Decoding Retirement Readiness: Expert Perspectives on Your Financial Journey

Key Takeaways from this article:

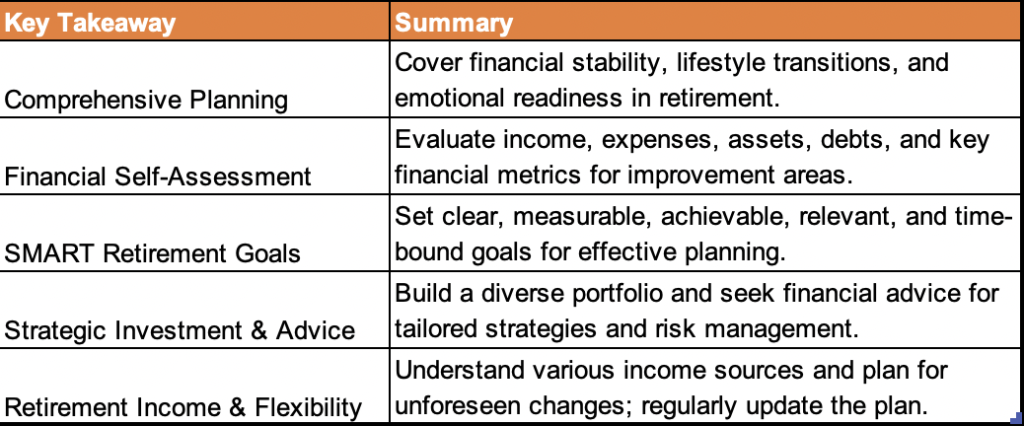

- Comprehensive Retirement Planning: Retirement readiness should cover financial stability, lifestyle transitions, and emotional preparedness, addressing living expenses, personal changes, and purpose.

- Financial Self-Assessment: It’s crucial to evaluate financial status by reviewing income, expenses, assets, and debts. Key metrics like savings rate and net worth help identify areas needing attention.

- SMART Goals for Retirement: Setting clear, measurable, achievable, relevant, and time-bound goals ensures effective retirement planning, aligning with personal objectives and deadlines.

- Strategic Investment and Expert Advice: A balanced, diverse investment portfolio tailored to individual goals is essential. Seeking financial advice helps customize strategies and navigate risks.

- Retirement Income and Flexibility: Understanding various income sources, like 401(k)s and annuities, and planning for unforeseen circumstances are vital. Regularly updating the retirement plan ensures it stays current and effective.

Introduction

The prospect of retirement is an exciting yet daunting milestone for many professionals.

With longer life expectancies, rising costs of living, and fewer company pensions, determining if you are financially prepared to retire has become more complex than ever.

This comprehensive guide aims to decode retirement readiness for you, providing expert insights and actionable strategies to help you effectively navigate your retirement planning journey.

Defining Retirement Readiness

Before assessing your current situation or setting future goals, it’s important to understand what retirement readiness truly means.

Retirement readiness encompasses:

Financial preparation – Having enough savings and income to cover all living costs

Transition planning – Determining timing, lifestyle changes, housing, etc.

Emotional readiness – Ensuring retirement aligns with your identity and purpose

This holistic perspective empowers you to plan confidently.

Now let’s explore how to quantify where you stand today.

Assessing Your Current Financial Situation

Gaining clarity into your current finances is a vital step towards determining retirement readiness.

By comparing your income streams, recurring expenses, assets, debts, and more, you can identify strengths to leverage and weaknesses to shore up when creating your retirement plan.

Gaining this comprehensive view allows you to calculate key metrics like:

Savings rate

Debt-to-income ratio

Net worth

These measures indicate your current retirement readiness and areas needing improvement.

Setting SMART Retirement Goals

Once you have assessed your finances, the next step is defining retirement goals to provide direction for your planning.

Adopting the SMART goal framework is a strategic approach that lays the groundwork for your success in achieving retirement objectives.

Let’s delve into each component of this framework to understand how it can shape a robust and effective retirement plan:

Specific: Clearly Define Each Goal

In the realm of retirement planning, specificity is paramount.

Rather than a vague aspiration like “save more money,” a specific goal would be “contribute $500 per month to my retirement savings account.”

Clarity in defining your objectives provides a roadmap for action.

Measurable: Quantify Goals with Concrete Metrics

Establishing measurable metrics allows for tangible tracking of progress.

Instead of a broad aim such as “reduce expenses,” a measurable goal would be “cut monthly discretionary spending by 15%.”

This way, you have a clear benchmark against which to gauge your success.

Achievable: Ensure Goals Are Realistic

While ambitious goals are admirable, it’s crucial to ensure they are realistically attainable.

Setting achievable goals involves assessing your current financial situation and determining what is feasible.

For instance, if you’re aiming to increase your retirement contributions, consider a percentage that aligns with your income and other financial obligations.

Relevant: Align Goals with Your Vision for Retirement

The relevance of your goals to your overall vision for retirement is a key consideration.

Your objectives should directly contribute to the retirement lifestyle you envision.

If travel is a significant part of your retirement plans, a relevant goal might be “save $10,000 specifically for travel expenses in retirement.”

Time-Bound: Set Target Deadlines for Goals

Time-bound goals are anchored by specific deadlines, adding a sense of urgency and accountability.

Instead of a goal like “pay off debt,” a time-bound goal would be “eliminate $5,000 in credit card debt within the next 12 months.”

This timeframe creates a sense of purpose and a clear endpoint for your efforts.

Embracing the SMART criteria ensures that your retirement goals are not just abstract aspirations but well-defined targets with a roadmap for achievement.

This framework empowers you to take actionable steps, measure progress, and stay on course as you navigate the journey towards a secure and fulfilling retirement.

Revisiting these regularly keeps you accountable and motivated.

Expert Insights on Retirement Planning Strategies

While assessing your current situation and defining goals are important first steps, creating and implementing your retirement plan requires determining the best strategies for your situation.

There is no one-size-fits-all approach to retirement planning.

Seeking input from financial experts can help guide key decisions like:

Appropriate asset allocation

Tax optimization strategies

Managing retirement account withdrawals

Maximizing Social Security benefits

Managing healthcare costs

Estate planning considerations

These examples demonstrate the value of working with a financial advisor.

Their specialized expertise and objectivity can prove invaluable when making complex financial decisions regarding your retirement planning.

Consider consulting an advisor to collaborate on a tailored strategy.

Building a Diversified Investment Portfolio

Building a diversified investment portfolio is a fundamental strategy for the growth and preservation of your retirement savings.

This approach involves strategically allocating your investments across various asset classes, each with its unique risk and return profile.

Let’s explore the significance and components of a diversified investment portfolio in the context of retirement planning:

Growth and Preservation

The primary objective of a diversified portfolio is to strike a balance between growth and preservation.

While seeking opportunities for your retirement savings to grow, diversification also aims to manage risks effectively.

By spreading investments across different asset classes, you aim to mitigate the impact of poor performance in any single investment on your overall portfolio.

Risk Management

Diversification is a risk management strategy.

Different asset classes react differently to economic conditions and market fluctuations.

For example, stocks may offer higher growth potential but come with higher volatility, while bonds tend to be more stable but offer lower returns.

By holding a mix of asset classes, you can offset potential losses in one area with gains in another, reducing the overall risk of your portfolio.

Balancing Your Portfolio

The composition of your portfolio should align with your unique financial circumstances and retirement goals.

Factors such as your risk tolerance, time horizon until retirement, access to other income sources, and anticipated retirement spending needs all play a role in determining the optimal mix of assets.

A financial advisor can provide valuable insights and assist in tailoring your portfolio to meet your specific requirements.

Common Portfolio Components:

A well-diversified portfolio typically includes a mix of the following asset classes:

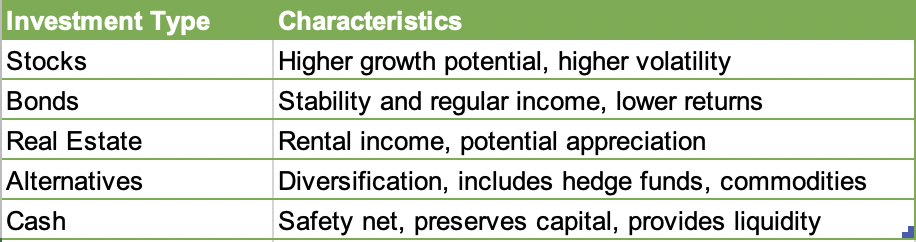

Stocks: Offer higher growth potential but come with higher volatility.

Bonds: Provide stability and regular income but with lower returns compared to stocks.

Real Estate: Investment in properties that can generate rental income and potential appreciation.

Alternatives: Diversify further with investments such as hedge funds or commodities to mitigate risk.

Cash: Acts as a safety net, preserving capital and providing liquidity.

Consulting a Financial Advisor

Given the intricacies of financial markets and the individualized nature of retirement planning, seeking the expertise of a financial advisor is highly beneficial.

An advisor can assess your financial situation, goals, and risk tolerance to design a customized investment portfolio that aligns with your retirement objectives.

In summary, building a diversified investment portfolio is a proactive strategy that aims to optimize returns while managing risk.

Tailoring your portfolio to your unique circumstances, with the guidance of a financial professional, positions you for a more secure and resilient retirement.

Understanding Retirement Income Options

A key aspect of mapping out your retirement plan is identifying potential sources of retirement income and how long they can sustainably last once you exit the workforce.

This involves assessing government benefits, employer-provided pensions, personal savings, earnings from assets, insurance products, and other tools at your disposal.

Common retirement income sources include:

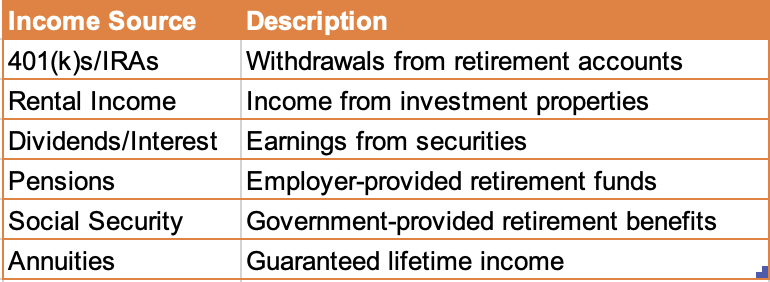

401(k)s/IRAs: Withdrawals

Rental Income: From investment properties

Dividends/Interest: From securities

Pensions: If offered from your employer

Social Security: Government benefits

Annuities: Provide guaranteed income for life

Understanding timelines and taxation implications around accessing each income stream allows you to effectively coordinate the optimal retirement income distribution strategy.

Addressing Lifestyle and Healthcare Costs

Financial security in retirement depends not only on your income sources but also on anticipated spending needs.

Rising costs associated with lifestyle preferences and healthcare can quickly erode your nest egg if not properly accounted for.

Some key considerations include:

Desired travel and leisure activities

Potential long-term care needs

Inflation impacts over a 30+ year time horizon

Medicare premiums and out-of-pocket medical expenses

Developing an estimated retirement budget helps quantify potential costs.

From there you can assess if your income streams can sustainably support your lifestyle.

Planning for the Unexpected

Even the most carefully constructed financial plans can go awry when faced with unforeseen challenges.

This is why contingency planning is an important component of retirement readiness.

It is prudent to prepare for situations like:

Emerging medical issues

Family emergencies

Longer life expectancy

Having an emergency fund, insurance coverage, flexible withdrawal strategies, and other backstops provides peace of mind.

Working through contingency plans with your financial advisor ensures you are prepared.

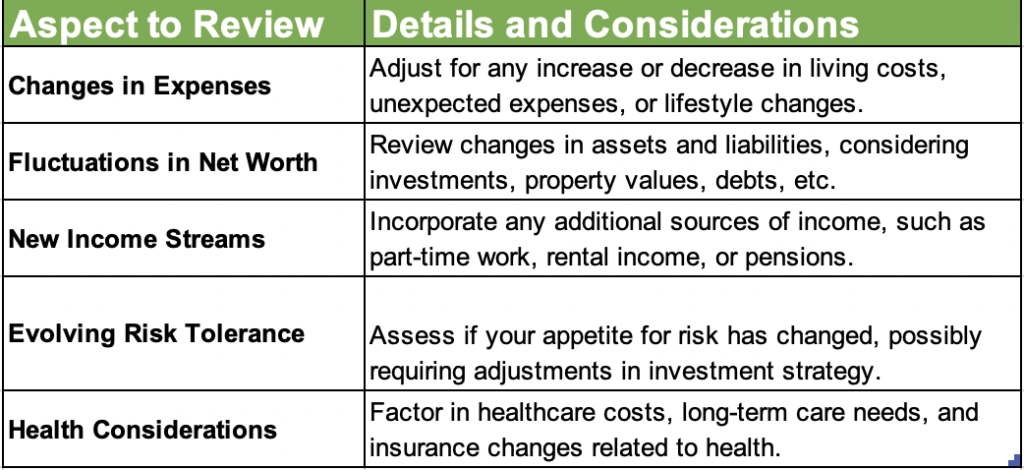

Reviewing and Adjusting Your Plan

Retirement planning does not end once you develop your initial strategies and goals.

As life evolves and market conditions change, so too should your plan.

Revisit your retirement plan at least annually, if not more regularly, to address:

Changes in expenses

Fluctuations in your net worth

New income streams

Evolving risk tolerance

Health considerations

Making periodic adjustments keeps your plan current, realistic, and optimized.

Consider reviewing your plan with a financial advisor for an objective second opinion.

Helpful Retirement Planning Resources

While this article covers fundamentals for assessing your retirement readiness, exploring supplemental resources can provide additional guidance for your situation.

Helpful tools include:

Books: The Retirement Bible by Suze Orman; Retire Inspired by Chris Hogan; The 5 Years Before You Retire by Emily Guy Birken

Podcasts: ChooseFI; Retirement Starts Today Radio; The Retirement Trailhead

As you determine next steps for your retirement planning, don’t hesitate to dig deeper using available resources.

The Journey Ahead

Preparing for retirement is a continuous process full of important milestones and course corrections along the way.

While decoding retirement readiness may seem daunting at first, breaking it down step-by-step makes achieving financial independence in your later years attainable.

Remember, every journey begins with intention.

Define your retirement goals, understand your current finances, seek expert guidance, and revisit your plan over time.

By remaining engaged and informed, you can retire confidently.

Here’s to embracing the next chapter!

P.S.

Did you read our article on How To Grow a Small Trading Account?