Smart Beta Or How To Dupe Dumb Retail Investors

Today, I read a very interesting article. I believe that a lot of you might find it informative. That is why I wanted to share with you my insights- staying in front of the screen for a long time chasing good entries has its pluses, as well. The guys from zero hedge have come up with a quite good article, explaining “smart beta”and how it is incorporated in the market. Have a loog below:

Active fund managers have figured out a way to combat the rather inconvenient fact that beating a passively managed index fund over time turns out to be exceptionally difficult, especially net of fees: build an algorithm that replicates your investment strategy, press “go”, then tell investors you’re indexing. This is called “smart beta” in the industry and, like any sophisticated-sounding strategy, it’s luring retail investors and bringing in billions. Here’s Bloomberg:

Few people have profited more from the so-called smart-beta craze than Tom Dorsey. A new exchange-traded fund that he runs using a century-old charting methods took in $1.2 billion last year. Then, in January, he sold his 22-person investment firm, Dorsey, Wright & Associates, to Nasdaq OMX Group for $225 million. Dorsey calls himself a money manager, Bloomberg Markets will report in its April issue, but his methods are more robot designer. He says so himself, proudly. If Dorsey and his team got abducted from their Richmond, Virginia, office by aliens, their algorithms could keep picking investments for the firm’s new money magnet, the First Trust Dorsey Wright Focus 5 ETF, forever. “Once a quarter, we press a button,’’ Dorsey says. The Focus 5 algorithm then generates a list of investments, and First Trust Portfolios, his partner company, executes them. Otherwise, they don’t meddle with the robot. “We just need someone to press the button.’’ It’s index investing with key twists, all of them rules-based, with no active management required. Most smart-beta funds track custom indexes. Some are simple variants of the Standard & Poor’s 500 Index and do what they say on the box. Others are hand-crafted and small batch, made by people with little more than a stock-filtering system and a dream.

So it’s index investing, only the index isn’t really an index, it’s a list of stocks generated by a machine and the machine is programmed to do what the fund manager would do if the fund manager were disciplined enough to follow his or her own advice all of the time. In other words, it’s not indexing at all — paradoxically, it’s active management on autopilot and advocates of traditional indexing think it’s nonsense. Here’s Jack Bogle via Bloomberg:

“Don’t mention smart beta in this office!’’

“I don’t even know what it means. Baloney. Marketing!’’

What it means is that fund managers can make a really compelling pitch to investors: “It’s the best of both worlds. These ETFs are smarter than ‘dumb’ traditional index funds, but they’re still passively managed.” While some of these funds follow what might be considered “plain vanilla” strategies (which makes you wonder why you wouldn’t just buy a traditional index fund), others try to be a bit “smarter” by shorting and (of course) employing leverage. As it turns out, some aren’t very smart at all:

Rick Ferri, founder of Portfolio Solutions in Troy, Michigan, says smart beta is a ploy for active managers to retake some of the billions lost to Bogle and his low-cost indexes. If an active manager has an investment strategy that shows positive returns over the past decade or so, and it can be encoded in an algorithm, he can call himself an indexer, charge higher fees for his secret sauce, and kick back and get rich, Ferri says. “Everything that used to be active management became fundamental indexing,’’ he says. The Janus Velocity Tail Risk Hedged Large Cap ETF has many of the things that smart-beta critics such as Ferri love to hate. Started in June 2013, the fund returned 6.8 percent in 2014, compared with 13.7 percent for the S&P 500, even though it invests in S&P 500–tracking ETFs. It underperformed because it paid for derivatives that protected it from tail risk—the slim chance that something would go really wrong. That insurance lowered its risk, certainly, but the fund captured just 50 percent of the index’s return, after expenses. Those totaled 0.71 percent, or $71 on each $10,000, compared with 0.39 percent, or $39 per $10,000, for Arnott’s PowerShares FTSE RAFI. “They’re making really good juice on this,’’ Ferri says.

Better still, some of the funds barely trade, which means if the automaton that’s automatically buying and selling based on some strategy the manager dreamed up two decades ago won’t quit producing loses, it may be difficult for you to pry your money from its robotic hands:

Velocity Tail Risk doesn’t trade much either. Some days fewer than 1,000 shares change hands, making it harder for sellers to find buyers. Last year, the average difference between an offer to buy and an offer to sell was 0.31 percent, or 62 times the average spread in the SPDR S&P 500 ETF Trust, which closely tracks the index.

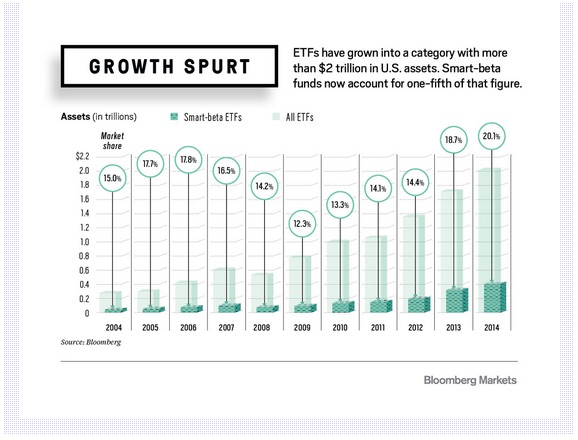

Much to the chagrin of the Jack Bogles of the world, smart beta funds look set to become increasingly pervasive. As Bloomberg notes, they now account for nearly 20% of the entire market for US-listed ETFs which means some $200 billion is now trading on autopilot, chasing who knows what based on a mishmash of esoteric strategies created by active managers who by virtue of their inability to outperform the dumbest strategy of all (simply buying an index), were driven nearly to extinction — and there’s limited liquidity. What could go wrong?