GBPUSD Trading Analysis

Last week, I shared my thoughts on the S&P 500.

So far, price action has remained relatively stagnant — no clear move in either direction.

That said, the overall structure still looks bearish to me.

While I haven’t opened a short position just yet, we have managed to catch a couple of strong double-digit trades this week.

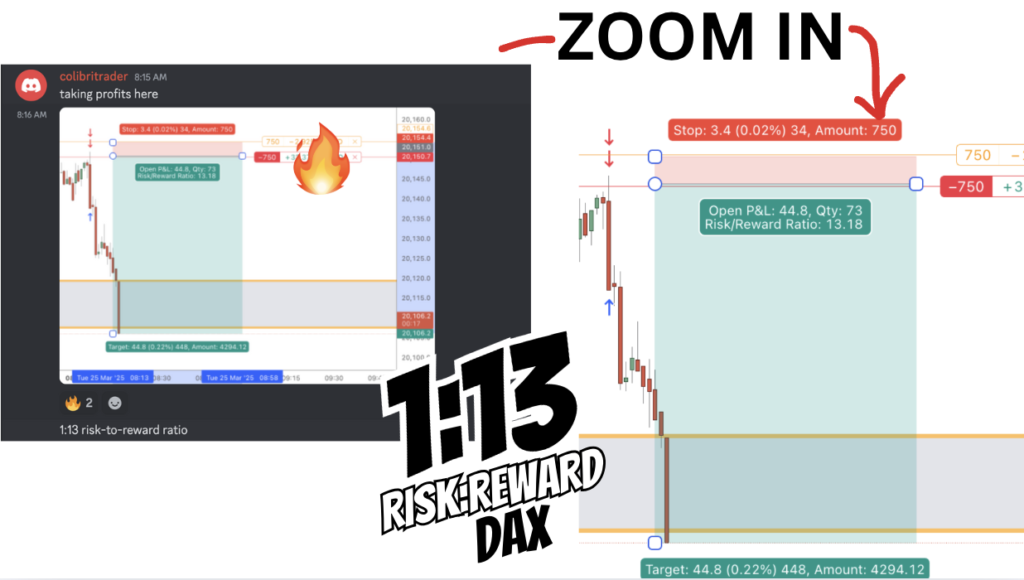

Here’s Trade #1:

This was our 1:13 risk-to-reward DAX trade taken on Tuesday.

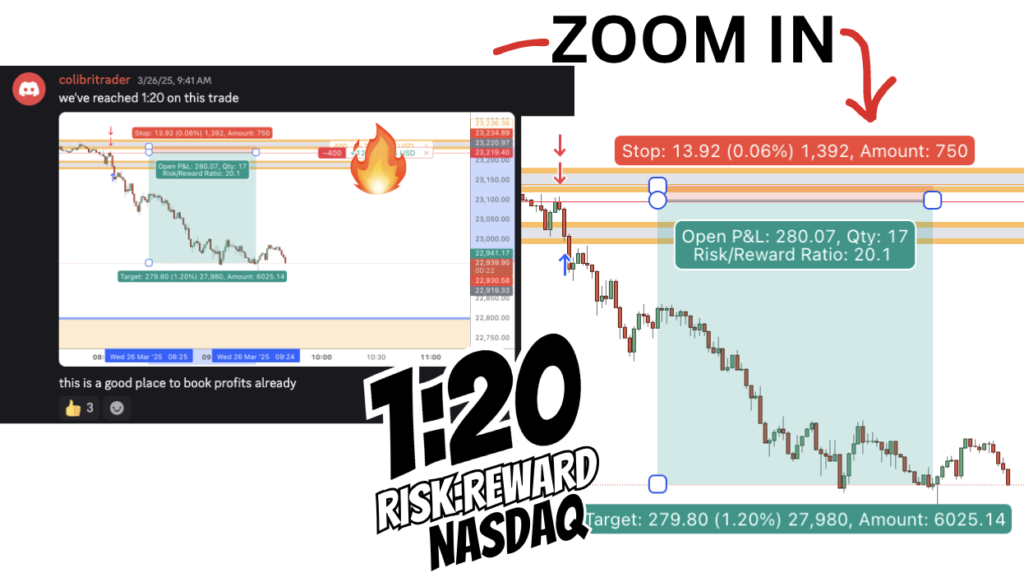

And here is trade #2:

This was a 1:20 trade on NASDAQ — a solid asymmetric win.

All in all, it’s been a strong week for day trading.

Still holding off on any long-term positions for now — waiting for the right setup.

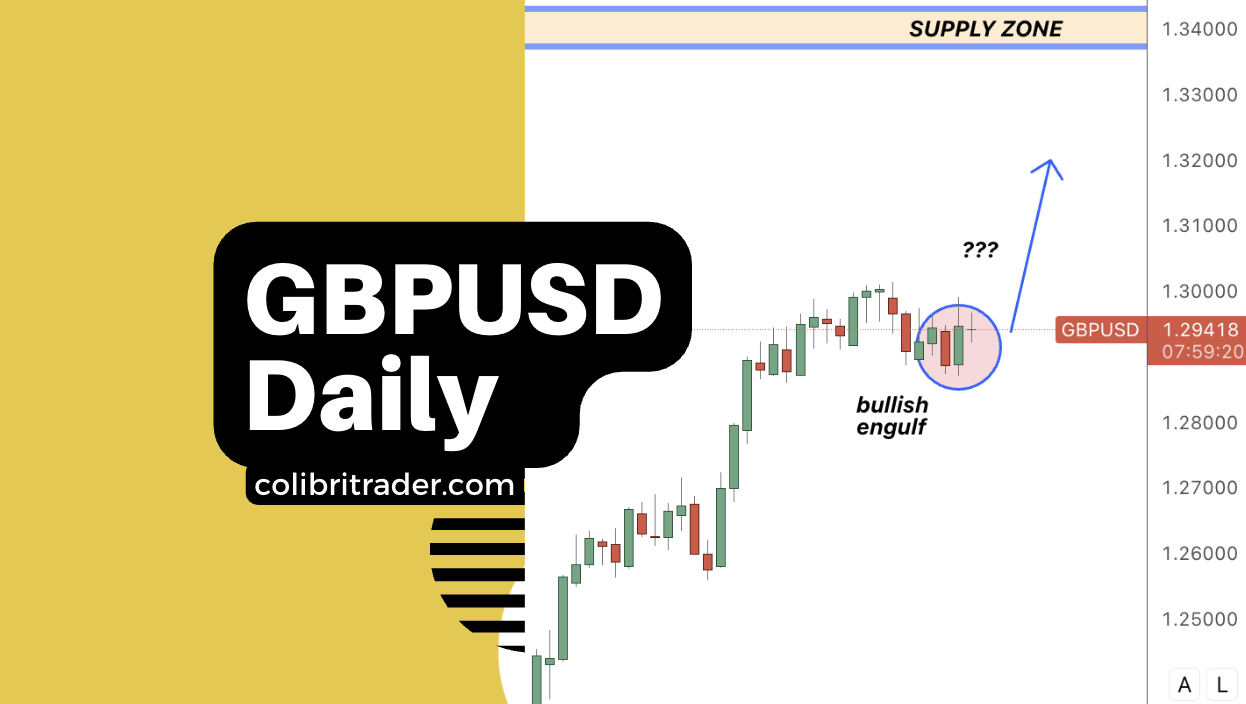

GBPUSD Trading Analysis

GBPUSD looks like it might be gearing up for a bullish move.

Yesterday’s close formed a bullish engulfing pattern — a strong signal of potential buying pressure.

I’ll be watching closely early next week for a possible entry if the conditions line up.

Specifically, I’ll be looking for confirmation from lower timeframes before committing to a position.

If the setup doesn’t materialize, no worries — I’ll stay patient and wait for the next high-probability opportunity.

Happy Trading,

Colibri Trader