How to Make a Forex Trading Plan in 10 Steps

How to Make a Forex Trading Plan in 10 Steps

So, making a successful forex trading plan…

Hmmm…

When you begin your Forex trading career, you will be “bombarded” with many different advertisements, trading methodologies, educational opportunities.

You will be offered an entire plethora of opinions on what it will take to become a successful trader.

The reality is that it’s entirely up to you to become a profitable trader. You need to recognise that you cannot expect to become successful without putting the work in on your own trading.

So…

The reality is that you need to have a trading plan.

Simply jumping into the marketplace is a recipe for disaster, as all professionals have strict guidelines that they follow in order to navigate the markets.

Perhaps even more importantly, survive tough spells as there are a seemingly endless amount of problems that could present themselves to you over the course of your career.

Contents in this article

Step 1: Decide What Type of Trader you are Before Jumping into Forex Trading Plans

One thing that people fail to think about before making a forex trading plan is what type of trader they are.

For example, you may be very patient. If that’s the case, then trading a higher timeframe might make quite a bit of sense.

However, if you need confirmation of a trade working out right away, then you will have a lot of trouble trading the weekly timeframe.

In that instance, you are probably more apt to trade short-term charts. Most people are going to typically be one or the other, and certainly will do better trading a timeframe and method that makes them comfortable.

It’s not just a matter of being comfortable, but it’s a matter of being able to execute your plan without mental distractions.

Step 2: Figure Out your Risk Tolerance before Making a Forex Trading Plan

The second thing that traders will need to do is understand what the risk tolerance is.

While there are mathematical formulas that you can use to decide whether or not a specific trade risk is acceptable, at the end of the day it doesn’t matter whether or not the math works out.

If you find yourself stressing about a particular trade size, it’s going to affect your results!

Fullstop.

Understand how much risk and loss you could take per trade comfortably and stick to that risk profile.

For example, if you are comfortable risking 0.5% per trade, but suddenly risk 2.0% on a trade, you may find that you are far too tempted to “tinker” with a trade, affecting your trade results.

Step 3: Search for your Market Before Making a Forex Trading Plan

While it may seem a bit counterintuitive, each market has its own personality.

Some markets will move much quicker than others, so therefore momentum is the first thing you should keep in mind.

That being said, this can change occasionally, as has been seen in 2019 with the British pound. The British pound has shown itself to be very volatile as Brexit has taken shape.

This has even been seen in the EUR/GBP pair, one that has historically been very stable and slow moving.

On the other hand, the NZD/JPY pair tends to be extraordinarily volatile as risk appetite goes up and down.

DAX (the German stock market) as well is an instrument that moves so fast that it has made a name of itself as being the “widow maker” in the markets.

Understand the market that makes the most sense to you and focus on that initially before adding several other markets to your repertoire.

Making a forex trading plan comes a bit later in the process…

Step 4: Focus on a system

Another step in forming a forex trading plan is to focus on a system.

This of course will be left up to the trader individually, but some traders have systems as simple as buying hammers and selling shooting stars on the daily chart.

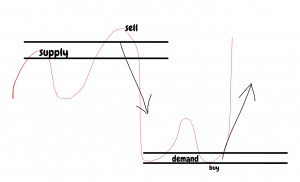

Others have much more complicated systems that will include not only price action but a handful of indicators as well, or incorporating supply and demand zones.

Others will then focus on fundamental analysis as opposed to technical analysis.

It comes down to personal preference, and what makes the most sense to you before coming up with a forex trading plan.

Step 5: Back Test before Starting a Forex Trading Plan

This is where most retail traders fail.

They fail to back test!

In order to come up with a forex trading plan, you need to back test!

You need to look at historical data to determine how your system would have performed in the past.

While past performance doesn’t necessarily suggest future returns, it gives you an idea as to whether or not a system or methodology even has a chance to work out.

For example, if you find a system that’s comfortable for you, but test it over previous market conditions and find that it has a negative return, you need to keep looking.

If it does in fact show good results, then you can begin to believe in the possibility of it being useful.

Step 6: Demo Trade before Concluding a Forex Trading Plan

This is another step that a lot of retail traders skip before finalising their forex trading plan.

And they shouldn’t…

They start trading right away with live money, instead of doing demo trades that can simulate whether or not the system can work.

Simply put, if you cannot make money in a simulated account, you certainly won’t make a great forex trading plan and you won’t make it in a live account.

Demo trading gives you an idea as to whether or not that back testing makes any sense.

It also does something crucial: it builds up confidence.

Unfortunately, what demo trading does not do is guarantee positive results when you go live.

It does really take a lot of time and dedication to become profitable. Some say, 10,000 hours!

Step 7: Live trading

After going through the previous six steps, you can start thinking of finalising your forex trading plan and trading your system in a live environment.

That being said, you should start out with a relatively small amount of currency in your account.

Remember: This is done in case of if psychological issues arise, or if there is some type of anomaly in the market, it will not cost you too much money.

You are getting closer to trading your full size and of course beginning a much more professional career.

There is a certain amount of adjusting that needs to be done when you go from demo trading to live trading, though.

This is where you can see the light at the end of the tunnel, and if you can retain the consistency that you have hopefully seen up to this point.

The next step is where you really start optimising your system…

Step 8: Optimisation

Optimisation of a trading system is crucial.

At this point, you should be profitable, but you may find that by tweaking your trading system a bit here and there, you can make even better returns.

For example, if you typically use the 50-day EMA as an indicator, you may find that adding the Bollinger Bands indicator for signs of overbought conditions may increase your results by another 5% per annum.

Include this in your forex trading plan!

How Do We Do This?

Yes, that is absolutely right- by more back testing and demo trading.

You are on the right path, but as most Forex brokers offer a free demo account for the life of your life account, you should be taking advantage of that.

You should hope that you can optimise your forex trading plan and system and improve your results over the longer term.

Never give up!

You should also be looking at the possibility of adding more systems and methodologies to your forex trading plan.

After all, most professionals have a different trading system for different trading conditions.

In a sense, optimisation of all systems becomes a career long process. Things are never “perfect”, and therefore traders are always looking for a better way forward.

Step 9: Scale Up

At this point, you could be starting to scale up in your position size.

Now that you know that you can make money with your current forex trading plan and strategy, it’s time to get more aggressive when the market conditions warrant it.

If you know that a particular set up is profitable 70% of the time, you may end up being a bit more aggressive when that set up comes as opposed to one that is profitable over the longer term but has a much lower frequency of success.

Risk:Reward

(As an example, your forex trading plan (strategy) might be successful 35% of the time, but has a 4 to 1 reward to risk ratio making it extraordinarily profitable over the course of several months.)

You begin to understand when it’s time to get aggressive, and when it’s time to open up a small position.

Scaling up can be one of the most exciting times for a trader, but it also can be one of the most dangerous.

It is at this time that traders are most vulnerable to significant losses based upon the larger sizes being used.

Also, this is the time when your psychology can betray you most severely.

All in all, this is the time to be extra careful and consider one more time before increasing your trading size!

Having a solid forex trading plan is essential!

Step 10: Journal

Although this is being written as the tenth step, the reality is that journaling is going to be crucial all the way through this process and for having your forex trading plan in check.

That being said, I have put the step of journaling at the end in order to emphasise its importance.

Even if you are profitable at this point you should be looking at journaling as a way to point out what you are thinking per trade, and what was going on in the market.

You should have a screenshot of the potential set up, and of course all of the results.

Professional traders know that given enough time they will start to notice patterns.

For example, you may believe that you are a great trader using the 50% Fibonacci retracement tool.

Unfortunately, once you start journaling and tracking your results, you may realise that the edge that you think you have is much less significant than you thought.

The Sample Size

Once you have a large enough sample size, you will be very surprised at what the differences between your perception and your reality are.

This is the main reason for journaling!

You can learn that there are specific times that you should not be trading.

Sometimes it might be the time of the day, sometimes it might be with specific external factors.

You will also learn that some trade set ups simply aren’t as reliable as others, be it based upon time frame, or possibly even various markets.

Once again, having a good forex trading plan is if uttermost importance.

While a particular pattern might be very profitable for major currency pairs, by journaling you may find out that minor currency pairs seem to produce quite a few more false signals.

It is the detail of the Journal that can make a huge difference as to what your results are over the longer term.

The Main Take Away from Making a Forex Trading Plan

The main take away for setting up a successful forex trading plan is that it is an ever-evolving process.

Making a trading plan is something that uses multiple steps, and never ends.

There is no such thing as a forex trading plan that you simply lean into for the rest of your life. There are always going to be small tweaks, because markets continue to change on a month-to-month basis.

As mentioned previously, Brexit has had a massive effect on the British pound.

This certainly would affect your forex trading plan as markets have been much more volatile than usual.

The solution might be something as simple as just not trading the British pound. On the other hand, it could also mean something along the lines of cutting your position size by half.

Or, you may find that in the chaos a particular indicator seems to be much more efficient at determining trade opportunities than in the past.

Issues When Making a Forex Trading Plan

One of the biggest problems that Forex traders face is that there is no one way to do things correctly.

At the end of the day, each of us are completely different and the old saying of “You can have two traders using the same system and the results will be massively different” is definitely true.

Learn to understand your strengths and weaknesses, using them to your advantage.

Understand that neither are all markets the same, nor are all time frames. All things being equal you will find your trading opportunities given enough time.

However, most retail traders do not spend the time necessary to find the road to profitability.

Always be patient!

It is a bit of a misnomer to think that trading is going to be easy, but it doesn’t necessarily need to be overly complicated.

It comes down to using the right tools for your psychology, as well as the way you see the markets.

Two traders can look at the same chart and come up with two different ideas.

Learn to understand what patterns and trade setups are the most profitable for you and hammer that time and time again.

At the end of the day, one of the main benefits of trading is that you have the ability to measure your statistics using numbers, and of course mathematics doesn’t lie.

Live well. Have a trading plan. Be a successful trader!

Happy Trading,

Colibri Trader