you why I did not close my trade yet.

All the technicals were aligned and an NFP could just have been a strong catalyst.

Here is the reason why I did not close my trade before the NFP.

My reasoning was if price falls a bit more I will have enough room to move my stop loss under my entry and then I am running a risk free trade.

That is what happened here and as you can see my stop loss is below my entry already.

Now, it is only a matter of me hitting my stop loss or my target, which was around the level of 1.3220.

What followed was the NFP, which as you can see dragged price down to my target level.

I did not hesitate and closed my position.

I did share this trade after taking it with my Twitter followers here:

When I closed the trade, I have made around 80 pips on this trade.

My original risk was around 20 pips, which makes for a 1:4 risk:reward ratio.

A smaller ratio than the previous two trades, but let’s forget that the volatility that the FX markets offers is lower than Dow.

One way or another, it was a very successful trading week.

I could not enter into a long trade off this support level, but was not expecting such a fast rebound.

Happy Trading,

Colibri Trader

Check out my trading article on Dow Day Trading Strategies.