Intraday Trading – How to Make Money in Intraday Trading

What’s more luring than prospects to make money fast?

For intraday traders, it’s a normal routine – just as taking losses.

What is intraday trading anyway?

The approach generates profit opportunities as traders buy and sell assets within one day.

To give you a rough overview, let’s look at the strengths and weaknesses of this way of trading.

Pros

- Low capital requirements

- A constant flow of trading setups

- Reduced risks of unexpected events

- Fewer factors impacting the price

Cons

- Mentally challenging

- Extensive time demanding

- High trading costs

- Limited risk-to-reward potential

Of course, many points would be more or less relevant, depending on your individual circumstances.

Let’s elaborate on that.

Intraday trading: professionals

Professional traders that work with low-cost brokers may only be affected by the limited R/R.

How so?

Suppose you’re mentally prepared, know your trading time niche during the day and minimise fees or spreads.

The only thing that is likely to limit a profit from a position is the size of the move.

In day trading, you need to close the trade by the end of the session, regardless of any move continuation signals.

Intraday trading: newbies

The biggest challenge for novice traders is the psychological side of day trading.

At the same time, the lower initial deposit and unlikely market shocks such as gaps and flash crashes help not to blow up too soon.

In intraday trading, the news releases are of less importance.

Why?

Most news tends to play out over weeks, if not months, making it irrelevant for intraday trading.

Even if the events impact the market sooner, how do you know they aren’t already priced in?

Sure, you should be aware of the release time, as the volatility can be high.

Expect the fact that something may happen.

Don’t focus on what will actually happen!

Thus, you may skip the fundamental factors and focus more on the price action.

You know, the less is more in trading, so it’s liberating that one more mystery is out of your sight.

What about “screen time”?

Talking about quantity, intraday traders get many entry signals daily.

On the one hand, it’s beneficial as novices need to get exposed to as many situations as possible to gain experience.

On the other hand, we don’t merely need a cliched “screen time” to succeed in trading, but also preparation and reflection.

Too much intake at once might be just too overwhelming, to the point of being counterproductive.

Stay fresh!

Find the right balance between the information input you’re exposed to and how you will process it.

Basics of Intraday Trading

Before delving into technicalities, check out your capital, time, and experience inventory.

What for?

Depending on the individual circumstances, the way you go about intraday trading will vary.

Let’s look at essentials first.

Capital requirements

You first need to decide what market you’ll deal with.

Not all markets are equally accommodative for intraday trading.

Suppose you want to day trade the US stock market.

FINRA, the US regulator, has a pattern day trader rule, limiting the number of executed trades on margin.

You’ll be limited to three trades on a margin within five business days.

At the same time, you must always maintain $25,000 in your brokerage account.

The leverage you’ll be allowed to employ to buy a stock is 4:1.

You can have higher leverage and a much lower initial deposit for trading US futures.

Look into forex and CFD trading if you want to go for the maximum leverage and minimum deposit size.

Just make sure the FX/CFD broker you choose is properly regulated.

Working hours

Intraday trading requires being consistently present at specific times of the day.

You don’t need to monitor prices around the clock, but your bread must be the most active trading hours.

The busiest time for each market is the first and the last hour of each trading session.

Make sure to choose the active hours to trade intraday.

Pro Tip: Avoid opening trades when the market is stagnant.

In the middle of the session, traders usually go for lunch, so the volatility and volume are reduced.

Also, the best time to day trade a specific market might not fit into your schedule.

It’s dangerous to trade when you’re in a rush or have thoughts in the back of your mind.

If the busiest trading hours happen to be when you’re exhausted from your full-time job, consider changing the market.

For example, if you live in the US, it wouldn’t be sustainable to trade London opening.

You’re supposed to sleep at 3 AM, not taking risks in the markets!

Don’t play a hero!

You can’t fool your body – over time, the impact of a wrecked sleep cycle is detrimental to trading.

Mindset

Frankly, if you’re just starting out and there’s no successful trading role model around, you’ll have a tough time.

Sure, you can learn from books or YouTube about the mindset conducive to trading.

However, one thing is to acknowledge it intellectually, and another – to live it through.

Imagine reading or watching whatever you can find about driving a car.

Do you really think that you’re a rival to formula-1 racers once in a driver’s seat?

You know what I mean.

Intraday trading can be fairly intensive.

You’ll need to make objective decisions fast.

This skill is a set of mental habits, many of which deal with patience.

Here is what you’ll need to work on.

- Patience in waiting for the right market state, the right setup, and the right trigger

- Patience to ride the target move and wait for an exit signal

- Patience to follow your plan whether you’re in a losing or a winning streak

So, what would be the best advice if you’re just starting out day trading?

Begin with a small size and work your way up as you develop the critical mental traits.

Intraday Trading Tips

The same hardships are present whether traders are engaged in the stock market, futures or cryptos.

What are they?

Intraday trading involves the following challenges:

- Mentally demanding

- Limited move potential

- Frequent price noise

Next, we’ll look at some intraday trading tips to address these obstacles.

Keep your charts clean

It’s already nerve-wracking to deal with price fluctuations, entries, targets, losses, etc.

There’s no need for too many extra things to analyse except for the naked price.

You don’t want to clutter your chart with gazillion indicators, lines, or anything else that will impede your judgment.

Ever heard of analysis-paralysis?

It’s about that.

Here’s an absurd example.

If your chart looks anything like that, you’re in trouble.

It’s ok to use a couple of tools now and then.

However, when it gets too many of them, you can throw price action analysis out of the window.

Use strong horizontal levels

Do you know why there are pivot price levels in any market?

Such as the one around 150.0-151.0 in Apple.

The big market players move the price.

You know, those loud names with deep pockets: hedge funds, pension funds, banks, or big individual investors.

When they accumulate positions, it can’t go unnoticed.

The market repetitively bumps into a few prices and retraces back.

Those prices are the spot where huge limit orders are placed.

The goal of short-term traders is to hide their stops behind strong levels to limit the risk.

Strong levels on the daily chart are powerful for intraday trading.

When the breakout occurs, traders can catch a decent move while staying in the green immediately after the entry.

If you aim for a rebound, such a price level is reliable to hide a stop behind it.

The idea is getting a maximum move potential with a minimum risk.

Here’s a warning for stock traders: the slippages can be severe.

Using a stop order to enter or exit the market at the breakout may result in 3 to 10 cents slippage.

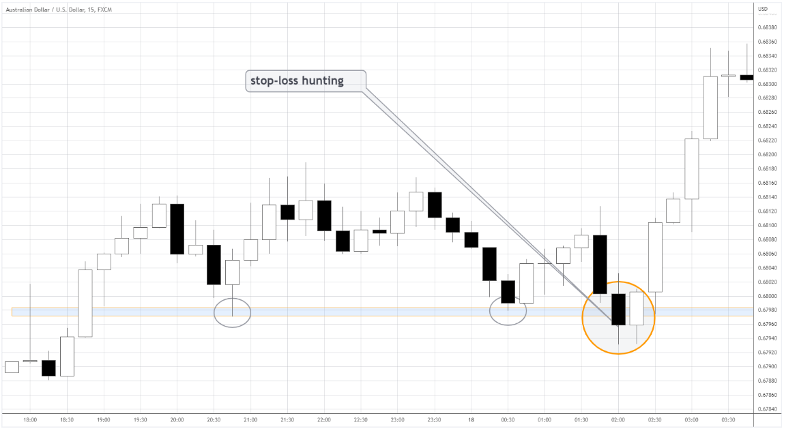

Embrace stop-loss hunting

Big players use various ways to accumulate positions.

A classic one is tapping into the liquidity of small traders by triggering their stops.

If a big buyer wants to get in at better prices, they may push (sell some) the market down a bit.

At the same time, the same player bids right where the majority is likely to place stops.

Once the price reaches that hot area, many traders would sell, filling the big order of a cunny buyer.

What happens after that raging bull absorbs most of the supply?

That’s right, the market soars, but without traders that didn’t have the guts to buy again.

Be prepared, because it happens daily!

You can wait until the level is pierced and only then get in – that’s a high-probability setup.

Is Intraday Trading Profitable?

Let’s put it into perspective.

How about a career in NBA?

Is it profitable?

Just look at the minimum salaries– a newly-drafted player without any NBA experience makes almost half a million dollars annually.

What’s sobering is less than 1% of all basketball athletes eventually make it to a professional career.

How about a professional career in trading?

Intraday trading is a performance-based field, just like sports.

Sure, the minority makes money consistently in intraday trading.

According to one study by SEC, on average, 70% of forex traders loose money every quarter.

That means around 30% of traders still hold afloat.

If we talk about merely staying above breakeven, there you go – you got a 30% chance not to lose money within three months.

However, is it worth it?

People get engaged in intraday trading to at least make as much as they would in their full-time jobs.

Vantage Point Trading’s Cory Michael says only 1% of people make good money in intraday trading.

The odds are likely higher to earning enough to cover living costs.

$63,689 is the average income of a day trader in the US.

So yeah, the fact that we have some extensive stats on intraday trading proves it can be profitable.

At what cost, though?

Intraday Trading Indicators

A few simple technical tools can be helpful in intraday trading.

How exactly?

Humans are vulnerable to various factors that can cloud the judgment of price action.

Exhaustion, mood swings, and distractions are only a few of the obstacles that affect the quality of trading decisions.

Intraday trading indicators, if used properly, can add objectivity to price analysis.

Let’s look at the best intraday trading tools and tips on using them.

Moving Average

There’s no rocket science in Moving Average.

The average prices for the defined period plot the line in the chart.

The shorter the calculated period, the more sensitive the MA to price action.

The market in intraday trading can be pretty erratic.

Thus, it’s better to use the MA that smoothens fluctuations and responds to recent changes quicker.

The Smoothed and Exponential MA can be a good option.

Generally speaking, look for the entry setups in the direction of the MA.

The stock prices in the chart above stay above the EMA, so we look for a bullish setup.

You can also use the MA as dynamic support or resistance level, as in the above case.

RSI

Here’s the momentum gauge, measuring the relative speed of price change.

RSI is particularly effective in range markets that are frequent in intraday trading.

Traders look for buy signals when RSI is “oversold,” reaching 30.

Conversely, the overbought RSI may show sell signals.

The RSI produced signals in different contexts for the stock index above.

Like other indicators, combine RSI with price action triggers for best results.

Volume

The bars below the candles represent intraday trading volume.

The differences in volume on a candle-by-candle basis give traders valuable information that can’t be found elsewhere.

Here’s an example.

In the first case, the big volume confirms the breakout; in the second – the reversal.

Note that futures, crypto, and stock charts can show volume data, but spot forex and CFDs can’t.

Intraday Time Analysis

The market can give different signals depending on the timeframe you analyse.

Intraday trading demands a clear framework for perceiving the time for signals to form.

How long do you plan to hold a position?

How often do you want to trade during the day?

Typically, intraday trading involves analyzing 1-minute to 15-minute timeframes.

Here’s a straightforward way to do it:

- Look at the daily chart for the big picture: what is the trend’s direction?

- Wait until a setup appears on the 15-minute chart.

- The trigger to open a trade shows up on the 5-minute chart.

Let’s look at the following stock charts.

Got it?

Simplicity is key!

Is Intraday Trading Safe for Beginners?

The short answer is it isn’t.

Nevertheless, many will keep going for slaughter, expecting quick riches.

We looked at the intraday trading challenges and saw the odds of success.

It’s not a big deal learning stock market technicalities.

Quality trading education isn’t a problem nowadays either.

The real challenge is overcoming your mental shortcomings and putting on the right mindset for intraday trading.

Newbies are in danger by default, as the lack of proper mental habits drags them down from the very beginning.

How to Make Money in Intraday Trading?

You’ll need five elements to have the best chances to succeed in intraday trading.

Here they are.

1. Capital – you’ll need money to make money!

Intraday trading is the way to multiply what you have, not pop-up profits from thin air.

2. Risk management – regardless of your strategy’s brilliance, there’s always a risk of loss.

Give yourself a chance to survive in intraday trading by risking not more than 1% of your capital per trade.

3. Education – get a quality theoretical foundation; if you don’t understand the basics, you can’t develop a meaningful intraday trading strategy.

4. Mentor – a good mentor will help you to find what works for you and help develop the right mindset.

Sometimes we just need a third person (preferably a professional) to look at how we’re doing in trading to advance.

5. Self-awareness – at the end of the day, you’re responsible for your progress and have to do the work.

Examine yourself regularly, be self-driven, and feel through the way of intraday trading that is suitable for you.

How are Intraday trading and Day Trading Different?

Although you see two different terms, the meaning is the same.

Both definitions involve opening and closing trades within one day.

There’s no doubt about what day trading is.

It even has legal grounds.

The US stock market regulator sees the one who executes more than three trades within five business days as a “pattern day trader.”

Some sources suggest intraday trading doesn’t mean necessarily exiting trades by session close.

One thing is for sure, both terms mean an active, short-term style, executing several trades within a couple of days.

Don’t stress about it.

Just make sure you’re willing to take an overnight risk in any form.

Happy trading,

Colibri Trader

P.S.

Have you checked my recent article on Trading with Bull Traps and why so many are flocking to this less known market approach.

P.S.

Here are 7 Pullback Trading Strategies that every trader should know about.