Live Trading vs. Paper Money 9 Major Pros and Cons

Live trading is not the same as paper trading.

These are indeed two completely different ways to perceive the market.

So what’s so different about these?

In the following article, I will walk you through a live trade from my day trading room 👨🏽💻

I will be commenting on all of the things that could have gone differently if I was trading with paper money.

I will also be listing all pros and cons of live trading vs. paper money.

Let’s begin👇🏽

Contents in this article

Contents in this article

- Live trading vs. paper money

- The Build Up- Live Trading vs. Paper Money

- The Stop Loss & Live Trading

- Buy Limit Order (Live trading vs. Paper Money)

- Live Trading vs. Paper Money and Same Day’s US Session

- US Session Trade

- Stop Loss and Sell Limit when Live Trading

- The Profit Taking

- Summing it All Up- Live Trading vs. Paper Money

Live trading vs. paper money

Today will be all about live trading vs paper trading.

I will share with you a trade on DAX based on my day trading strategy that I took in my day trading room.

Without further ado, let’s hop in and check out this DAX trade.

The Build Up- Live Trading vs. Paper Money

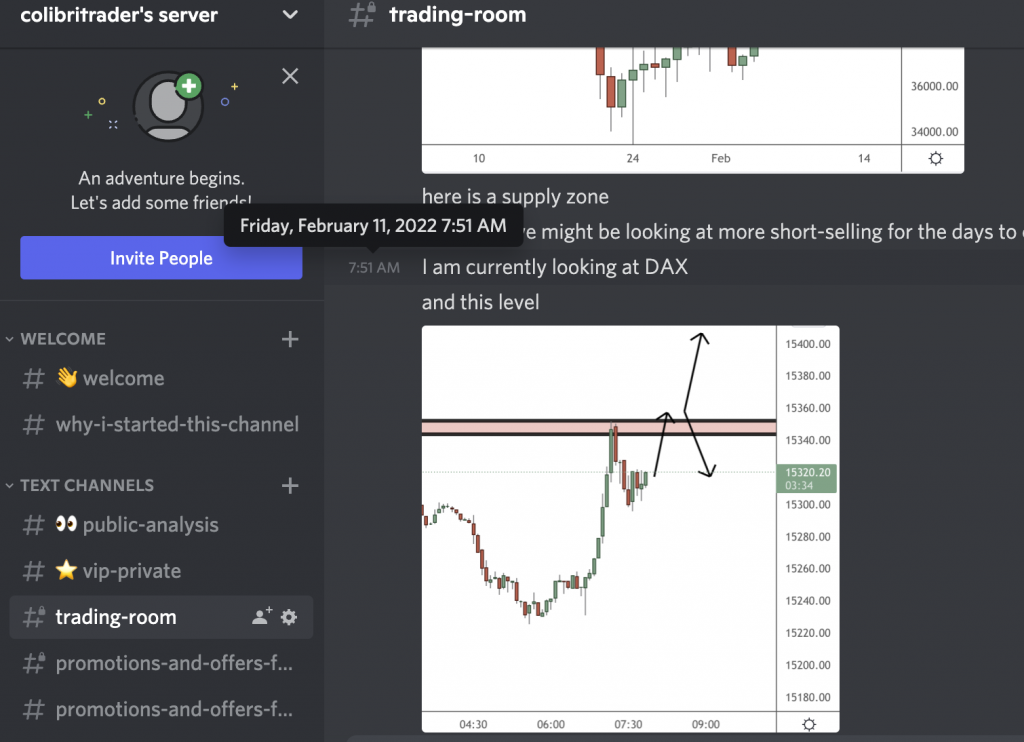

Before taking a trade, I usually share with the other members what I am looking for.

These are specific levels that are based on my day trading course’s strategy.

On this particular morning, I was looking to go short off a specific level.

So, here is what I shared with the rest in the live trading room:

Early in the morning (at 7:51am London time to be precise), I was looking for price to go above the supply zone I have marked on the chart.

This happened 30 minutes later.

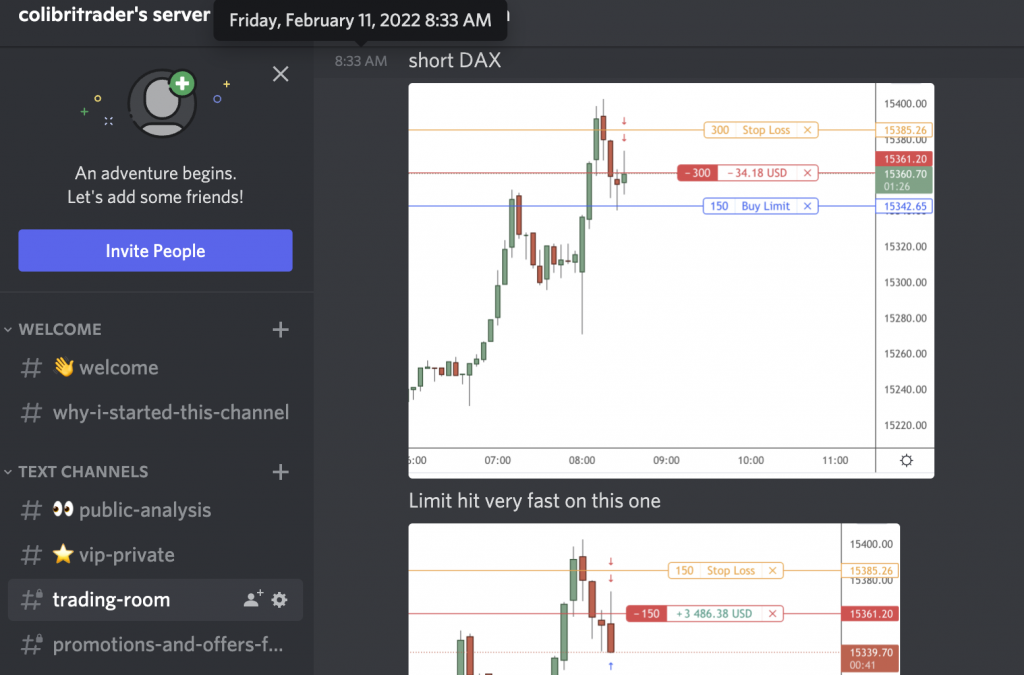

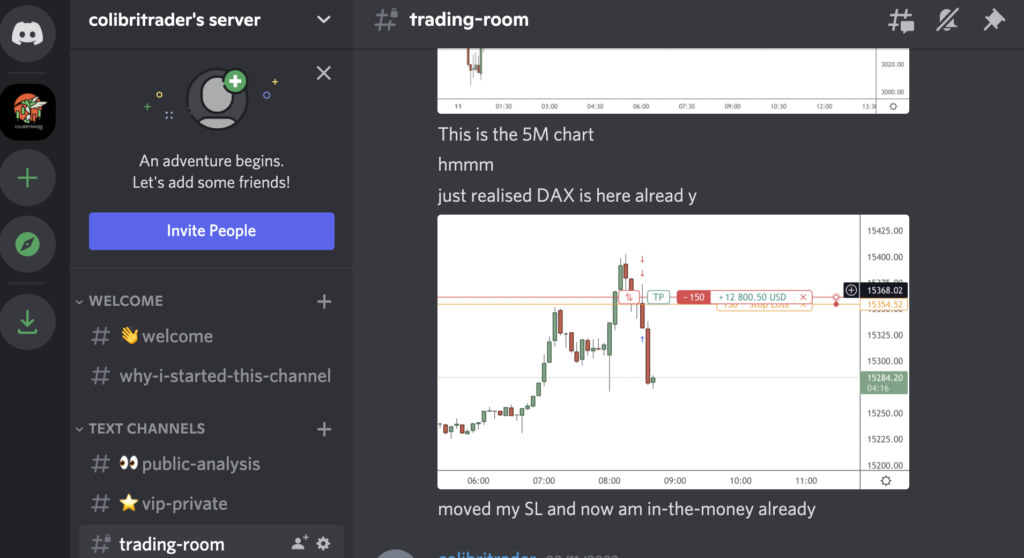

At 8:33 I was shorting the DAX based on my day trading strategy’s rules.

And here is how it looked:

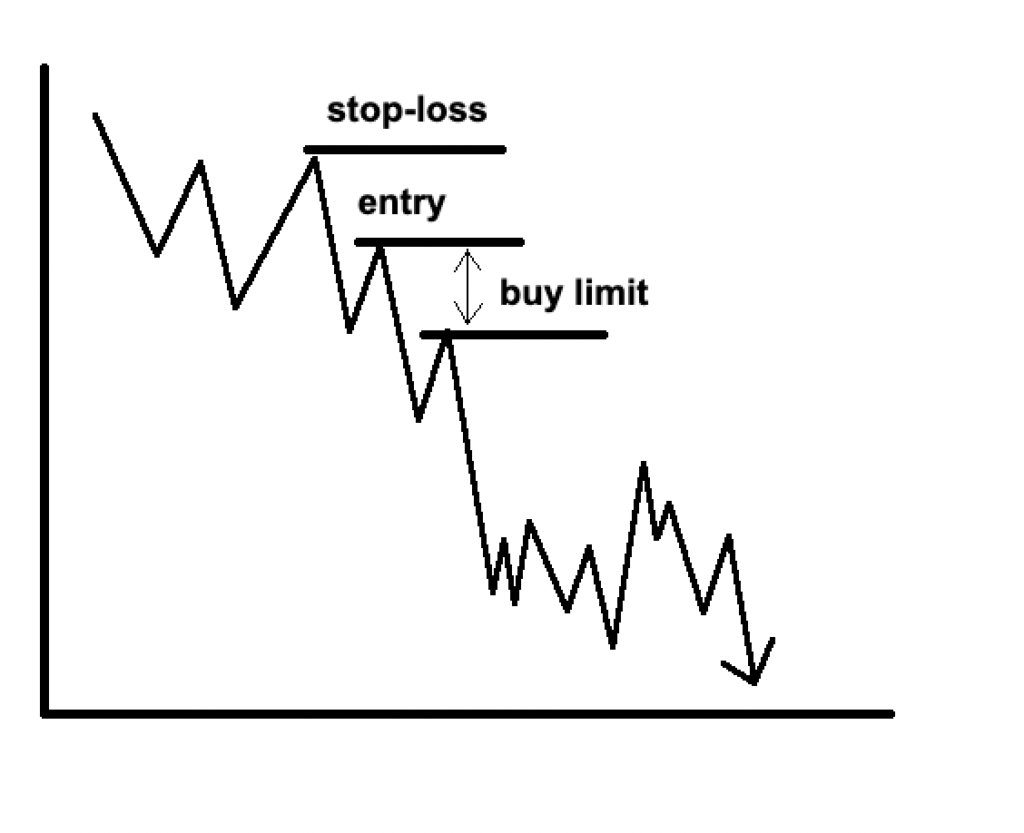

The Stop Loss & Live Trading

Where do you place a stop loss.

There are a lot of factors that I consider and I have shared all of them in my day trading course.

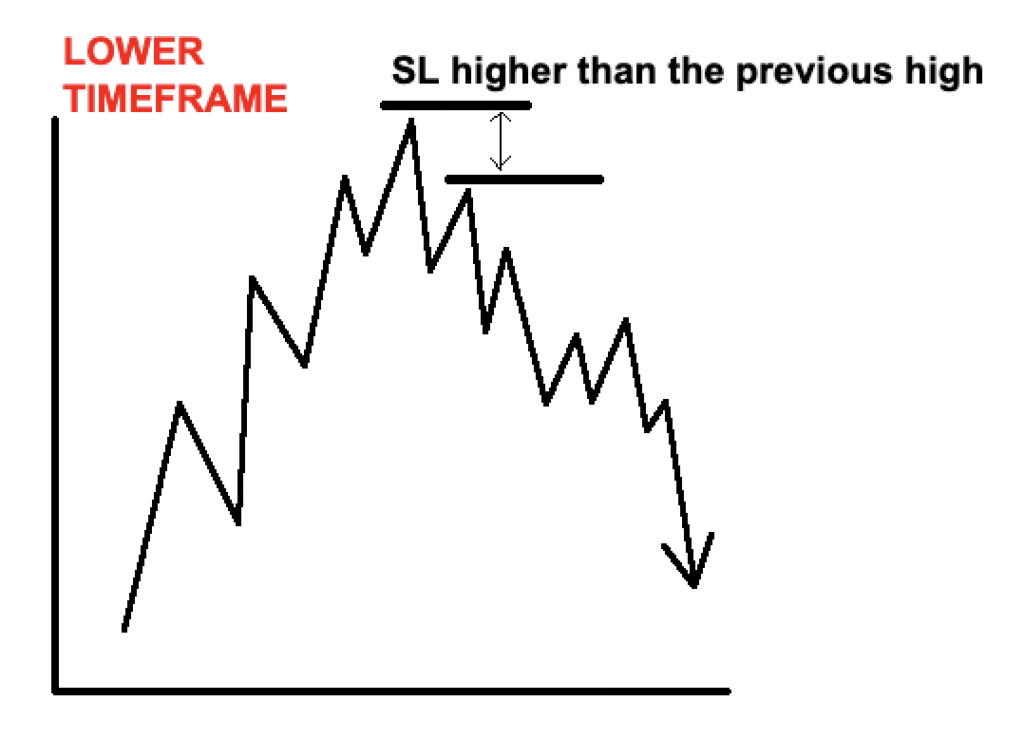

For this particular case, it was a previous high from a smaller timeframe.

Once a stop loss is placed, I never change it.

I believe that one of the major obstacles for new traders moving from paper money to live trading is to know where to place their stop losses.

Con: The second biggest danger is in the ability to stick with your stop loss once you have placed it already.

That is why live trading is so difficult for the beginner trader.

Let’s move on now and see what happened with this trade next.

Buy Limit Order (Live trading vs. Paper Money)

The next stage of the trading process is the buy limit or the place where I am taking partial profits.

In this case, it was placed here:

After I reached a 1:1 risk reward I booked my first profits.

From this moment on I was running a risk free trade.

What a great feeling!

Pros of Live Trading: No paper money transaction can beat the feeling of running a risk-free trade.

Here comes one of the major differences, too.

If you are trading with paper money you are just looking to make as much as possible and in a way trying to prove yourself.

When you are trading live, you are more conservative.

And a little while later, here is where the trade went:

At this moment I am moving my stop loss below break even.

The limit order did a great job and allowed me to run this trade for a decent return.

And here is a little while later:

What a decent run!

Con: Trading with paper money does not give you a feeling of a real tangible profit and loss and hence it is very easy to learn bad habits fast.

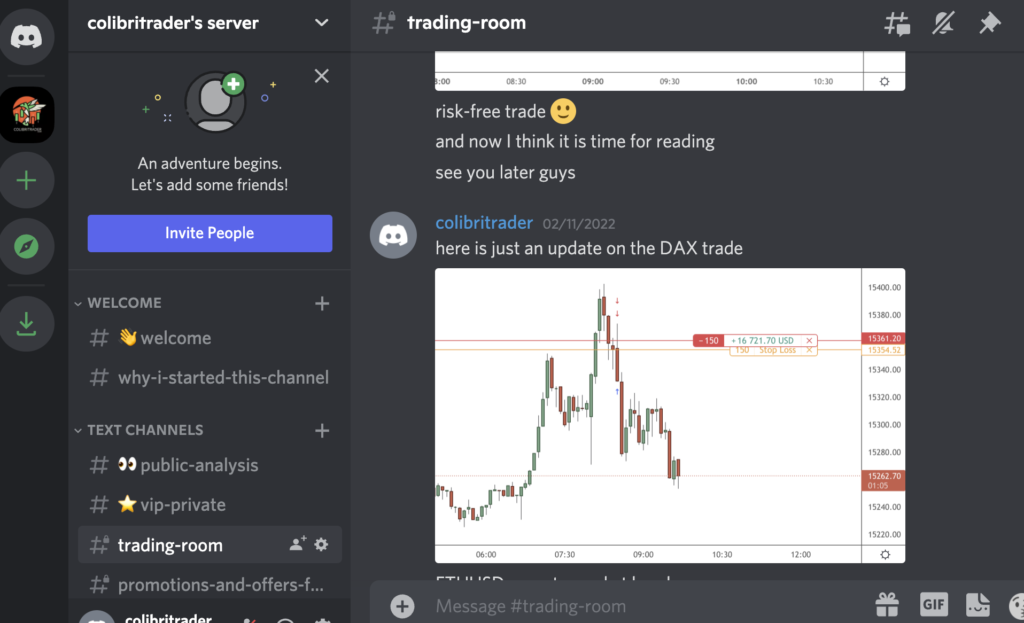

Live Trading vs. Paper Money and Same Day’s US Session

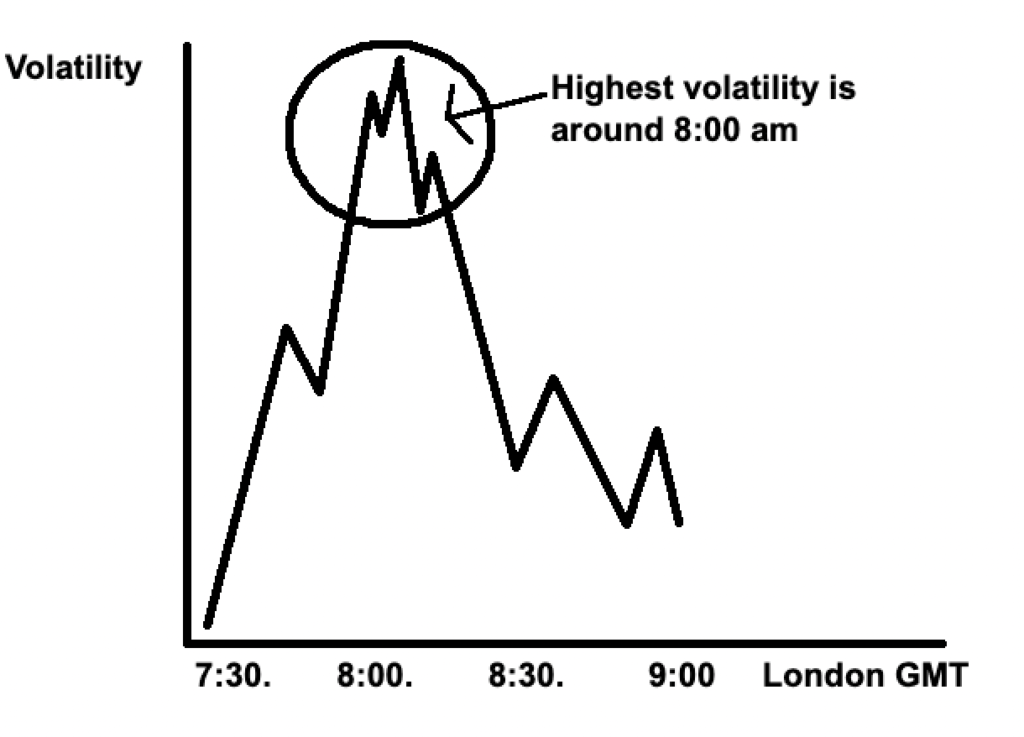

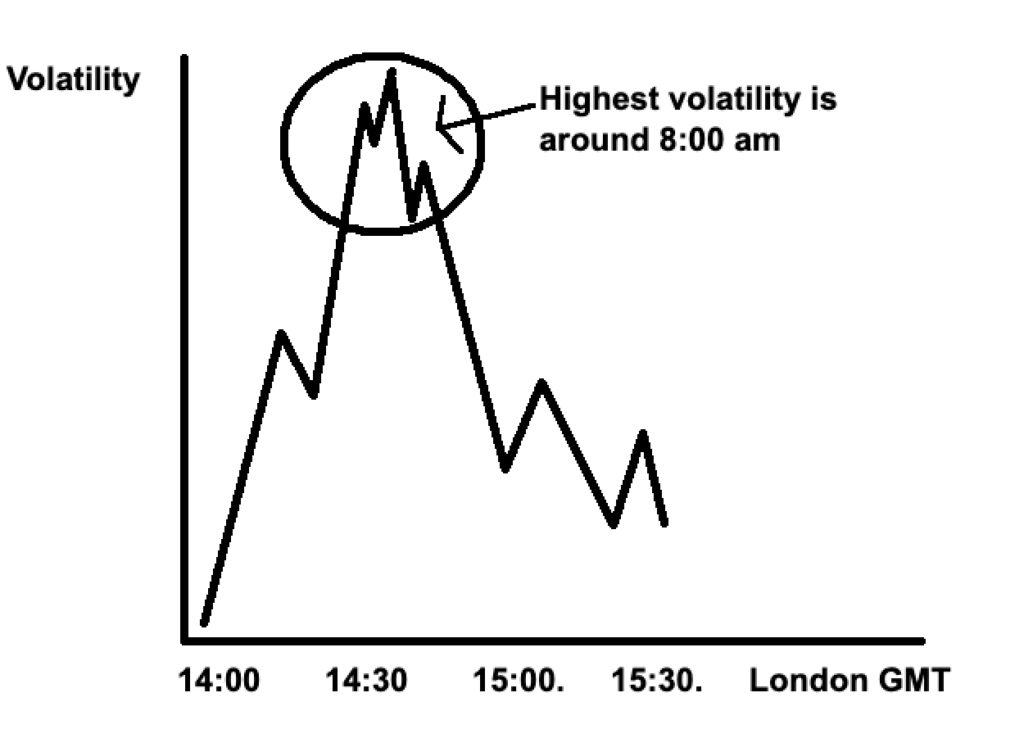

Some traders like to see not just differences between live trading and paper money, but also between the different trading sessions.

Although I certainly see differences between live trading and trading with paper money, I don’t get where they see a difference between the two sessions.

Markets are markets and unless you are looking to trade at specific time of the day, the differences between US and London open are not so big.

Both sessions are quite volatile, so not much of a surprise here.

But these are the most volatile times when best opportunities present themselves.

London session

And US Session:

US Session Trade

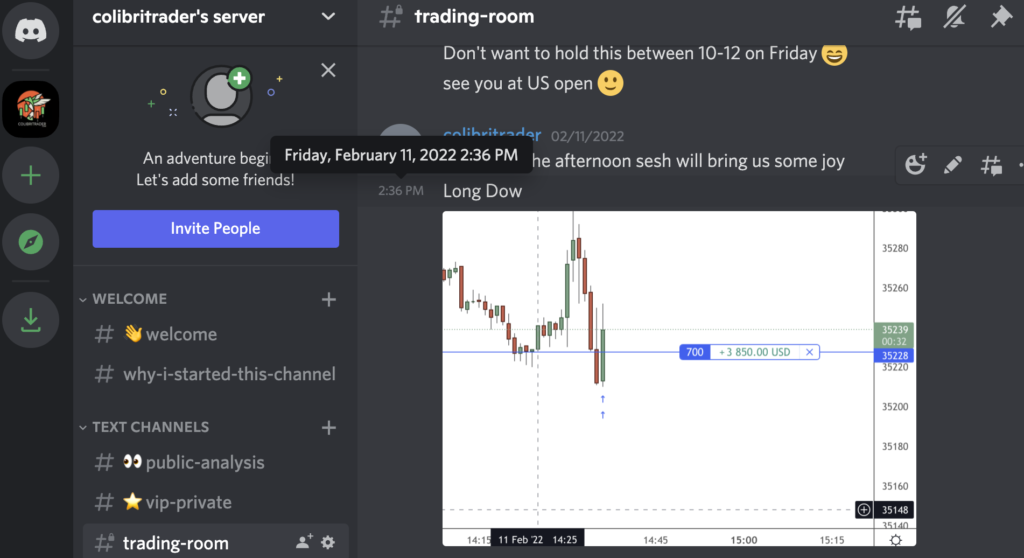

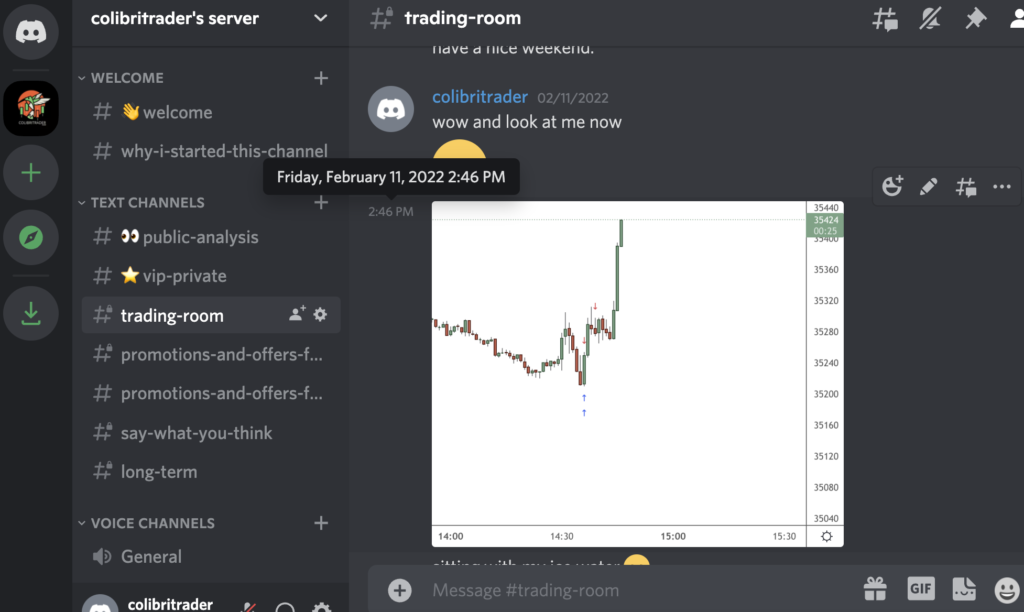

Talking about London and US session, I will walk you through the second trade I took in the day trading room in that same day.

It was a Dow Jones trade.

It was a long trade this time.

Just notice the time I took it:

Correct!

It was just when the market is most volatile.

There are reasons for that, but if you are not experienced, this type of strategy might not be suitable to start with.

You really need to know what you are doing if you are taking trades around this time.

Con: Best opportunities when live trading come around the most volatile times in the session, but they are also the hardest to get in for someone who has been just trading with paper money, i.e. a beginner.

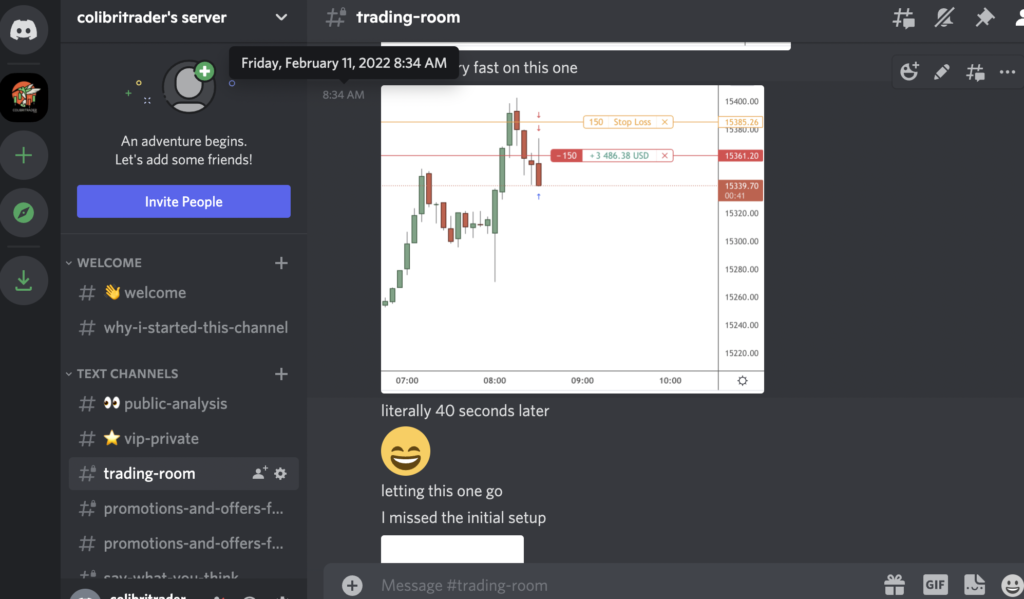

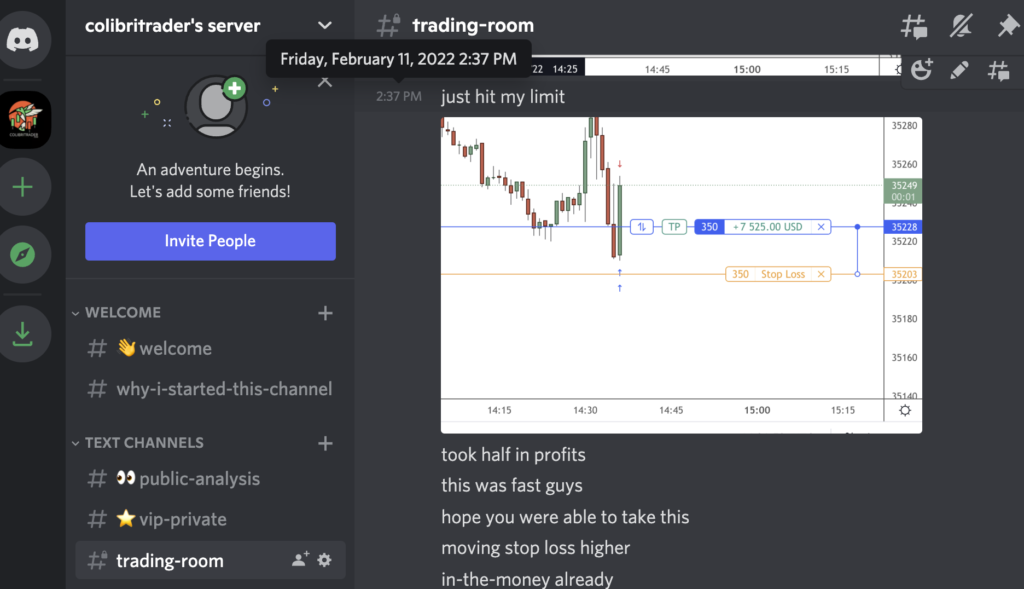

Stop Loss and Sell Limit when Live Trading

I will try to keep this short, since I already explained briefly the process above.

My Sell Limit order was quickly hit and then from this moment on I was riding a risk-free trade.

My limit was hit literally 40 seconds later.

Pro and Con: This could be a pro or a con for someone who has only traded with paper money before. Such fast price action is not for the faint-hearted. If you are not used to it, when times are bad, it might cost you dearly.

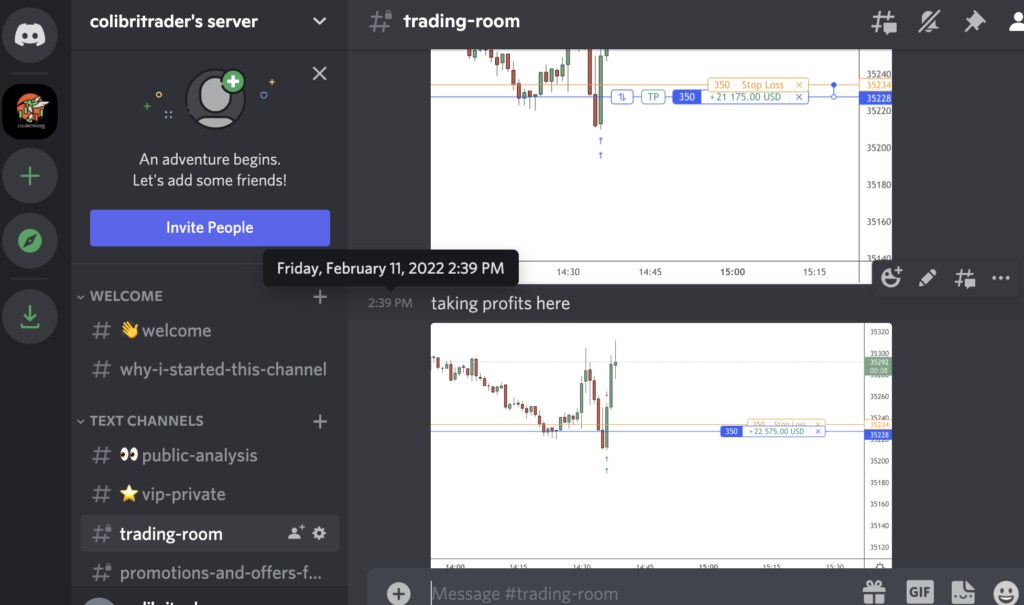

The Profit Taking

Profit taking with this trade was unusually fast.

Price just shot up quickly to hit my target.

As you can see, the time was 2:39 pm, which was literally 2 minutes later.

Such fast movements are not typical even for me, but you cannot change the nature of the markets.

You cannot beat Mr. Market!

Pro: If you are live trading as opposed to trading with paper money, you are always more cautious.

Even though in some rare circumstances like this one, if I let this trade run a while longer, I could have made a lot more.

Here is where price went next:

As you can see, only 6 minutes later price is already +170 points higher.

If you were trading with paper money, you would have probably let this trade run longer.

But what is price went down.

You could have ended up breaking even.

Considering the volatile nature of the markets, that is not a great bet to make.

Con: Trading with paper money is not the same as live trading. When trading with paper money you will learn bad habits that will work against you when you switch to live trading.

Summing Up Live Trading vs. Paper Money

There are pros and cons when it comes to trading with paper money and live trading.

As a beginner, it is always a good idea to start with a Demo account and paper trade.

As you progress, you might look at live trading as trading with money that you can afford to lose.

You should always start small until you build the confidence in your live trading results.

Pro tip: Some of the costliest mistakes in my career have been when I have become more confident and increased my trading size.

These are possibly the most important tipping points in your live trading career.

Always make sure that you are not risking more than 1-2% of your overall capital.

This is easier said than done, especially when it comes to live trading.

In the end, live trading is totally different from trading with paper money.

Be careful and don’t be misled into thinking that if you are profitable with paper money, you will repeat the same success when you go live.

Happy Trading,

Colibri Trader

P.S.

Interested in Price Action? Then, you will need to check out 👉🏽 Best 8 Price Action Patterns?

P.P.S.

Did you know that we help 10 students to become profitable each month. Learn more here 👈🏽

Great knowledge, thanks my lord Colibritrader