Inside Bar Trading Strategies: 5 Ways to See Price Action Through the Inside Bar

Inside Bar Trading Strategies: 5 Ways to See Price Action Through the Inside Bar

Although not so famous, the inside bar trading techniques have been enticing more traders recently.

In case you have not heard about the inside bar, you can keep on reading.

In case you know about this candlestick pattern, you should still consider checking the below article, since you might be able to find information that is not shared elsewhere.

You can start with downloading the free E-Book below and then proceed with the article.

Download the Inside Bar Free E-Book

What is an Inside Bar

As price action trader, we need to learn how to use candlestick patterns like the inside bar properly.

What is an inside bar?

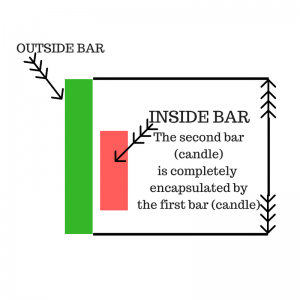

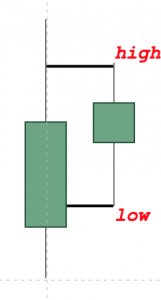

As the picture above illustrates, an inside bar is the opposite of a bullish/bearish engulfing pattern. The first candle totally engulfs the second candle.

Depending on the place it forms it could be either a continuation of a reversal pattern. That is where traders fail of recognising the power of this candlestick pattern.

The inside bar could be a very powerful tool for finding trading entries if used correctly.

Variations of the Inside Bar

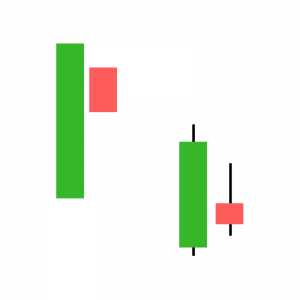

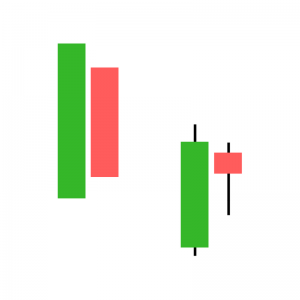

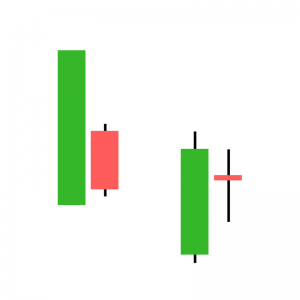

There are as many variations of the inside bar as there are days of the year.

In other words, the inside bar formation comes in different shapes and sizes:) but the definition is always the same- First Candle Engulfing Second Candle. Check out a few of those below:

or alternatively, DOWNLOAD THE FREE INSIDE BAR E-BOOK

All of these candlestick formations look different, but there is one thing that unifies them and it is ALWAYS the FIRST candle fully engulfs the SECOND candle!

Once you remember this rule, you will see the inside bar formation in a different pair of eyes.

All these variations above are confirming just one thing: price is congesting, while gaining more attention and attracting more buyers/sellers depending on the circumstances.

If the information above is still confusing READ ON, because by the end of this article about the inside bar you will be able to see them amongst a sea of candlesticks and (hopefully) profit from them!

The Inside Bar as a Continuation Pattern

Let’s first look at the inside bar as a continuation candlestick pattern. In order to qualify an inside bar as a continuation pattern there needs to be:

- A well-established trend either bullish or bearish

- No close proximity of a major support/resistance level

Once those two criteria are met and an inside bar forms, then we have a good entry place for a potential trade. Let’s have a look at a few continuation patterns of an inside bar within an established trend.

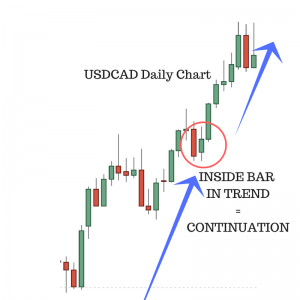

Above is the USDCAD FX pair and the candlestick formation in the middle of the trading range. Inside bar trading in this situation would be:

- Waiting for a daily close

- Check if the high and the low of the second candle are within the range of the first candle

Once those two conditions are met, most inside bar traders would take a long position at the open of the next trading day.

Let’s now look at another example of a continuation pattern and how to trade an inside bar.

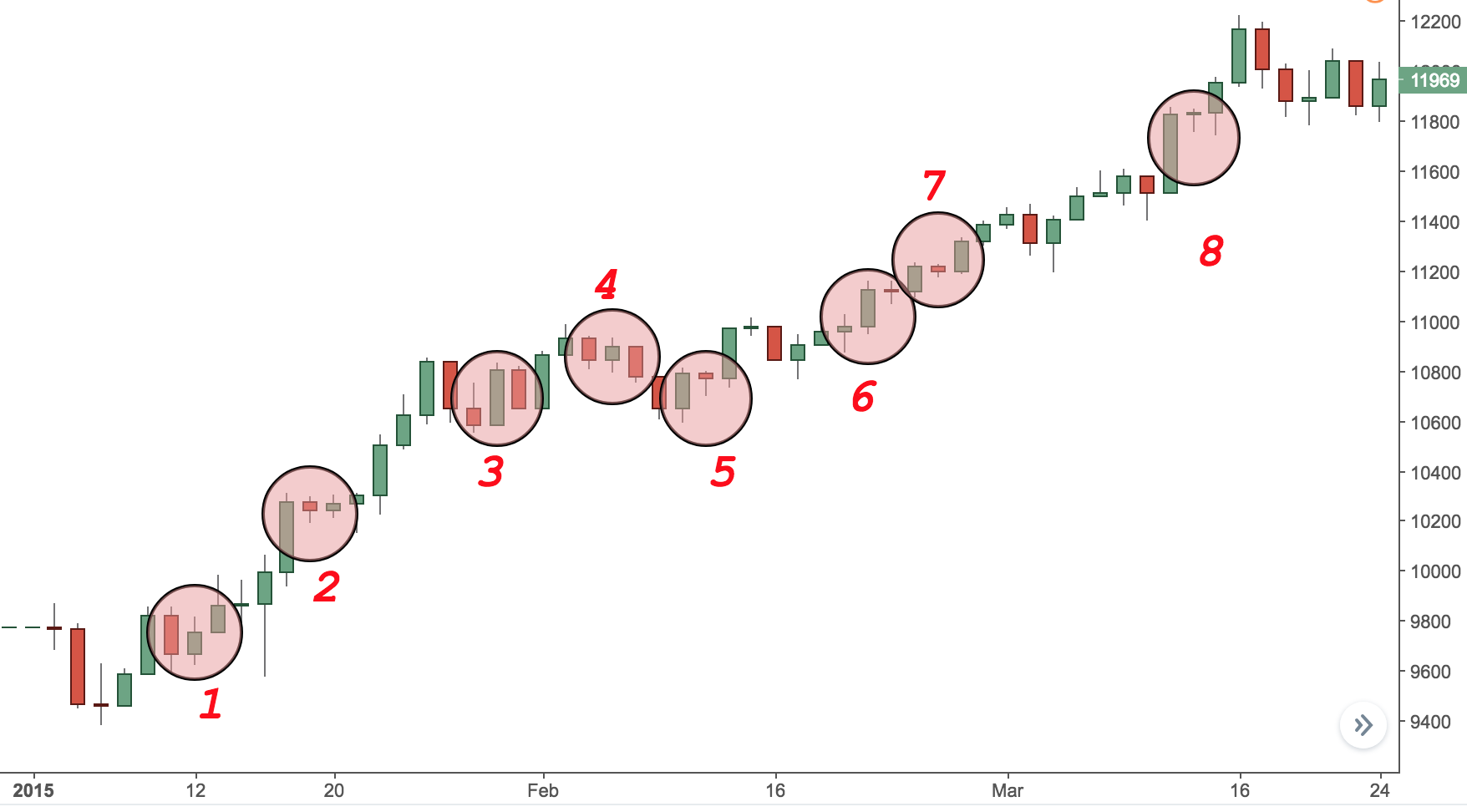

I have taken the DAX daily chart.

As you can see from the chart above, there were three occasions on which an inside bar formed.

Each one of these occasions would have worked perfectly well if a long position was taken and if the above conditions were met.

Let’s now have a look at a reversal pattern and how to trade the inside bar.

The Inside Bar as a Reversal Pattern

Inside bar trading is a hard strategy.

The reason being is that so many traders are getting it wrong. Should they read the inside bar as a continuation or a reversal pattern.

I have laid out the rules for inside bar trading as a continuation pattern. Here, I will explain how I am using the inside bar when it comes to reversals.

Check out the chart below and try to come up with your own explanation.

For an inside bar to be considered as a reversal pattern, we should have:

- Major support or resistance area

- Inside bar trading takes place when an inside bar forms around a major level

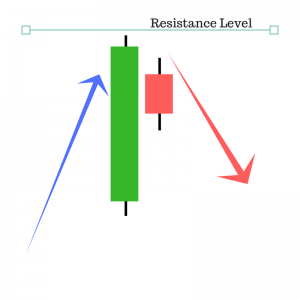

As you can see from the chart above, the inside bar formed at a major resistance level on the daily chart.

After the close of that candle price quickly reversed and started falling sharply down. This pattern occurred on the 2nd of February, 2018 when was pretty much the top of the EURUSD.

Ever since this pair has been going down. Let’s have a look at another example now:

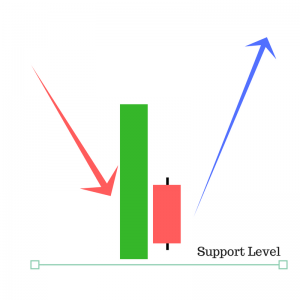

In the chart above, there is an inside bar that formed on a major support level. The inside bar was then followed by a bullish engulfing and the price quickly went higher and higher.

Inside bar trading is as good as trading any other candlestick pattern formation. That is why when I am using it, I am using it as part of a trading system.

Usually, you need to consider quite a few things in order to take a trade. Using price action is simple, but it also does require you to look at different timeframes for confirmation and look at the overall market picture.

Inside Bar Trading- Continuation vs. Reversal Recap

In order to recap the inside bar trading, let’s look at the following illustrations and try to visualise them for the sake of better remembering them:

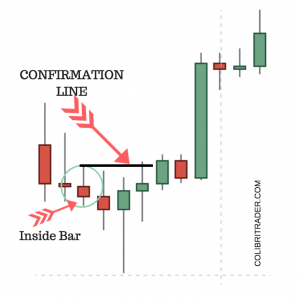

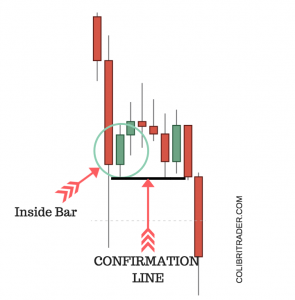

A) Reversal- once price reaches a major support or resistance level as the two illustrations below show and an inside bar forms at these levels, then we have a reversal of price.

Try to memorise those scenarios in order to better understand how to profit from the inside bar.

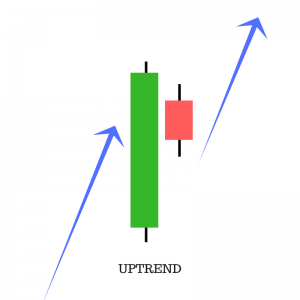

A) Continuation- when we have a well-established trend and price forms an inside bar in the middle of the range, that means that the inside bar is confirming the continuation bias. Check out the two illustrations below:

First, let’s have a look when there is an uptrend…

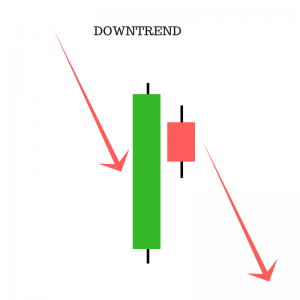

…and now when there is a downtrend

Once you realise that inside bars can be used for trading the trend and trading the range, then you can fully understand their power.

It is probably one of the least talked about candlestick patterns and probably the one that is most underestimated and least understood, as well.

Inside Bar Trading Strategies with Timeframes

When it comes to trading the inside bar and timeframes, I can confirm that traders to use it on all timeframes.

IMPORTANT: From my experience I can say that it works best on timeframes above 4 Hours.

As a rule of a thumb, the higher the timeframe, the less noise there is.

Therefore, I believe that the most useful and also used timeframes are 4H and Daily.

I am myself using those two timeframes.

My trading strategy reveals an approach of using a confluence of timeframes. I have experienced this to be probably the most useful and consistent method of trading the markets. The inside bar is not an exception here, too!

The Inside Bar and Stop Loss

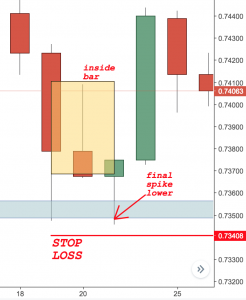

Just look at the chart below. It is the chart of the AUDUSD from the 10th of July, 2017. The inside bar formed in the middle of a trading range in a bullish market which was considered as a continuation.

Now, let’s zoom in and see the inside bar itself.

You can see that the second bar is completely encompassed by the first bar, thus creating an inside bar trading opportunity.

From the chart above you can see what is a good place to place the stop loss. Although there is no rule that is set in stone, most traders tend to place the stop loss just under the previous swing low.

Based on my experience, once an inside bar is formed, we might see one last spike lower from the following candle.

REMEMBER: With inside bars, you need to leave slightly more space than the average candlestick formation.

When you are wondering of where to place your stop loss with an inside bar, think 10 pips wider than a regular stop loss.

It depends on the circumstances, but in general there is a high chance we might see the price re-testing the lows in an uptrend when the inside bar occurs. Check out the image below:

The chart above is taken from the AUDUSD pair from the 20th of June, 2018. I even wrote about this pair HERE.

As described above, when an inside bar forms, there is a high chance of a final spike (as it occurred above), therefore you must calculate for a wider stop loss.

If your average stop loss is 10 pips below the nearest swing high/high, for an inside bar I would add an additional 10 pips, which makes it 20 pips below low/high for a stop loss.

It is hard to estimate an exact stop loss but with practice you will find your way around. A stop loss for EURUSD will be different than one for GBPJPY. So, you will need to take into consideration

Inside Bar in Trading and Trending Markets

The best thing would be to give an example of both types of markets and how inside bar trading applies to them.

A) Trading Markets

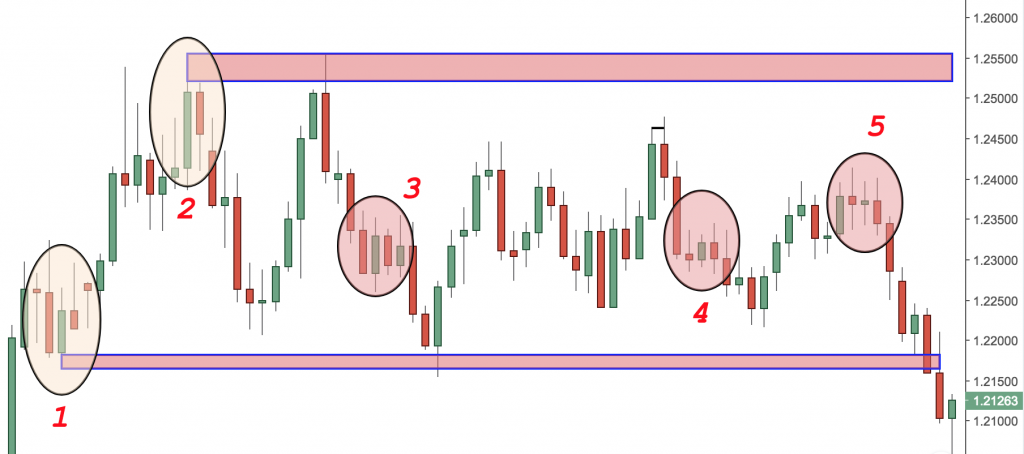

As you can see from the chart above, we have 5 different places in which inside bar trading opportunities took place.

The rules that I use for trading the range with inside bars are very simple:

- There must be a pre-defined range

- Only take the trades that are close to the support/resistance levels

From the information provided above, we can see that there were only two places in which the inside bar was tradable.

I am sure you have already guessed correctly- these are inside bar marked with 1 and inside bar marked with 2.

Number 3,4 and 5 are all formed in the middle of the trading range and this makes them non-tradable.

B) Trending Markets

In the chart above you can see a sequence of 8 inside bars.

In order to consider inside bars as a continuation pattern, we need to qualify them by two criteria:

- Well-established trend (up or down)

- No major resistance/support level nearby

As you can see from the chart above, from the 8 inside bars only one failed. Number 4 was not profitable, but the other 7 were!

An astonishing figure that even the most talented of traders are sometimes struggling to achieve.

As I like to say, you should not aim for perfection, but for consistency. There is no such thing as a perfect trader or a holy grail of trading.

What you should aim for is hard work, dedication and persistence!

Complex Inside Bar Candlesticks Formations

A) Bullish Hikkake

This candlestick pattern was popularised by Dan Chesler in two articles printed in the Active Trader magazine and the Technical Analyst magazine- both published in 2004.

So what does the Hikkake look like and how do we trade it.

Let’s first begin with a chart of a bullish Hikkake:

The bullish Hikkake resembles a three inside down candle. The bullish Hikkake does not require a previous uptrend, nor is the colour of the candle important.

In theory it is supposed to be a bullish pattern, but practice has proven that on certain occasions it acts as a bearish harbinger.

The Encyclopedia of Chart Patterns reveals that this pattern is twice as likely to lead to a bullish breakout than a bearish breakout.

This leads us to look at the Bearish Hikkake pattern.

B) Bearish Hikkake

Similar to the bullish Hikkake pattern, the bearish counterpart looks like that:

Just like the bullish Hikkake candlestick pattern, the bearish Hikkake does require the price to close below the low of the second candle of the inside bar (as marked with the dark line above).

I don’t personally believe that this pattern is as effective as just the pure inside bar, but it is one of the less known methods that some traders do use.

I am not saying that it cannot be a profitable trading strategy, I am just confirming that I have not used it extensively so to know if it is effective or not.

According to Bulkowski’s Encyclopedia of Chart Patterns, it is one of the more common patterns.

Although I do not know that many traders using it, the encyclopedia is confirming that it only works about 50% of the time.

Psychology Behind the Inside Bar

It is not so difficult to imagine the behaviour of the market participants when an inside bar is forming.

Let’s imagine a daily chart.

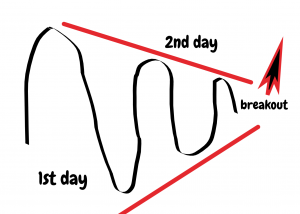

It takes two days for an inside bar to form.

During the first day, there is a larger candle that forms. The second day is when a small candle is forming, which when looked through a smaller timeframe looks like a consolidation period.

The illustration above will help you visualise price action on the smaller timeframes. The inside bar candlestick pattern when looked from a smaller timeframe perspective looks like a consolidation phase.

It is indeed a consolidation phase, during which market participants are placing their order in anticipation of the future price move.

As such, the market psychology during the formation of an inside bar is one of a waiting nature and it really does creates suspense amongst the traders trading breakouts.

As you are probably already familiar with it, I am not a big fan of breakouts. The reason being is that when trading breakouts you are anticipating a future move, as opposed to reading the market.

In my professional trading strategy I am showing a step-by-step guide on how to actually read the market and NOT ANTICIPATE.

Based on my experience, in most cases anticipation leads to self-destruction.

Two More Examples of Inside Bar Trading

The example above is taken from the AUDUSD FX pair.

There is an inside bar on the daily chart, which occurred on the daily chart. At the time of writing this article, price is trading at 0.7375 and I have a long trade in this pair.

You can track it too- today’s date is the 29th of June, 2018. Let’s see where the price of AUDUSD will be in the next week/month.

The second example I will provide is an inside bar that formed and led to a massive sell-off in the German stock market (DAX)

Summing Up Inside Bar Trading Strategies

Inside bar trading is not one of the most common approaches to price action trading.

At least, it is not as popular as pin bar trading techniques or the bullish engulfing pattern.

Although not so popular, it could be a very powerful candlestick formation, especially at turning market points or during long trending markets.

It is not as easy and straightforward to grasp as the other popular candlestick pattern and is often misunderstood and misused, but if traded properly, it could lead to very satisfactory results.

In this article about the inside bar, I have walked you through a number of examples and also showed you different techniques of trading this candlestick pattern.

From the simple bullish/bearish inside bar to the complex Hikkake candlestick pattern, I have walked you through the processes that lead to the formation of this pattern.

The inside bar candlestick pattern is often not given enough importance, but I hope with this article to reach more traders who want to learn about it.

Happy Trading,

Colibri Trader

p.s.

Did you know about my PROFESSIONAL TRADING COURSE?

Check out the sample video below from my price action trading course to get a feel for it.

Hi Colibri,

This is an important subject and article. The reason is that the inside bar is such a subtle signal and often over looked by most.

In beginning of article I was hoping you would go into the psychology behind the inside bar then part way through you did so well done on being one step ahead of us.

In this case you anticipated and broke one of your trading rules.

lol

I agree trading is not that complex although 95% tend to do just that. If it was explained that trading is about waiting more than the trading maybe many more would be successful and better understand their job as a trader.

Your trading course is just that a simple straight forward approach to reading price action and entering once confirmation has taken place. I don’t know which article it was but I’m sure you have one relating to making sure you wait for a candle to close before entering a trade.

Your AUD/USD trade is an interesting one because you have failed at catching the reversal so far and yet you have not given up, there is another lesson in just that action. You little dirty bird !

The dax was another incredible 1000 point move to the downside which I don’t think you alerted anyone about (?) but that’s not my point no one knows anything but it was an inside bar signal at resistance level.

It must have taken allot of thought and time to write this article so thank you for your time.

Regards

Hi Dan,

Thank you for your comment! It did really take me a lot of time to put all my thoughts into this article- must have been more than a week.

I am glad you are having a few good points. Psychology does really play a part (and a major one!) and traders must really emphasise on that as opposed to jumping from one trading strategy to another. it is all about the PATIENCE and the ability to restrain yourself from taking every other trade that comes your way.

Regarding the article, I believe it must be this one you are referring to:

https://www.colibritrader.com/taken-trade-trade-take/

Thanks for your great feedback!

Keep up the great work and words!

Colibri

Does these strategies work for day trading stocks?

They might, although I have never used them. Day trading is usually the hardest of all styles and the one in which the majority of traders are losing (much more than in any other trading style and timeframes). I would more like concentrate on the 4H and Daily when using them

Hello, my opinion is it would work on stocks as the psychology behind them would be the same.

One DAX there were 2 indside bars on daily tf.

June 15 2018

Feb 5 2019

Seemingly easy signals to an inside bar trader.

It’s a method all on it’s own.

Yes, it could very well be a strategy on its own. Problem with it would be (as most others) that traders will lack the patience to only wait for an inside bar 🙂

[QUOTE] Yes, it could very well be a strategy on its own. Problem with it would be (as most others) that traders will lack the patience to only wait for an inside bar

Hi Colibri,

Good point and that is the crux of trading, the lack of patience phenomenon.

Of course emotion control or regulation too.

Yes Dan! That is definitely the point! I wish traders were spending more time on that element as opposed to their trading strategy

Hello, my opinion is it would work on stocks as the psychology behind them would be the same.

One DAX there were 2 indside bars on daily tf.

June 15 2018

Feb 5 2019

Seemingly easy signals to an inside bar trader.

It’s a method all on it’s own.

One thing that was interesting on DAX was there was a failed inside bar on daily tf just before the latest drop.

I was almost sure Dax was going to the round number 12000

Hi colibritrader. From the article, I understand that if the market is in a ranging state and an inside bar forms near the Support or Resistance level, then this usually indicates a reversal of price direction is imminent. Now, could this concept also imply that if an inside bar does NOT form near the Support and Resistance level and price has breached the established range, then a breakout is imminent? Will price breakout from the range?

Very good question- I have detailed this in this article. It does imply that and in most cases that is exactly what happens. You need to be careful though where support and resistance stay. Let me know if you have any other questions and good luck in trading!

Give me your e book

Which ebook?

Thanks Colibritrader Really usefull

Glad you found this helpful!