Is Market Selloff Close and How To Recognise One

How important are market selloffs and how do we recognise one when it comes?

In my last market analysis, I was expecting to see DAX selling off based on purely technical reasons.

Here is my article from the 21st of November, 2021:

A few days later and after some fundamental news hit the wires, we are seeing DAX having its biggest selloff of the year.

Not just DAX, but all major market indices sold off.

But since I was telling you about DAX, here is what happened just a few days after my trading analysis post on the 21st:

I am not sure I can handle this market selloff.

I have not seen such a sharp selloff in recent years.

This must be one of the worst market selloffs I have personally experienced!

I wish I was shorting it up there…

These and hundreds of similar posts were going all over the internet on Friday, when the selloff occurred.

Is a 1000 Points Drop a Major Market Selloff

Who would have believed that?

Would you?

If I told you the market will go down 1,000 points in one day, what would you have done?

These type of thoughts are very common with beginner traders and wanna-be rookies alike.

But was it really possible to take part of this move or all of it?

Indeed, it was.

And it still is!

Usually, market turning points historically have always begun with a very sharp market selloff.

Purely based on history, if this is considered to be the beginning of a new cycle, then we could possibly be just on time to make some money.

But bear with me.

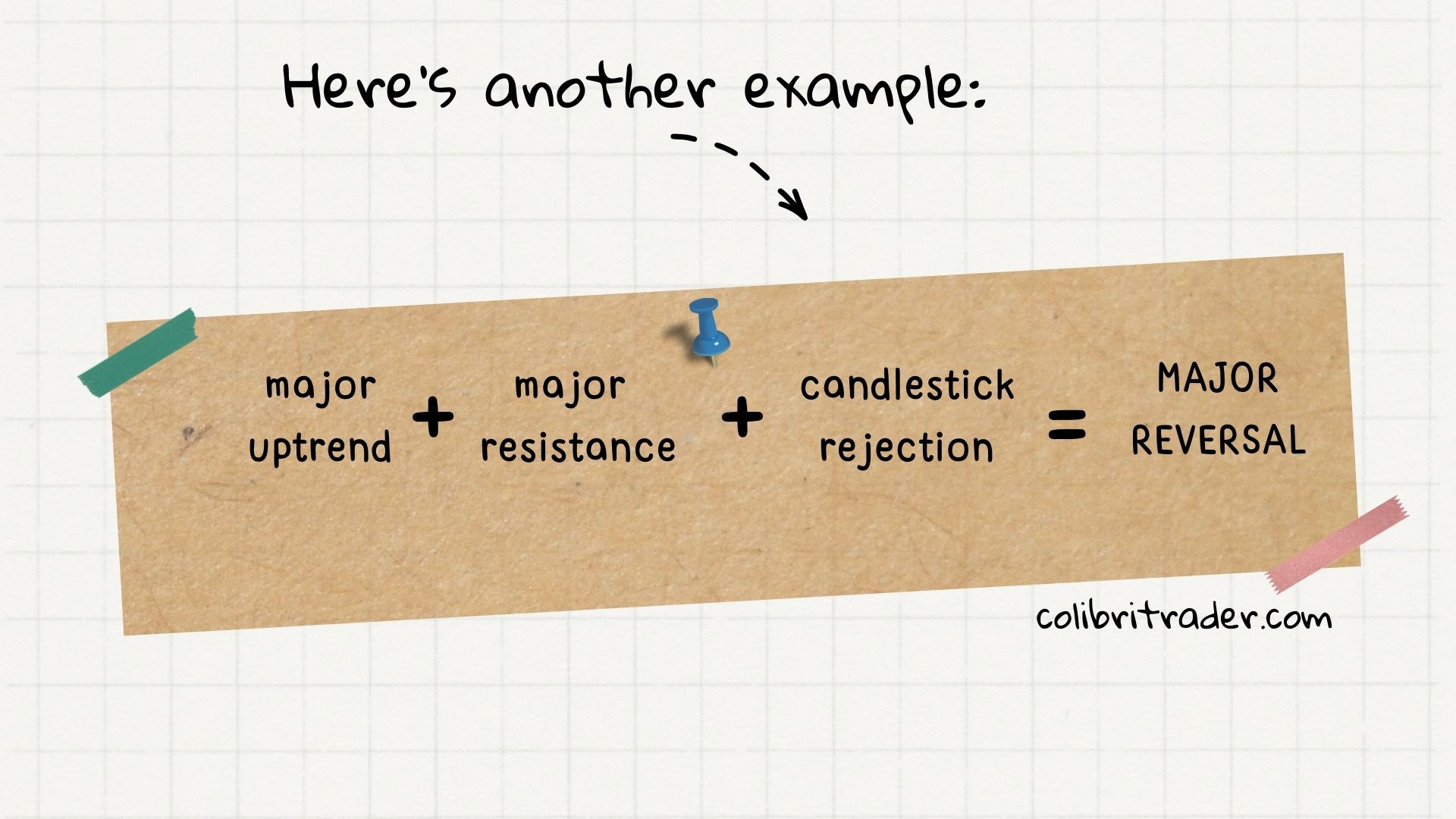

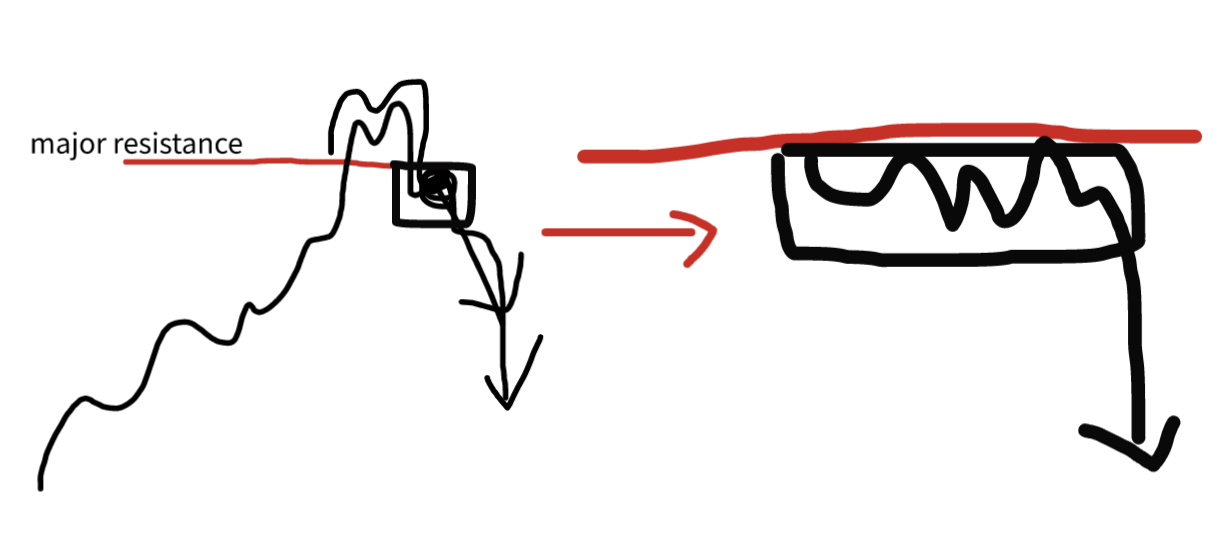

Look at this illustration and I will walk you through it shortly:

Some Other Market Selloffs

It wasn’t only DAX that was selling off on Friday.

Traders experienced major selloffs across different countries.

There were big market selloffs from US to Asia.

There were even crypto currencies selloffs, which was contradicting the widespread belief that these are safe heaven instruments.

Seems like when there is a major selloff, even safe heaven instruments are affected.

Here is the weekly chart of Bitcoin, that lost around 8% of its value:

Traders are pulling out money from the markets in unprecedented speed.

The question is would this one be a short-lived or a major turning point?

Let’s dig deeper now

When Technicals Are Reading a Major Selloff

I am looking at a few randomly chosen markets and am seeing the same or very similar pattern across.

Let’s have a look at them first and then summarise why they are so similar.

First things, first.

Here is the CAC40 (French Stock market) monthly chart:

Where is the price located?

Correct!

It has just rejected a new high.

This is also known as a bull trap and very commonly leads to a change of the trend.

What about crypto?

Here is the BTCUSD weekly chart:

We are seeing a very similar pattern on the weekly bitcoin chart.

Let’s have a look at Japanese 225 index:

A very similar outlook.

But who knows… maybe it is just a coincidence.

Let’s have a look at S&P500

We are at an all-time high, so there is no reference to a previous supply zone or a major resistance level, but look at this pin bar on the Monthly chart.

It all looks very bearish.

Now, I am not saying this is a market top, since such a statement would be foolish.

What I am saying is that all of the market evidence that I have gathered points to further market selloff.

What Shall I Do

I am not a financial advisor.

I am not in the business of giving trading advice.

What I am doing is simply reading the market technicals.

And they are all painting a very bearish picture.

If we are experiencing a possible rejection on all of the higher timeframes like weekly and monthly, this is already a worrying enough sign.

Just as I promised you!

Here is what worries me:

1) Major Uptrend

2) Major Resistance Level (Supply Zone)

3) Candlestick rejection pattern after a new high

Those are the 3 worrying signs that I happen to notice across so many different asset classes.

Let’s just hope that my analysis would be wrong and this will not turn out to be a major market selloff.

List of largest daily changes in the Dow Jones Industrial Average

I think it is quite relevant, talking about major market selloffs to share a list of the biggest daily changes.

The index I have chosen is Dow Jones, because it has one of the most reliable historical data.

The Friday’s drop of close to 6% is very close to some of those numbers.

This makes me question if we are not getting closer to one of those market turning points.

I am standing here by myself, it is close to midnight (time of writing this piece) and am wondering how the market will open tomorrow morning.

This statistic give me one more reason to doubt the bullishness of the current market environment.

Or, even if there is not major turning point just in front of us, how long do we have left?

It is almost like asking:

I have never been a big fan of guess work and trading the markets for over 2 decades now has come to show me that you should never try to predict.

What one should concentrate on is reading them and just following what they are throwing at you.

Grasp it with both hands.

Such opportunities come and go fast, so act accordingly.

Market Selloff- Where Are Those Opportunities?

A lot of you might be saying by now- stop talking and show us where those opportunities are.

Again, I am not a financial advisor.

I can only share with you what I am looking for or more precisely where I am looking for trading opportunities.

As you can see from my “brilliant” illustration, the best places to look for those opportunities are:

1) Price is already below the major resistance

2) Price halts for a while there and prints another bearish confirmation

When the price is already below the major resistance (or supply zone), price action traders will be looking for shorting opportunities.

It is under the resistance level where the big selloffs begin.

In other words, if prices have just sold off from the highs on Friday, it means it will take some time to pick up some new sellers.

If of course this is a genuine market turning point.

If not, we will see some bearish rejections and price will continues its uptrend.

Market Sell-Off Strategy

There are a lot of strategies when it comes to market sell-offs.

Some of them are to protect you against one.

Others are specifically designed to help you make profits during one.

In all of these cases, the best thing to do is to only trade/invest in what you already know or are familiar with.

For instance, do not trade in crypto if you have never opened a single trade in it.

Do not use margin, especially if you are new to it.

Sometimes, even listening to other experienced traders could be a recipe for disaster.

I you would allow me, I will share with you my 3 steps to reach a trading zen when it comes to market selloffs.

3 Steps To Master Market Selloffs

As I have mentioned above, first and foremost comes understanding of what you are most familiar with.

`Therefore, my 3 steps are as follows:

1) Understand the mechanics of an instrument- the ins and outs of what makes them tick

2) Learn an already tested successful trading strategy

3) Do not panic and do not over-leverage yourselves

Even if these 3 steps look simplistic, they are essential for the newcomer.

If you have never faced major market selloffs before, you need to be aware that what is see is what other market participants see.

You need to also be aware of the fact that 95% of traders lose money in the long-term.

So, what might seem logical to do and the “obvious” thing to do, might not be necessary a winning approach.

Especially if a lot of other traders are using the same logic.

Try to join the 5% of traders.

Market Selloff- Mixed Feelings

Just like anything important in life, major market turning points occur almost unnoticed.

They slip through our fingers and when we have noticed them, it is almost too late.

Do not let things slip through your fingers.

Study the markets.

Learn profitable trading strategies.

Stick with them!

Happy trading,

Colibri Trader

Thanks for sharing with us, great Tutor.

Thanks for the feedback