GBPUSD trading analysis 30.05.2022

Dear traders,

This is Colibri Trader, (a.k.a. Atanas).

This is where we take the best trading ingredients from the day to make a fresh new treat for you every week.

Last week I walked you through DAX.

Price did go higher as expected, but the micro supply zone did not hold.

We saw a very bullish breakout, which negated our trading scenario.

Currently, the price still looks bullish, until proven wrong.

In other words, we could see a bearish signal, but it is still not there.

Therefore, I am staying on the sidelines.

GBPUSD trading analysis 30.05.2022

Have you seen the pound?

It’s dope.

It sold off from the heights and now is down almost 15% from last August’s highs.

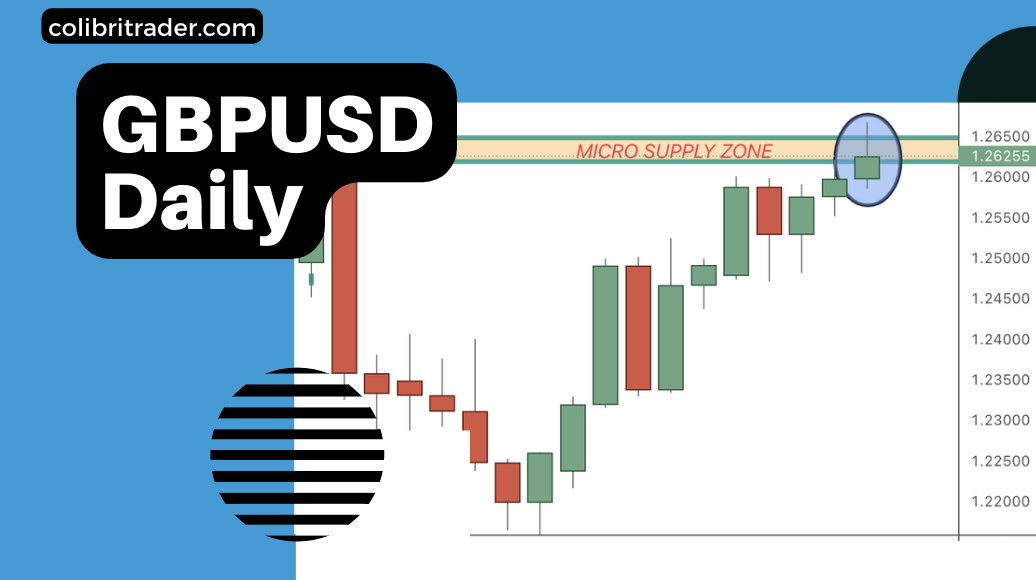

What’s great about it is that it did a typical supply zone retracements, which looks like that:

This is exactly how price looks right now on the GBPUSD chart.

- There is a micro supply zone retracement

- Price printed a pin bar-looking candlestick

What I will be looking for next is a confirmation from the 4H chart.

This might get extended over the next couple of days, but for now all of my attention will be directed towards this currency pair.

Happy Trading,

Colibri Trader

P.S.

Here are the 7 Factors To Consider Before Placing a Trade

P.P.S.

Learn the 8 Price Action Patterns that Every Trader Should Know About