Futures Contract Example

Imagine a corn farmer planting crops and waiting for the grain to ripen in several months.

The farmer plans to sell the corn to cover the costs of maintaining the farm and keep some profits.

Sounds good so far.

All finances were calculated beforehand, according to the expected revenue from the sale of crops.

There’s a little “if”, though….

The plan will work out ONLY IF the crops are sold at the expected commodity market price.

Remember: The lower the corn price at the time of sale, the harder time the farmer will have doing business!

There is a way to protect against such risk – sell the futures contract when the price is favourable, before the corn delivery.

Keep in mind the futures contract example usage as we dive deeper into what such agreements are all about.

When an investor buys a futures contract, they can buy the underlying commodity at a fixed price at the time of expiry.

The opposite goes for a seller of a futures contract like our farmer example from above.

This is how futures contracts work: the agreements help parties to protect the business against market risk.

On the other hand, speculators can use futures to make profits from the market’s volatility.

Contents in this article

What are futures – an example

Here, we’ll look closer at the example of how futures contracts are used.

All futures market participants are divided into two broad categories – hedgers and traders.

Who do you think our farmer is? 😉

As his primary goal of employing futures is mitigating risks, the farmer is a hedger.

Let’s extend on that.

Hedging example

Suppose the farmer planted corn in the late spring while the market prices were quite volatile.

Corn futures surged from 560 to over 700 cents per bushel during the planting season!

The illustration below shows the corn planting season during the second part of spring (see the green area).

Let’s say the farmer plans to sell all crops at 660 cents per bushel (see the green line).

The sale at such a price will cover all costs and provide decent profits.

So, the farmer decided to sell September 2021 corn futures contracts at 660, locking-in sale price.

Important: The size of the futures position should closely resemble the expected volume of the harvest.

After the harvest season in late summer (see the orange area), the market price significantly declined.

But the farmer has nothing to worry about!

Even though the market price fell below 560, he could still sell the crops for 660, thanks to the futures contract.

Trading example

Futures traders don’t want to get rid of risks completely.

The risks are the costs of doing their business!

What’s that supposed to mean?

Traders look for opportunities to profit from the price fluctuations, trying to minimize risks and maximize rewards.

Here’s an example.

Above is the same time period as in the hedging example.

The market broke above the descending trendline and the key 540 resistance, presenting an entry point for traders.

A long entry would be at the close of the breakout day (see the candle in the ellipse).

The protective sell order is hidden below the strong demand zone around 540, while the target is near June’s highs.

Notice that the risk to reward ratio for such a trade is 1:5 (the red area is the risk; the green one is the reward).

How do you buy a futures contract?

Futures are traded on exchanges.

The largest futures exchanges are US-based; the CME Group is the world leader by trading volumes.

Although, almost every country with a developed finance sector offers futures on the exchange.

You’ll need to open a brokerage account to buy a futures contract.

Expect a minimum deposit of around $2500 for a futures trading account.

Some brokers even lift the minimum deposit rule.

However, the lower your deposit is, the fewer instruments choice and room for drawdowns you’ll have.

Makes sense?

Also, the fees will be more felt if the account is small.

Just like for any other financial instrument, you’ll use a trading platform to buy a futures contract.

Some of the top futures brokers that are also high-quality platform providers are NinjaTrader, Interactive Brokers, and Optimus Futures.

When can you trade futures?

Usually, you can trade futures almost around the clock, five days a week.

Consider CME; most instruments are traded from 6 PM to 5 PM ET.

Only agriculture and the softs futures’ trading sessions vary.

For example, let’s look at the soybean futures.

The soybean trading hours are divided into regular and extended (electronic).

| Soybeans (/ZS) trading hours (ET) | From | To |

| Regular | 9:30AM | 2:20PM |

| Electronic | 8PM | 8:45AM |

Next, let’s look closer at each session.

Regular trading hours

Here’s the core session, where you can expect the most volume and liquidity; thus, the price action signals are more reliable.

The trading hours are similar to major US stock exchanges, with closing almost two hours earlier (NYSE closes at 4 PM).

For hedgers (especially big ones), it’s the best time to fill the order at a specific price without impacting the market.

Pro Tip: If you only plan trading regular sessions, be careful about gaps – they are frequent.

Here’s an example.

All circled areas are gaps that consist of the closing of a previous session and the opening of the next one.

So, swing traders should plan the risk management carefully, accounting for sharp price changes.

Electronic trading hours

Still, frightened by gaps between regular sessions?

Actually, you can trade inside those gaps during electronic trading sessions.

However, the volume is very different from the main sessions, so the market is more susceptible to noise.

Sometimes even retail traders manage to “make some noise” during electronic trading as bids and asks are thin!

In the image below, the candles inside the orange circle also have gaps – those happen due to thin volumes.

Make sure you give the market enough room to breathe.

The example below shows the regular and electronic hours combined.

As you see, the gaps aren’t that wild (see grey arrows).

Most of the gaps happen before the electronic hours start due to over five hours of pause between sessions.

There’s a lot that can happen in five hours!

Contrary to a 45-minute pause after extended hours close and the main session open.

In the chart above, the circled example on May 3rd shows the minimum difference between closing and opening prices.

Futures vs. spot forex and CFDs

Around twenty years ago, there were no substitutes for futures.

In the nineties, another derivative appeared – Contracts for Difference (CFD), offering exposure to most assets available only via futures.

Spot forex is another instrument that’s been competing with futures since then.

Nowadays, for retail traders, the popularity of CFDs and forex seems to surpass futures.

Are futures still relevant?

Let’s find out!

Why trade futures

Transparent market data is one of the major advantages of trading futures.

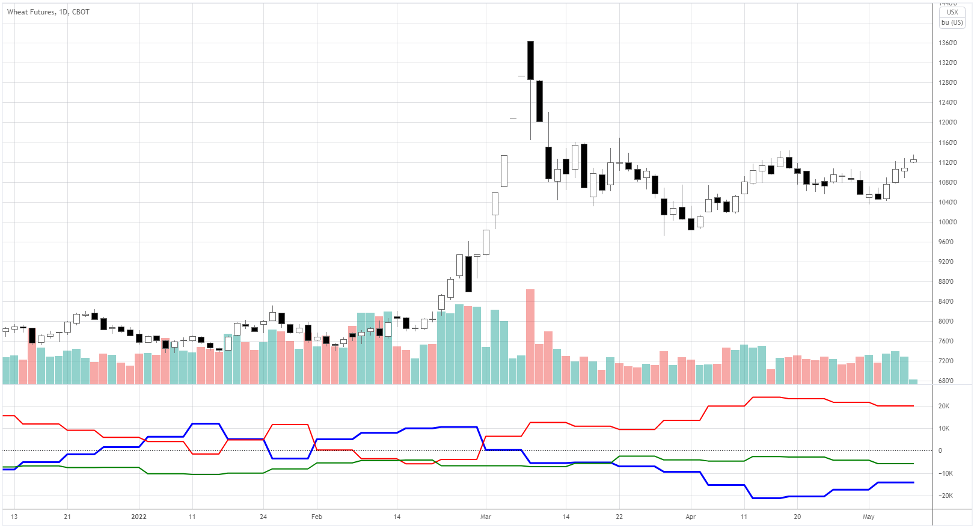

Consider the chart of wheat futures below.

The bars at the bottom of the main chart show the daily volume, that’s helpful in signal validation.

Notice that the volume was the highest at the market top in March.

The Commitments of Traders (COT) reports also gives insights into what other traders are doing.

The blue line of the indicator window shows the net positioning of commercial hedgers – those “farmers” we talked about earlier.

The red and green lines represent large and small speculators, respectively.

The most powerful signals come up when the blue line crosses the red one around 0.

Such a crossover happened on March 1st.

Look at that rally afterward!

Finally, futures are well-regulated, and the risk of any sort of fraud is amongst the lowest

Why trade forex and CFDs

CFDs and spot forex are mainly popular due to lower margin requirements, higher leverage, and less rigid lot sizes.

Although CME recently launched micro contracts addressing the lot size issue.

In some cases, you’ll get a better entry price with CFD than futures on the same underlying.

It depends on the broker, though.

Time and CFDs on futures

If you’re trading CFDs on futures, be careful with the charts your broker provides.

Usually, CFD charts show regular hours along with the electronic ones; the time will also be shown according to the broker’s location.

The point is it’s easy to forget about the relevance of prices at specific times, ending up trading during electronic hours.

Cryptocurrency futures: what’s the point?

There are futures on cryptos too!

If you’re into digital assets, here are three reasons to look into futures.

1. Short that coin!

Cryptos don’t always go up, sometimes for a while.

In bear markets, you would need futures to short digital assets.

2. Leverage

Established coins like Bitcoin or Ethereum aren’t likely to move over 50% within weeks anymore.

To make meaningful returns on a few percent change dollar-wise, you need bigger capital.

If you’re an active trader and cannot afford freezing tens of thousands of dollars in a coin, leverage is a solution.

3. Worry-free staking

In the decentralised world, you can make passive income in three ways: mining, staking, and yield farming.

Does the last one remind you of anything 😊?

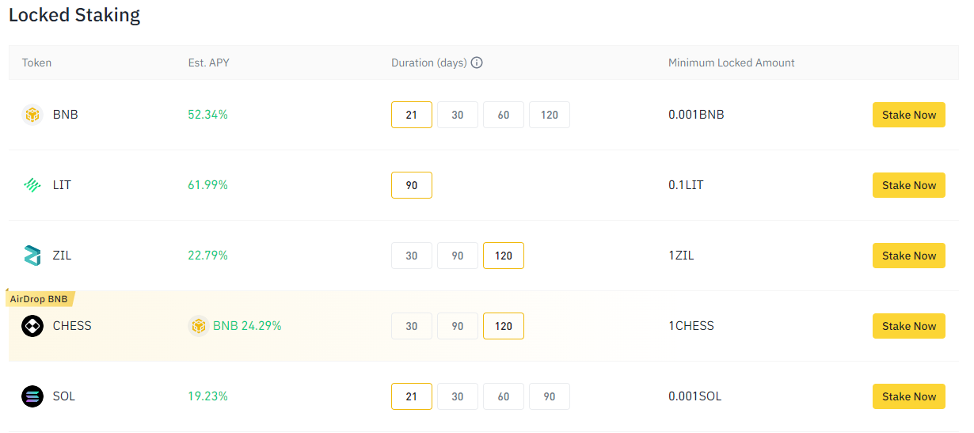

Look at those yields!

Suppose you want to stake BNB for the highest APY; that’s (52.34%/365) *21=3.01% in just 21 days.

However, like commodities, cryptos expose an investor to volatility risks.

Best believe the volatility in cryptos can be nasty!

The weekly BNB chart above shows a 46.07 USD average weekly change (see the indicator window).

With current prices, that translates into around 14% volatility.

So, it’s gambling to expect to make a 3% return in three weeks, while every week can shed 14% value of the investment.

Pro tip: You can short BNBPERP (“perpetual BNB futures”) of the same volume as your investment once you start staking.

After 21 days, cover your short position.

You might very likely end up in profit, even if you happen to stake when the market is crashing.

Final words

Since long ago, futures have helped investors to eliminate market risks and make profits from volatility.

Today the entry barrier to start trading futures is incredibly low.

It is important to note that the ease to start trading doesn’t cross out the leverage-associated risks.

Whether corn or digital money, futures are an incredible tool if used correctly.

Happy Trading,

Atanas (a.k.a. Colibri Trader)

P.S.

Did you know that the🦋 Butterfly Futures Strategy is one of the most popular strategies that reaps consistent profits for futures traders if used correctly.

P.S.

Why are some traders making 10 times or even 20 times more money than others? Learn how to use and apply Smart Money Levels in your trading. Want to skip the details and get the FULL SMART MONEY COURSE? OK, here is the real deal and it comes with a 14-day money back guarantee. Didn’t improve your trading results, don’t pay for it and keep the trading materials 😲 How’s that for fair?