How to Set Up Reasonable Trading Targets

What are trading targets?

A trader’s performance depends on the sum of the trading decisions taken daily, weekly, monthly.

Get the Trading Targets PDF

A trading plan increases the possibility of succeeding when trading financial markets.

Having good money management skills, and the ability to set appropriate trading targets also helps!

Speaking of trading targets, any trading plan involves a risk and a reward. Somehow, traders find it easier to define the risk.

After all, the stop-loss order protects the account for a bigger drawdown than otherwise thought.

But the reward, or the take-profit level, is the one that creates confusion among traders.

How much is too much when it comes to trading targets?

Should traders set for bigger market moves while using smaller volume?

Would trading on smaller market moves, but increased volume work better?

Contents in this article

- Trading Targets

- Money Management Rules to Set Up Reasonable Trading Targets

- Trading Targets Derived From Appropriate Risk-Reward Ratios

- Elliott Wave and Trading Targets

- Using the Equity of a Trading Account to Set Trading Targets

- Correlations and FX

- Negative Swaps and Their Impact on Trading Targets

- EURUSD Pair

- Trading Interest Rate Differentials

- Conclusion

Trading Targets

This article focuses on how to set up reasonable trading targets in such a way so to give the trading account bigger chances to survive.

Appropriate trading targets refer to how to set the take-profit level.

Therefore, this article provides a step-by-step approach to understand the process better.

Moreover, integrating trading targets with the overall money management setup is mandatory.

As you’re about to find out, setting reasonable trading targets derives from the risk of a trade.

The currency market’s volatility attracts many traders in search of a quick return on their investment.

But the market doesn’t always move too much.

In fact, sometimes it doesn’t move at all, making it difficult to sit on a trade until it reaches the take profit level.

Furthermore, traders must include other costs affecting a trade.

Hence, setting trading targets that make sense requires deeper analysis than initially thought.

Money Management Rules to Set Up Reasonable Trading Targets

As it is often the case, many retail traders ignore the advice of having a stop-loss order.

They “feel” like:

- the market, or the broker has something with their positions.

OR - they think that the broker will trigger the stop-loss order to only stop them out.

Is the Broker Against You?

In fact, this is nothing but self-pity or just excuses for bad performance.

No one has anything with anyone.

The currency market is so large that no single trader can impact the movement in any particular currency pair.

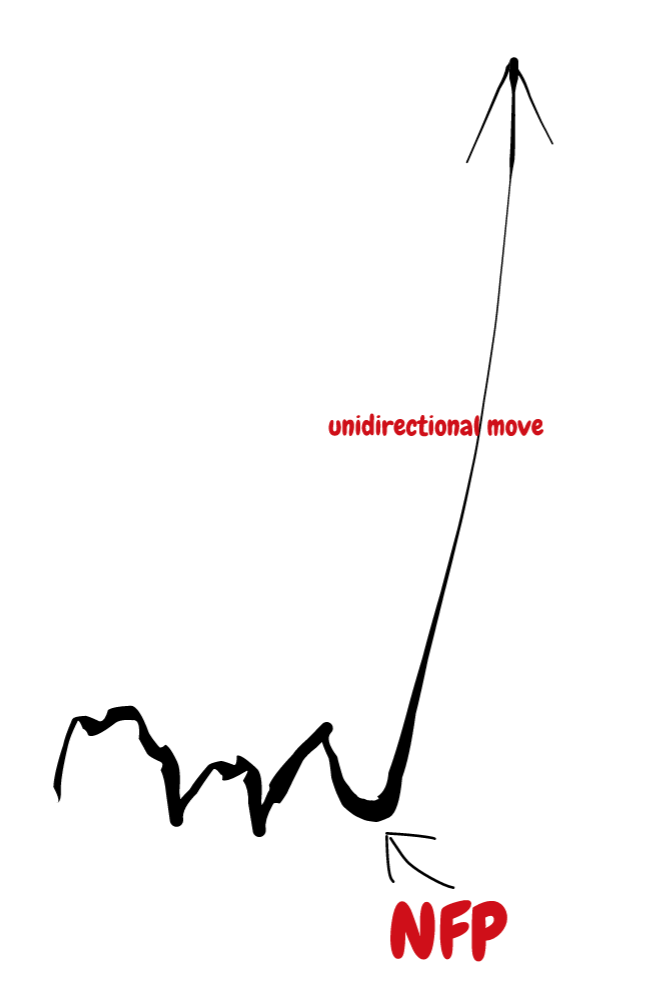

Contra argument: prices of different currency pairs do move abruptly in a single direction during important economic releases like the NFP.

While this is true, it doesn’t mean that one entity moves the market.

Instead, because all trading algorithms have instructions to buy or sell based on the economic data, they all execute the order at the same time.

This creates a unidirectional move.

Adjusting Stop Losses and Targets

As a trader, you should always have a stop-loss and a take-profit for any given trade.

They can be adjusted in time.

However, the ideal situation calls for adjusting only the trading targets, or the take-profit levels, rather than the stop-loss too.

The thing is that there’s a big difference between the stop-loss and the take-profit level.

- The stop-loss defines the risk, while the take-profit defines the reward.

- Second, the stop-loss invalidates a trade, while the trading targets validate the reward.

Moreover, while traders may change the trading targets, they should not adjust the stop-loss level, unless the aim is to protect the trading account.

Even so, the money management parameters change, and that may influence the overall performance.

Trading Targets Derived From Appropriate Risk-Reward Ratios

Money management rules define an appropriate risk-reward ratio as one that has minimum double the reward for the risk taken.

For every $1 risked, the reward is set to $2 minimum.

Obviously, the bigger the risk-reward ratio, the better.

But again, it all comes down to the risk and the expectations for the move to follow.

If your setup comes from the monthly chart and the stop-loss needs a few hundred pips, targeting a bigger risk-reward ratio than 1:2 is difficult.

Even if the price reaches the desired trading targets, it will take a lot of time to do that.

Not to mention that bigger risk-reward ratios need even more time.

However, the lower timeframes do provide setups that allow setting better trading targets.

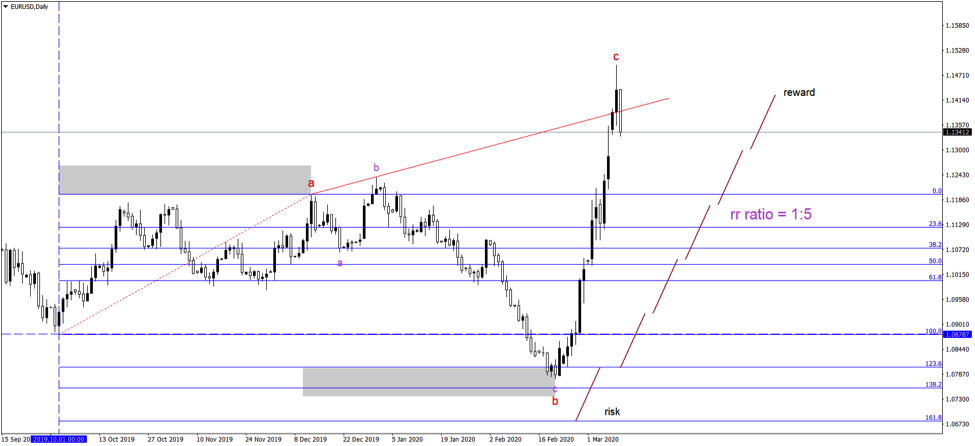

Take, for instance, the recent EURUSD price action.

EURUSD Example – Setting Trading Targets with Bigger Risk-Reward Ratios

Sometimes the trading setup is responsible for bigger risk-reward ratios than 1:2.

Depending on the setup, in some cases, the price must reach a certain target in order to confirm the previous market moves.

The recent EURUSD price action provides a perfect example.

Since the beginning of 2020, the EURUSD was in a free falling mode.

It dropped from 1.12 to below 1.08, with little or no pullbacks.

Many “trading gurus” called for parity again.

The European Central Bank (ECB) and the Federal Reserve of the United States (Fed) were engaged in divergent monetary policies.

Elliott Wave and Trading Targets

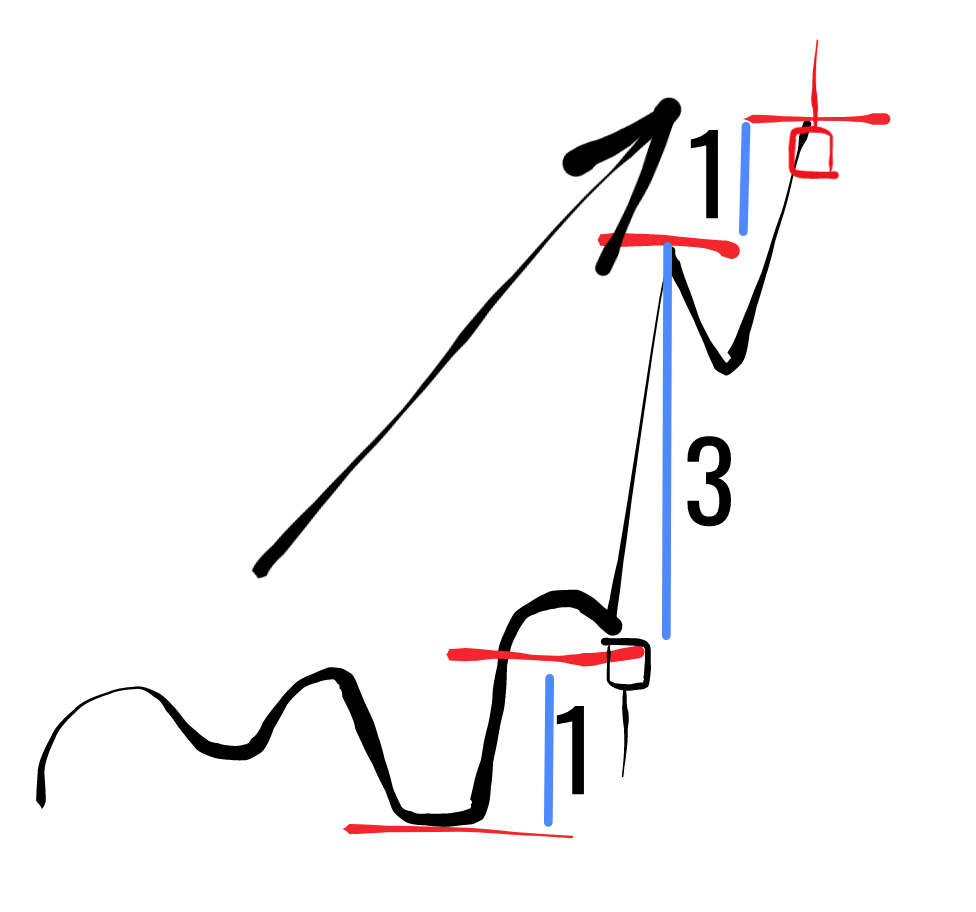

For the Elliott Wave trader, the move lower represented the c-wave of an elongated flat pattern.

More importantly, for it to be a simple correction, the price must do two things.

- First, to fully retrace the c-wave (the one in purple).

- Second, to reach the 0-b trendline (the red line on the chart above).

- Finally, both moves should have come in less or at the same time it took the c-wave to form.

As for the risk-reward ratio, it all starts with setting the risk.

The elongated flat of a larger degree should not retrace more than 161.8% of the previous a-wave.

Hence, that’s the stop-loss for the long trade.

If we project the risk until the price reaches the 0-b trendline, the resulting risk-reward ratio exceeds 1:5.

Therefore, sometimes the trading targets required by the price action exceed the standard 1:2 common in Forex trading.

Sure, traders could have settled for the 1:2 risk-reward ratio, but it made no sense to exit the trade until the price reached the 0-b trendline.

Otherwise, the entire trading setup would not make sense, according to the Elliott Waves Theory.

Using the Equity of a Trading Account to Set Trading Targets

The earlier example showed how, sometimes, the market forces traders to set trading targets bigger than 1:2.

It simply means that trading with the idea that it is mandatory to have 1:2 risk-reward ratios is wrong.

In fact, traders must always adapt their trading targets and use the 1:2 risk-reward as the minimum profit for the risk taken.

The same ratio provides help in a different way.

The currency market is made up of tens of currency pairs and other financial instruments.

The decision to trade one currency pair over another is difficult.

Correlations and FX

Moreover, correlations, direct, and inverted ones affect the performance of a trading account.

For instance, assume you’re bullish on the USD.

So what?

As a trader, you must also decide against what other currency you buy the USD?

Forex trading takes place in pairs, so deciding on the pair to trade is as important as deciding what currency to buy or sell.

A bullish or bearish USD means that the USD pairs move in tandem.

EURUSD, GBPUSD, AUDUSD, USDCAD, USDJPY – all of these pairs usually move in the same direction, in a correlated fashion.

Therefore, the trader faces two choices:

- One is to pick one currency pairs and trade the entire position as given by the money management system.

- The other is to split the risk among various, correlated currency pairs, by trading a lower volume on different levels and on different currency pairs.

Find the Right Trading Volume

Assume that you don’t risk more than 1% of the trading account on any given trade.

To find out the volume, you need to follow several steps.

- First, find the number of pips needed from the entry place to the stop-loss.

- Second, set the trading volume in such a way that the account doesn’t lose more than 1% in case the market reaches the stop-loss level.

- Finally, set the trading targets at minimum twice the risk.

That is, if you use the standard approach, as explained so far in this article.

Don’t Put All of Your Eggs in One Basket

To avoid putting all your eggs in the same basket, another option is to split the volume into different small parts over various correlated pairs.

Moreover, instead of targeting a specific market level on one single pair, target double the risk.

Therefore, if the risk is 1% of the trading account, the cumulative trading targets for all the trades should be no more than 2%.

Important note: Always use the equity of the trading account to calculate the drawdown and the reward.

Remember that the equity reflects the real value of the account, therefore it provides an accurate picture of its performance.

Quick Review on How to Set Trading Targets Using the Equity of a Trading Account

Here are 4 steps to setup trading targets:

- Start by finding the right volume for your trade on any given currency pair.

- Also, make sure the stop-loss doesn’t trigger a loss bigger than 1% of the trading account.

- Continue with spreading the volume on other correlated pairs. Use different entries for each trade.

- Finally, close all trades if the account loses more than 1% of its equity.

Alterntively, exit when the equity of the trading account grows by 2%.

This way, the 1:2 risk-reward ratio remains in place, and the trader spreads the risk amongst various currency pairs.

Negative Swaps and Their Impact on Trading Targets

We live in a world where central banking is changing drastically.

Monetary policy concepts that were unthinkable a few years back are viewed now as the new norm.

Various central banks around the world, important ones, moved the interest rates into negative territory.

The Bank of Japan (BOJ) or the ECB are just a couple of examples.

In doing so, they caused a widening of the interest rate differential between different currency pairs.

EURUSD Pair

For instance, consider the EURUSD pair.

Up until recently, the Fed ran a tightening cycle.

It hiked the federal funds rate to over 2%.

However, at the same time, the ECB kept the deposit facility rate well below the zero level – into the negative territory.

Such a difference caused traders a lot of pain, especially those long on the EURUSD.

For every position held open overnight, the broker charges or pays an interest rate differential in the form of negative or positive swaps.

Up until recently, such differences were insignificant, but the negative rates made it a cost to consider.

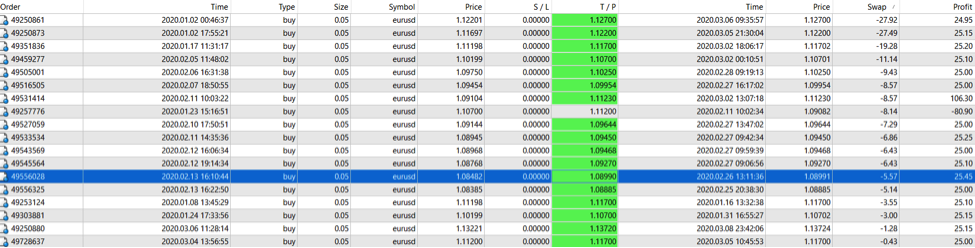

As the image below shows, setting trading targets when scalping isn’t always a good thing, especially when the swap for the trade is negative.

This trader made a few critical mistakes:

- First, the trader didn’t set a stop-loss order for the trades.

- Second, there is no risk-reward ratio – the trades went into negative territory for two months before reaching the take profit.

- Finally, for some trades, the negative swap exceeded the profit. Despite reaching the target, he position ended up losing money instead of making a profit.

Conclusion: Therefore, set trading targets considering all the possible costs that may affect the performance.

Fundamental Trading Targets – Do They Work?

Besides technical analysis, the fundamental analysis leads to tremendous trading setups.

Macro-trading or macro-investing requires a bigger time horizon than technical trading.

The trading targets set this way exceed by far the technical trading results.

However, there’s at least one thing to consider- time, or the timing of your entry.

Most macro-traders are ahead of the curve.

They usually interpret the business cycle and position for a recession/expansion way ahead of it.

Therefore, the risk is bigger, but the reward as well.

When setting trading targets using fundamental analysis, traders don’t look at days or weeks for a trade to reach the target, but at months or years.

Trading Interest Rate Differentials

Again, the interest rate differentials help to explain macro-trading and compare trading decisions with technical trading.

Because the interest rate dictates the value of a currency (i.e., the higher, the better), traders favour the currencies paying a higher interest rate.

They sell the ones with a lower interest rate.

Can it be that easy?

The answer is, yes.

Fundamental trading is suitable for traders who:

- Have a big enough trading account

- Bigger horizon for the trading targets set this way

- Avoid the emotional rollercoaster of watching the markets all day and suffering after each trading decision

RBA vs. Fed

The Reserve Bank of Australia (RBA) and the Fed moved their interest rates on two different paths up until recently.

The RBA is on an easy path for several years, while the Fed managed to hike the federal funds rate in the meantime.

Naturally, this created a fundamental trading opportunity.

Active managers looking for market inefficiencies quickly spotted the simple trade developing in front of their eyes.

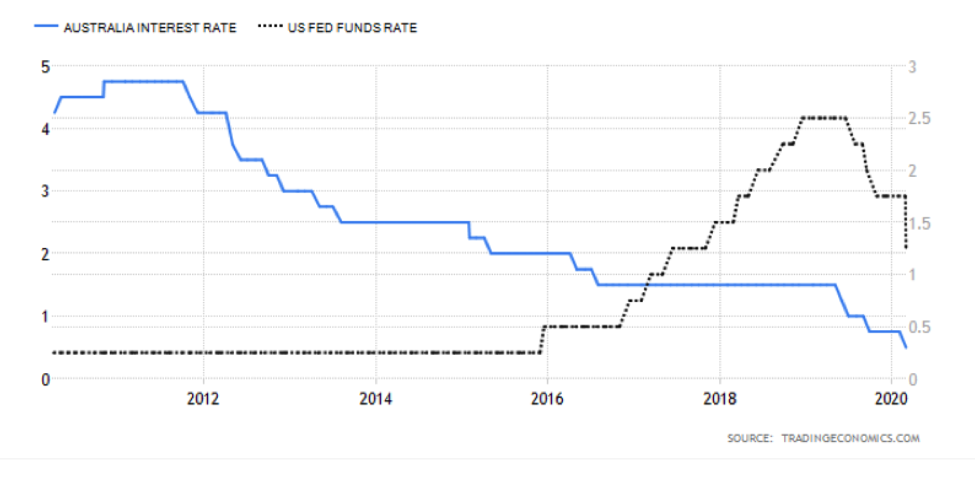

The chart below shows the federal funds rate in the United States in comparison with the cash rate in Australia.

2010-2012

In 2010-2012, the cash rate of almost 5% exceeded by far the federal funds rate.

However, at one point, the Australian economy began to deteriorate, and the RBA began an easing cycle.

It didn’t stop ever since.

While Australia lowered the cash rate, the United States economy blossomed.

Faced with low unemployment and relatively stable prices according to its mandate, the Fed began raising rates.

At some point, it even reduced the balance sheet size, further pushing the dollar higher.

At the same time, the RBA did nothing.

As the chart show, the two rates crossed, and the interest rate differential changed direction.

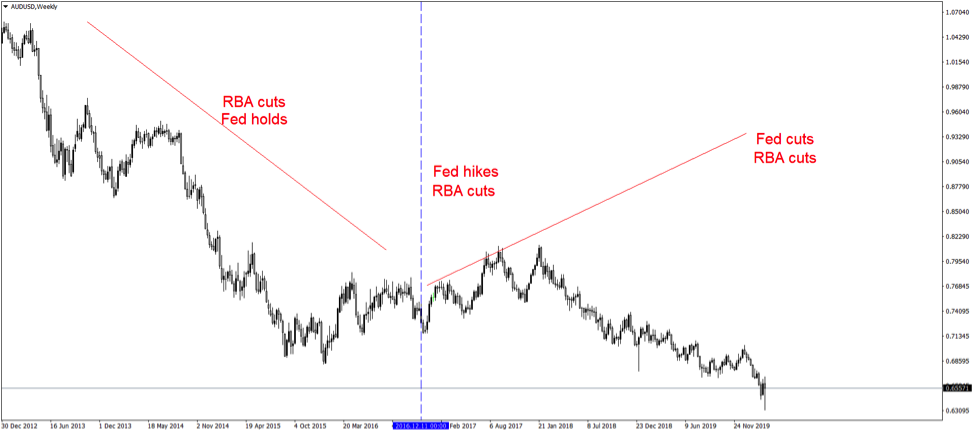

What happened with the AUDUSD pair?

A quick comparison of the two charts shows how the interest rate differential helps to set proper trading targets.

In other words, when the Fed was on hold, and the RBA cut rates, the AUDUSD pair declined.

Next, the Fed hiked, and RBA continued to cut – the AUDUSD resumed falling after consolidating for a while.

Finally, the Fed delivered a few cuts, but the RBA is not done cutting as of yet.

Conclusion

Setting reasonable trading targets is a fine balance between technical and fundamental analysis.

Also, money management plays a vital role too.

As this article showed, it is not only about risk-reward ratios, but also about combining all the elements available to the trader.

Some traders prefer only technical setups.

Others strive when interpreting different economies and make the most of the differences between them.

Technical or fundamental trader or investor, knowing how to set up appropriate trading targets helps in growing the trading account.

The simplest way is to use tight money management rules by adding a risk-reward ratio exceeding 1:2.

In doing that, traders know that the reward is realistic, and the account has room for error.

Another way to set different trading targets is to use the trading account’s equity advances and declines.

By spreading the entries on multiple pairs using lower volume, the risk decreases as well.

Finally, setting trading targets based on fundamental (macro) analysis works too.

Some traders combine all of the approaches mentioned in this article to hedge the strategies against each other.

They tend to make the most of the potential market moves.