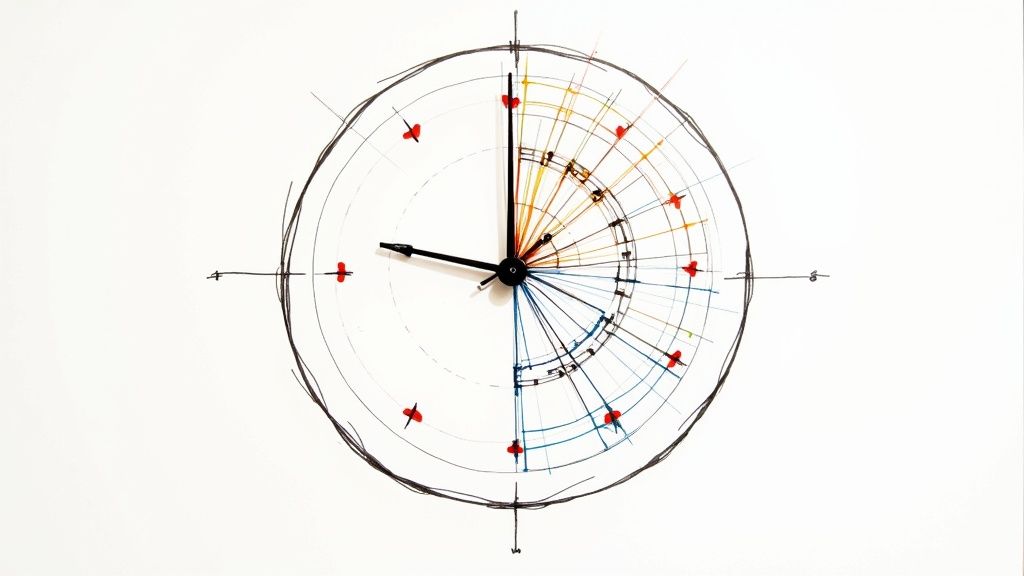

Forex Market Trading Hours: The Essential Guide for Global Trading Success

The Reality of 24-Hour Forex Trading

Many people are drawn to forex trading because the market operates 24 hours a day, five days a week. While this schedule does allow traders worldwide to participate at any time, the reality is more nuanced – not every hour offers the same trading opportunities. Understanding how trading activity ebbs and flows throughout the day is essential for success in the forex market.

The Myth of Constant Action

Though the forex market never sleeps during the trading week, activity levels vary significantly throughout the day. Trading volume rises and falls as different financial centers open and close around the globe. For example, when Asian markets like Tokyo, Sydney, and Hong Kong begin their trading day, certain currency pairs become more active. However, even during peak Asian hours, overall market movement tends to be more subdued compared to European and U.S. sessions.

Many new traders learn this lesson the hard way – they assume they can trade profitably at any hour. The truth is that during quiet periods, wider spreads and reduced liquidity can eat into potential profits. That's why timing your trades to match active market hours is so important.

The Importance of Session Overlaps

The most dynamic trading often happens when major market sessions overlap. The period when European and North American markets are both open is especially active, as two of the world's largest financial centers operate simultaneously. During these hours, major economic news from both regions can trigger sharp price movements in currency pairs. For example, when U.S. employment numbers are released while European markets are still open, the impact on EUR/USD and other pairs can be significant.

Navigating Quiet Periods

The time between New York's close and Asia's open is notably slower. During these quieter hours, reduced trading volume can lead to erratic price moves and make it harder to execute trades efficiently. Smart traders often adapt by scaling back their activity or sitting out entirely during the slowest periods. Many use platforms like TradingView to monitor market conditions and plan their trades for busier sessions. This selective approach helps protect trading capital and reflects the reality that success in forex requires picking your moments carefully, not trading around the clock.

Practical Implications for Traders

To trade effectively in the 24-hour forex market, you need to align your strategy with natural market rhythms. Study historical data to find the hours when your preferred currency pairs are most active. Consider how public holidays and market closures might affect trading conditions. Whether you focus on short-term moves during busy overlap periods or take longer-term positions, your trading schedule should match market conditions. By respecting these natural cycles rather than fighting them, you'll be better positioned for consistent results in forex trading.

Mastering Major Trading Sessions

Despite being open 24 hours a day, 5 days a week, the forex market shows distinct patterns of activity tied to major financial centers worldwide. Trading volumes and price movements cluster around three main sessions – Asian, European, and North American – each with its own unique rhythm and characteristics that savvy traders can use to their advantage.

The Asian Session

The trading day begins in Asia, with Tokyo leading the way alongside Sydney, Hong Kong, and Singapore. This session sets up the day's initial market movements with steady but measured trading. While generally calmer than other sessions, currency pairs like AUD/JPY and NZD/JPY often see more significant price swings during Asian hours. Traders working with these pairs should watch this session closely to spot potential opportunities.

The European Session

When London opens, market activity picks up considerably as the European session gets underway. This period brings some of the day's highest trading volumes, especially for pairs involving the Euro and British Pound. Price movements tend to be swift and decisive during London hours, often establishing trends that continue throughout the day. The European session typically generates a large portion of the total daily forex trading activity.

The North American Session

As New York begins trading while London is still open, we enter the most active period of the forex day. This overlap creates ideal conditions for short-term traders as two major financial hubs operate simultaneously. Market-moving economic news from both regions frequently hits during this window, creating sharp price movements especially in USD pairs. Many day traders focus on this session for its consistent stream of trading opportunities.

Understanding Session Characteristics for Effective Trading

The key to success lies in matching your trading approach to each session's specific traits. If you trade EUR/USD, you might concentrate on the European-American overlap for the best opportunities. Those focusing on Asian currencies often find better results during the Asian session.

To make the most of each trading session, keep these factors in mind:

- Currency Pair Activity: Each pair shows distinct patterns during different sessions. Study historical data to find the best trading windows for your preferred currencies.

- Volatility Levels: Risk management needs change with market conditions. Consider smaller positions during highly volatile periods. Colibri Trader offers guidance on managing risk in different market conditions.

- Trading Style: Your strategy should fit the session. Quick scalps work well during busy overlaps, while longer-term trades might suit quieter periods. Colibri Trader helps traders develop strategies that match their style and schedule.

- Economic Calendar: Track major economic releases and their timing. These events often trigger significant market moves. Use platforms like TradingView to monitor news and analyze its market impact.

By learning the unique qualities of each trading session and adjusting your approach accordingly, you can find better trading opportunities in the forex market. Colibri Trader provides the tools and knowledge you need to create an effective session-based trading plan that fits your goals.

The Power of Session Overlaps

The forex market's 24/5 schedule creates natural ebbs and flows as major financial hubs open and close throughout the day. The most active trading happens during key overlaps when multiple markets operate simultaneously. These windows offer unique opportunities through increased trading volume, price movement, and market depth. Let's explore how traders can make the most of these dynamic periods.

Why Session Overlaps Matter

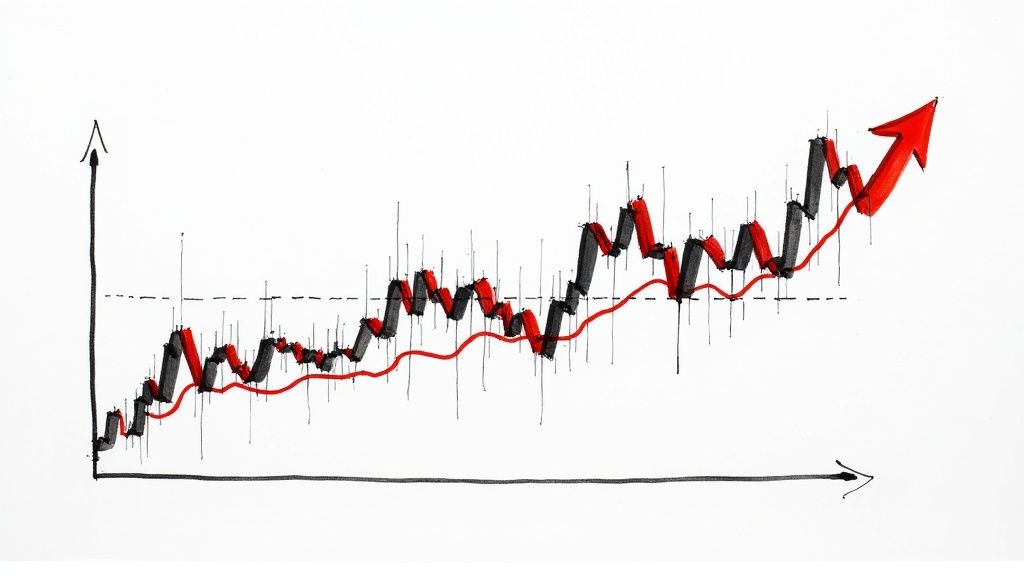

When major financial centers like London and New York are both active, market activity intensifies significantly. The European-North American overlap (1 PM to 4 PM GMT) is particularly important since it brings together two powerhouse markets. During these hours, trading volume swells and prices often move with greater speed and force. The release of key economic data from either region can spark sharp price movements in currency pairs, especially those involving the US dollar. For example, when US employment numbers come out during the overlap, EUR/USD and GBP/USD pairs frequently see dramatic swings.

Riding the Volatility Wave

Price swings during overlaps can seem intimidating, but they also create prime conditions for skilled traders. Many professionals use technical analysis platforms like TradingView to spot potential trade setups ahead of these busy periods. By studying price patterns, support/resistance levels, and other indicators, they aim to profit from the increased market movement while keeping risks in check.

Strategies for Session Overlaps: Aggressive vs. Conservative

Different traders tackle overlaps in distinct ways based on their goals and risk tolerance. Quick-moving scalpers try to capture many small profits from rapid price changes, often using tight stops to limit potential losses. On the other hand, position traders might use the extra liquidity during overlaps to enter longer-term trades at better prices, focusing on established trends rather than short-term swings. Colibri Trader offers guidance on developing overlap trading approaches that match your personal trading style and comfort with risk.

Managing Risk During Overlaps

Success during overlaps requires careful attention to risk management since price moves can be sharp and sudden. Smart position sizing becomes even more critical – many traders reduce their normal trade size to account for wider price swings. Using appropriate stop losses is essential, and some traders employ trailing stops that move with profitable trades to protect gains. For instance, if the EUR/USD moves strongly in your favor during the London-New York overlap, a trailing stop can help lock in profits while still giving the trade room to run. Understanding how to adjust your risk controls for overlap conditions is key to trading these periods effectively.

Navigating Quiet Market Periods

The forex market runs 24 hours a day, 5 days a week – but activity levels vary significantly throughout each trading day. While some periods see intense trading and price movement, others are notably quiet. Let's explore how to handle those slower periods between the New York close and Asian open.

Understanding Low-Volume Trading

Trading during off-peak hours comes with unique challenges. When fewer traders are active, liquidity drops and spreads widen. For instance, a currency pair that normally trades with a 1-pip spread might jump to 3 pips or more during quiet periods. These increased costs can quickly eat into profits, especially for traders making frequent small trades. The reduced liquidity also means your orders may fill at prices different from what you expected – a problem known as slippage that adds extra risk to your trades.

Identifying False Breakouts and Erratic Moves

When trading volume drops, price movements become less reliable indicators of true market direction. You'll often see false breakouts where prices briefly cross important support or resistance levels before quickly reversing. These fake signals can trap unwary traders into losing positions. The thin market conditions mean even small orders can push prices around more than usual, creating choppy price action that doesn't reflect real buying and selling pressure.

Strategies for Quiet Periods: Patience and Prudence

Trading quiet periods effectively requires adjusting your approach. Many experienced traders simply sit out the slowest hours, protecting their capital instead of forcing trades in poor conditions. If you do choose to trade, consider scaling back your position sizes to limit potential losses from adverse moves. Focusing on longer-term trades rather than quick scalps can also help – this lets you ride out short-term price swings while waiting for your broader market view to play out.

Colibri Trader: Your Guide to Navigating All Market Conditions

Success in any market environment starts with understanding price action and the forces of supply and demand. Colibri Trader provides detailed education through its Ultimate Supply and Demand Course and Price Action Method, teaching traders to spot quality setups across different market conditions. The platform emphasizes developing strong discipline and emotional control – skills that become especially important during challenging low-volume periods. With the right knowledge and mindset, you can learn to trade effectively in both busy and quiet market conditions.

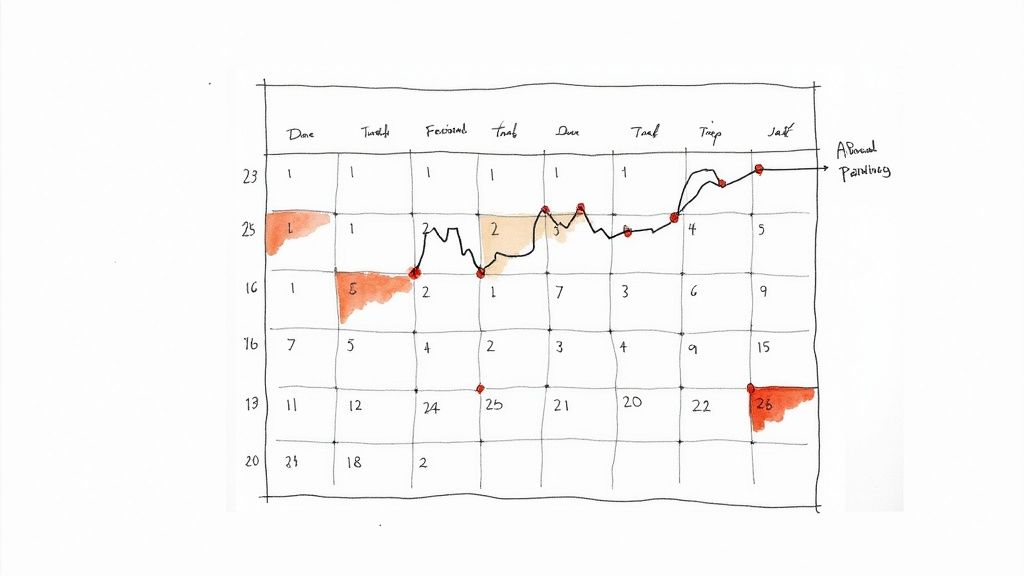

Building Your Session-Based Trading Plan

The 24-hour forex market doesn't require constant monitoring – it needs a focused approach. Smart traders select specific market sessions that align with their strategy and lifestyle rather than trying to trade around the clock. By creating a structured plan around key trading windows, you can maximize opportunities while maintaining balance. Let's explore how to build a trading schedule that works for you.

Aligning Your Strategy with Market Sessions

Start by matching your trading style and preferred currency pairs to the most suitable market sessions. For instance, if you primarily trade EUR/USD as a day trader, you'll find the most action during the European-North American overlap from 1 PM to 4 PM GMT when volume and price movement peak. On the other hand, AUD/JPY traders should focus on the Asian session. By targeting the right hours, you avoid dead markets and find better trading setups.

Creating a Sustainable Trading Routine

While market timing matters, your personal schedule and energy levels are just as important. Trading demands sharp focus – trying to trade when you're tired leads to mistakes. Build your trading day around when you perform best, even if that means missing certain session overlaps.

Some traders naturally work better at night and might choose to trade the Asian session, regardless of their preferred pairs. Others who are early risers could take advantage of the European open. The key is finding your optimal schedule rather than forcing yourself to trade at inconvenient times. Colibri Trader provides guidance to help traders develop plans suited to their individual needs.

Sample Session-Based Schedules

Here are two example schedules to consider:

Schedule 1: London-New York Overlap Focus

- 9 AM – 1 PM GMT: Market analysis, news review, trade preparation using tools like TradingView

- 1 PM – 4 PM GMT: Active trading during the London-New York overlap

- 4 PM – 5 PM GMT: Review trades, adjust strategy, plan for the next day

Schedule 2: Asian Session Focus

- 10 PM – 12 AM GMT: Monitor market opening, assess early trends

- 12 AM – 4 AM GMT: Active trading during peak Asian session hours

- 4 AM – 6 AM GMT: Review performance, prepare for potential European session trades or end trading day

Remember these are just examples – your ideal schedule should reflect your preferences, trading approach, and target currency pairs.

Balancing Trading with Life

Successful trading requires more than just market knowledge – it needs balance. While forex markets run 24/7, you shouldn't. Make time for breaks, exercise, family and friends. Mental fatigue can hurt your trading results. Colibri Trader emphasizes both technical skills and maintaining the psychological discipline needed for consistent performance. By creating a trading plan that respects both market opportunities and your personal needs, you build a foundation for lasting success in forex trading.

Advanced Session Trading Strategies

Now that we have covered the basics of forex market hours and session patterns, let's explore specific trading approaches that can help you make the most of each market session. Understanding both market timing and underlying price drivers is key to developing effective strategies.

Understanding Bank and Institution Activity

Major banks and financial institutions have a strong influence on price movements during their local trading hours. During the London session, European banks actively trade and rebalance their positions. Similarly, American institutions dominate the New York session. This creates distinct price patterns – for example, when European banks open their trading day, their activity often leads to clear directional moves in Euro pairs. By tracking these institutional patterns, traders can spot high-probability setups during specific sessions.

Timing Trades with Economic News

A good economic calendar is essential for session trading success. Key data releases like interest rate decisions and employment numbers create reliable market volatility. Different types of news have predictable effects – a strong US jobs report typically strengthens the dollar against other currencies during New York hours. Being selective about which news events to trade and having clear entry/exit rules helps capture these moves effectively. The key is understanding both the timing and likely market reaction to different types of economic releases.

Adjusting Position Size By Session

Smart position sizing is crucial as volatility changes throughout the day. The calmer Asian session often has steadier prices and tighter spreads, potentially allowing larger positions while keeping risk in check. When sessions overlap, especially London-New York, wider price swings mean smaller positions are safer. Rather than using fixed lot sizes, think in terms of percentage risk per trade. This helps maintain consistent risk levels despite changing market conditions between sessions.

Building Session-Specific Trading Plans

Creating strategies for different sessions requires blending market timing knowledge with your personal trading style and preferred currency pairs. A scalper might focus on the busy London-New York crossover, using quick technical signals to capture small moves in EUR/USD within minutes. A swing trader could instead trade AUD/JPY during Asian hours, holding positions for days to catch bigger trends. The key is tracking your results – win rate, average gains/losses, maximum drawdown – to identify what works best in each session. Regular review helps refine your approach over time. Colibri Trader provides the tools and guidance to develop and test session-based strategies that match your goals and risk tolerance.

Ready to improve your trading with better market timing? Take the Colibri Trader Trading Potential Quiz to see how our personal coaching can help you succeed. We offer detailed training, expert guidance, and a helpful trading community to support your forex trading journey.