The Best Ever Day Trade

Dear traders,

I have been trading for over two decades now and have been leading the day trading program for close to 4 years.

As the majority of my students know, I have had hundreds of double-digit returns but this year, one trade stood above and beyond all other trades I have ever taken.

This was a 1:55 risk-to-reward trade that I took in August.

In other words, put in a dollar, got back $55.

It was a DAX trade, too.

In this article, I will walk you through this day trade and my thinking process behind it.

Enjoy the reading 🙂

A trade was born

In the early morning of August 1st, 2023 I switched on my screens 15 minutes before the market Open.

As usual, I was skimming through the markets.

FX majors…

Indices…

Gold even…

Then back to indices… DAX and Dow and as the clock was ticking closer to market opening, I spotted a potential entry on DAX.

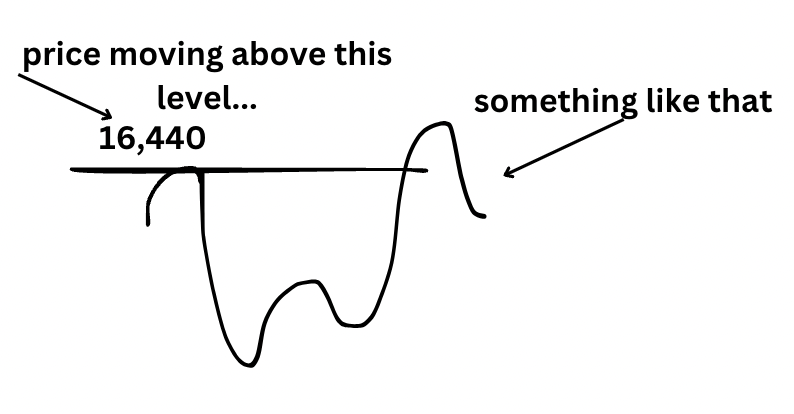

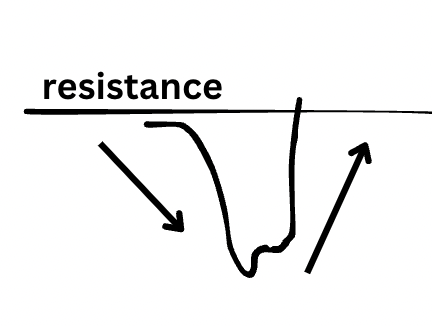

The price pierced through the 16,440s and then I knew if I were patient enough and if the price returned back to that level I might have an opportunity to short the DAX according to my morning rule.

Here is what I was looking for:

And then, just like clockwork, 7 minutes later the market retraced back to the 40s.

At precisely 8:07 a.m. London time, I shorted 1,500 contracts.

This is literally what I was looking to see (which means I would not have taken action if the price did not retrace to this level).

The alternative scenario would have been if the price just broke out and then I would have missed this trade.

I would not have placed a trade if the risk profile of this trade wouldn’t have matched my strict risk management rules.

But this trade was a textbook example of a short trade.

Trade was on…

And then from here, the price started an exciting journey.

The First 90 Minutes

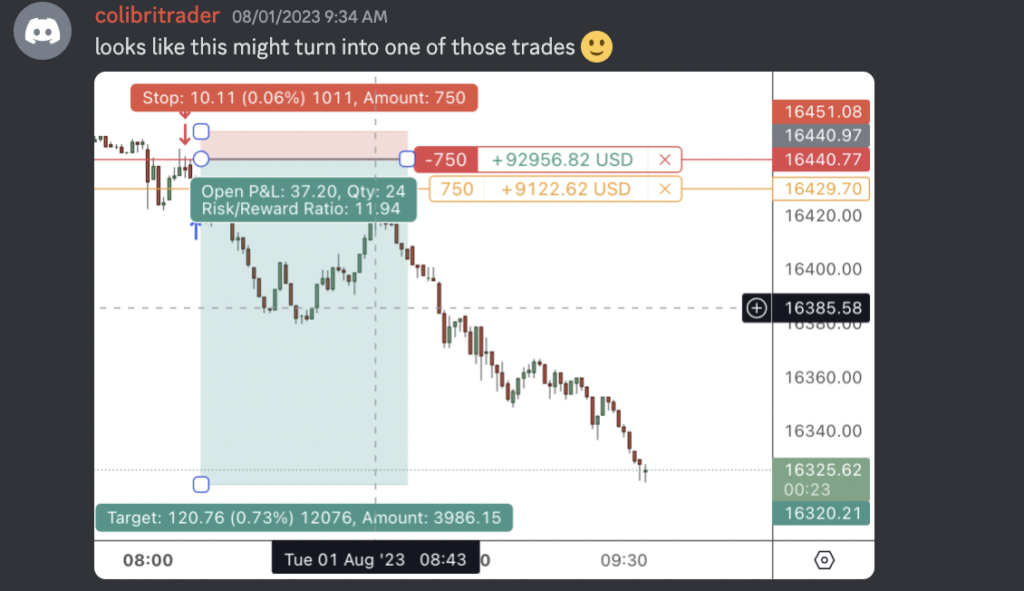

This was a serious contender to be a great trade straight from the bat.

I have noticed that like all of my other double-digit trades, this one was showing the same characteristics from the very beginning.

90 minutes have barely passed and I was already running a 1:12 risk-to-reward trade.

This was enough of a confirmation for me to move my stop loss just under entry.

I also took half of this trade in profits and was already IN THE MONEY.

Sweet place to be in really.

To Book or Not to Book Profits

At this moment various thoughts were going through my mind.

Shall I book my profits?

Shall I continue running this trade?

The more I wanted to be rational, the harder it was when my P/L was showing such a significant return over such a short period of time.

It was like learning how to ride a bike and not knowing when to stop when you are just starting to accelerate downhill.

A sweet feeling, but also one that usually has two outcomes:

Outcome #1: Price reversing

Outcome #2: Price breaking even lower

Based on my experience and also based on the rules of my day trading strategy, I just let this trade run.

What happened next?

12 Hours Later

My agony was paying back.

I did not check the charts for almost 12 hours and then I decided to have one last look before the end of the day.

And I was certainly seeing how good of a decision it was to stick to my rules and let this trade run.

Here is what I saw on my screens and what I shared with my community:

My new risk-to-reward ratio was 1:18.

I have certainly done better than that, but the amount of time it took for this trade to reach that return was mindblowing.

Just a little over 12 hours!

At this moment, I was certain that I had caught a whale.

How big is the whale?

The next morning, at precisely 7:55 a.m., I switched on my screens.

I was certain that this trade had already snowballed and turned into a very decent-sized one.

However, even I was taken aback by what I posted to the community on August 2nd.

Have a good look at that:

I was running a monster trade.

24 hours and 35R later, I was dumbfounded in front of my screens.

I have already moved my SL once.

Was it time to trail my stop?

It took me 15 minutes to decide and YES, I moved my SL lower.

I secured 160 points.

And now, even if the price moved against me, my worst-case scenario was a positive 160 points in my P/L.

Not too shabby for the second day of the month.

What should I do then?

Was I to take profits or to let this trade run?

This is where the rules of my strategy helped me one more time.

I glanced at the clock, and I came to the realization that I had exceeded one of the pivotal ‘time constraints’ I rely on to maintain objectivity in each trade.

Let his whale grow even bigger…

How big is big enough

The next time I revisited this trade was on the following day.

I switched the monitors on and logged into my trading account.

I was just about to enter into a new time constraint, which meant I needed to be a little bit more patient.

Then, once the charts loaded, this came up:

I knew I needed to hold until after the market open and this was probably the hardest test.

I had two options in mind: either swiftly secure profits if the trade turned against me, or let it continue until it passed the next time constraint I was monitoring.

And then just as the market was opening, the price continued lower and broke the nearest supply zone.

I was looking at a new personal record.

I was standing on a 1:55 risk-to-reward trade.

This was exactly what I wanted to see before taking profits.

It was a confluence of factors that prompted me to seize the opportunity and take profits.

These factors were:

A) New low

B) Trade within the new time constraint

C) Good level from a Daily perspective

This was the perfect time for me to close this trade and baaaam!

Trade was closed.

A new personal record was achieved.

I couldn’t believe my eyes as I stared at the screens.

My trading account has just reached a new all-time high.

It was time to celebrate.

It was time to walk away from the screens.

But it was only 4 minutes after the market opened.

It was bloody 8:04…

P.S.

If you want to know more about this trade, or what are the time constraints I am using to help me unobjectively find trades like this one…

Alternatively, you can BOOK FROM HERE