Live Trading Results with Notes

Contents in this article

Live trading results are one of the biggest fascinations that traders are keen on.

In this article, I will walk you through the live trades that were taken last trading week (28 Sept to 02 October 2020).

I would like to put the emphasis not so much on the outcome of my trades (although this is important, too), but also on digging deeper into my thinking process.

Where should I begin from?

Maybe the first live trade of the week.

By the way, if interested you can check out how to join our trading room if interested to see me take trades in real time.

Note: Those results are real and taken from my trading room.

Live Trading Results #1 Trade (Long Gold)

Here is our trade in Gold from the 28th of September.

Half of the profits were taken in 1863 and the other half I let run or hit my stop-loss, which was set above break-even once the price was far away from entry.

Trade was taken based on my day trading strategy.

There was a possibility that it might be a major reversal point in Gold, which is why I am still running this trade.

Only price can tell us if we should get out of a position once it is profitable.

The most important thing is that once we are in the money and have booked parts of the profits, we can afford to reach such high risk: reward ratios.

Here is where the price is at the time of writing this article (2nd of October) and I am still running this trade.

The current risk: reward ratio is higher than 1:10.

This is more than anyone could have imagined at the time when this trade was taken.

Download my Handwritten 5 Rules of Trading:

Live Trading Results #2 Trade (Long GBPUSD)

A very similar trading setup to the previous one with a slightly different live trading result.

The trade was based on a combination of my supply and demand strategy and my day trading strategy.

This trade did not show profitability from the very beginning.

You can clearly see the difference between trading FX and commodities in terms of how fast a trade develops.

FX is the slower one.

The trade finally started moving towards the end of the London session.

Once the price was significantly higher, I took 50% of the GBPUSD trade at 1.2923 and moved my SL higher to 1.2854, which was around 14 pips higher than my entry.

I took profits at around +90 pips initially and then my second part of the trade was stopped at +14 pips, since Brexit talks reversed the direction.

I usually use my day trading strategy to enter in trades like these just to fine-tune the entry.

On this particular occasion, I was in a hurry and took the trade by using a wider stop-loss.

It was still a great trade since I followed my rules after taking the trade and booked 50% of the profits after my initial target was reached.

In the second half, I still managed to make money even though prices reversed.

Important: at all times you need to make sure to book profits so that your P/L goes up.

That is the essence of profitable trading and a good trading strategy is just the starting point.

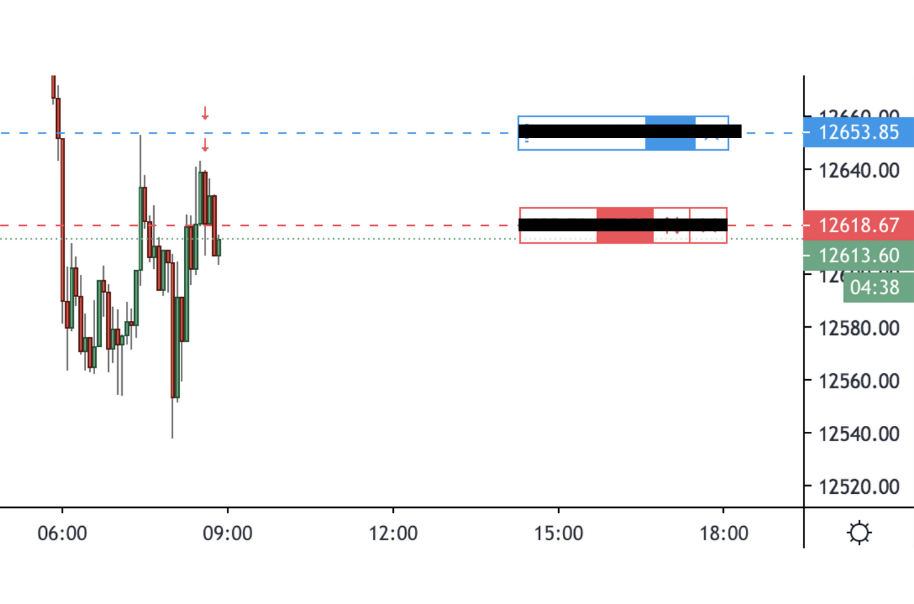

Live Trading Results #3 Trade (Long Dow Jones)

This live trade was taken based on my day trading strategy.

The trade netted about 50 points and the risk on this trade was around 19 points.

Not my typical risk-reward ratio, but it was still a good trade with 2.5x times return.

Not too bad.

My entry was late.

Originally, I had planned to enter into a long trade at around 27920.

Even though I had my signal confirmed at this level, I was away from the screen and could not physically take the trade.

A few minutes later I managed to pull the trigger and end the day with +50 points in my equity.

Here is a more in-depth explanation of the trade:

It was a well-planned trade with a not-so-timely execution that could be improved in the future.

Every live trade I take is different and from every live result, I do learn more and more about myself.

Live Trading Results #4 Trade (Long GBPUSD)

This live trading result could be taken based partly on my supply and demand trading strategy mixed with the day trading strategy.

It was an NFP day and usually, I avoid trading before the event.

On this day I got tempted (a mistake!) and did not have great results before the NFP numbers were out.

This GBPUSD live trade was taken in the afternoon session only after the NFP numbers were out.

The trade was initiated at 1.2906 with a wide stop-loss, which usually is not what I am using in trading.

I just wanted to make sure that I will not get stopped just before the price reverses direction.

The reason was the higher volatility on that day because of the NFP earlier that day.

Shortly after I was proven right.

The price literally turned upside down after taking the trade.

My target was much higher but because it was Friday and a lot of traders are taking profits early I decided to do the same.

I booked my profits only 25 pips above my entry.

Not my usual practice, but anything that makes my P/L grow is welcome.

Live Trading Results #5 Trade (Short DAX)

As I said earlier, Friday was an NFP day and my usual practice is not to trade before the NFP results are out.

Unfortunately, as it sometimes does happen I got tempted to enter in a trade going against my rules.

Important note: Losses in trading are unavoidable but you should do everything possible to reduce their size and magnitude.

Here is my first losing trade of the week:

I entered into a short DAX trade.

My stop loss was unusually wide standing at a whole 35 points!

I entered this trade in a rush, which was another mistake.

Initially, everything was going well, but I was soon to be proven wrong.

Here is what happened next…

At this moment, the younger trader in me was saying to try and try again and get into another trade.

The mature trader in me was saying do not, this is a trap.

I followed the mature trader in myself and even though the price went down for another 100 points before reversing, I did the right thing.

I cannot emphasize enough how important it is not to end up overtrading.

You should have limits in your trading and sometimes even if you have not reached your daily stop for the day, which was this case, you need to stop.

It was an NFP day and I was risking going into a bad pattern of behavior, which is detrimental in the long term.

We, as professional traders, need to stick to our positive P/L.

Even though this day was a losing day for me, I managed to limit my overall daily losses to only -10 points, which was a feast.

Losses are healthy as long as they are limited and you learn from them!

Conclusion

When trading live, you must have a clear pre-written road map.

You need:

- Good trading strategy

- Ability to follow simple rules

- Avoid overtrading

- When you make money to maximize your profits and when losing to cut them as fast as possible

These four rules are essential.

In every profession, you need to spend time to learn new habits and new rules.

Trading could be as difficult as we make it, but that is another good reason to keep it simple.

In the above article about live trading results, I have tried to explain my reasoning for the past trading week.

The point of this article was to show you the trade and the outcome.

p.s. Why I have created my trading room

If interested in following me in real-time when I am sharing my trades as I take them and learn by my trades, you can join me through my Day Trading Program.

I have started my trading room to help other traders.

I strongly believe in two things:

1) law of attraction

2) synkyndineo– from Greek literally means taking risks together

To better understand my motivation of creating this live trading channel, I will tell a story.

The Acts of the Apostles describes a voyage of St. Paul on a cargo ship from Sidan to Crete to Malta.

As they hit a storm: “When they had eaten what they wanted they lightened the ship by throwing the corn overboard into the sea.” […]

It is provided by the Rhodian Law that where merchandise is thrown overboard to lighten a ship.

What has been lost for the benefit of all must be made up by the contribution of all.

Now, I hope that you will better understand my motivation for starting this channel.

In the world of trading, there is no such thing as taking risks together, but I hope to come as close to it as possible.

Pliz send

What do you mean?