Pitchfork Trading Strategies Revealed

Pitchfork Trading Strategies Revealed

One of the trading tools most overlooked by Forex traders, Andrews’ Pitchfork is part of every trading platform. Moreover, Pitchfork trading strategies have a mystique aura as few traders understand the use of the tool.

Before understanding the Pitchfork trading strategies, one needs to get familiar with the tool. While an old concept, trading with Andrews Pitchfork has a substantial impact in today’s financial markets too.

Download The Free Pitchfork E-Book

Perhaps traders misinterpret the importance of Pitchfork strategies because of the tool’s appearance: three parallel lines. Basically, two parallel channels that follow the price. What’s so exciting in that?

Pitchfork trading has its roots over a century ago, in the late 1880’s. It is then when Roger Babson understood the gravity concept that governs our lives. Believe it or not, he found similarities in Newton’s work related to gravity and gave birth to revolutionary trading concepts.

To this day, what Babson started represents a leap forward in technical analysis.

This article intends to present the power of Pitchfork trading strategies. Moreover, how to use them in today’s financial markets in such a way to forecast future prices.

Among other things, this article will cover:

- Pitchfork Trading Strategies Revealed

- The Elements of Andrews Pitchfork

- Understanding the Pivot Points – The Start of All Pitchfork Trading Strategies

- The History of Pitchfork Strategies

- Pitchfork Trading Strategies With the Rules of a Trend

- The Schiff Line

- Using the Schiff Line to Project Dynamic Support and Resistance Levels

- Pitchfork Trading Strategies with Elliott Waves

- Pitchfork Trading Strategies with Impulsive Waves

- Pitchfork Trading Strategies with Corrective Waves

- Pitchfork Trading Strategies on Bigger Timeframes

- Conclusion

Above all, we’ll deal with an old concept adapted to today’s markets. Are you in for a staggering technical analysis ride?

The Elements of Andrews Pitchfork

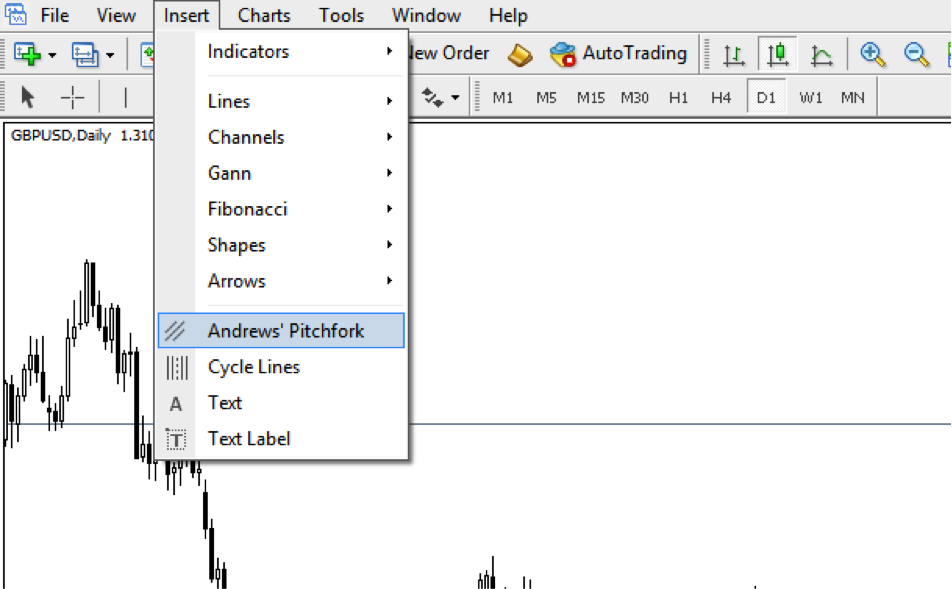

As mentioned earlier, all trading platforms offer the Andrews Pitchfork tool. Even the MT4, the most popular trading platform for the retail trader, has it incorporated under the Insert tab:

Hence, selecting it is relatively easy. When doing that, the mouse will show a number: 1, 2, and then 3.

Each number corresponds to one click. Therefore, to project the Andrews Pitchfork, you need three clicks. No more, no less.

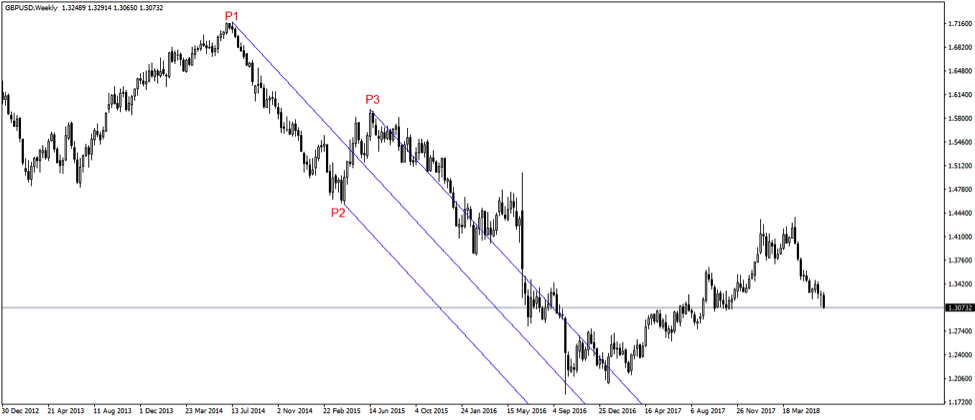

The three clicks or points that define Andrews Pitchfork are the pivot points. Obviously, traders address them as P1, P2, and P3.

The three parallel lines projected from the pivot points are the Pitchfork’s elements. And, the basis of any Pitchfork trading strategies.

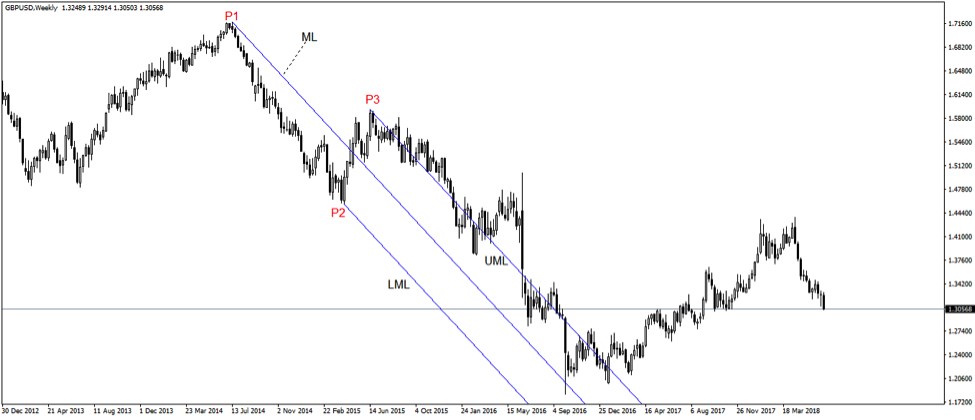

By far, the line in the middle is the most important one. Called the Median Line (ML), it represents the reason why traders draw the Pitchfork in the first place.

The other two lines, the UML (Upper Median Line) and the LML (Lower Median Line) act as dynamic support and resistance for the price but also define the underlying trend.

What makes the ML so important? It has the power to attract price. Hence, it serves both as a take profit level as well as a confirmation that a specific pattern formed.

Understanding the Pivot Points – The Start of All Pitchfork Trading Strategies

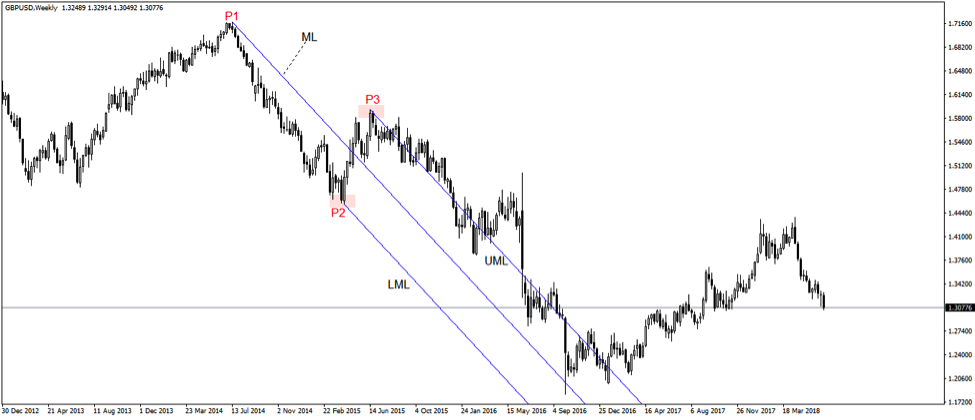

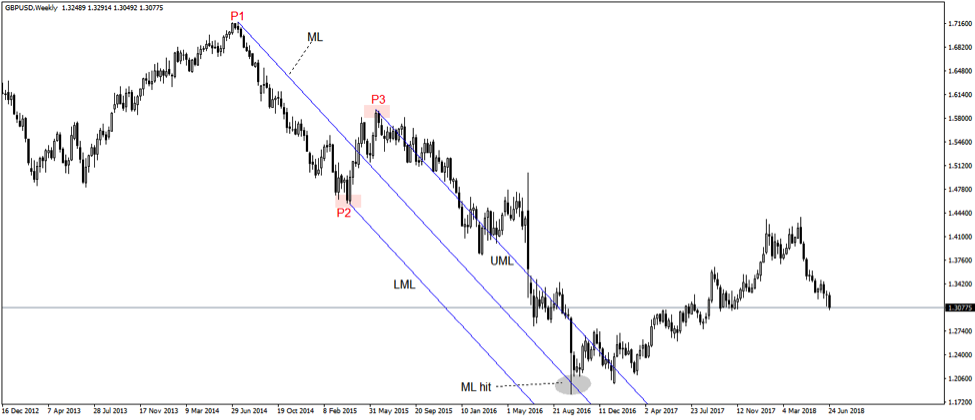

The two charts above show the GBPUSD weekly timeframe. Effectively, they show the last four years’ worth of price action, with everything that was in between: Carney coming at the helm of Bank of England, the Brexit vote, but also the uncertainty that came after that.

IMPORTANT: There is a reason why the three pivots are marked with the red color. The idea is to highlight their importance as they sit at the base of any Pitchfork trading strategies.

Obviously, the key to Pitchfork trading is the right selection of the three pivot points. In fact, there is a strong controversy as to what are the places for the pivots, as the ML, UML, and LML will quickly change their angle.

Download The Free Pitchfork E-Book

The History of Pitchfork Strategies

Obsessed with the concept of gravity, Babson was among the first ones to develop the idea of a market cycle. He discovered that the market (stock market at that time) swings above and below a rising or falling line.

He called that the “normal line” (the ML in current Pitchfork trading strategies) and it is the earliest interpretation of waves that define a movement.

Late in the 1930’s, Ralph N. Elliott took the idea a step forward, putting the basis of one of the most exciting trading theories ever created: the Elliott Waves Theory.

So, he did, and the forecast span from 1933 to 1948 and the price action that followed was almost similar. The exact methods used died with him, and Dr. Alan Andrews, a friend of both Bobson and Marechal, took the work forward.

Dr. Andrews used two deviations from the Bobson’s normal line, and they represent the birth of the UML and LML. He is responsible for the two parallel lines derived from the P2 and P3.

Pitchfork Trading Strategies With the Rules of a Trend

As mentioned earlier, the key in Pitchfork trading comes from the pivot points. Traders use a set of rules to find the right place for the pivots and then interpret the price action.

The ML’s ability to attract price represents a strong incentive for buying dips and selling spikes into the LML and UML respectively.

The rules of a trend come to help. We all know that a bullish trend is made of a series of higher highs and lower highs. For as long as the series holds, the trend will keep going.

A bearish trend, naturally, is made of a series of lower lows and lower highs.

While the P1 is always the top or the bottom of a trend, the focus shifts on the other two pivots. The idea is to use the lower low and lower high in a bearish trend, and the higher high and the higher low in a bullish one.

Just like that, we have a rule, and now you understand why the GBPUSD weekly timeframe has the Pitchfork drawn like this.

If set right, the pivots will project the three lines. Moreover, the ML will have the tendency to attract price. This is one of the basic Pitchfork trading strategies and many traders merely disregard the Pitchfork once the price reaches the ML.

The Schiff Line

Dr. Andrews worked with many traders during his technical analysis findings. There is one trader, though, from New York, that took his work even further.

Named Jerome Schiff, he’s the father of the so-called Schiff line. This is a line that connects the start of the Pitchfork with its end. Or, more precisely, a line that connects P1 with P3 and then traders project it further in time.

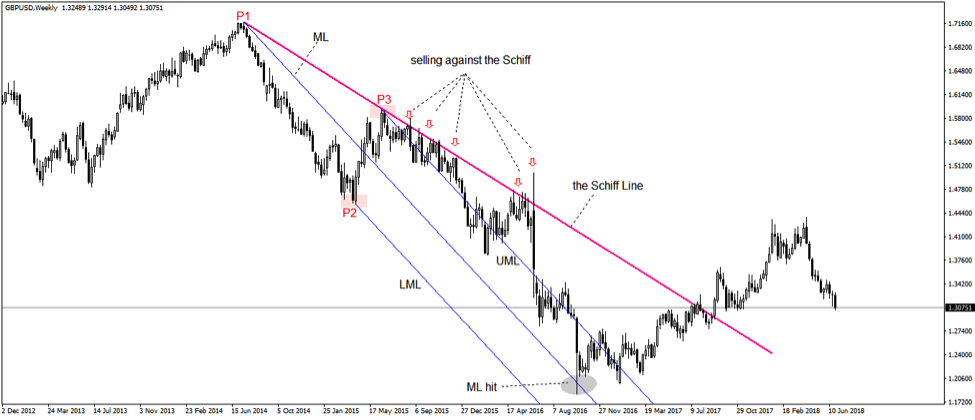

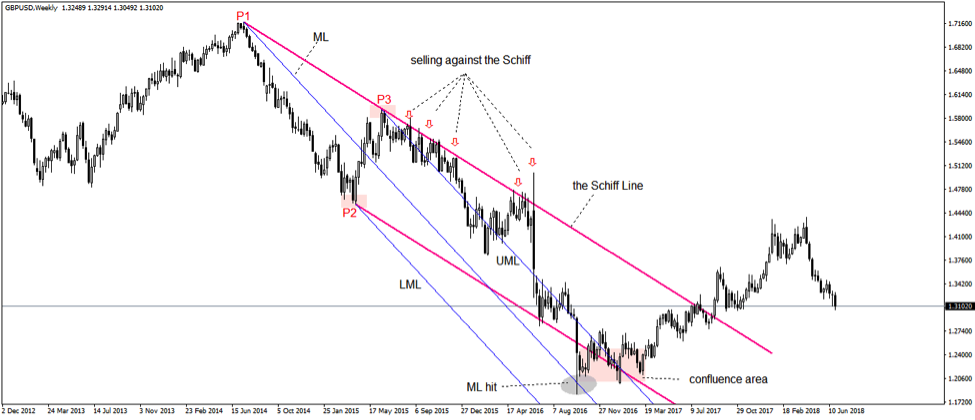

Using the same GBPUSD weekly chart, the red line represents the Schiff line as designed by Jerome Schiff.

The idea behind such a concept is that it acts as a reminder of the overall trend.

REMEMBER: Only after the Schiff line breaks, traders look to build another one, in the opposite direction, using the same Pitchfork trading strategies but for a different trend.

The interesting part in the chart above is that the price does break the Schiff line. However, it fails to close above it at each and every attempt.

We can safely say that the Schiff line acts as a dynamic resistance in a bearish trend. And, as dynamic support in a bullish one.

Selling against the Schiff lie is one of the most powerful Pitchfork trading strategies in a falling trend.

But what’s the target for such trades? Because the market has the ability to trade above the UML, the dynamic support and objective is not the ML. Instead, the UML acts as a target when selling against the Schiff line.

Using the Schiff Line to Project Dynamic Support and Resistance Levels

One of the oldest concepts in technical analysis, support and resistance forms on the horizontal (classic) but also in a dynamic manner (it follows price). The rule says that once broken, support becomes resistance, and the other way around.

Between the classic and dynamic levels, dynamic ones are more powerful. To find them, traders use innovative ways. One of them is to project the Schiff line derived from Andrews Pitchfork.

First, traders draw the Schiff line as described in this article. Next, they copy it and paste it on the other pivot (P2).

The resulting line provides strong dynamic support in a bearish trend. Moreover, when it meets the ML and UML, it gives a strong bullish incentive to any trader that wants to pick a bottom.

For the traders following the rules described above, the projected Schiff line provides a strong support level. Many things happen around the same level:

- the price reached the ML

- the Schiff line, and the UML converge into a strong dynamic support

- a triangle as a reversal pattern forms in the area

The bounce is so strong that the price finally closes above the Schiff line. The ability to find confluence areas with the Andrews Pitchfork’s elements is one of the most effective Pitchfork trading strategies.

Pitchfork Trading Strategies with Elliott Waves

Ralph Elliott set the basis of the theory wearing his name around the same time when other traders worked on the Pitchfork’s concepts. It so happens that today’s traders can blend the two concepts together.

The thing is that projecting the pivots from the absolute bottom or top of a trend doesn’t work all the time. Sometimes the angle makes no sense and traders choose to ignore it.

However, Elliott comes to help. Before going into more details, here’s a reminder of what makes the Elliott Waves Theory:

- Elliott divided the waves into impulsive and corrective

- He used numbers to count impulsive waves (1-2-3-4-5) and letters (a-b-c) for corrective ones

- An impulsive and corrective wave form a market cycle

- In impulsive waves, most of the times the 3rd wave is the longest one

- Corrective waves form more often than impulsive waves

Pitchfork Trading Strategies with Impulsive Waves

The groundbreaking change that comes with integrating Pitchfork with Elliott comes from the pivot points. Instead of using the series of lower lows and lower highs or higher highs and higher lows, traders use the end of the waves.

This comes handy not only in the case of P2 and P3 but also in the case of P1. It makes it not mandatory for the P1 to be at the top or bottom of a trend.

Instead, Pitchfork trading strategies derived from the Elliott Waves Theory use:

- The end of the previous wave for the P1

- Wave’s a end for the P2

- Wave’ b end for the P3

Obviously, that’s the case in corrective waves. And, the target is to project and find out the end of the c-wave (using the ability of the ML to attract price).

In the case of an impulsive wave, traders use:

- The end of the previous wave for the P1

- Wave’s 1 end for the P2

- Wave’s 2 end for the P3

The target, in this case, is to project the 3rd wave’s length, to find out where the price meets dynamic support or resistance (hint: the ML again).

Download The Free Pitchfork E-Book

Pitchfork Trading Strategies with Corrective Waves

As a case study, let’s use the same GBPUSD weekly chart. It shows a triangle as a reversal pattern at the bottom of the primary bearish trend.

The integration rules between the two concepts say that the P1, in this case, is not at the absolute bottom (the GBP flash crash). Instead, it belongs to the end of the previous wave.

If the previous wave ends with a triangle, then the end of it is the place for the P1. Or, the point from where the ML defining the bullish trend starts.

The a and b in blue show the places for the P2, respectively the P3, and the rest is history: the ML attracts the price, while later the LML provides strong dynamic resistance.

In case you’re wondering how the previous Pitchfork trading strategies worked in this bullish trend, here’s the answer:

First, project the Schiff line by connecting P1 with P3. Next, copy and project it from the end of the P2 (wave a).

The result is a mind-boggling dynamic resistance given by the rising UML and the projected Schiff line. Add to this the double top the pair made in that area, and you have all the ingredients of a by-the-book reversal given by Pitchfork trading strategies.

Naturally, Elliott traders won’t know if the market will form an impulsive or a corrective wave next. They do have an idea, but not a certainty.

Hence, one can imagine instead of the waves a and b in blue, waves 1 and 2 of an impulsive wave. The idea is the same, as the P1 starting place won’t change. Therefore, the same ML will drive the price action.

Pitchfork Trading Strategies on Bigger Timeframes

The bigger the timeframe, the stronger the implications.

The example in this article used a relatively big timeframe: the weekly GBPUSD. What traders do is they take direction from the more significant timeframes and go on the lower ones to look for details.

Fibonacci plays an enormous role in technical analysis, in Pitchfork trading strategies too.

This approach further gives dynamic support and resistance every time the price reaches the projected trendlines. But again, the key is to use the proper way to project the pivot points as they are decisive in the final and correct angle.

Conclusion

Now it is an excellent time to go back at the start of this article and check the GBPUSD first chart posted. From a simple concept, Pitchfork trading strategies paved the road for finding great price projections.

In technical analysis, this is all that matters. No one claims to pick tops and bottoms all the time. Instead, by using a logical approach to trading, one knows what the path of least resistance is.

When one, two, or more factors point to the same direction, the trading decision becomes more natural.

From a simple three-line concept, Andrews Pitchfork provides trading strategies that are difficult to match. It uses logic and clear rules for finding strong support and resistance areas, as well as confluence ones, both classic and dynamic.

Integrated with the Elliott Waves Theory or with other technical analysis concepts, Pitchfork trading strategies come to complement and reinforce a trade.

Once again, a hundred-year-old technical analysis concept survived the test of time to give incredible trading setups. I’m sure that after reading this article, trading with Andrews Pitchfork will become one of the favourite ways of approaching today’s financial markets.

p.s.

If you are interested to learn how I see the markets and trade on a daily basis, check out my PROFESSIONAL TRADING COURSE page.

Here is a sample video from it:

Excellent article.very helpful to me.Thankyou very much.

Hi Zahid, that’s great to hear! Let me know if you have any questions.

Can We use same method to Trade on H4 time Frame? Because You only Use Weekly As Example

Hi Lucky, I am not myself using Pitchfork on a daily basis, i am just sharing how it is used with the rest of my followers. I am using Price Action and Supply and Demand zones for my personal trading. Let me know if you have specific questions regarding Price Action/Supply and Demand because that’s where I have a first hand knowledge

Article is good, but when personally you do not use this, it isn’t part of your trading, I doubt about its success.

The traders who have known me for some time know that I am not personally using the Pitchfork method, which does not mean that it cannot be used profitably. The aim of this article is to familiarise the reader with the method, so that he/she can choose whether this method would suit their trading personality.