Dissecting the GBP-related pairs

Dissecting the GBP-related pairs

The past week was pretty quiet due to the US holiday. I was not really active myself and I believe a lot of traders are getting into a Christmas mood. Not trading is one of the options that a lot will consider. This will leave us with lower liquidity and maybe some opportunities to come.

by: Colibri Trader

A lot of attention has been given to dissecting the GBP-related pairs recently. If we were to relate trading to literature, I would say- Brexit was the intro, US election were the main body and now markets are anticipating the “outro”. Is it an outro or we will see just a continuation of the current trends? This is a question I am trying to answer by looking at the market behaviour.

Dissecting the GBP-related pairs

Over the weekend, I did look deeper into the GBP-related pairs. I have spotted a striking resemblance- it seems like they are all headed up north. The pound sterling is getting stronger as we speak. I will try to eave the fundamental reasons aside for now. This article will try to analyse the technicals by looking into a few different GBP-related pairs.

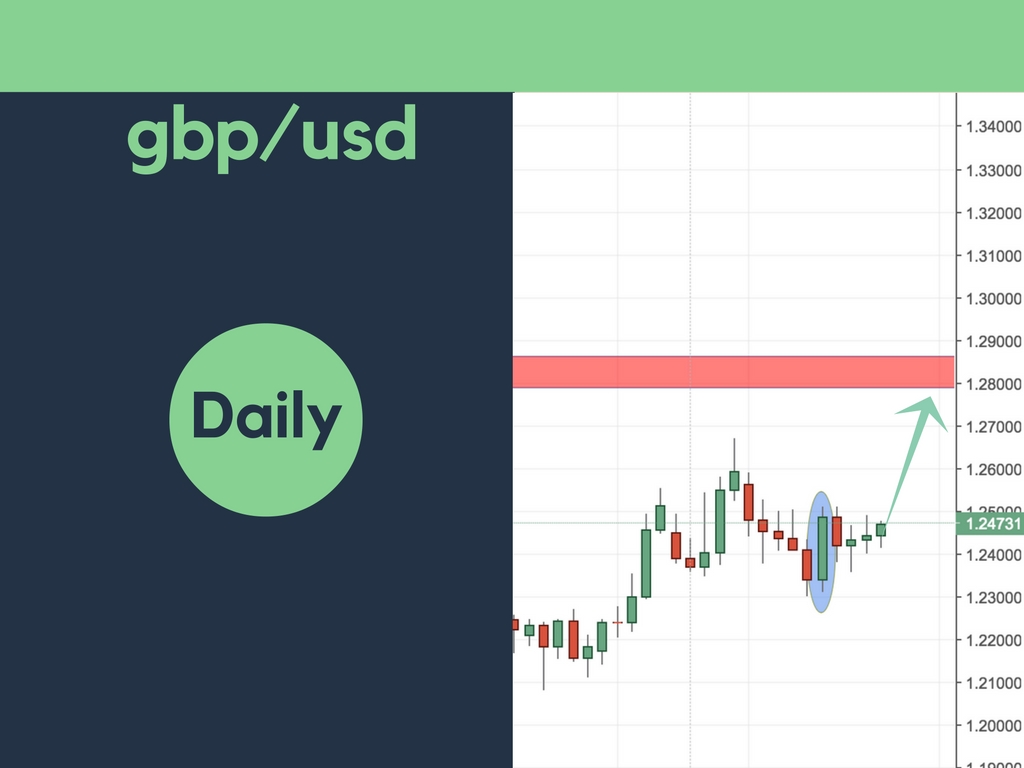

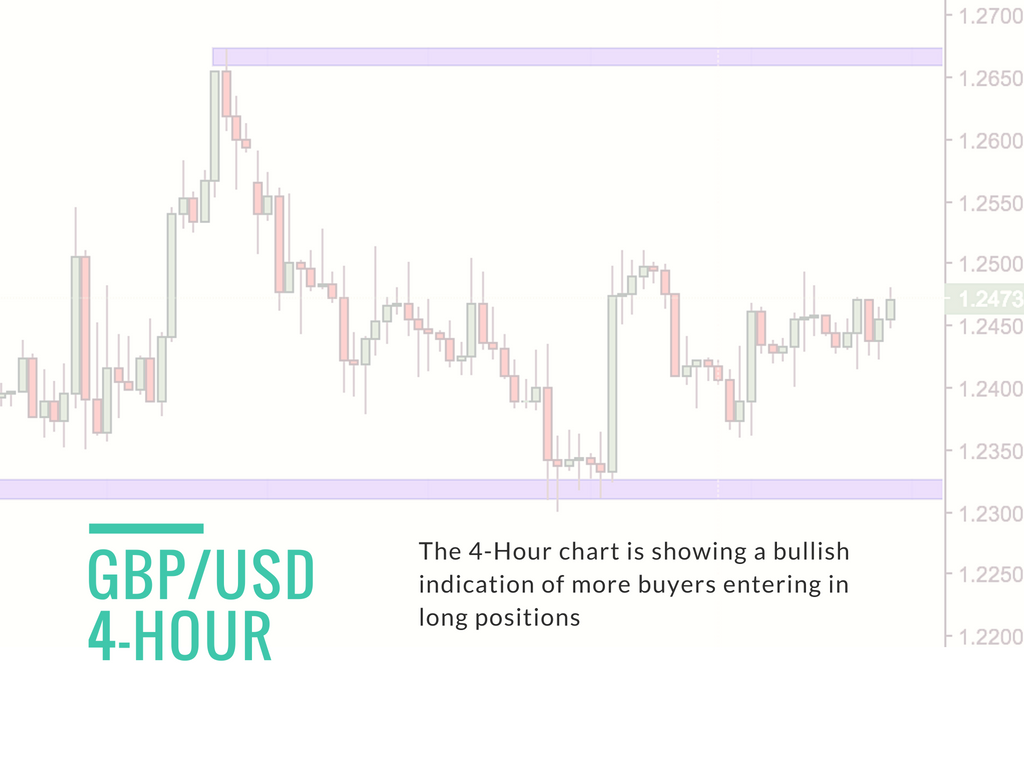

First Pair- GBPUSD

As you can see from the chart above, the GBPUSD is getting ready for a new move to the upside. The next level price target I am looking for is 1.2800. That is where the major resistance stays and also a level that will meet a lot of short sellers. Let’s have a look at the 4-Hour chart below:

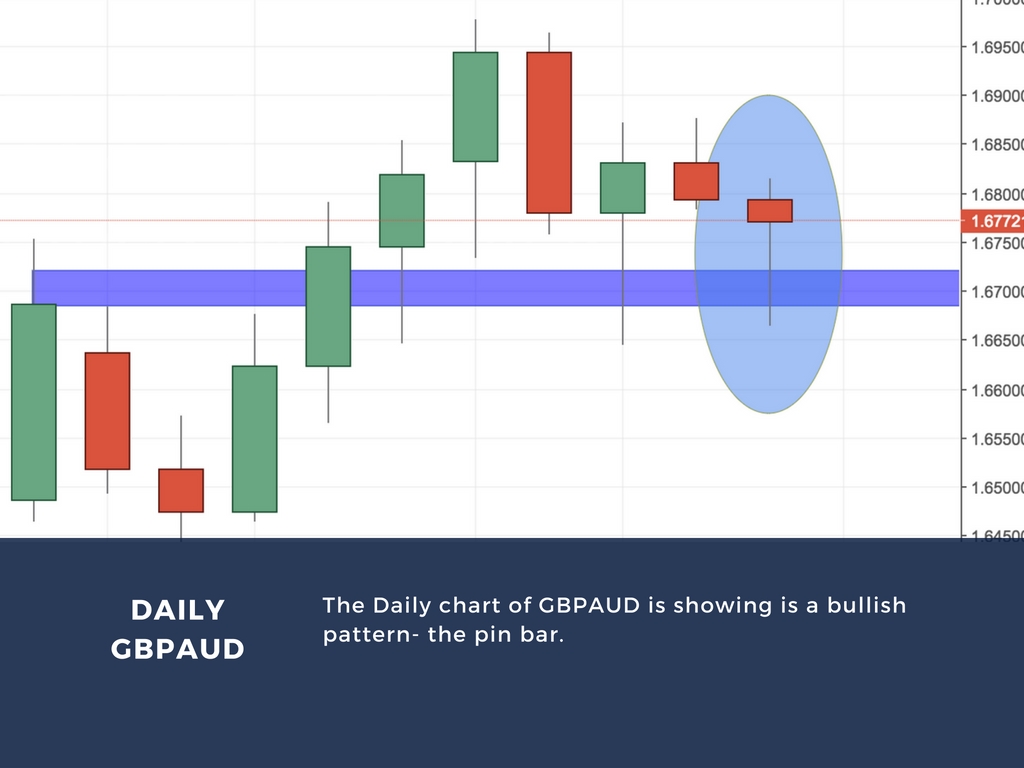

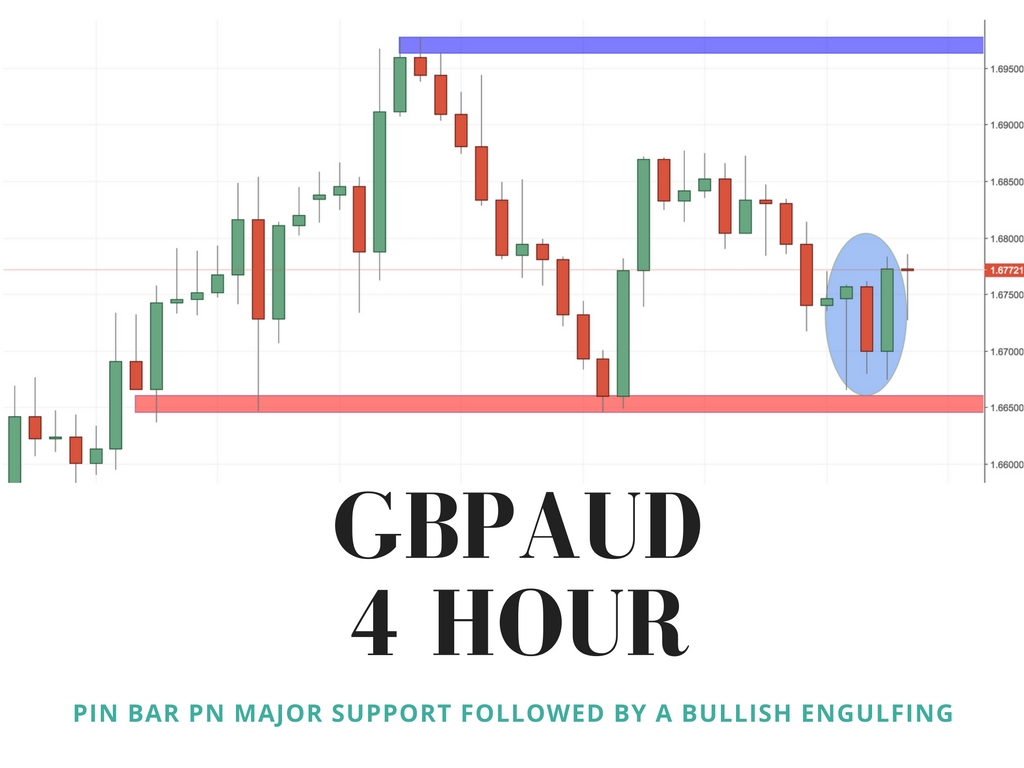

Second Pair- GBPAUD

As you can see, this pair is also exhibiting a bullish patter. The Daily GBPAUD is revealing less and less sellers reflecting in a pin bar candle. My first price target is the level of 1.7000. Let’s have a look at the more detailed 4 Hour chart below:

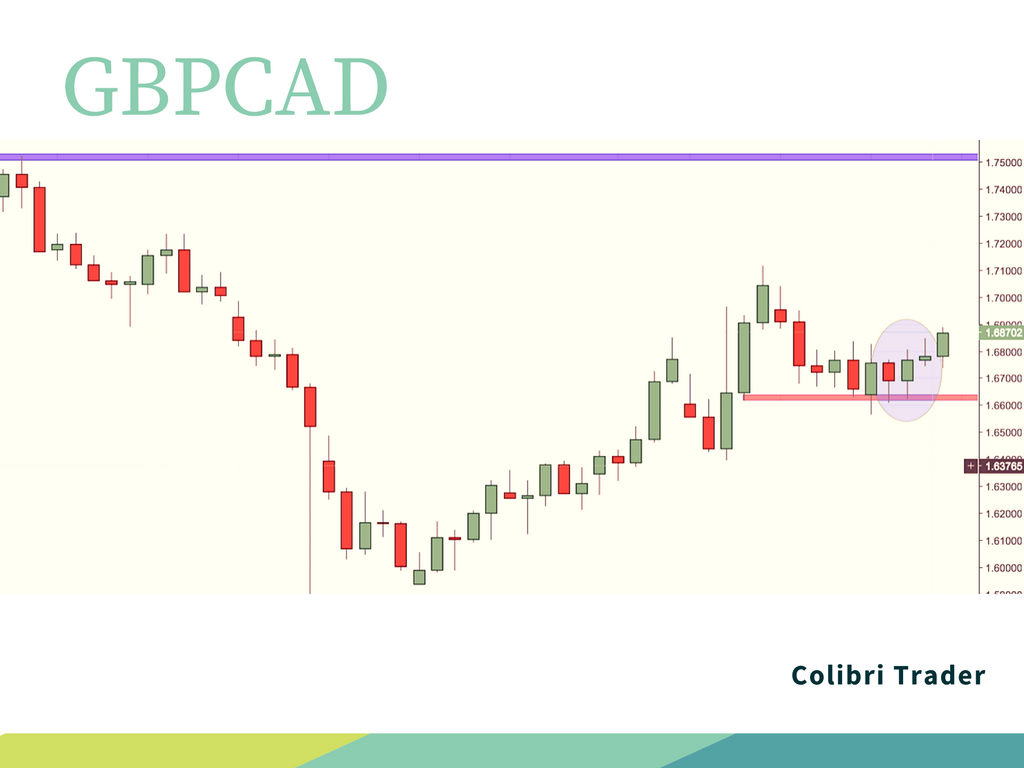

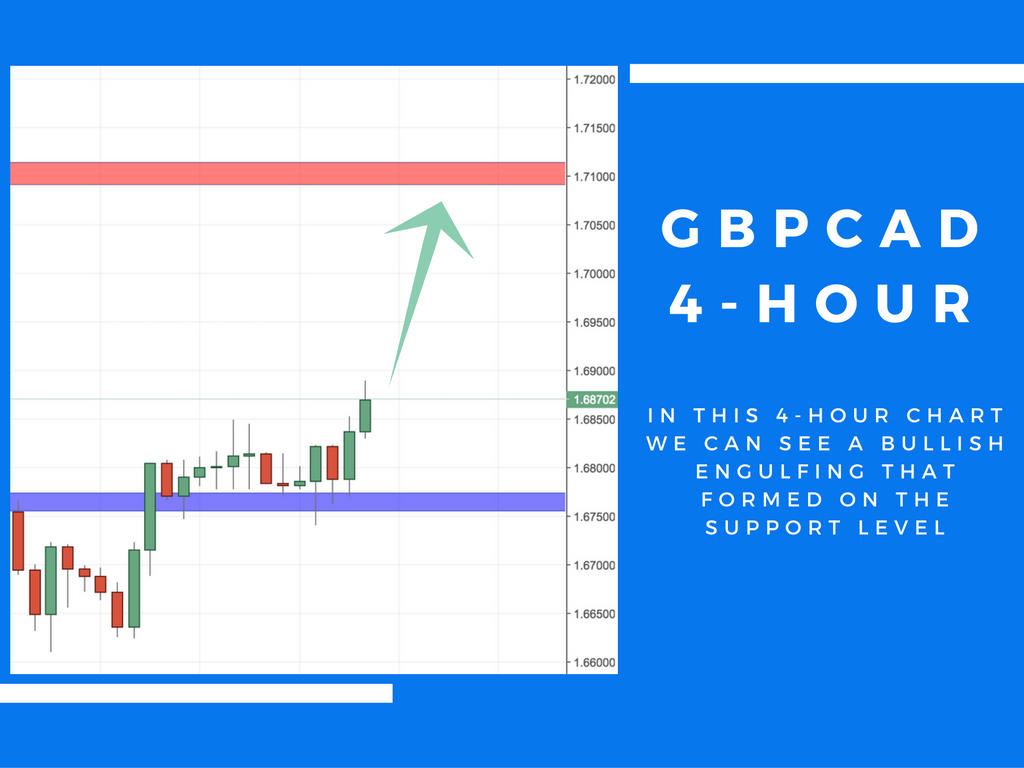

Third Pair- GBPCAD

In this pair, we can see the bullish engulfing pattern that formed a couple of days ago on the Daily chart. It gave way to a lot of new buyers to join the rally. The candlestick pattern appeared just above the 1.6600 support level. Traders are eyeing the 1.7500 as the next resistance area. That is where the first big sellers will be met. Below, I will give a zoomed-in screenshot of the 4-Hour chart of the GBPCAD:

All of these charts are a selection of the pound sterling that is gaining a lot of attention recently. In this article, I have dissected three of the most popular GBP-related pairs that are showing bullish signs. I have covered both the Daily and the 4-Hour charts, confirming my point of view. I have tried to be as objective as possible and delineate the road that those pairs are taking.

Happy Trading,

Colibri Trader