Essential Day Trading Strategies- Pros and Cons of Day Trading

Essential Day Trading Strategies- Pros and Cons of Day Trading

So what are day trading strategies and why am I writing about them…

Possibly, the majority of traders will be familiar with day trading.

Some of you will be day traders and a lot of this article’s readers will be just looking to start using one or another day trading strategy.

But for the majority of beginners, day trading will be a term that needs explaining and further definitions.

The aim of this article is to familiarise the beginners with day trading, while proposing an alternative view to the day trading to the more advanced traders.

>>DOWNLOAD 5 LESS-KNOWN FUTURES TRADING STRATEGIES<<

Contents in this article

Am I Day Trading Or Not?

Am I a 100% long-term trader?

NO!

Why is that?

I have started my professional trading career as a day trader in one of the leading prop trading companies in London almost 10 years ago.

Having said that, it would be a lie if I said I am a 100% long-term trader.

I do use a mix of trading styles, but still contribute the majority of my equity to long-term trading.

I do only use about 20% of my overall trading capital for day trading.

In the best trading years, only 20% capital did manage to return as much as I made from my long-term trading strategies.

This does not mean that every year is the same. In fact, there are not two years the same.

Important: That is why I believe that a mix of trading styles can benefit your trading results, too!

It is important to stick to what works for you.

Beware that day trading strategies are the most difficult of all other strategies and hence hold the record for the biggest failure rate amongst traders.

I read somewhere that 95% of day traders are losing money day trading, but in my opinion this figure is probably even higher.

I just want to prepare you to have realistic expectations before anything else.

If you are interested, please proceed to learn more about day trading or if you are somehow experienced, check out the exact way I day trade HERE.

The Essentials of Day Trading

So, what is day trading?

In a nutshell, that is trading that takes place in the same day.

Day traders that are using day trading strategies are opening and closing their positions within one working day.

What would be a day trading strategy without a decision quickly taken…

Hence, requirements for day trading are T.T.R.A.Q.:

(T) Trading Plan

(T) Trading Strategy

(R) Rigorous Money Management Plan

(A) Advanced Trading Skills

(Q) Quick Decision Making but well-thought out B Plan in case the market turns against you

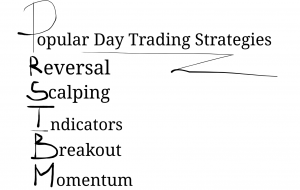

Popular Day Trading Strategies

There are as many day trading strategies as there are traders.

For the sake of simplicity, I will group them in a 5 major categories.

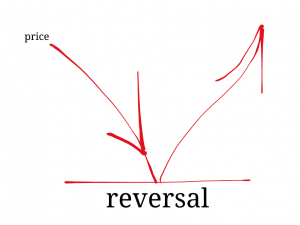

A) Reversal

This a trading strategy that incorporates an element of contrary thinking in itself.

Contrary to trend-following, a reversal trading strategy is not only a day trading strategy, but an alternative way of thinking.

Traders that utilise a reversal mindset tend to wait for the price to reach a certain level (also called pivot level or point) and go against the general trend expecting that it will reverse.

As enticing, this strategy could be quite dangerous, especially for the inexperienced trader.

I have a few articles on trend-following but depending on the market conditions, reversal strategies could be extremely profitable if used correctly.

B) Scalping

There are various scalping strategies and sometimes the word “scalping” is used interchangeably with “day trading”.

Although not exactly synonymous, both words carry very similar meanings.

Scalping takes place within the same trading day and a trade could last from seconds to a few minutes or a few hours.

It really depends on the:

a) market environment

b) risk profile of the trader

c) how long does it take to hit a stop-loss or target

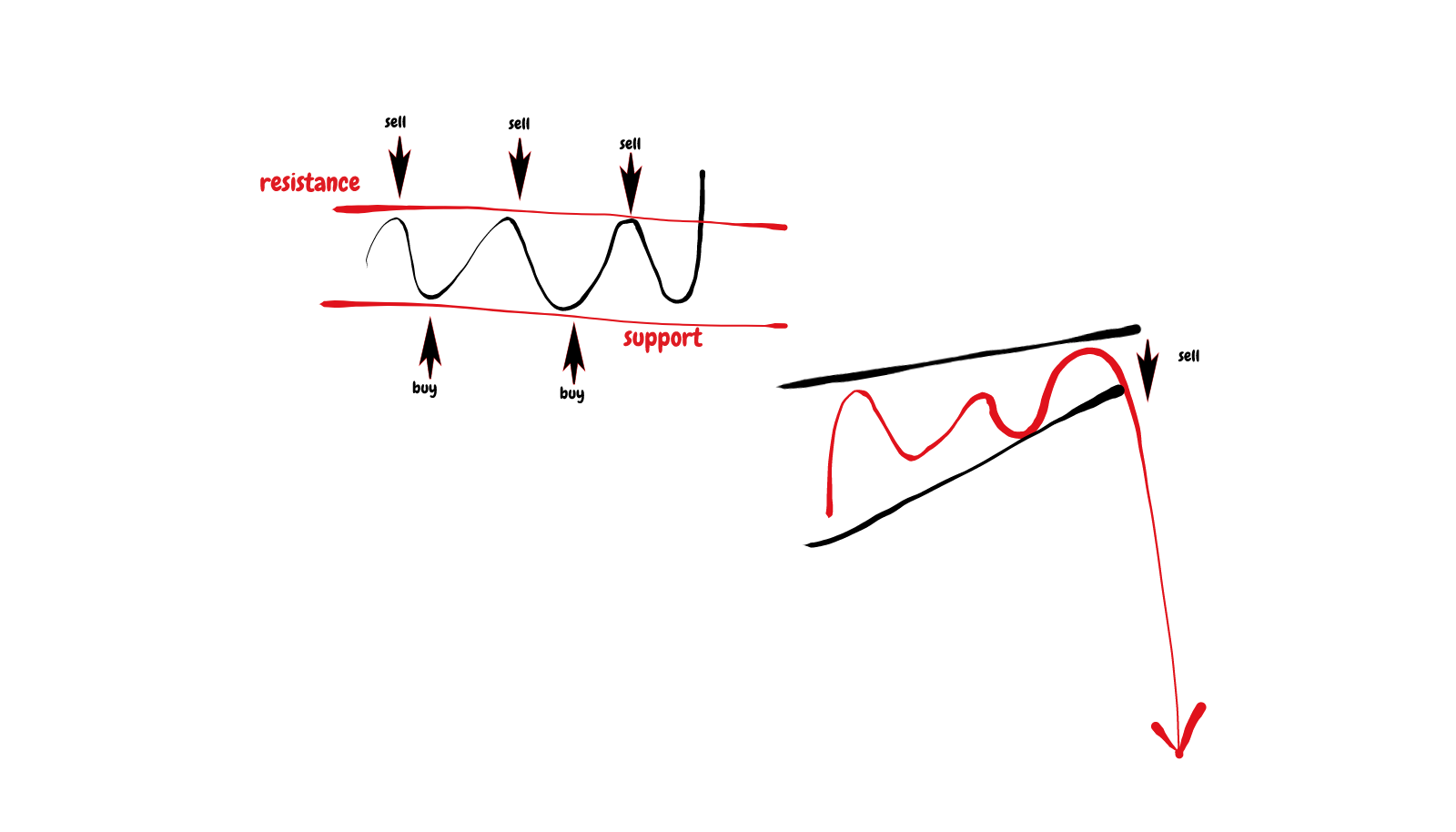

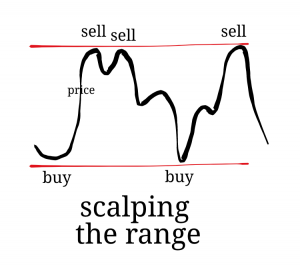

A common scalping strategy in the forex market is scalping the range. The major principle behind this day trading strategy is shown in the image below.

Day traders scalping the range are looking to “buy” the support and “sell” the resistance.

C) Indicators Based

Another popular day trading strategy or a group of strategies is based using trading indicators or oscillators.

Popular day trading indicator-based trading strategies include, but are not limited to:

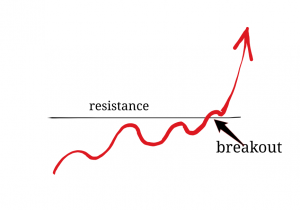

D) Breakouts

Opposite to a reversal day trading strategy, the”breakout” strategy is possibly one of the most popular day trading strategy.

Unfortunately, or maybe fortunately, in the world of trading “popular” does not equate “profitable”.

Therefore, although popular I cannot say that trading breakouts is the most profitable day trading strategy amongst traders.

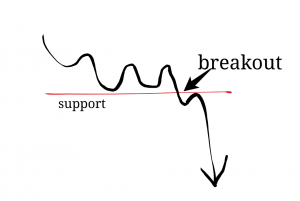

In a nutshell, a breakout strategy means buying when you expect that the price will go higher and selling when you expect the price will go lower.

“The breakout” occurs at pivot levels such as support and resistance. Here is a short illustration of a bullish breakout:

And here is another illustration of a bearish breakout:

E) Momentum

This day trading strategy is usually utilised by day traders trading with stocks.

It incorporates “volume” and usually buys in an uptrend when there is an increase in the volume corresponding to the same trading session.

On the other side, day traders are selling when there is a downtrend and an increase in volume.

It could be a profitable way to day trade the market, but like any other day trading strategy, one needs to be very experienced with it and have traded in that way for possibly quite a few years.

In the screenshot from IBM daily share below, you can see an increase of volume and the price “jumping” higher at those places:

Day Trading vs. Long-Term Trading

It is a long-standing debate and one that is somehow elusive to the amateur trader.

Should you use a day trading strategy or take a long-term trading approach?

What strategy will make you the most profits in the shortest possible timeframe?

No wonder so many traders are rushing into day trading without realising that this is possibly the hardest of all trading styles and requires the most trading skills.

No wonder that statistics show that day trading strategies and day trading is one of the worst performing styles in this field.

Is it the style or the lack of experience and a profitable trading system to follow.

IMHO, day trading strategies requires the highest amount of screen time in order to be successful or a very experienced mentor who has a very high number of trading hours.

Day trading is hard.

This type of trading could be extremely rewarding, but don’t forget that about 95% of day traders lose in the long-term.

Pros of Day Trading

The proponents of this trading style are claiming that they can make a lot more money a lot quicker than any other trading style.

I do agree and disagree with this statement.

I do disagree because I know more people losing money and claiming that they made fortunes by using day trading strategies than I know good risk-managers.

On the other side, I do agree that if you are disciplined and experienced enough you can make more money by using a day trading strategy than waiting for a certain long-term trading opportunity.

If you knew what you were doing, you could use this time and make money on the smaller timeframes.

Unfortunately, we humans are not very reasonable and fall in the most common day trading traps that other beginner traders fall into, as well.

If you knew how to manage those situations you could be doing pretty well with when using a day trading strategy.

Cons of Day Trading

For a lot of long-term traders, day trading is just a waste of time.

And they could be right, especially if we consider the fact that the majority of day traders are losing money.

It is harder for a day trader to be disciplined because of the short time interval that a lot of important trading decisions need to be taken.

For day trading money management and risk management should be the leading factors in use.

Unfortunately, I have almost not met a day trader who puts those two traits before making money quick when talking about day trading.

The amount of risk taken per trade when using a day trading strategy should be even smaller than when utilising a long-term trading strategy.

Alas, this is not the case 95% of the time!

Since you are taking more trading decisions for shorter periods of time, there is a higher chance of making a bad decision.

Hence your risk appetite should be more restrained when day trading.

Popular Instruments to Day Trade With

Some of the most popular instruments to day trade with are:

- Forex.

- CFDs

- Commodities (Gold amongst the most popular)

- Treasuries

You can use day trading strategies with the majority of available financial instruments.

When I was having my first prop trading experience, I was sitting on the desk with a Bund, Bobl and Schatz trader, a Cable trader, an Oil trader, a DAX trader and a Gold trader.

All these traders were trading on the futures markets and they were coming from different walks of life.

The DAX/Eurostoxx trader was the owner of the prop trading company and the head trader.

There was a risk manager who was looking after each trader’s performance and trading his own account, as well.

In this prop trading shop, pretty much the whole universe of trading instruments was covered.

This can give you an idea that day trading could be as variegated as the traders practicing this style.

Can You Use Both Day Trading Strategies and Long-Term Trading Strategies Simultaneously

There are two camps in the trading community.

Camp A believes that sticking to one trading style is the best.

Cam B believes that sticking to a few different styles is better.

I strongly believe that sticking to what works for you is possibly the best decision (meaning combining a day trading strategy with a long-term strategy).

The financial markets offer different periods with different volatility and different market moves.

Sticking to only one trading style might limit your trading opportunities.

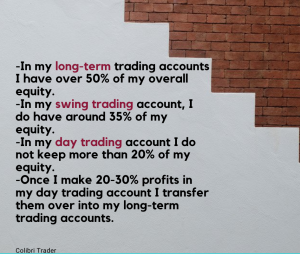

I have a few different trading accounts with different brokers and my funds are divided into them differently.

In my long-term trading accounts I have over 50% of my overall equity.

In my swing trading account, I do have around 35% of my equity.

In my day trading account I do not keep more than 20% of my equity.

Once I make 20-30% profits in my day trading account I transfer them over into my long-term trading accounts.

I keep it as simple as that.

Important: Day trading helps me stay on track and don’t do stupid things in my long-term strategies. Even if I take aggressive trades and they don’t end up in positive territory, they occur in my day trading account, which is only 20% of my overall trading portfolio.

My Favourite Instruments to Day Trade With

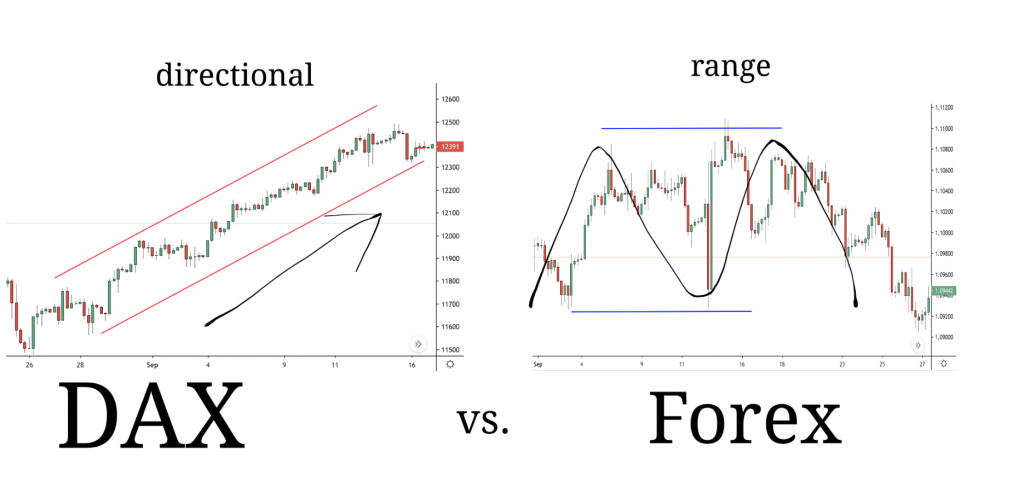

I have tested day trading strategies with major Forex pairs, Gold and DAX.

After a considerable time spent in learning the market structure and the directional bias of the above mentioned markets, I have chosen DAX as my main day trading market.

I believe that with day trading strategies, more than any other trading style, it is of crucial importance to understand the way one instrument behaves and more important- the behaviour of the traders trading them.

After monitoring DAX for many years, I started day trading it.

There are two major reasons for that and they do not exclude the possibility to profitably day trade with other instruments. The reasons are:

- DAX has better delineated directional bias than the other instruments I have compared it with

- I can manage my risk better with DAX and increase my profit potential with the day trading system I am using

If we have a look at the chart below, you will see a striking difference between trading DAX and trading Forex.

Direction!

Yes, that is correct. When you are trading the DAX there is a direction, i.e. it is forming trends more often than Forex pairs do.

That is one of the major reasons why I believe that if you choose a good entry point you will be able to hold onto a trade (if you are disciplined enough) and get a better risk:reward ratios than if you were trading Forex.

This presumes you are using a good day trading strategy.

Easier said than done, you will say!

And you will be absolutely right.

I do not believe in shortcuts in trading.

I do believe in ways to maximise your profits when you are on the right side of the market.

The rest is managing your risk, trying trying to limit your losses and managing your in-born traits of biased behaviour.

My Day Trading Strategy in a Nutshell

Since I have already mentioned about the way I look at different trading instruments above, I believe that I should shed a bit more light on the way I look at trading with DAX.

Possibly other day traders will be interested to learn more about how I approach a new trade and what I am looking for before committing to a trade.

(In case you want to get the full trading strategy, you might check my day trading course page, which walks you step-by-step and shows you the most intricate details of my system in great depth.)

As I mentioned above, in my day trading strategy I am only using one instrument and concentrate all of my energy and trading skills on it.

In this case this is the DAX- the German stock market.

A) Reasons why I like trading with the DAX

As listed above, it is directional.

Check out this chart from yesterday, where it went up over 2% in one day:

Even though trading FOREX could be profitable (so I have heard), being able to maximise your winners by sticking to one direction is an unbeatable way to make profits in today’s markets.

This is in other words- following a mini trend while using a day trading strategy to “squeeze” the most juice out of it.

B) RISK:REWARD

Another feature that mostly only trading with indices (certainly not FX) offers is the great risk:reward ratios that they presents to the day trader.

Important: For a short timeframe such as one day, trading the DAX can sometimes give risk:reward ratios as high as 1:10 or even more!

I have not heard of any Forex day trading strategy, that can give such a great outcome.

If we take the example from above (11 October, 2019) and if I have followed my trading strategy to the dot, one single trade would have led to a return greater than 12 times the risk taken!

Although past performance is not a guarantee for future results or trading strategies do not give the same results in real trading environment, this gives a very strong indication of what sort of results can a day trader get by following this day trading strategy.

C) Conservative in nature

Who said day trading should be aggressive in nature?

Who said that by being conservative you cannot reach better day trading results than being aggressive?

Remember: One thing that I love by using my day trading strategy is that it allows me to be conservative while achieving aggressive results on certain trading days.

For me losing a small amount or making a small amount is the same. I am not after those small losses or small profits.

My day trading strategy does allow me to manage my risk pretty well while having the sporadic huge winner that takes care of all of the losses or winners once it happens.

Using my DAX day trading strategy does help my P/L curve that looks like one of the two below. Guess which one?

Of course this is the right one!

There are a few occasional winners each month that are taking care of my P/L curve.

There might be down months, as well!

What matters when using a day trading strategy on DAX (and anything else) is not to let your emotions “draw” your P/L

Don’t let a few small loses to turn into an avalanche of losses!

The way I trade tries to minimise the exposure to 1% of my equity.

I believe that being conservative and trying to reduce the potential loss (which will inadvertently occur sooner or later) while increasing the profit exponentially is what really does matter.

D) Pay less attention to losers than winners

As long as I am taking care of my risk profile and not risking more than 1% daily, I am not really paying a lot of attention to my losses.

They do happen!

The sooner you accept this, the better!

Instead, I try to spend more time thinking on why certain winners in my day trading strategy have not generated even greater returns.

In other words what would I have done differently to get to better results when I was in a winning trade.

It is almost like best friends.

Why should you spend time on regretting that certain “good friend” has not contacted you for a while and try to contact him/her over and over again when you have already a few very good friends calling you regularly.

Why you should care about someone who does not care about you when you could care more about the people that do care about you!

Answer this question and you already have one inch better day trading strategy than a moment ago.

E) Range trade or breakout

My day trading strategy does not really pay attention if there is a range or a breakout imminent. All it does take into consideration are pivot levels and risk management.

I could make money in ranges and around breakouts.

Here is an example of one of my latest trades using this particular DAX day trading system.

In this trade I made around 65 pips while risking between 7 and 14 pips on the different positions taken.

So, for one of the trades the risk:reward was almost 1:10 and for the other 4 trades was around 1:5

Before taking this trade, there was a range, which turned out to be a breakout!

You should not try to predict anything in trading, since it is just impossible.

F) Targets

This naturally leads us to the last but not the least element of my day trading system- targets.

Sometimes you are missing a humongous trade, while at others you are making sure you are closing a position and taking something home instead of the price reversing and hitting your stop loss.

Day trading has its ups and downs, but always must have targets.

Without targets you are not going to go far.

An important element of my day trading strategy is targets. They are almost as important as having great risk management skills.

Not always I hit my targets, but I am at least making sure that they are there and they are tangible enough and realistic!

There is nothing worse than an unrealistic target!

Conclusion

As with any other trading strategy, a day trading strategy has its pros and cons.

Day trading is possibly the one with the highest number of failed traders and I hope by now you have seen why so many of them are failing. Amongst the major reasons are:

- Lack of emotional control

- Lack of a good trading system

- Lack of good risk management skills

- Lack of the ability to stay in winning trades for longer

- Lack of a longer-term trading strategy to help them diversify the risk

These are just a few of the reasons that I have experienced in my trading career. There are probably as many reasons as there are traders out there.

One thing that strikes me is that even with such a high number of failed day traders, nobody is paying enough attention what should be done to improve those numbers.

Maybe day trading is not for you or you should change features of your day trading strategy.

Maybe you should swap day trading with longer-term trading or just stick to whatever strategy makes money.

Don’t look back in anger- instead try to maximise on those profitable trades that do really matter!

Be passive-aggressive and never risk more than 1% of your equity!

P.S.

If you want to get better at day trading, you can consider my trading program with a private discord channel.

Great knowledge thsnks

Thank you!

Very nice