How To Be Objective

There are no certainties in this investment world, and where there are no certainties, you should begin by understanding yourself.

“James I. Fraser

So, how to be objective? The most important thing in trading/investing is the ability to stay cool in uncertain and stressful situations, as there will be many of those. Unfortunately, human nature is not built this way. As soon as money is committed to a trade, so too is emotion. That is when the problems start to accumulate because of the biases we develop. They (biases) are actually greatly magnified once we are committed to a trade. Therefore, it is mandatory that we develop a way to measure objectively where the market is staying in relation to our position.

I am far away from the idea that perfect objectivity is realistic, but I believe that we can still take the necessary steps to increase our impartiality as much as possible. It is not only important that we maintain our balance by learning how to maintain it and protecting it from internal and external forces. By “internal”, I mean our psychological state and by “external”, I refer to colleagues, the media and all events going on around us.

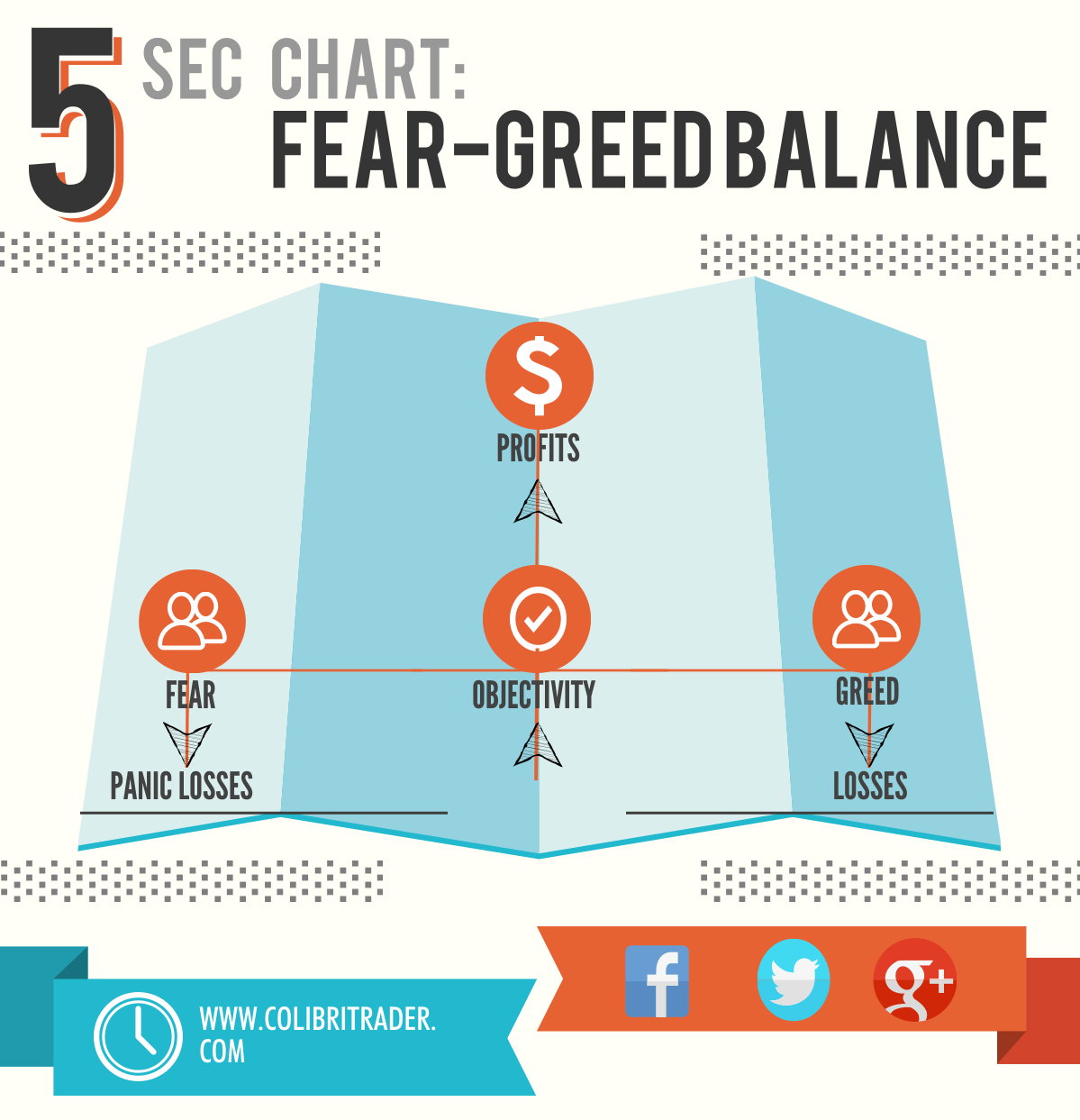

We as traders, are constantly bombarded by external stimuli and we need to learn how to control them if we want to be objective and therefore successful as traders. News, gossips and sharp moves caused by technical reasons can cause traders’ emotions to shift quickly between emotions of greed and fear. You should be on the watch out and make sure that you are in control of the situation and don’t let external/internal forces influence your objectivity. In the end, prices of financial markets are determined by the “actions” of investors to emerging economic and financial environment, rather than by the environment itself. This means that the wild price swings (and not only them) are caused by the emotions of traders like hope, fear and general expectations. That is where you should emphasize more- you need to be better able to ignore those market gyrations around you as much as possible and concentrate on the important factors. That is another reason why Price Action is a great tool for trading- the best in my opinion. It really eliminates the element of guessing and as long as you trade what you see and stick to the rules, you should be doing extremely well in the end.

The markets themselves are driven by crowd emotions. They have been around longer than us. That is what has been driving them around year-on-year since they came into existence. You cannot change the way markets behave; you should take for granted that trying to outsmart Mr. Market could be detrimental for your trading account.