NASDAQ Trading Analysis 21.02.2025

Dear traders,

Last time I shared with you my thoughts on DAX.

And one of the scenarios- the bullish one played out.

Funny enough, I am in a short DAX trade since yesterday and this seems to be gaining some momentum.

I started seeing a possible correction in place, but it is still too early to say.

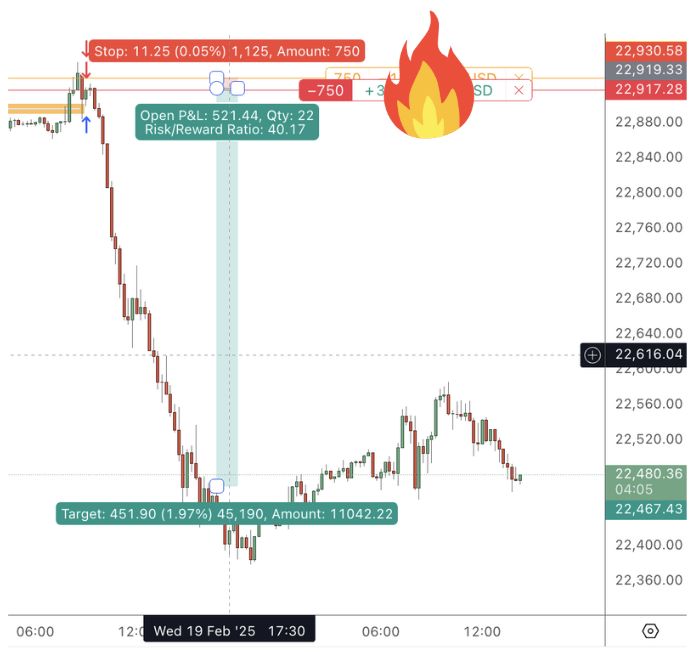

The trade was taken based on my day trading strategy and here is the result:

Currently, I am getting 40X on this trade, which is great.

But let’s see if this is the beginning of a bigger slide.

If this is the case, my risk-to-reward ratio might increase from 1:40 to higher.

But let’s see what I am looking for today.

NASDAQ Trading Analysis 20.02.2025

Today I am looking at NASDAQ.

A major supply zone has been tested.

I am looking for a potential sign for a long-term short trade.

Currently, I am in a short trade since Monday, which has turned from a day trade to a 1:14 risk-to-reward ratio trade

So, all in all, this has been a fantastic week.

It was not very active, but I managed to get two double-digit trades based on my day trading strategy.

From a long-term perspective, I still have not taken any trades but will be looking to get into a short trade if the right environment presents itself.

What would I be looking for in a potential short entry:

- Rejection of the Supply Zone

- Candlestick confirmation from the lower timeframes

For now the rejection is still unclear, but if I see a bearish engulfing or an inverted pin bar, I might consider taking a long-term short position.

Until then, I will just continue monitoring my shorter-term trades.

Happy trading,

Colibri Trader

P.S.