How to Master the TradingView Platform- Useful Tips and Tricks

How to Master the TradingView Platform

How to master the tradingView platform? With the Internet penetrating our lives in the last decades, we do more and more things online. It is no wonder the online industry grows steadily, with TradingView, a leader in the trading world.

Contents in this article

- Understanding the Trading Platform – The Best Way to Master TradingView

- Financial Markets Overview

- Explaining the TradingView Platform

- Built-In Indicators with the TradingView Platform

- How Does TradingView Make Money?

- Special Indicators with the TradingView Platform

- Extra Trading Tools on TradingView

- How to Publish an Idea

- Publishing a Trading Idea

- Conclusion

As more and more people come online every day, the online trading potential remains huge. Forex brokers offer a variety of trading tools to use, but that’s not enough.

Most of the brokers offer limited options. Because of the high costs for developing their own trading platform, brokers choose the classic MT4 or MT5.

After all, why bother building an in-house trading platform when you can “rent” one? While for the brokers this is a solution, traders lose most.

The problem is not that the MT4 or MT5 isn’t good. They are excellent.

However, they have some limitations, and the need for something new appeared. TradingView filled this gap and positioned itself as more than just another trading tool.

As the company likes to say, it offers “free stock charts, stock quotes, and trade ideas.” Naturally, not everything on TradingView is for free, as this is not a charity.

However, most of the tools are free, and, for the retail trader, they are a great set to find opportunities. Moreover, TradingView is a global community for retail traders.

People like sharing ideas, debating them, and, why not, bragging. With a clever blend between social media and trading, the company evolved into the number one developer of social networking and data analysis. Obviously, for the retail trader.

This article aims at offering more than a glimpse into what TradingView is. We’ll cover the trading platform and its capabilities, but also how to make the most of TradingView.

In the end, you’ll see that it has truly unique features. Trusted by millions of traders, it is time to see what makes TradingView so popular.

Understanding the Trading Platform – The Best Way to Master TradingView

TradingView grew in popularity over the last years because of its proactive approach. The company, based in California, United States, invested continuously in the platform.

Like any website, its success depends on the generated traffic. In other words, how popular TradingView is among retail traders.

To attract traders, the management team understood that the platform is critical. For this reason, TradingView strived to provide state-of-the-art charting tools. Moreover, the trading platform gives access to a plethora of worldwide markets.

Literally, there’s nothing in this world you could not find on the TradingView platform. Obviously, only related to financial markets.

Besides the trading platform, the company invested heavily in growing the social component of it. Right on the homepage, the chat function shows how active the community is.

Running multiple funding campaigns, TradingView managed to improve the traders’ experience continually. It now offers access to all the markets in the world. Moreover, its trading platform, the central piece of the TradingView’s concept, is one of a kind.

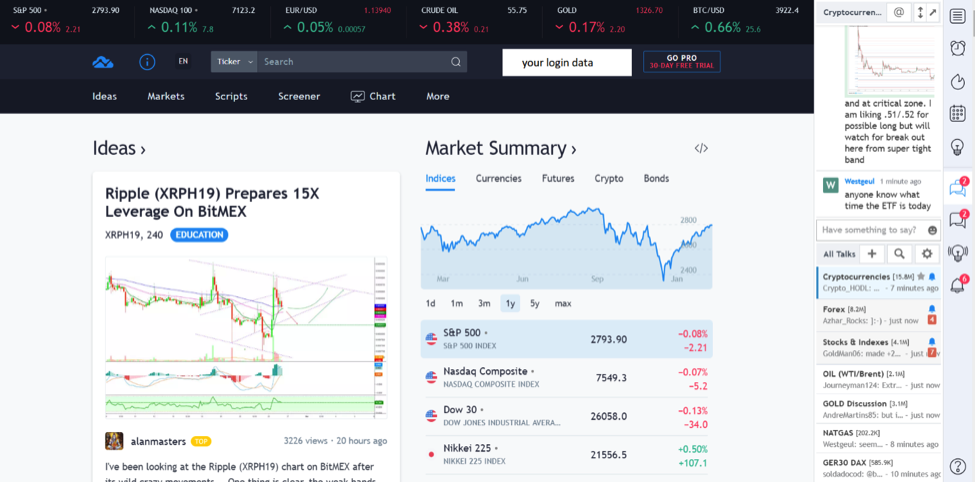

Here’s what you’ll get when first visiting the website:

Before anything, keep in mind that this isn’t all the info that fits the screen. There’s a scrollbar on the right side, pointing to much more content on the homepage.

However, the first screen is the most important one.

It is the eye-catcher!

Hence, it must tell most of what TradingView really is about.

First, on the top of the page, there’s the market ticker. Live quotes of relevant markets in the world.

Next, there’s the search bar. You can search for people, markets, trade ideas, and anything you can think of related to trading.

Finally, creating an account gives you the login data. The process is smooth, and in the end, you have free access to most of the TradingView world.

Financial Markets Overview

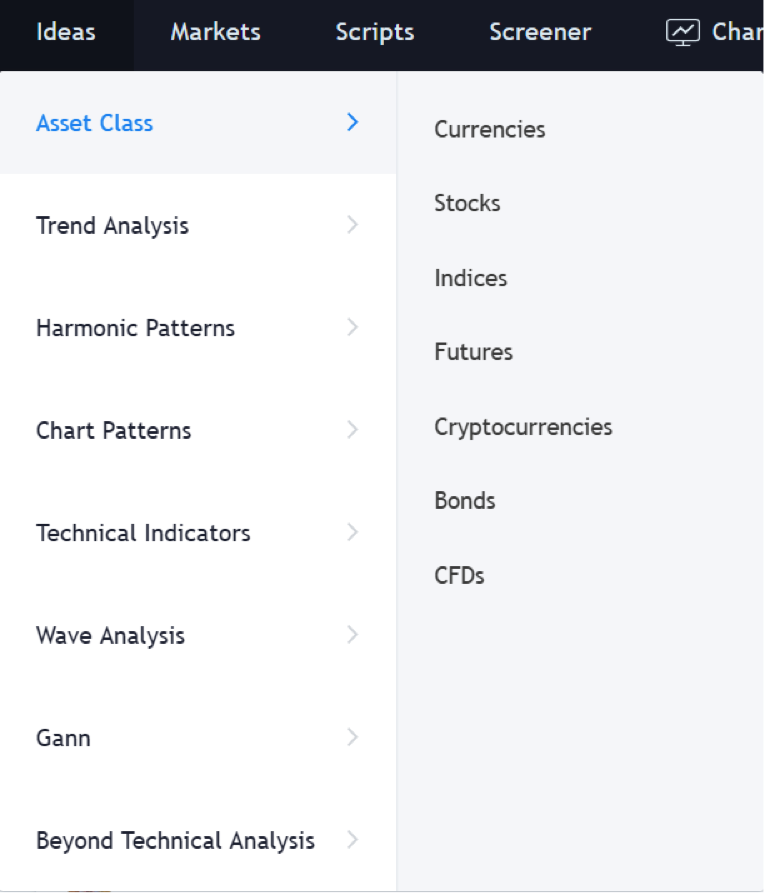

From the start, TradingView emphasises the vast number of markets it offers all in one place. Placing the mouse on the “Ideas tab” (we’ll come back to that topic later), gives an overview of what’s there to find.

Traders from all over the world and of all types (scalpers, swing traders, investors, news traders, etc.), post their trading ideas (including me sometimes). They use the TradingView platform to build a chart and publish the idea.

Next, the TradingView platform builds a short video that validates/invalidates the trade. Finally, as time passes, everyone on TradingView can see if the idea publishes was successful or not.

The more accurate a trader is, the more popular he/she becomes. Traders have followers, receive likes, and so on, just like the other major social platforms in the world.

With, one major exception: here, everything is about trading.

Coming back to the image above, it shows the published ideas on each market. So, if you want to have a clue about what retail traders say about any one of those markets, just select one and see how they went.

Using the “Asset Class” category, we see all the available markets:

- currencies

- stocks

- indices

- futures

- cryptocurrencies

- bonds

- CFD’s

By selecting any one of these categories, you have access to the published ideas of fellow traders around the world. Moreover, anyone can comment, add notes, agree, etc. with the idea posted. Effectively, traders engage in what they love most: talking/interpreting markets.

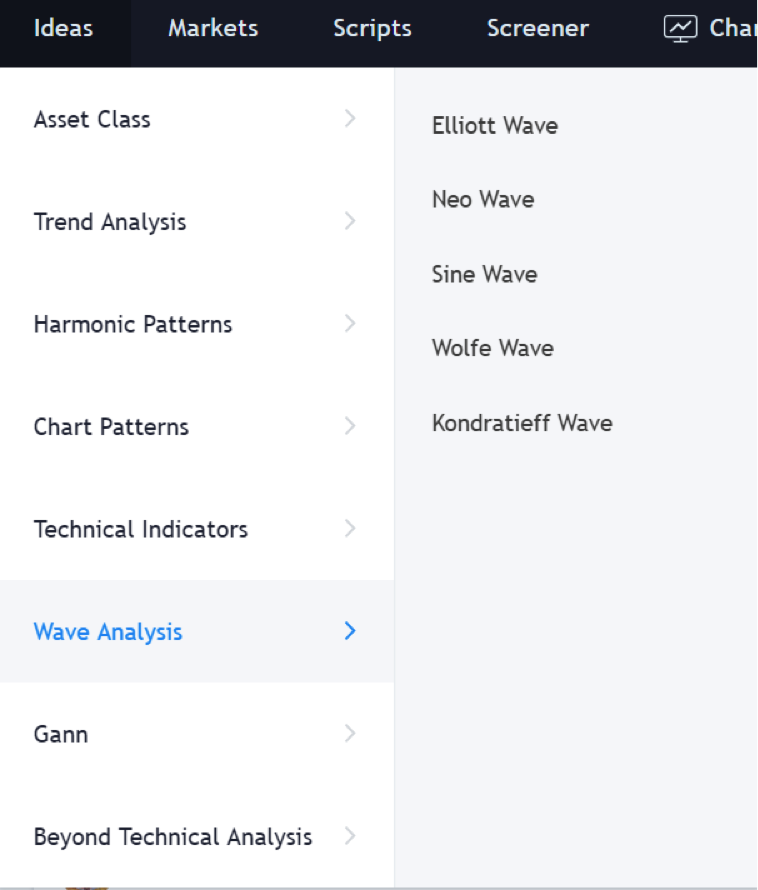

TradingView goes deeper, though. It even classifies the ideas based on different waves analysis type, like:

- Elliott wave

- Neo wave

- Sine wave

- Wolfe wave

- Kondratieff wave

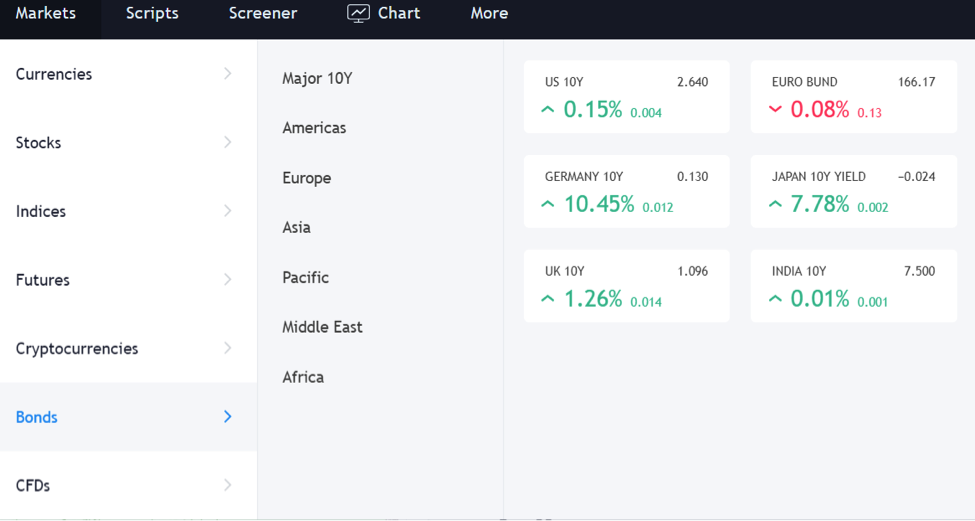

Interested in trading, say, the bond market?

Not a problem!

In other words, everything is there, just a few clicks away. But we have not talked about the TradingView platform yet, so let’s dig in.…

Explaining the TradingView Platform

Let’s say you want to analyse a market. Any market!

First, you need to find the market on the TradingView website. For this, the search box helps.

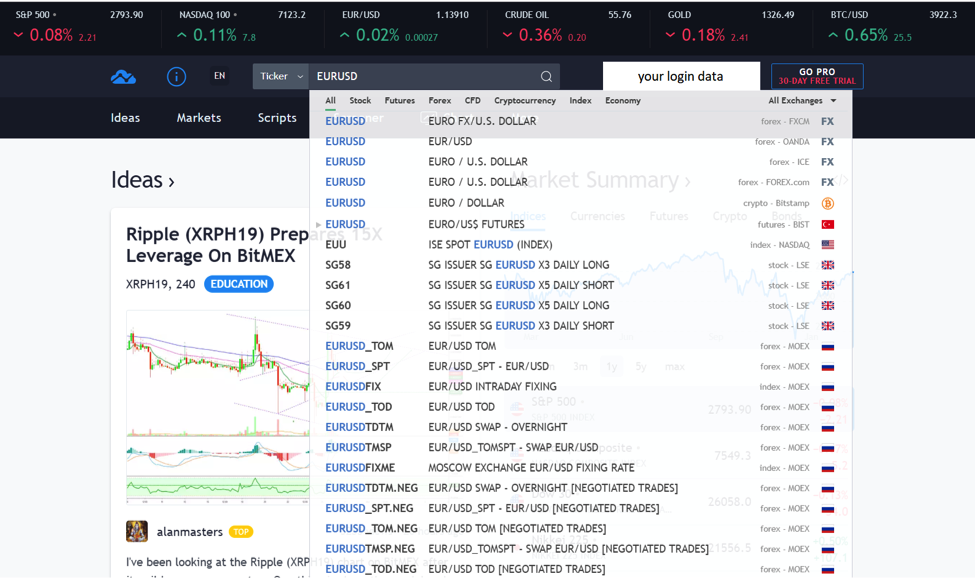

As shown below, go to the search box and select what you want to search for (ticker, people, etc.) Let’s say we look for the EURUSD pair, the most popular trading pair on the currency market.

Simply tipping EURUSD, TradingView brings up a list will all products that contains it. Moreover, there are all the brokers it has an agreement with, as well as the countries where related EURUSD products exist.

Next, after selecting the market (in our case we just pick the first EURUSD in the row). By clicking on it, the following chart appears:

It gives basic info about the current EURUSD level. A line chart shows the price action and traders can compare it on multiple broker flows.

Finally, for the full-features’ chart, make sure you click in the top-right corner. By doing that, a new tab opens up on the Internet browser. And that’s the place where traders take advantage of the full TradingView platform.

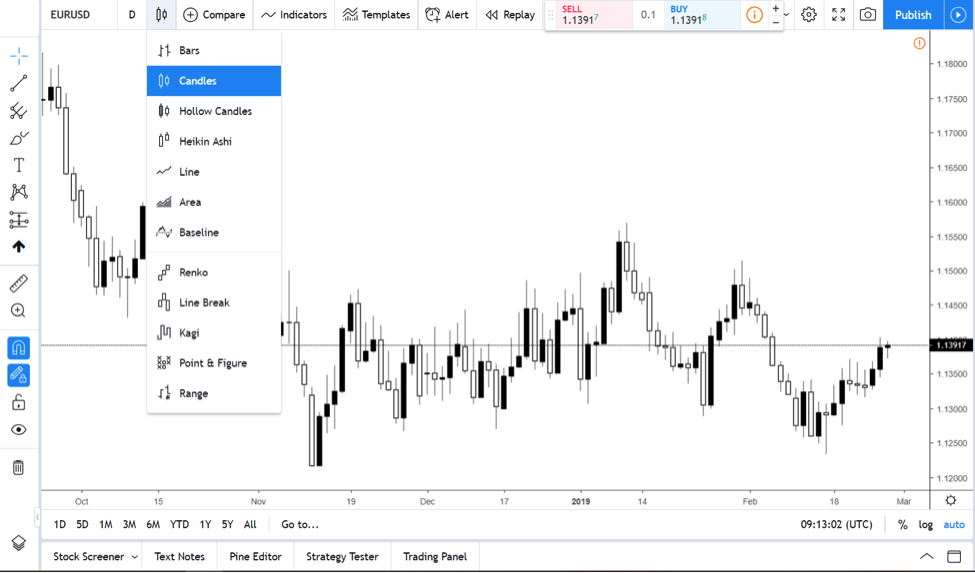

To fully understand how different this platform is, just have a look at the type of charts provided. Most trading platforms for non-professional traders (a.k.a. retail traders) offer only three types of charts:

Instead, TradingView goes the extra mile. On the same market, besides the three types mentioned above, other options exist, like:

- Hollow candles

- Heikin Ashi

- Area

- Baseline

- Renko

- Line break

- Kagi

- Point and figure

- Range

Do I have your attention now?

Built-In Indicators with the TradingView Platform

There’s a large variety of indicators on the TradingView platform. From classic trend indicators to new ones, traders find all they need.

We won’t list the classic trend indicators here. Every trader knows them from the other popular trading platforms.

Instead, here are some unique trend indicators to consider:

- Arnoud Legoux Moving Average

- MA Cross

- Triple EMA

Oscillators exist too. Not only the standard ones (e.g., RSI – Relative Strength Index, CCI – Commodity Channel Index, etc.) but new ones like:

- Klinger oscillator

- Historical volatility

- Coppock curve

Here’s an interesting thing to consider. TradingView is free for all users.

But, there’s a catch. A free account gets you access to limited resources.

However, over three-quarters of all TradingView content is free. The rest belongs to the Pro subscribers. Or, to subscribers that pay a monthly fee for using particular indicators.

In my opinion it is totally worth it, especially if you are serious about trading.

How Does TradingView Make Money?

First, TradingView offers the Basic package for free. Again, with this package, traders have access to tons of info and data. However, there are other plans too:

- Pro

- Pro+

- Premium

The last package sells for almost $40/month, and you get a sense of the cost of using paid plans. It is up to each and every trader to decide if it is worth the investment or not.

Why would anyone upgrade from the Basic package? One reason, for instance, is that you can’t use more than three indicators on the same chart.

Those willing to look at more than three, need to upgrade. Period.

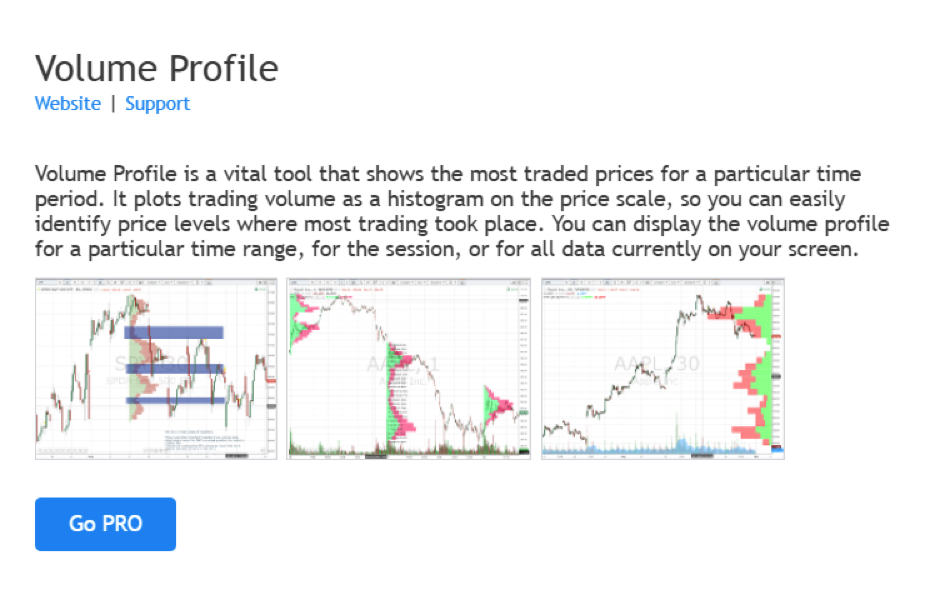

Take the Volume Profile indicator, for instance. Those using VSA (Volume Spread Analysis), will find it quite interesting. However, TradingView offers it only with a Pro subscription.

With the Basic package, there’s a commercial popping up every time on the left side of your screen. While you can click and close it, it keeps coming up. Again. And again.

Want an advertising-free account? You’ve guessed right: you need to upgrade your account.

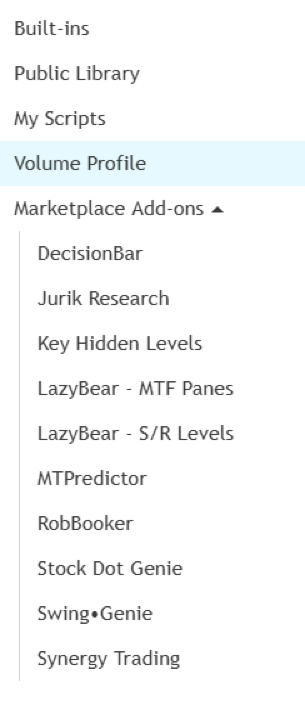

Third, TradingView profits from selling monthly subscriptions for its tailor-made indicators. Called Marketplace Add-ons, these indicators’ price range from a couple of tens of dollars to over a hundred dollars each month.

As I am not promoting anything here, I won’t into details regarding price, etc. This is something for you to find out. However, the next section covers a few of them.

Special Indicators with the TradingView Platform

In the Marketplace Add-ons category, there are around ten indicators. Considering the price to pay for them, we assume they have unique qualities.

Here are the most important ones, together with a short description:

- Decision Bar

- also called trading with the “Rhythm of the Market” it aims at showing where the market will go next

- Jurik Research

- combining speed with exceptional smoothness, Jurik research uses advanced algorithms to forecast future prices

- MTPredictor

- based on the works of Steve Griffit’s, the MTPredictor uses an isolation approach to Elliott Waves, but also VSA when trading markets

An important aspect to remember is that all the Marketplace Add-ons are rather combinations of indicators. Moreover, they present strategies based on more indicators. Thus, they make the life of the retail trader easier.

Extra Trading Tools on TradingView

All traders know the basic trading tools offered by all trading platforms. Andrews’ Pitchfork, the Fibonacci tools (Retracement, Expansion, Time Zones, Arcs) or the Gann tools are some of them.

Once again, TradingView goes the extra mile. Besides the classic tools like the ones mentioned above, traders are free to use things like:

- Schiff Pitchfork

- Modified Schiff Pitchfork

- Pitch Fan

- Trend-Based Fib Extension

- Fib Wedge

The good part is that TradingView offers them all for free. With only the Basic package, traders have access to all the above. And, some more.

How to Publish an Idea

An exciting feature of the TradingView platform is the social component. No other trading platform went to such length and had such success like TradingView.

And, many a platforms have tried.

Most brokers try to create similar communities.

The idea of making traders communicating and socialising, appeals to them.

How come?

One reason is that the traders remain engaged. Even if they do not actually trade, they stay in contact with the market.

They learn something new, remain actively interested in trading, and so, hopefully soon rather than late will find their trading edge.

Another reason is that TradingView came up with this brilliant idea of publishing a trading scenario. Clearly, other brokers have tried that too.

Many invented contests, where traders publish trade ideas and give an argument. However, the simplicity of the TradingView publishing option made a huge difference.

Publishing a Trading Idea

That’s a piece of cake!

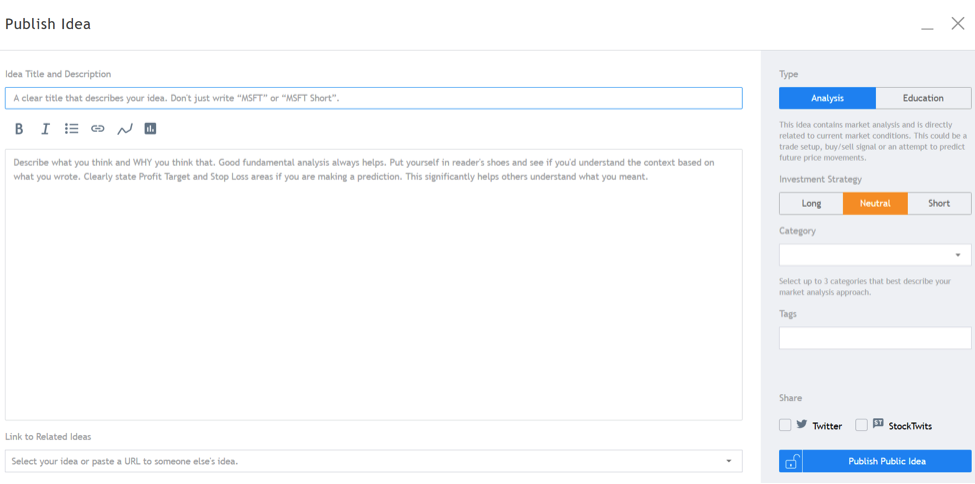

In the upper-right corner of the chart, there’s a button called “Publish.”

First, traders do their analysis. Regardless of the trading tools or theories, traders opt for a scenario.

Second, by clicking the Publish tab, a new screen opens. It asks for more details before “locking” the idea.

To start it, traders need to give a title and a short description. Next, decide if this is an analysis (trade setup) or just contains educational material for the ones interested.

Moving forward, traders decide if the strategy is bullish, bearish, or neutral. Finally, after selecting the category and a few tags, the idea is ready for publishing.

Note the open lock on the bottom-right of the chart above? That means that up to the point when clicking that button, you can still edit the trading idea.

Once pushed, the idea becomes locked. And, published. Anyone can see it, comment on it, approve it, like it, or the opposite.

A fabulous add-on is the time element. It helps traders evaluate their strategies too.

Let’s say you publish an idea. On the right side of the chart, you can find all the published ideas, in the form of a scroll.

From time to time, you can check how it went. Did the market go where it was supposed to?

Or not…

A short video shows the upcoming candlesticks, validating or invalidating the scenario.

Conclusion

Starting small but aiming big, TradingView grew to become the number one place to be for the retail trader. If anything, only for having access to almost all the markets in the world.

From commodities to exotic currencies; from bonds to options, stocks, and futures, the TradingView platform offers them all.

For sure, it wasn’t a smooth ride.

Not only a competitive industry, but promoting in the trading field is subject to strict regulation, too. Yet, TradingView found a brilliant idea of combining a trading platform with social media.

Hence, we can say that social trading is thriving on the TradingView platform when compared with the competition.

While not everything is for free, most of the stuff is. Being a business, TradingView aims at making a profit.

However, it does that in a transparent way. Traders know all the time if there is a cost and what they’ll get.

This transparency built trust. In an industry full of crooks, trust is a true gem.

As a matter of fact, the entire investment industry is based on trust. Therefore, it should come as no surprise that TradingView chooses to build its business on trust.

Traders trust they can find the best solution for the non-professional trader. Furthermore, they appreciate that most of the tools are free of the chart, including access to all markets.

On the other hand, TradingView honours the trust, too. By providing both free and paid-for products, it addresses all categories of traders: from wanna-be traders to those that trade for a living.

To sum up, this article is designed to make your life easier when using TradingView for analysing the market. I’m sure that by the end of it, you’ll see why retail traders love this platform.

P.S.

Have you checked my article on the MT4 trading platform?

The most comprehensive & best independent review of TradingView that I have ever seen. Well done.

Thanks Ed! That was my aim and hope I have not missed something important! IF there is anything that I might have missed, please let me know!