King Dollar

Dear successful traders,

This has been the longest monthly winning streak in history for King Dollar. Although, I do not discuss a lot fundamentals, I don’t deny that moves like that are influenced by fundamental reasons. One way or another, I believe that we can see further USD gains. Let’s have a look at this interesting article I have just found out:

From Chris Kimble

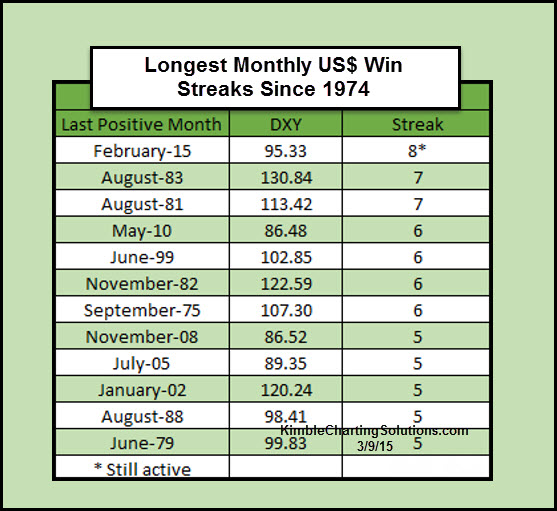

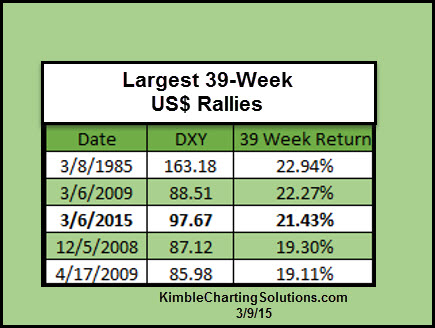

“King Dollar” is on a roll of late, and I don’t just mean the past few weeks. The U.S. dollar has accomplished something recently that it has never done since the Dollar Index was created back in 1974! The table above reflects that for the first time ever, the U.S. dollar is up eight months in a row. Below is a table that takes a look at U.S. dollar performance over the past 39 weeks (nine months). As you can see, the dollar is up over 21% in the past 39 weeks, which is the third largest 39-week rally in history.

If King Dollar happens to remain one the worlds most preferred currencies, how much higher could it go?

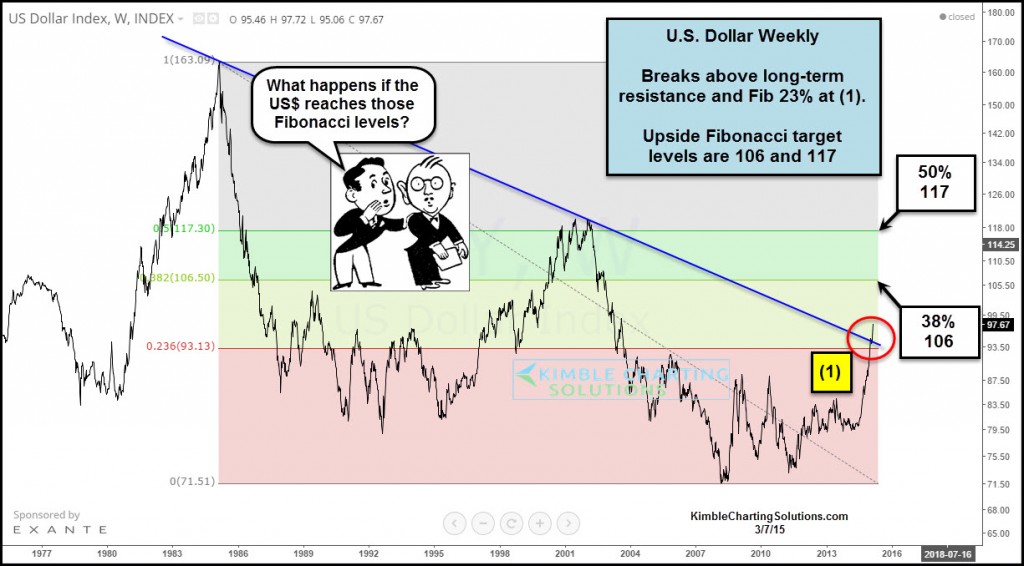

The above chart takes a long-term look at the US Dollar since the 1970’s. I applied Fibonacci retracement levels based upon its all-time high in 1985 and the lows reached in 2008. As you can see of late, the US Dollar broke a resistance line dating back to the all-time highs and its Fibonacci 23% retracement level at (1). This was an important breakout of dual resistance! Since a recent breakout is at hand, what levels could the US Dollar reach? The next key Fibonacci resistance levels look like this…the 38% Fibonacci resistance level comes into play around 106 and the 50% Fibonacci retracement level comes into play around the 117 zone. Can the US Dollar really reach these levels? When you look at the percentage of Dollar bulls and the positions they own, these levels might not surprise a few of them.

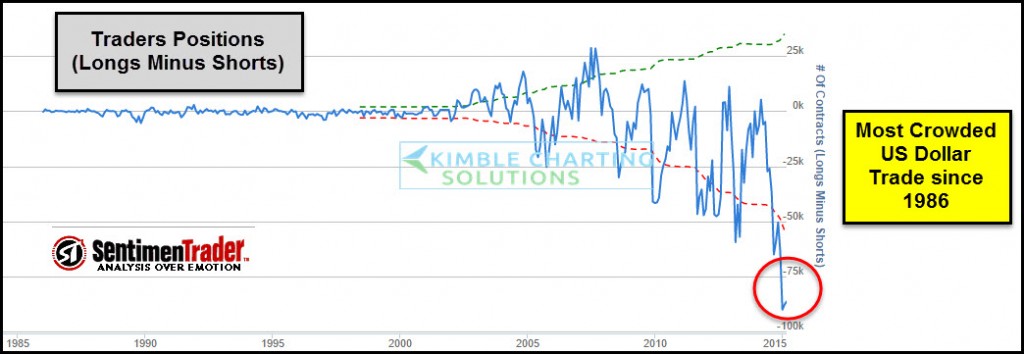

At this time, 87% of investors are bullish the Dollar (not shown), according to Sentiment Trader.com. Dollar traders have also established the most lopsided positions in history, reflected in the chart above. Think about this, should the US$ do nothing more than reach its 50% level of the all-time highs in 1985 and the lows of 2008, it would have to rally another 20%! This is NOT a prediction, its sharing where key long-term price levels come into play. I totally respect that sentiment is lopsided, to a degree that I have not seen in my 35-years in the business. I also totally respect that sentiment can remain lopsided for longer than many of us think. In the end, price is the only thing that pays and King Dollar is on a role and one must respect its upside possibilities and the potential of its impact on other assets should these targets be reached.