MACD- How It Became One of The Most Famous Indicators- PART II

MACD and How It Became One of The Most Famous Indicators- PART II

by: @colibritrader

How the name was born and why MACD is such a famous indicator

As you have already possibly seen, I wrote another article on MACD HERE. At the same time, I am feeling the need to re-iterate some of the major concepts and expand a bit on others, so here is a second article on MACD.

OK… so where do I start from…. Maybe a simple chart and the MACD histogram platted along will be a nice way to kick this off:

MACD’s histogram simply plots the difference between the fast and slow moving average.

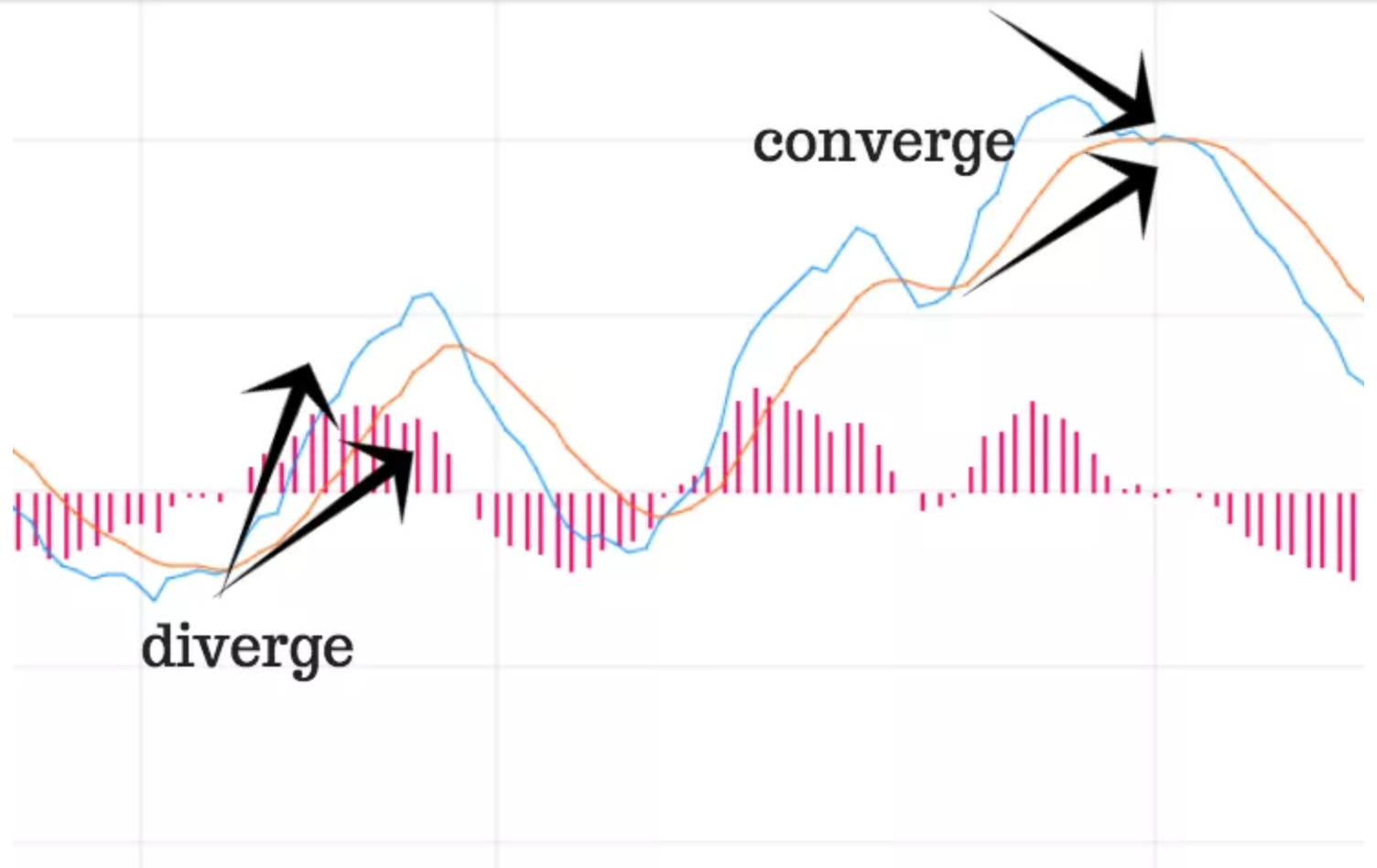

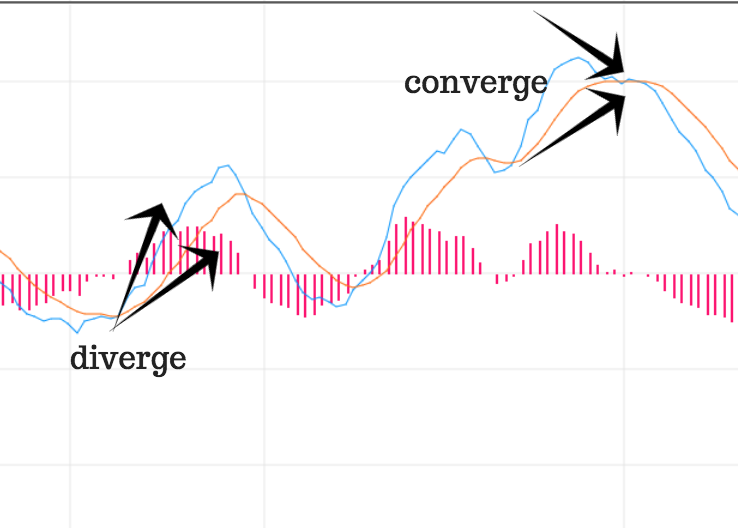

If you look at our original chart (the chart above), you can see that, as the two moving averages separate, the histogram gets bigger. Or just look below zoomed version of the histogram only:

This is called “divergence” because the faster moving average is “diverging” or moving away from the slower moving average.

As the moving averages get closer to each other, the histogram gets smaller. This is called “convergence” because the faster moving average is “converging” or getting closer to the slower moving average.

And that is how you get the name, Moving Average Convergence Divergence!

MACD can be pronounced as either “Mac-Dee” or “M-A-C-D.”

Origin

The creation of the MACD as we know it can be split into two separate events.

- In the 1970’s, Gerald Appel created the MACD line.

- In 1986, Thomas Aspray added the histogram feature to Appel’s MACD.

Aspray’s contribution served as a way to anticipate (and therefore cut down on lag) possible MACD crossovers which are a fundamental part of the indicator.

Meaning- M-A-C-D

Moving average convergence divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices. It is used to spot a change in the short-term trend of the market.

Methods to Interpret

There are three common methods used to interpret the MACD:

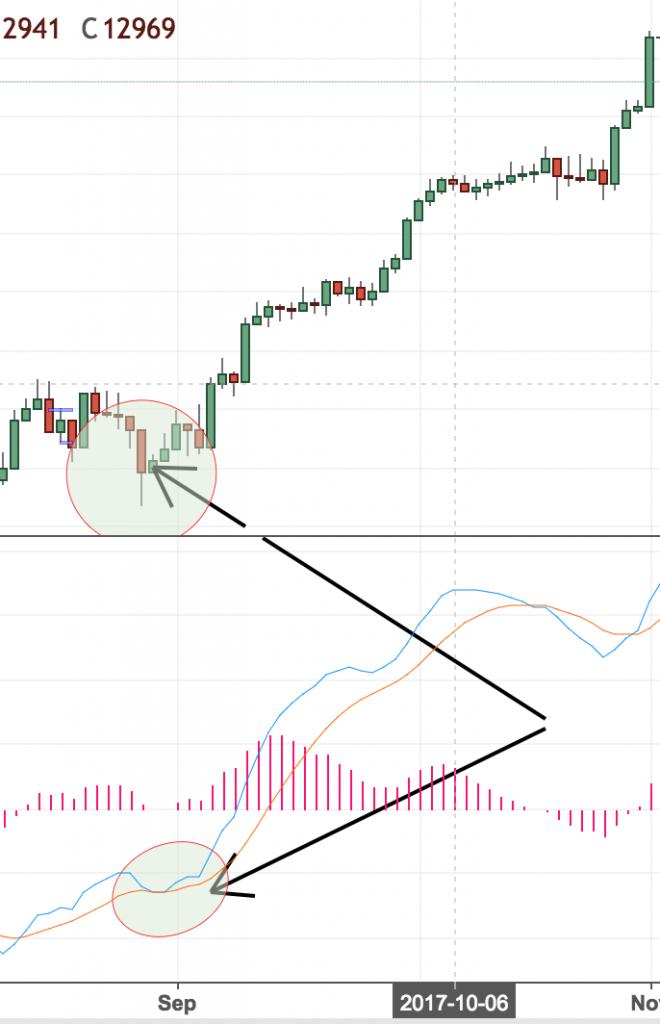

- Crossovers – As shown in the chart above, when the MACD falls below the signal line, it is a bearish signal, which indicates that it may be time to sell.Conversely, when the MACD rises above the signal line, the indicator gives a bullish signal, which suggests that the price of the asset is likely to experience upward momentum.Many traders wait for a confirmed cross above the signal line before entering into a position to avoid getting getting “faked out” or entering into a position too early, as shown by the first arrow.

- Divergence – When the security price diverges from the MACD. It signals the end of the current trend.

- Dramatic rise – When the MACD rises dramatically – that is, the shorter moving average pulls away from the longer-term moving average – it is a signal that the security is overbought and will soon return to normal levels.

How to use MACD

With an MACD chart, you will usually see three numbers that are used for its settings.

- The first is the number of periods that is used to calculate the faster moving average.

- The second is the number of periods that is used in the slower moving average.

- And the third is the number of bars that is used to calculate the moving average of the difference between the faster and slower moving averages.

The default settings for the MACD indicator are:

- Slow moving average- 26 days

- Fast moving average – 12 days

- Signal line – 9 day moving average of the difference between fast and slow.

- All moving averages are exponential.

Calculation of MACD Formula

The MACD indicator is calculated as the difference between the fast and slow moving averages:

MACD = 12 Day exponential moving average- 26 Day exponential moving average

The signal line is calculated as a 9 day exponential moving average of MACD.

Why use MACD?

The MACD is a combination of both trends. The short-term moving average accounts for most of MACD movement as it quickly responds to price changes.

It would not be possible to look at each and every stock to spot the trend. Beginners should use MACD for identifying the short-term and intermediate trend, say of three to five weeks, only.

Take only those short-term MACD signals which are in the direction of the larger trend.

Important: if the larger degree trend is upward, one should take only consider buy signals and vice versa. This would help avoid whipsaws.

When not to use MACD

MACD is an easy and popular tool used to identify short-term price trends. “However, in a dull and lacklustre market, avoid the MACD indicator as it would generate a lot of whipsaws.

Yet among all the secondary oscillators, the MACD is one of the best and most reliable indicators to identify a trend and is easy to use.

I do not personally use it, since I am a price action trader, but I know swing traders that find it pretty useful.

Use MACD with other indicators

The MACD indicator may not be sufficient to take an investment or trading call. Investors should use other indicators to take decisions.

Although the MACD is effective, it is not complete in itself. Traders should make use of other indicators such as RSI, Fibonacci series, candlestick patterns, Bollinger Bands, and stochastic to confirm trend direction.

Important: I do use only Price Action, which would include only candlesticks from the above listed.

No one indicator can ever constitute sound investment logic on its own. Each one of the technical indicators is basically lagging interpretation of market direction. That is why I am so fond of price action, as mentioned above.

You would often notice that every other signal on one indicator would be directly opposing a signal on another indicator, making it extremely hard to arrive at a trading decision not based on the hindsight bias.

How to trade using MACD- different trading

There are two moving averages with different “speeds”, the faster one will obviously be quicker to react to price movement than the slower one.

When a new trend occurs, the fast line will react first and eventually cross over the slower line.

When this “crossover” occurs, and the fast line starts to “diverge” or move away from the slower line, it often indicates that a new trend has formed.

Check below how the blue line is moving over the orange line creating this “diverging” situation.

From the chart above, you can see that the fast line crossed under the slow line and correctly identified a new downtrend. Notice that when the lines crossed, the histogram temporarily disappears.

This is because the difference between the lines at the time of the cross is 0. As the uptrend begins and the fast line diverges away from the slow line, the histogram gets bigger, which is good indication of a strong trend.

Important Terminology:

Signal-line crossover:

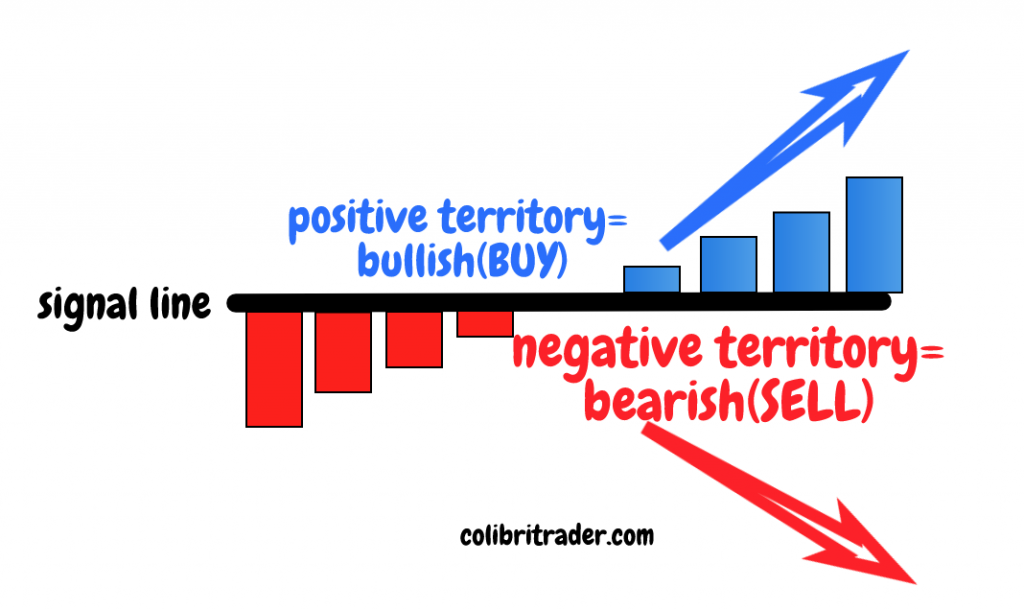

A “signal-line crossover” occurs when the MACD and average lines cross; that is, when the divergence (the bar graph) changes sign.

The standard interpretation of such an event is a recommendation to buy if the MACD line crosses up from below through the average line (a “bullish” crossover).

Traders sell if it crosses down from above through the average line (a “bearish” crossover).

These events are taken as indications that the trend in the stock is about to accelerate in the direction of the crossover.

Bearish Signal-Line Crossover Example from DAX 4 Hour chart:

Zero Crossover:

A “zero crossover” event occurs when the MACD series changes sign, that is, the MACD line crosses the horizontal zero axis. This happens when there is no difference between the fast and slow EMAs of the price series.

A change from positive to negative MACD is interpreted as “bearish”, and from negative to positive as “bullish”.

Zero crossovers provide evidence of a change in the direction of a trend but less confirmation of its momentum than a signal line crossover.

Bullish Zero Crossover Example from EURUSD 4 Hour Chart:

Divergence:

“Divergence” refers to the two underlying moving averages drifting apart, while “convergence” refers to the two underlying moving averages coming towards each other.

- Positive divergence:

A “positive divergence” or “bullish divergence” occurs when the price makes a new low but the MACD does not confirm with a new low of its own.

- Negative divergence:

A “negative divergence” or “bearish divergence” occurs when the price makes a new high but the MACD does not confirm with a new high of its own.

A divergence with respect to price may occur on the MACD line and/or the MACD Histogram.

Conclusion

The MACD indicator is the most popular tool in technical analysis, because it gives traders the ability to quickly and easily identify the short-term trend direction.

The clear transaction signals help minimize the subjectivity involved in trading, and the crosses over the signal line make it easy for traders to ensure that they are trading in the direction of momentum.

Very few indicators in technical analysis have proven to be more reliable than the MACD, and this relatively simple indicator can quickly be incorporated into any long-term trading strategy.

Don’t forget that I do not use it on its own.

I use strictly a professional price action strategy, an extract of which you can see in the video below:

p.s.

Check out my Best Educational Award from FXStreet here.

Again- THANK ALL of you for voting me out amongst so many other educational providers! It means the world to me!