Donchian Channel Indicator and How to Trade with it- 5 Proven Strategies

Donchian Channel Indicator and How to Trade with it- 5 Proven Strategies

Richard Donchian developed the Donchian Channel Indicator back in 1936. He is a fund manager, writer, and also known as the father of ‘trend trading.’

This indicator might look a bit complex in the beginning, but it is easy to use once you understand the way it works.

Donchian Channel Indicator is versatile and works in all types of markets. You can find this indicator on all the major trading platforms by default.

Initially, this indicator was not that popular, but when the famous Turtle Trader group used the concept of trend-following breakout trading, Donchian Channel gained the popularity in the trading community.

Traders use the Donchian Channel Indicator to assess the volatility of the market. On the charting platform, this indicator is formed by taking the highest high and lowest low of the last “N” periods.

The line is marked for high & low values. The area between low of the price and high of the price is considered as the “channel” of the particular period chosen.

You can select the ‘n’ period according to your trading requirements. But if you are an absolute novice trader, make sure to use the ’20’ default period setting.

Donchian Channel Indicator is placed over the price chart of any particular asset.

This helps you to visualise where the current market price is relative to the lower and upper bound of the Donchian Channel.

You can also add the midline on your chart, which provides the midpoint between the channels.

This indicator helps you to understand the following on your price chart:

- Spotting breakouts

- Identifying Support and Resistance levels

- Gauging the trend

- Understanding market volatility

- Finding the market swing highs and lows

The Donchian Channel Indicator is made of three bands:

- Upper Band – 20-Day high is the upper band.

- Lower Band – 20-Day low is the lower band.

- Middle Band – The average of the upper and lower band.

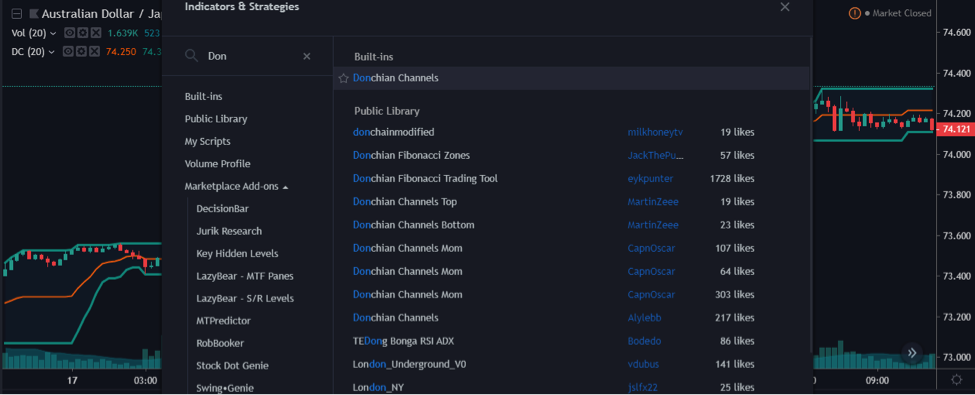

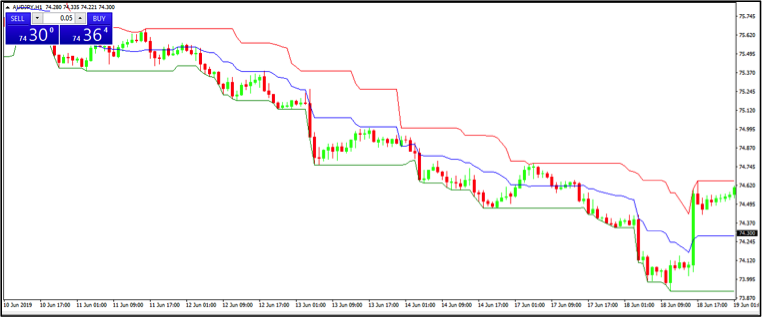

The Donchian Channel Indicator applied on to the AUD/JPY Forex chart

The Donchian Channel Indicator works on all the timeframes in any of the markets. This indicator can be used stand-alone to identify the overbought/oversold conditions.

Bearish and bullish extremes are identified by the Donchian Channel Indicator, which helps the trader to identify breakouts, reversals, and breakdowns.

The top channel determines the extent of bullish energy, which highlights the highest price market achieved for a particular period.

The centreline of the Donchian Channel Indicator identifies the mean reversion price.

This highlights the middle ground achieved for a particular period through the battle between buyers and sellers.

The bottom channel of the Donchian Channel Indicator identifies the extent of bearish energy.

This highlights the lowest price market achieved for the particular period through the battle between buyers and sellers.

Overall, the Donchian Channel Indicator identifies the relationship between the trading ranges over predetermined periods and the current price of an asset.

You can choose the number of price bars you wish to look at.

If you use the Donchian indicator over 40 price bars, the channels of the indicator are calculated and plotted based on the 40-period price bars.

Applying the indicator on to your Trading View charts

Since the Donchian Channel Indicator is extremely popular, you can find it by default in most of the trading platforms.

In order to apply this indicator to your Trading View charts, just search for Donchian Channels under the indicator tab and double click.

Installing the Donchian Channel Indicator on MT4 Terminal

MetaTrader has a vast user base and a large set of default indicators; however, Donchian Channel Indicator is not one of them.

You can download it as a custom indicator and apply that to your MT4 charts in less than 5 minutes.

Follow this link to download the Donchian Channel Indicator. After downloading, follow the below steps to add it to your MT4 Terminal.

- Copy the indicator file.

- Open your MT4 Terminal.

- Click on File (Left top corner) > Open Data Folder.

- Open MQL4 Folder.

- Open Indicators Folder.

- Paste the downloaded indicator File here.

- Now restart your MT4 Terminal.

- Click on Insert > Indicators > Custom.

- Find the indicator and click ‘Okay.’

This is how your MT4 chart should look after applying the Donchian Channel Indicator to it.

Working of the Donchian Channel Indicator

When the prices are stable, the Donchian channels will be relatively narrow, and when there is heavy price fluctuation, the indicator channels will be wider.

Most of the traders use the Donchian Channel Indicator to trade the trend, and they also rely on volatility to generate profits.

Now it totally depends on the trader on how he/she uses this information to create profitable strategies for themselves.

Contrarily, when the price of any asset goes below the most recent X period value, then they can be interpreted as a sell signal.

Also, some traders prefer to trade the “dead market” conditions on the lower timeframes by using the Donchian Channel indicator.

In options trading, traders use this indicator for their ‘call’ and ‘put’ option strategies. This helps them to maximise their profits in range-bound conditions.

Traders can use the Donchian to identify the following characteristics of Price-Action.

- Overbought – When prices approach the upper band of the channel, the market is said to be in an overbought condition.

- Oversold – When prices approach the lower band of the channel, the market is said to be in an oversold condition.

- Breakout – In dead market conditions or when the market is moving in a range, it is an indication for an upcoming breakout.

- Trend – When prices constantly stay at an overbought or oversold area, it is a confirmation of the trend, or it’s a signal of the price getting stronger.

When the market is in any of the above states, you can use the Donchian Channel Indicator to enter or exit your trade.

If you are already in a trade, you can also manage your open positions actively.

Breakout trading using this indicator

There are so many different ways to use the Donchian Channel Indicator.

Beginners use it to trade the channels’ high and low point, whereas most of the professional traders use this indicator to identify breakout trades.

This helps the traders to determine the long or short positions.

If any particular asset is trading higher than the indicator ‘n’ period, take a long trade and book your profits when the indicator goes below the ‘n’ period.

Remember: This strategy works only in active trending markets, and to make money using this indicator always go with the trend.

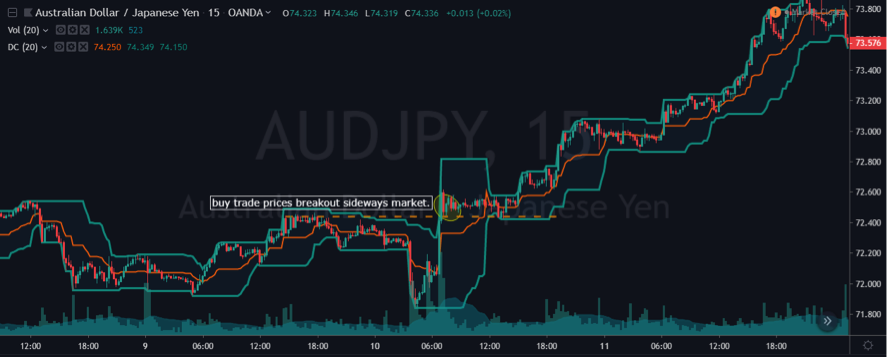

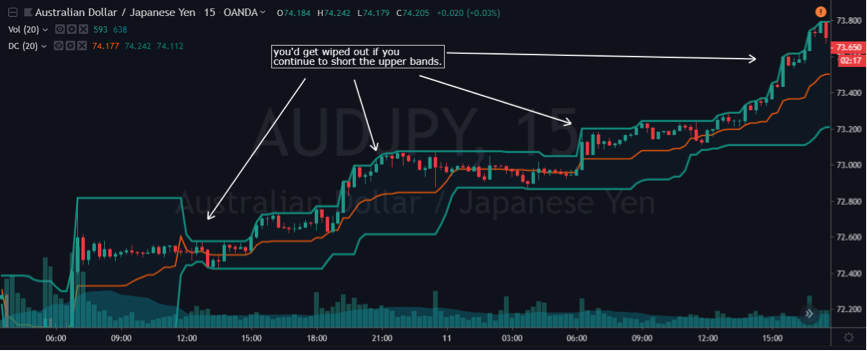

Let’s identify the buying position by taking an example of the AUD/JPY Forex pair.

As you can see, we’ve applied the Donchian Channel Indicator on the newly started trend, which is visible in the image below.

We have taken a 15-minute Forex chart, which covers the market from 9th October to 11th October.

In the above image, we have highlighted the significant breakouts with an orange dotted line.

This breakout is a potential buy signal for us.

Hence we have opened a long position at 72.45 on 10th October.

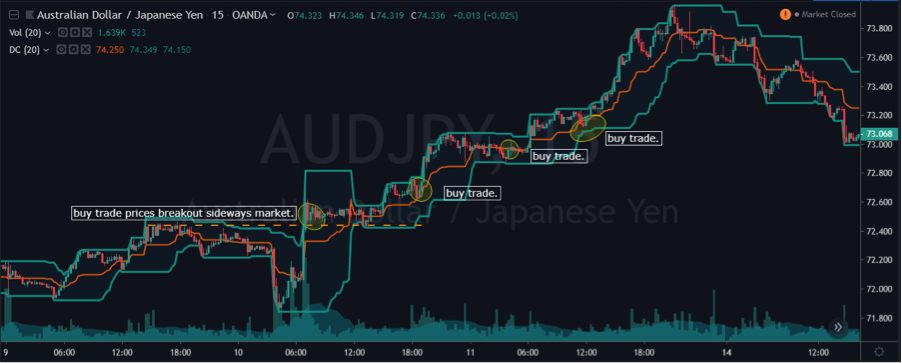

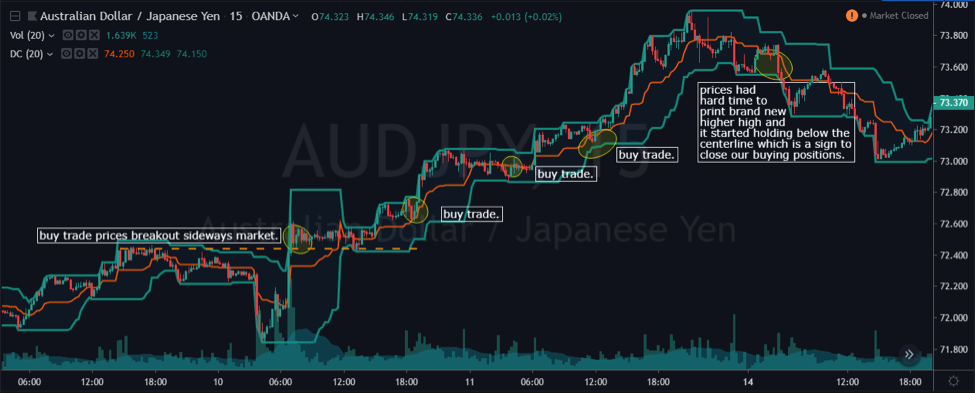

Scaling your trade by using the centreline of the Donchian Channel Indicator

The centreline of the Donchian Channel Indicator is the average of the upper and lower channel.

Confirmation traders use the centreline breakout to take trades in the market.

In a healthy trending market, it is easy to scale your positions.

As you can see, whenever the prices hit the centreline, Donchian Channel Indicator indicated at least a couple of buy trades.

In the below image, we have opened three other long positions.

We have essentially scaled our trades here by using the centreline of the Donchian Channel Indicator.

We then closed our buy positions (below image) at 73.56 when the price goes and holds below the centreline on 14th October.

By taking these trades using the Donchian Channel Indicator, we managed to make a profit of about 110 pips in AUD/JPY pair.

Pairing the Donchian Channel Indicator with Average True Range

This is another breakout strategy for higher timeframes.

You can’t use this strategy for intraday trading.

This strategy will better suit someone who invests in the long term.

It will suit someone trading the daily/weekly timeframe.

Step 1

Apply both Donchian Channel Indicator and Average True Range Indicator on your charts.

Then identify last year’s low levels on the ATR indicator.

If the current ATR low is lower than the previous year’s low, your trade has more odds to perform in your chosen direction.

Step 2

Find the breakout of the Donchian Channel Indicator.

If the prices go above the upper channel, go ‘long,’ and if the prices go below the lower channel, go ‘short.’

Buy Example:

As you can see in the below image, ATR was showing less volatility in the market, and the market was in a consolidation phase.

This means, someone is building orders in the market; when the prices go above the Donchian channel, it indicates a long position.

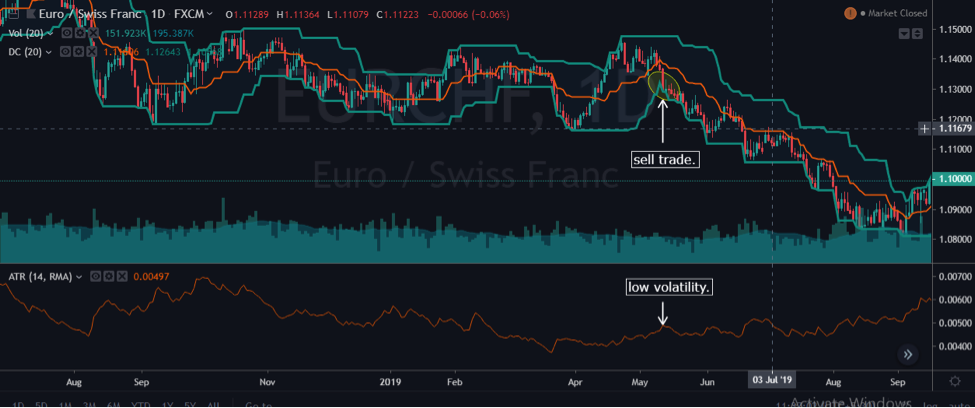

Sell Example:

To place a sell order, just do the opposite of what we have explained above.

When the market on a higher timeframe turns sideways for a longer period, it is an indication that someone is building positions to move the market in the longer-term.

Expect the market to break the downside of the Donchian channel if:

- If the higher timeframe shows a downward trend and

- A lower timeframe shows the consolidation phase

As you can see in the below image, ATR was showing less volatility, and prices broke the lower Donchian channel.

This means that the market is ready to print brand new lower low, and it indicates a potential sell signal, and we can see the result of the sell trade we took.

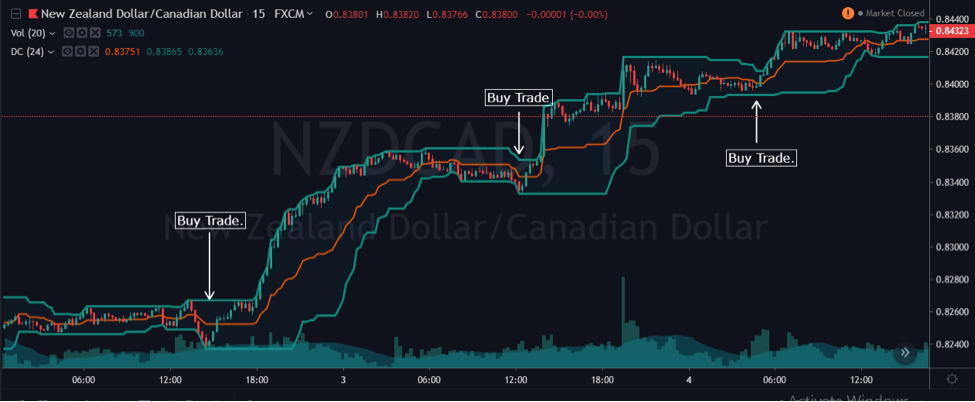

Using Donchian Channel Indicator for intraday trading

As you know by now, the Donchian Channel Indicator works very well on all the timeframes.

Unfortunately, you can’t use the default setting (20) on all the timeframes. Finding the appropriate setting for the indicator is the key component to generate consistent profits.

20-Period parameter works very well to trade the higher timeframes such as Daily, 240 Min, and 60 Min.

For the 30/15 chart, we are using the 24-period settings, so that we can visualise the full day’s range.

The idea is simple.

When the market is in an uptrend, go ‘long’ when the prices hit the lower channel.

Similarly, when the market is in a downtrend, go ‘short’ when the prices hit the upper channel.

In the below image, whenever prices hit the lower channel, it took off firmly.

This method is one of the easiest and simplest ways to trade the Donchian channel for intraday trading.

This strategy will generate a lot of signals, but you need to manually figure out when to “trust” the signal and when not to.

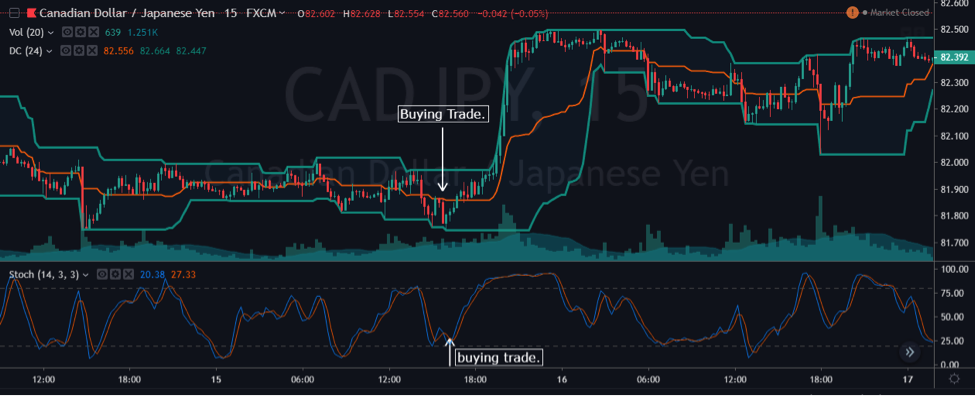

Increasing signal accuracy by pairing Donchian Channel Indicator with Stochastic indicator

If you are a trader who follows the trend, we suggest you to use any momentum indicator to spot accurate trading signals.

You can use any momentum indicator, and our favourite choice is Stochastic.

This indicator avoids the price and volume data. Instead, it follows the momentum and speed of price action.

It is a leading indicator in the industry, which oscillates above and below the zero line.

By pairing Donchian Channel Indicator with Stochastic, we can easily spot accurate trading opportunities.

Important: To use this strategy, make sure the market is in trending condition.

It is an indication for traders to GO LONG if:

- In an uptrend, when the price action hits the lower channel of the Donchian Channel Indicator and

- If the Stochastic indicator gives a sharp reversal at the oversold area

Conversely, traders GO SHORT if:

- In a downtrend, when the price hits the upper channel and

- If the Stochastic indicator gives a sharp reversal at the overbought area, it is a potential sell signal for us.

Exit your position when the reverse happens from the upside.

Buy Example

In the CAD/JPY below chart, the market was in an uptrend.

During the pullback phase, when all the conditions of our strategy are met (marked as Buy trade), the prices took off and printed a brand new higher high.

This strategy works very well on the lower timeframe for the intraday trading across all the charting platforms.

It will also help you to find out higher probability setups so that you can easily scale your trades.

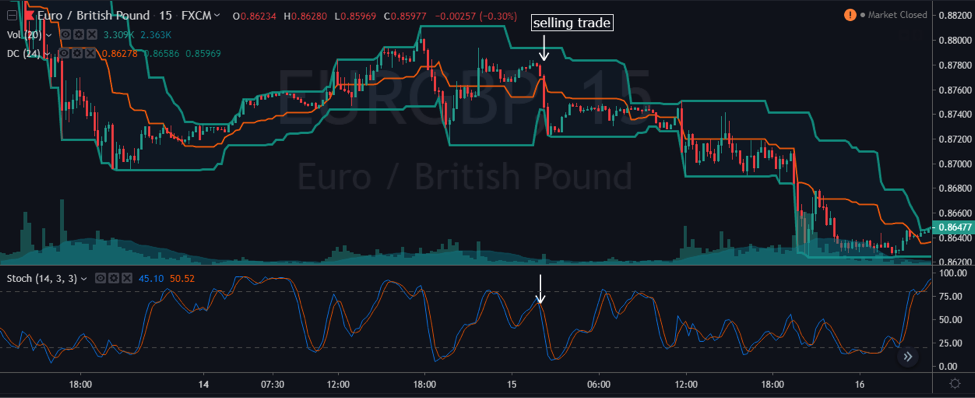

Sell Example

As you can see in the image below, EUR/GBP was in a downtrend.

On 15th October, when the price action hits the upper Donchian channel, the stochastic was also ready to reverse at the overbought area.

This is a clear indication for us to go in for a sell trade.

Don’t make this mistake when you trade using this indicator.

Most of the novice traders blindly trade the Donchian Channel Indicator.

They think when the market hits the upper band, it means the market is ready to reverse.

And when prices hit the lower band, it is a sign to go long.

This is the biggest mistake they do because market behaviours are often different.

This strategy sometimes works very well when the new trend is about to start, but in strong trending conditions, this often fails.

Don’t use this basic technique to identify the overbought and oversold areas.

It is better to pair it with some other reliable indicator to time your entries and exits, which we shared above.

The problem with most of the traders is that they use an indicator stand-alone to trade all types of markets.

For instance, they use momentum indicator/oscillators/trend following indicators to trade choppy market conditions.

Well, DON’T!

In choppy market conditions, both the buyers and sellers fight very hard to move the market.

As a result, markets become quite volatile and print a lot of spikes/whipsaws.

Most of the time, beginners and even some professional traders get trapped by trading these adverse market conditions.

These kinds of mistakes cost them a lot of money, and as a result, they start to blame the indicator.

You need to understand that none of the indicators are perfect!

Most trading indicators work very well in trending market conditions only.

Others tend to do well in range-trading markets!

Originally Richard Donchian built this indicator to only trade the trending markets.

Hence, always try to avoid adverse market conditions and only take trades when things are clear.

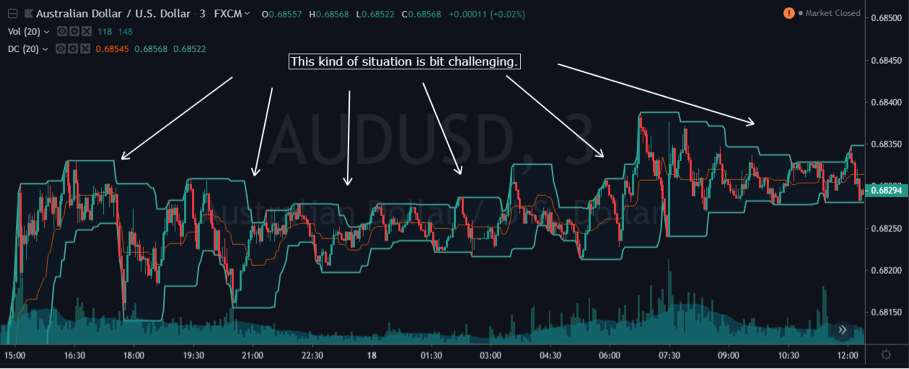

As you can see in the below image, prices were quite volatile!

Both buyers and sellers are trying very hard to lead the market.

Let the market print a smoother trend, and only then make a trading decision.

If you use this indicator to trade only trending market conditions, in the long term, you will see a lot of your trades working.

Bottom Line

We hope you find this article on Donchian Channel Indicator informative.

This indicator offers a unique way of spotting intraday signals as well as long term trading opportunities with good risk to reward ratios.

You can use the channels of the Donchian Channel Indicator in different ways.

You can identify trading opportunities and also to gauge the volume.

Make sure to use proper money management techniques and structure your position sizing to make consistent profits.

Happy Trading!

Colibri Trader

P.S.

Have you checked my article on Day Trading?

Or check out my Twitter page @priceinaction

Thank you for the detailed article

My pleasure! Let me know if you have any questions!