Supply and Demand Charting: Real-World Strategies That Actually Work

Why Traditional Supply and Demand Analysis Isn’t Working Anymore

While supply and demand principles remain important, the standard ways of analyzing them often miss the mark in current markets. Many traders still rely on basic approaches that don’t capture how markets actually behave. The core concepts still matter, but we need fresh ways to apply them. So what’s causing this gap between theory and reality?

The Rise of Algorithmic Trading

The explosion of algorithmic and high-frequency trading (HFT) has fundamentally changed how markets move. These computer systems can analyze data and execute trades in milliseconds – far faster than any human trader. For instance, when breaking news hits, algorithms may trigger thousands of trades before a person can even read the headline. This speed creates rapid price shifts that traditional supply and demand charts simply can’t track effectively.

Outdated Assumptions

Many traders still work from assumptions that made sense decades ago but don’t match today’s reality. The classic view assumes supply and demand stay relatively stable over time. But markets now respond instantly to everything from economic data to social media trends. A single tweet can send prices soaring or crashing within minutes. This means those neat, static supply and demand zones traders relied on have become far less reliable guides.

The Need for Dynamic Analysis

Successful traders have moved beyond static analysis to track supply and demand as they actually behave – fluid and constantly changing. Many use tools like TradingView to watch how prices respond to shifting market conditions in real time. They understand that a supply zone that acted as strong resistance yesterday might mean nothing today if the broader context has changed. The key is staying flexible and adapting to what the market is showing right now.

Focusing on Order Flow

Smart traders now pay close attention to actual buying and selling pressure rather than just historical price levels. By tracking order flow – the stream of incoming trades – they can spot where real demand exists right now. For example, if large buy orders suddenly appear at a certain price, that may signal an important demand zone forming, even if past price action doesn’t highlight that level. The tools within Colibri Trader help traders identify these real-time shifts in market behavior.

The most effective way to analyze supply and demand today combines time-tested principles with close attention to how modern markets actually work. Traders who let go of rigid assumptions and embrace tools that capture real-time market dynamics put themselves in a much better position to profit consistently. Making this shift isn’t just helpful – it’s essential for trading success in current conditions.

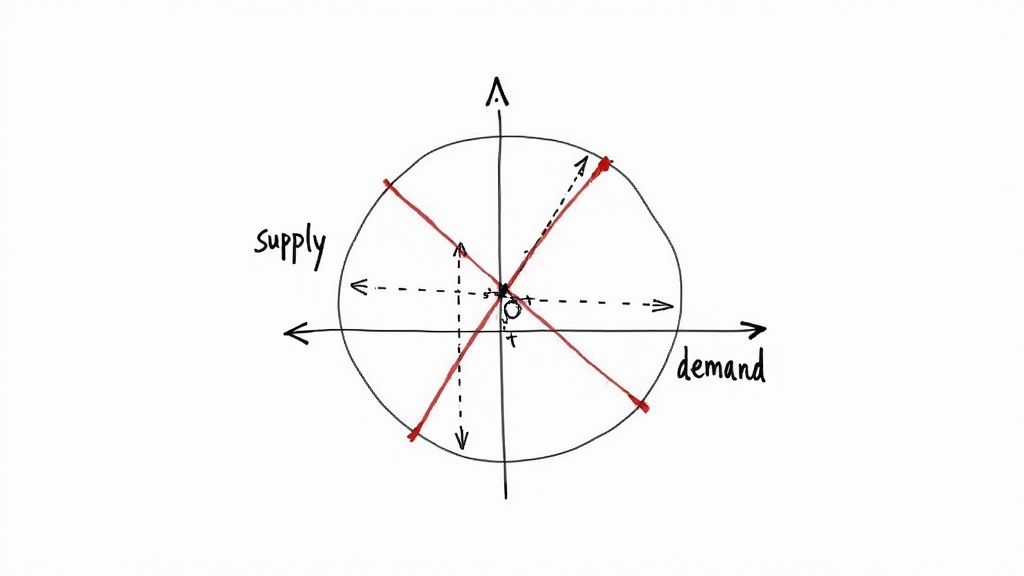

Finding Supply and Demand Zones That Actually Matter

Effective supply and demand analysis requires more than identifying every swing high and low on a chart. To find tradeable opportunities, we need to focus on the zones that consistently influence price movement while filtering out market noise. Let’s explore how to identify these high-impact areas.

Quality over Quantity: Filtering for High-Impact Zones

When analyzing supply and demand zones, focusing on quality rather than quantity is essential. Not all zones carry equal weight – some reflect temporary market reactions while others show real institutional buying and selling pressure. The key is learning to tell them apart.

For example, a stock might spike up sharply during a short squeeze, creating what looks like a supply zone. But since this move is driven by technical factors rather than genuine selling pressure, it’s unlikely to act as meaningful resistance later. In contrast, a supply zone that forms gradually with strong volume after an uptrend tends to be more reliable. You might find it helpful to read more about How to master supply and demand for additional insights.

Identifying Genuine Institutional Activity

Large investors leave clear footprints on price charts through their trading activity. One way to spot potential institutional involvement is to look for notable volume spikes alongside significant price reversals. These often signal major players establishing positions that can create durable supply or demand zones.

The price action around these zones provides additional confirmation. When price repeatedly fails to break through a level despite multiple attempts, especially on high volume, it often indicates strong institutional selling forming a reliable supply zone. These rejections tend to be cleaner and more decisive than retail-driven moves.

Mapping Zones with High Probability of Success

Finding high-probability zones requires combining historical price analysis with current market conditions. While past support and resistance levels matter, market dynamics change over time. A zone that previously acted as strong support may not hold the same significance under different circumstances.

This is where tools like those offered by Colibri Trader become valuable for analyzing supply and demand in real time. By incorporating live order flow data and market context, traders can better assess which zones are truly relevant now rather than relying solely on historical levels. This real-time perspective helps identify the zones most likely to influence future price action.

Success in supply and demand trading comes from understanding how modern markets work. By filtering out noise, focusing on institutional activity patterns, and adapting to changing conditions, traders can identify the zones that matter most. Using the right tools to analyze real-time market data helps pinpoint these high-probability areas more effectively.

Building Your Technical Analysis Toolkit

A solid supply and demand charting system needs just the right mix of tools. While technical indicators can help spot opportunities, using too many often creates confusion. The key is keeping things simple – select just a few key tools that clearly show supply and demand zones without cluttering your charts. You might want to check out: How to master supply and demand for more details on this approach.

Choosing the Right Indicators

The best indicators for supply and demand trading confirm what price is already telling us, rather than trying to predict future moves. Here are the most useful tools to consider:

-

Volume: This is your most important ally in supply and demand analysis. When you see high volume as price reverses near key zones, it adds weight to those levels. For example, if price drops sharply with heavy volume at a supply zone, that’s strong evidence it will act as resistance. Similarly, strong buying volume at demand zones helps confirm support.

-

Moving Averages: While not essential for finding zones, moving averages help filter market noise and show the main trend. When price breaks above a key average while leaving a demand zone, it often signals a stronger upward move is starting.

-

Relative Strength Index (RSI): The RSI helps spot potential reversals when price hits supply or demand zones. When RSI tops 70 in a supply zone, it often warns of an upcoming drop. This works especially well when combined with other signals from price action.

Avoiding Analysis Paralysis

Too many indicators on your chart makes it harder to spot clear supply and demand levels. This can lead to second-guessing and missed trades. Start with just price and volume – the basics. Then carefully add one indicator at a time, watching how it helps your analysis. If an indicator isn’t making your trading decisions clearer, remove it. Simple charts often work best.

Validating Trading Opportunities with Colibri Trader

After spotting potential trades using supply/demand zones and your chosen indicators, validation is key. Colibri Trader’s tools help confirm these setups by showing real-time order flow – actual buying and selling pressure at key levels. This data lets you check if your chart analysis matches current market activity before taking trades.

Practicing and Refining Your Approach

Developing your technical toolkit takes time and practice. Keep testing different indicator combinations while staying focused on clear supply and demand zones. Review your trades regularly – what worked and what didn’t? Look for patterns in how your technical tools interacted with key zones during winning and losing trades. This helps you build a reliable system that fits your trading style while avoiding information overload.

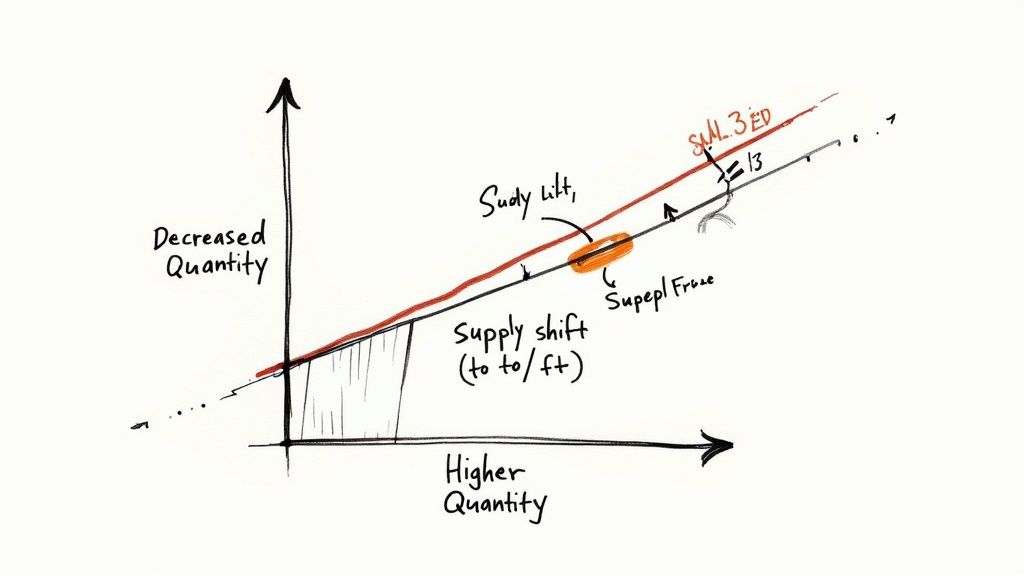

Learning from Market History (Without Getting Stuck in the Past)

Once you’ve built strong technical skills, the next key step is learning how to effectively use market history in your supply and demand charting. This goes beyond simply looking up old price levels – it’s about understanding how markets have evolved and applying relevant historical patterns to your current trading decisions.

The Value of Historical Context in Supply and Demand

Past market events provide rich insights into how supply and demand work together to move prices. Take the platinum market between 2013-2018 as an example – during this period, major swings in industrial demand and mining output led to significant price volatility. By studying how supply shortages and surpluses affected prices during this time, traders can better anticipate similar situations. The oil market offers another useful example – price data going back to 1971 shows how global events have shaped supply-demand dynamics over decades. This long-term view helps put current price movements into proper context.

Identifying Recurring Patterns and Themes

While exact price levels rarely repeat, broader market patterns often resurface in similar ways. This is where supply and demand charting becomes especially powerful. For instance, by studying past periods when large institutions accumulated positions before distributing them, traders can spot comparable setups forming in real-time. Recognizing these recurring themes helps anticipate potential market turning points based on historical precedents.

Avoiding the Trap of “History Repeats Itself”

Simply assuming history will repeat is a risky oversimplification. Markets constantly change due to new technology, regulations, and economic shifts. For example, algorithmic trading has fundamentally changed how prices move in the short term, making old price levels less reliable on their own. That’s why historical analysis must be combined with current market conditions. Those tools help bridge this gap by letting traders analyze historical supply and demand zones alongside real-time order flow data. This balanced approach helps traders adapt historical insights to current conditions while filtering out outdated information.

Applying Historical Analysis to Practical Trading

The real value of historical analysis comes from improving your ability to identify high-probability supply and demand zones. By examining how these zones performed under different market conditions in the past, you can better judge their potential strength or weaknesses today. A supply zone that held during highly volatile periods may be more reliable than one that formed during quiet, range-bound trading. Looking at past breakouts from these zones can also help set realistic expectations for future price moves. When you combine this historical perspective with current market data, you can make more informed trading decisions and improve your entry and exit timing. This practical blend of past and present insights leads to more effective supply and demand charting and increases your odds of successful trades.

Developing Your Trading Game Plan

A well-designed trading plan connects your supply and demand chart analysis to consistent profits. This plan needs clear rules for entering and exiting trades, managing positions, and controlling risk. Think of it as your personal trading handbook – a structured guide that helps you make rational decisions even when markets get emotional.

Entry Timing: Precision Over Prediction

Rather than trying to guess market direction, successful traders focus on precise entries at proven supply and demand zones. This means being patient and waiting for price to reach your pre-mapped zones before looking for confirming signals. For example, when price hits a demand zone, watch for buying signals like hammer candles or bullish engulfing patterns with strong volume. This disciplined approach keeps you from chasing trades and helps ensure better risk-to-reward setups.

Position Management: Balancing Risk and Reward

Good trade management starts after you enter a position. You need to decide position size based on how much you can risk and how much you might gain. Always use stop losses to protect your account if trades move against you. For example, if you expect a $1 move but only want to risk $0.25 per share, place your stop $0.25 below entry. This way you know exactly what you’re risking while giving trades room to work.

Risk Control: Protecting Your Trading Capital

Every solid trading plan needs clear risk rules. Beyond basic stop losses, decide what percentage of your account you’ll risk per trade and across all open positions. Spreading trades across different markets can also reduce overall portfolio risk. For more risk management strategies, check out: How to master supply and demand charting. Setting firm risk limits upfront helps you avoid emotional decisions when markets get volatile.

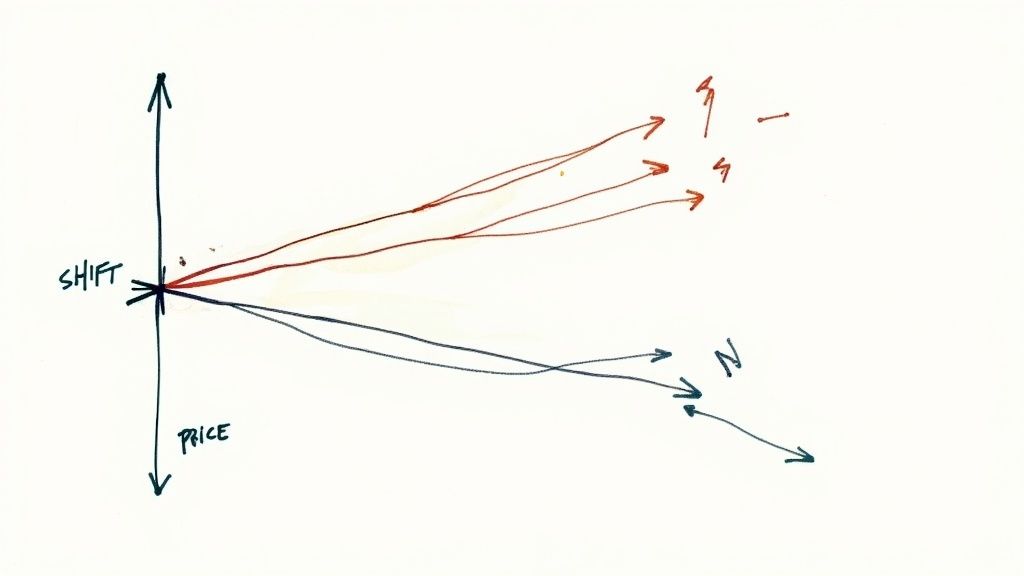

Adapting to Market Conditions: Staying Flexible and Objective

Markets change constantly, so your trading plan must adapt too. Stubbornly following outdated strategies leads to losses. Review your trades regularly – both winners and losers – to see what’s working and what isn’t. Colibri Trader offers tools for testing strategies with historical data so you can refine your approach based on real market behavior. Be ready to adjust your entries, exits, position sizing, and even which markets you trade as conditions evolve. Staying flexible while following your rules helps you stay profitable as markets change. Using order flow data alongside supply and demand zones lets you time entries and exits more precisely.

Staying Ahead of Market Evolution

While having a solid trading plan is essential, markets never stand still. Your supply and demand charting approach needs regular updates to match market realities. Let’s explore key changes shaping trading today and how to adjust your strategies accordingly.

The Impact of Algorithmic and High-Frequency Trading

Computer-driven trading now dominates market activity. These systems can execute trades in milliseconds, responding to news and price moves faster than any human trader. This speed creates new challenges – price swings happen almost instantly, making traditional static supply and demand zones less reliable. For instance, when major news breaks, algorithmic trades can trigger rapid price moves before manual traders can even process the information. This calls for more flexible, real-time analysis methods.

Changing Market Structure and Fragmentation

Trading now happens across many different venues – from major exchanges to dark pools. This makes it harder to see the complete picture of supply and demand using conventional approaches. Tools like Colibri Trader help by combining data from multiple sources to show clearer order flow and market depth. Understanding how different trading venues operate has also become key for accurate supply and demand analysis.

The Rise of Artificial Intelligence in Trading

AI tools are changing how we analyze markets. These systems can process huge amounts of data to spot patterns and even trade automatically. Rather than replacing human analysis, AI provides traders with deeper market insights. You can use AI to better define supply and demand zones, time entries and exits, and spot potential market moves based on past data. Of course, we must carefully consider both the benefits and risks of AI-driven trading.

Adapting Your Strategies to Evolving Conditions

Success in modern markets requires updating your supply and demand methods. This means using live data feeds, advanced charting tools, and understanding how computer trading affects price action. For example, instead of only looking at past price levels, consider tracking real-time order flow to spot current buying and selling pressure.

Practical Approaches for Incorporating New Techniques

Here’s how to effectively add new methods to your trading:

- Start with Education: Keep learning about new tools and market developments

- Experiment and Backtest: Test strategies with historical data before trading live

- Focus on Risk Management: Use strict risk controls to protect your account

- Seek Mentorship and Community: Connect with experienced traders to share knowledge

Ready to improve your supply and demand trading and keep up with market changes? Check out the tools and resources at Colibri Trader to take your trading to the next level.