How to Trade with ADX (Average Directional Movement Index) Like a Pro

How to Trade with ADX (Average Directional Movement Index) Like a Pro

An unusual trend indicator, ADX, or Average Directional Movement Index is a great tool to measure trends. And, to ride them accordingly. In this article, I’ll cover what ADX is and how to trade with ADX to make the most of today’s financial markets.

We can track ADX’s roots back to 1978. Another one of J. Welles Wilder’s indicators, ADX was born from the desire to measure a trend’s strength.

>>Get the ADX Cheat Sheet HERE<<

You must imagine that back in the day, the currency market was almost inexistent. Those that had an interest to trade with ADX were merely stock market speculators.

The ADX is a unique trend indicator. From the moment you plot it on the Metatrader 4 platform, you notice something strange.

As a trend indicator, the ADX doesn’t appear on the main chart. Unlike the Bollinger Bands, Moving Averages or the Alligator indicators, the ADX appears on a separate, small window, at the bottom of the main chart.

Just like an oscillator does! However, to trade with ADX, one should remember its trending feature.

This article covers everything there is to know about how to trade with ADX and how to interpret it on multiple timeframes.

Moreover, we’ll look at its elements and how it is constructed. Furthermore, we’ll use plenty of examples to illustrate how to trade with ADX in the 21st century currency markets.

But, more importantly, the aim is to cover every aspect of this powerful indicator. So that, in the end, it should become everyone’s favourite.

Contents in this article

- Explaining the ADX Indicator

- Interpreting the ADX Indicator

- How to Trade with ADX when it Prints Below 20

- How to Trade with ADX when it Prints Above 40

- Examples of How to Trade with ADX

- Filtering the ADX Signals

- The True Way to Trade with ADX

- Market Timing with ADX

- ADX Limitations and Drawdowns

- Conclusion

Explaining the ADX Indicator

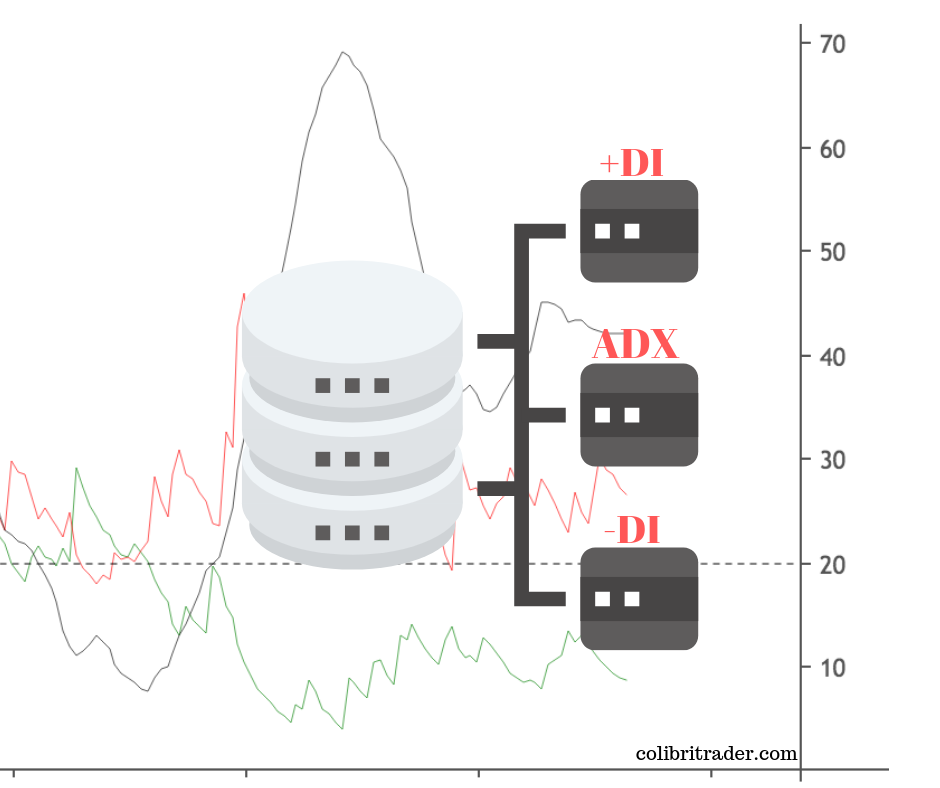

Wilder is well-known for developing a bunch of other indicators we still use today. In fact, few people are aware of the fact that the ADX as appears on today’s trading platforms is nothing but a combination of two previous indicators developed by Wilder.

The +DI and -DI, now an integrant part of the ADX, show a positive or negative directional bias. The ADX combines the information provided by the two. Moreover, it adds a smoothed moving average to smooth out the result.

So, before taking any trade with ADX, know that:

- +DI represents a positive directional indicator

- -DI is a negative directional indicator

- the ADX indicator does not show the future market direction, but only the movement’s strength

We won’t go into details regarding how the +DI and -DI indicators are built. Instead, we’ll look at how it appears on the MT4 platform, how to apply in on a chart, and how to trade with ADX.

Applying the ADX on a Chart

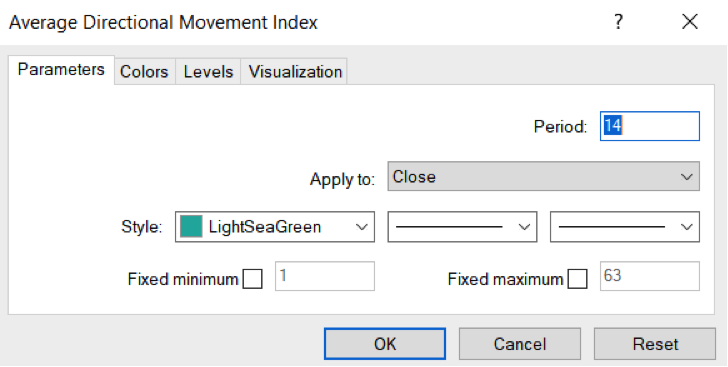

As mentioned earlier, the ADX is a trend indicator. Therefore, just go on the Metatrader4 platform, then select Indicators and from the Trend Indicator’s list, pick the first one that appears on that list.

Next, on the pop-up window similar to the one above, you can choose the main settings. Namely, the style (in this case a continuous LightSeaGreen) line, the period and how to apply the ADX when compared with the actual prices.

The default period follows the same conventional 14 periods used for many other indicators, like the RSI (Relative Strength Index), for example. The idea is that the more periods used, the flatter the information provided by the ADX. Hence, to trade with ADX considering more periods becomes more difficult.

Moving forward, on the Colours’ tab, the two directional indicators, +DI and -DI appear. The default colours are red and blue, and they appear under a discontinued line, but that’s easily changeable.

In fact, it is recommended to change the lines into continuous and make them a bit thicker before taking a trade with ADX. The explanation is simple: in the end, the indicator shows three lines on a small, little window, and you’ll want to make them as visible as possible.

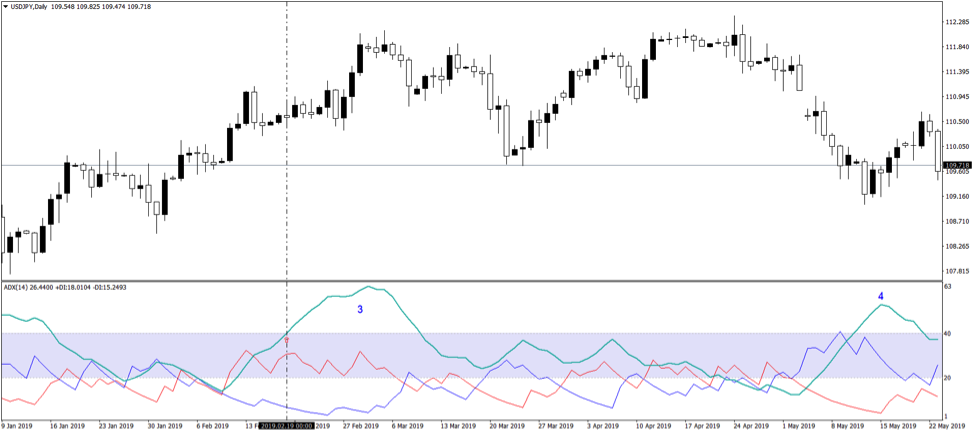

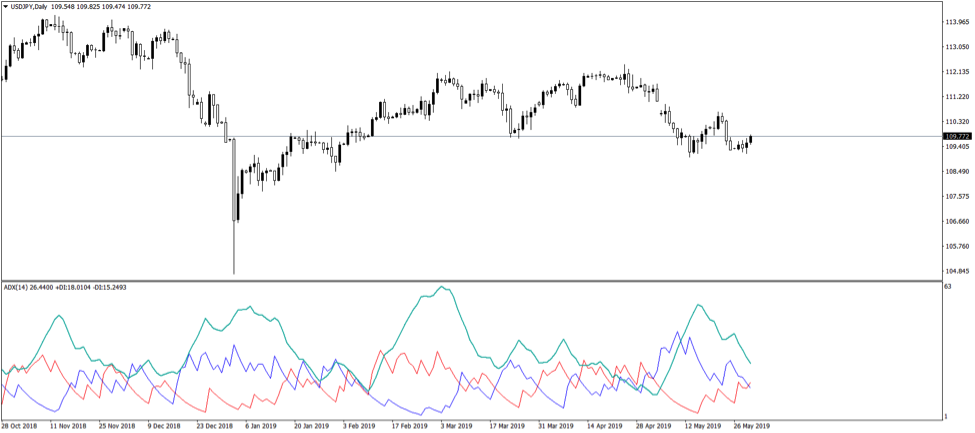

Here’s the ADX indicator applied on the USDJPY daily timeframe. The three lines, thicker now, represent:

- +DI – the red line

- -DI – the blue line

- ADX – the green line

Interpreting the ADX Indicator

Please note that in order to trade with ADX, one needs to interpret all three lines together. A quick view at the ADX window tells us that this is a positive indicator. Namely, it ranges only in positive territory, with values between 0-100.

The focus when interpreting the ADX indicator sits with the +DI and -DI cross. And, with the slope of the ADX line.

More precisely, when +DI crosses above -DI, that’s a bullish cross. Or, in plain English, when the red line crosses above the blue line.

Conversely, when +DI moves below -DI, that’s a bearish cross. It translates into the red line falling below the blue line.

Whenever one of the two situations happen, it means the market is “ready to do something.” It is time to trade with ADX.

So, the next step is to interpret the ADX. Or, the green line.

Two major situations exist when interpreting the ADX:

- ADX below the 20 level

- ADX above the 40 level

Let’s take them separately and see what it means for the overall ADX interpretation.

How to Trade with ADX when it Prints Below 20

Before doing anything, we need to alter the indicator’s window. More precisely, to add the 20 level onto it.

First, make a right-click anywhere on the MT4 chart. Second, select the Indicators List tab. Next, find the Averaged Directional Movement Index and click the Edit button. Finally, under the Levels tab, choose Add and insert the 20 mark.

By selecting OK on the main window, the 20 level appears on the chart. Just like on the chart below:

Focus on the green line. The ADX line.

The key to trade with ADX is to interpret the green line in conjunction with the +DI and -DI. Moreover, after interpreting the +DI and -DI, check the ADX line’s level. The 20 mark is critical.

Here’s the rule: when the ADX prints values below the 20 level, it shows that the trend is weak. Trend weakness means trend traders will skip the +DI and -DI signal generated by their cross.

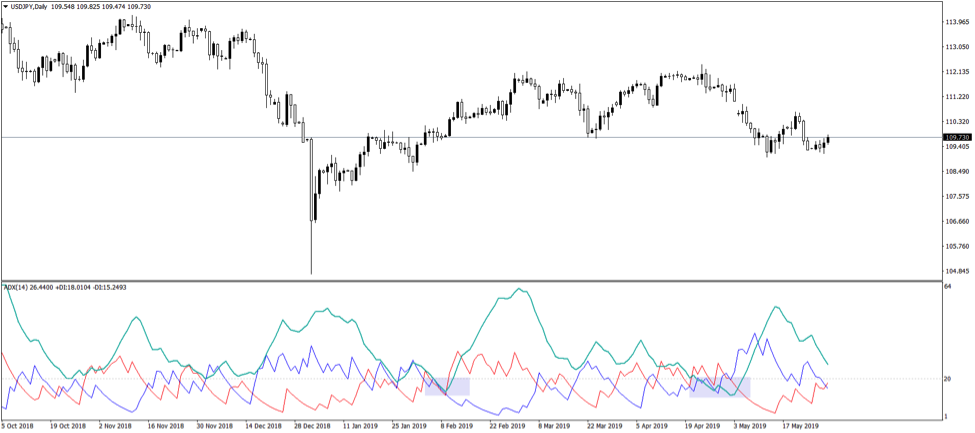

On the USDJPY daily chart, we analyse here, there where two instances during 2019 price action when the ADX line moved below the 20 level.

Remember: Any signal generated by +DI and -DI when the ADX shows similar conditions, indicate that this is not a trending market.

So, what’s next?

Does this mean that we should focus only on ADX values above the 20 level?

Yes and no. The thing is that the area between the 20 and 40 levels has no meaning.

It is neutral.

What trend traders want to see is the ADX moving above the 40 mark.

How to Trade with ADX when it Prints Above 40

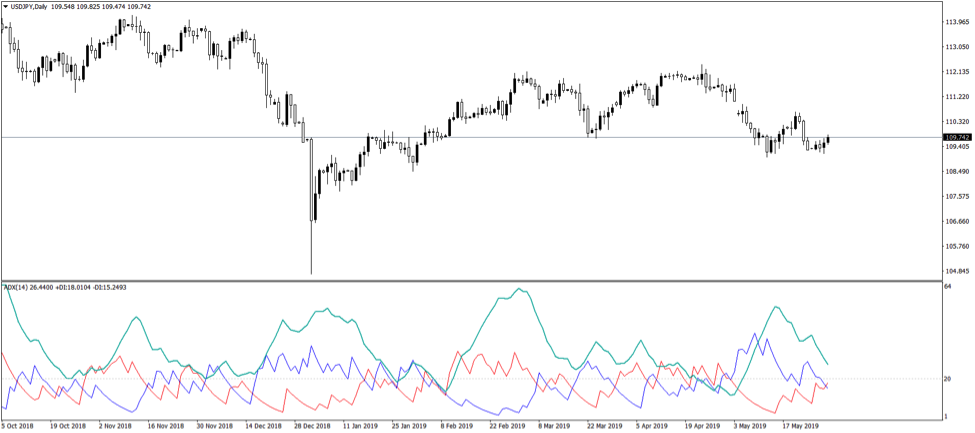

We need to alter the ADX indicator again. Following the same steps as the ones mentioned earlier, just add the 40 level on the ADX window.

For a trend’s perspective, one should trade with ADX only when it moves above the 40 level. That’s when the trending conditions are strong enough to encourage traders to step in.

Keep in mind that, after all, the ADX indicator is lagging. What we, as traders, should hope for is to jump on a trend and make some pips on the move up or down.

In the end, this is what all trend traders do. They look for a trending market. Next, go in. Finally, look at reversal patterns to exit.

The ADX indicator serves all these purposes. However, the most important function is the signal to enter a trade.

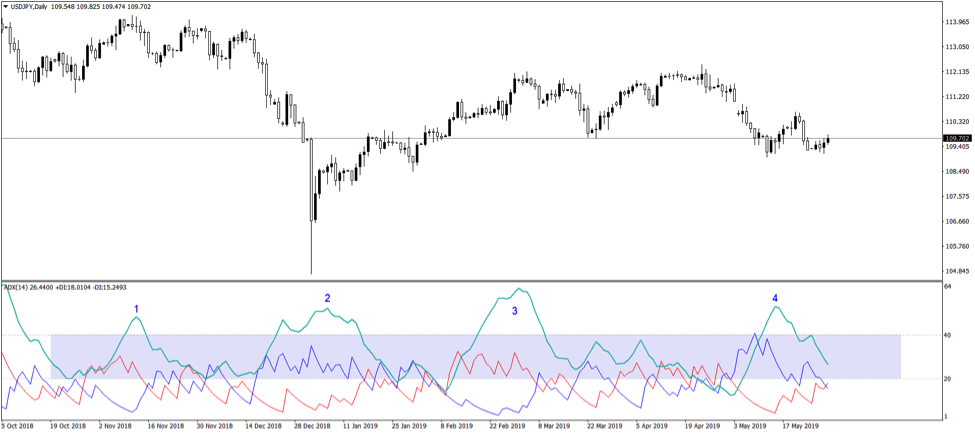

The chart below shows the 20-40 area and four instances where the ADX popped above it. That’s what we want to see to trade with ADX.

Let’s consider the situations below and interpret them one by one. The aim is to explain using a step-by-step approach on how to trade with ADX so to make the most of the signals it generates.

Examples of How to Trade with ADX

Before looking at each example, let’s review the conditions to trade with ADX:

- the green line (ADX) moves above 40 (this way we find out the trend’s strength)

- +DI and -DI give the market’s direction (bullish or bearish)

So, all a trader must do is to buy or sell when the ADX goes above the 40 mark. As for the direction, this is given by the red line crossing above or below the blue one. Above means bullish, below means bearish.

It becomes clear now why the ADX is a lagging indicator. As all four situations from the above show, the bullish or bearish signal appears way earlier before the ADX moving above 40. Therefore, the 20-40 area, or the time it takes the ADX to cross it, represents the lagging.

Lagging makes traders avoid trend indicators. Many fear they’ll end up entering too late in a trade, at the top or bottom, due to the lagging factor.

And they are right. Lagging indicators do cause situations like this.

However, savvy traders always use a filter to distinguish between false signals and signals that worth the risk. After all, all trades bear a risk, and what matters the most is to pick the ones with the best chances to make a profit.

In my case, I do use pure price action trading as my major noise filter and trading indicator.

Filtering the ADX Signals

From left to right, let’s take each situation and see how to filter the ADX signals to make the most of this indicator. This way, I will show how to trade with ADX so that you won’t end up entering at the top or bottom.

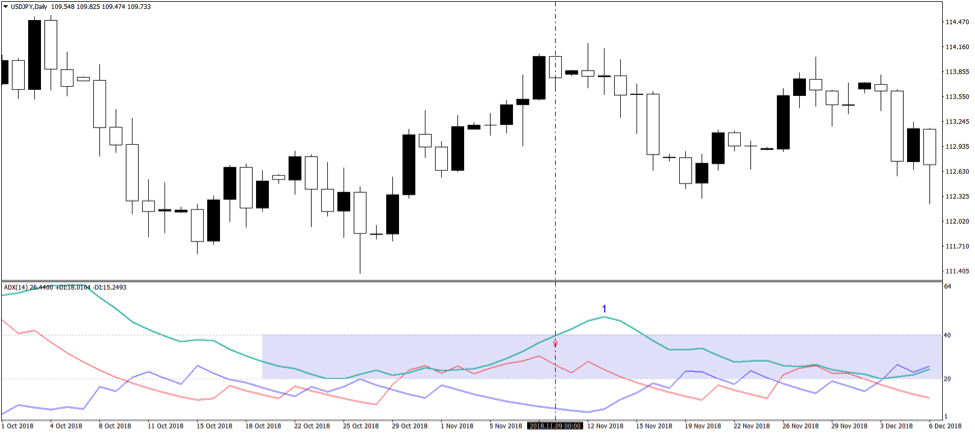

The first example is a perfect one. I’ve zoomed a bit the chart for more clarity.

The red line crosses above the blue one, on the left side of the vertical line. That’s bullish.

Hence, we should wait for the ADX line to move above 40.

And go long.

Simple, isn’t it?

The problem with this approach is that in doing so, we’ll buy the top.

Why is that?

The key to trade with ADX, or to take the ADX signals, is to interpret the +DI too or the red line, more precisely.

In a bullish or long signal, it should be on the rise too. In a bearish, or short signal, it should have a declining path.

In this case, at the entry point marked with the red arrow, the +DI is on a descending path. Hence, skip the signal!

As it turned out, the market peaked shortly after, and the ADX fell below the 40 level again.

How about the second situation?

The True Way to Trade with ADX

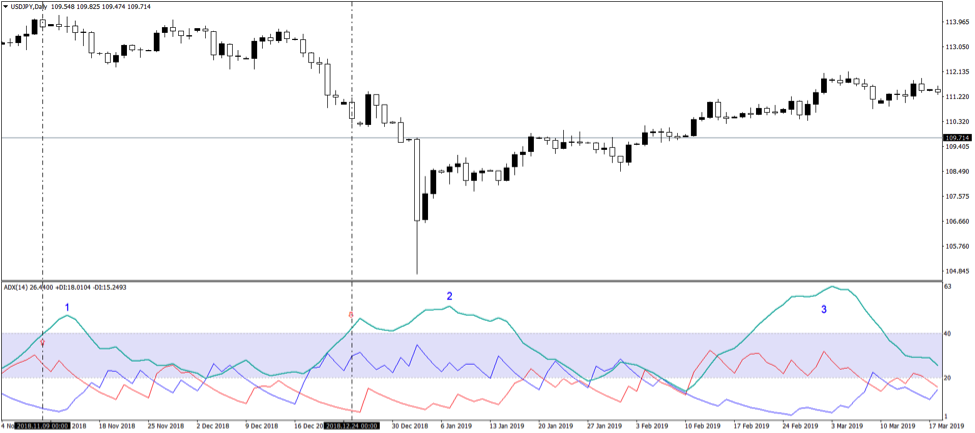

The second example illustrates perfectly how to trade with ADX. First, the +DI and -DI formed a bearish cross. We should look to go short.

Second, the ADX moves above the 40 level. That’s the entry.

Finally, looking at the red line (+DI) for confirmation, we have a “good-to-go” signal. Why?

Because it is declining after a bearish cross, it confirms the strength shown by the ADX line. It so happens that following this ADX bearish signal, traders would have been on the right side of the market when the JPY melt-up at the start of 2019.

The third example shows another valid ADX signal. Only this time, it is a bullish entry.

With all three conditions respected, it means the USDJPY is in a strong, bullish trend. The entry on the long side just got green light.

Market Timing with ADX

Alexander Elder is responsible for this approach, as he explained it in great details in one of his books, “Trading for a Living”. He focuses on timing the market using the ADX but using its peaks, instead of the break through the 40 level.

When the ADX starts declining and +DI is still above -DI, that’s a buy signal. Moreover, when the ADX doesn’t fall anymore and becomes flat, it is time to sell.

We won’t go into details regarding the market timing strategy used by Elder, as some traders find it useful, others don’t. It is enough to mention it here and let you test it yourselves if it brings an edge beyond what’s discussed in this article.

ADX Limitations and Drawdowns

Like any other indicator, the ADX indicator is not perfect. And, it doesn’t fit all market conditions.

For instance, the currency market (and not only) trades a lot of time in consolidation. In other words, trending conditions simply don’t exist, and the ADX spends most of the time between 20 and 40. Or, even below 20.

As such, sometimes it pops above the 40 level, only to peak quickly after. That’s the case in the last example used on the USDJPY chart, one that I’ll invite you to document as it refers to recent price action.

One of the most important ADX limitations is its inability to signal ranging conditions. However, this is quickly offset by its power of predicting strong trends.

We already mentioned lagging. If there were one way to filter the signals generated by the three lines in such a way to entry earlier in the trend, that would be nice. However, it is up to each trader to do a bit of extra research to find out the best way to trade with ADX.

Conclusion

Also called the “trend strength” indicator, the ADX offers a great way to profit from trending conditions. The three-step strategy shown here is enough to help you ride trends on various timeframes.

Obviously, the bigger the timeframe, the bigger the move. However, the same strategy to trade with ADX works on lower timeframes too.

Scalpers that want to enter a trade for 5-10 pips or so can use it on the five-minute chart. Moreover, swing-traders that simply want a slice of the price action during a trend use the strategy on the hourly chart.

Word of caution: I do not use that indicator to scalp!

Furthermore, anything above four-hour needs more patience to find out the right timing to enter a trade.

How about the exit?

Exiting a trade is a different story. Traders focus on reversal patterns on the same timeframe or the lower one.

Or, they simply wait for the ADX to get back below the 40. However, in this case, the lagging factor might be responsible for wiping out all the profits up to that point, so a bit of flexibility in choosing the exit point is necessary.

The ADX indicator has many advantages over other trend indicators. Take the Moving Average, for instance. It shows bullish or bearish conditions while the price remains above or below it.

But the ADX indicator goes one step further. Not only it shows that, but it also “tells” traders when exactly to enter the trade. And, if conditions don’t warrant the entry, traders should simply skip it.

After all, this is what all traders want: an indicator to filter the vast majority of generated signals. And, for riding trends, the ADX remains one of the most powerful trend indicators ever created.

P.S.

Have you checked my recent article on 5 Trading Strategies with Moving Averages?

Outstanding

Thank you Satbir!