Day Trading Dow Jones- 5 Real Trading Examples

Contents in this article

- Intro to day trading with Dow Jones

- Example #1- Dow Jones day trade with late entry and late exit

- Example #2- The day trade that I exited too early

- Example #3- Day Trading Dow Jones outside of regular trading hours

- Example #4- Day trading Dow Jones good entry and perfect exit

- Example #5- Dow Jones and Day Trading- Mastering Stacking Positions

- Summing it all up- Dow Jones and Day Trading

Intro to day trading with Dow Jones

DOWNLOAD 5 LESS-KNOWN FUTURES TRADING STRATEGIES PDF

Day trading with Dow Jones… where do I start?

As with other instruments, day trading Dow Jones has its own specifications.

This article will not go into many details of how I am trading the Dow Jones.

I will probably follow up with a second article on that.

For the time being, I will share with you some of the important times that you should be paying attention to aside from the London open.

Sometimes a very bullish or bearish day starts when London opens.

Therefore, this trading session is not to be underestimated.

Still, the highest volatility Dow Jones traders usually experience around the US open.

This happens at 9:30 am EST.

Let’s have a look at a breakdown of some of the essential times for day trading Dow Jones.

Then, I will walk you through 5 real Dow Jones day trades.

Enjoy…

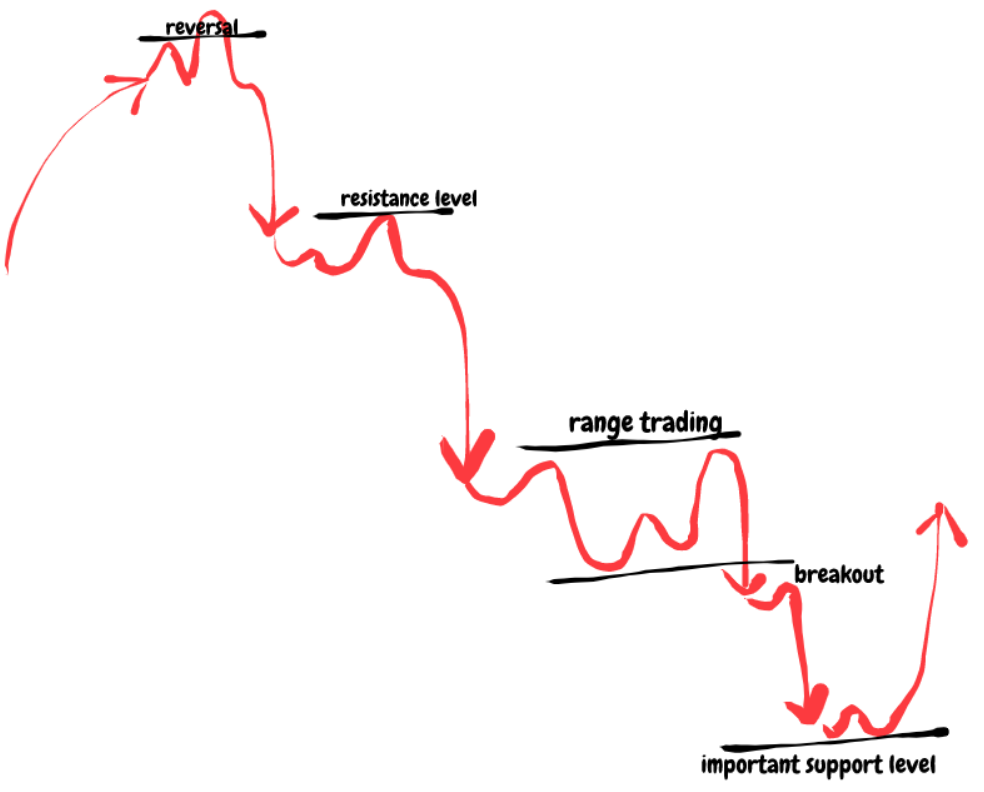

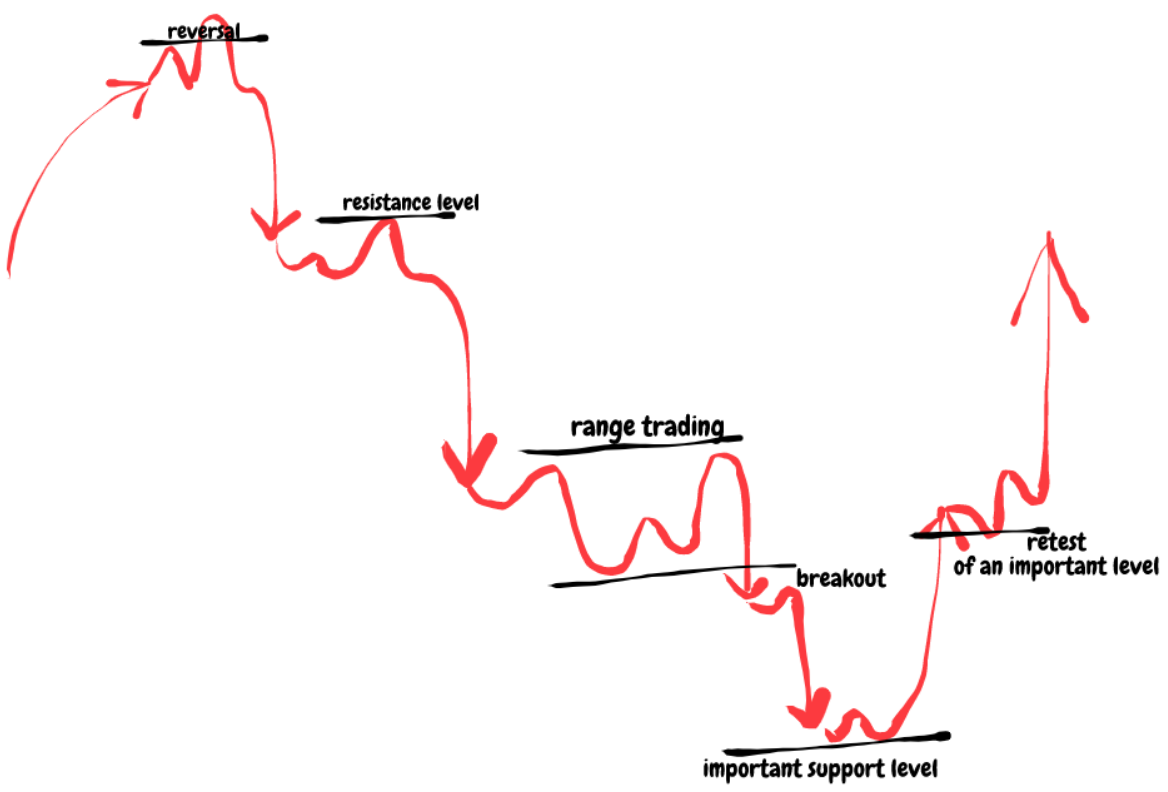

Best time to trade Dow Jones

The times listed below are EST (Eastern Standard Time).

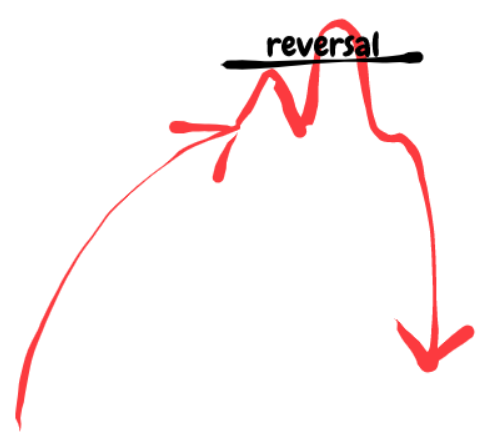

9:30

That is when the stock market opens.

Usually, traders are seeing an initial push in one direction.

9:45

Depending on the day, but it could take around 15 minutes for traders to find their feet in the frothy trading waters.

A very common pattern is for Dow Jones to reverse straight after the initial push.

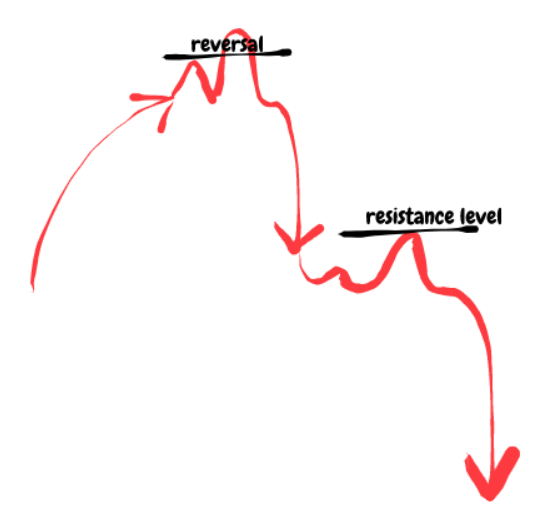

10:00

At this time the trend is either established already or will be challenged one more time.

In a lot of cases, the trend will re-test a significant level like a support/resistance level and then resume the trend.

11:00-11:30

The market usually continues the move and in a higher percentage of cases will slow down since the volatility dries up.

Traders are getting ready for lunch and thus the volatility is reducing.

Get ready for a range…

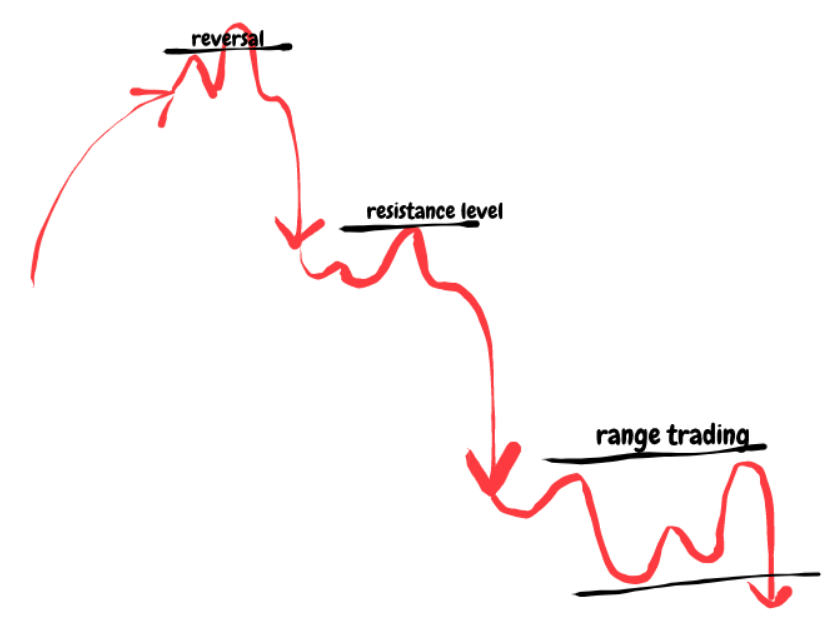

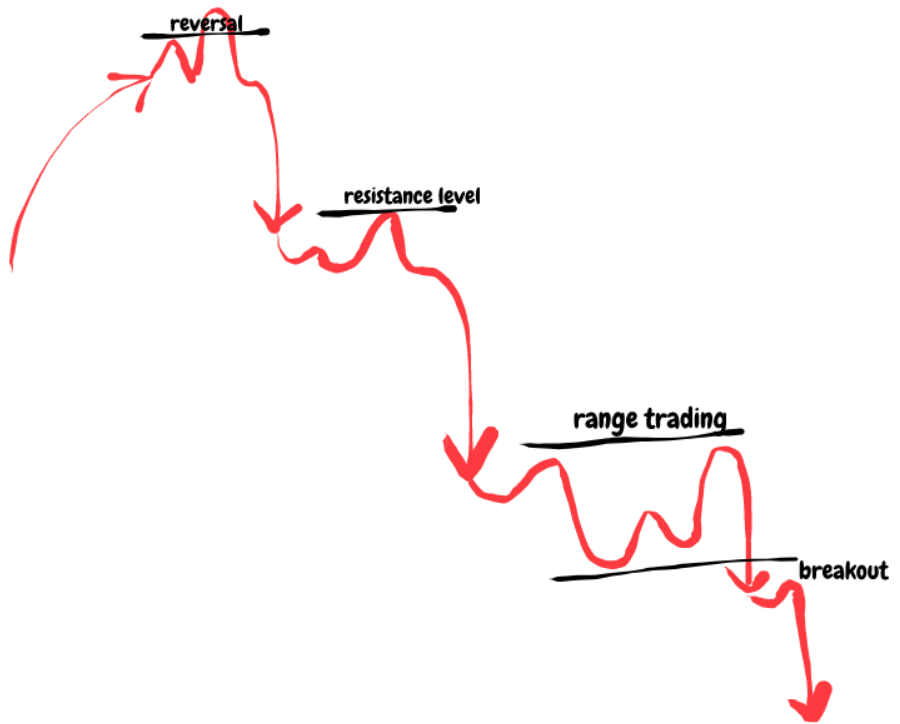

11:45-13:30

This is the time that by presumption is the quietest of the whole day.

Not always the case, but usually it is clever to stay away around these hours.

And why not grab a lunch or dinner, depending on where in the world you are based…

13:30-14:00

Expect higher volatility around this time.

It is very likely that the range trading will see a breakout in one direction or the other.

14:00-14:45

Around this time we are getting closer to the end of the trading session.

Traders will be asking questions such as will the trend continue further down (as in our example).

Is there a possibility for it to reverse at this point?

Maybe there is an important support level that was reached…

15:00-15:30

Expect some shakeouts here.

The trend might reverse and erase some of your profits if you do not take profit at the “important support level”.

It might as well continue its powerful fall with even more strength.

In my eyes, it is all supply and demand and price action.

It is all in the hands of the market participants.

15:55- 16:00

Just a few minutes before the close, the liquidity dries up and a lot of the traders are closing their positions.

Or they are running an overnight market risk.

These are just exemplary figures and charts.

In real life, those movements might be different.

Bear in mind that no two days in day trading are the same even if there are so many common trading patterns.

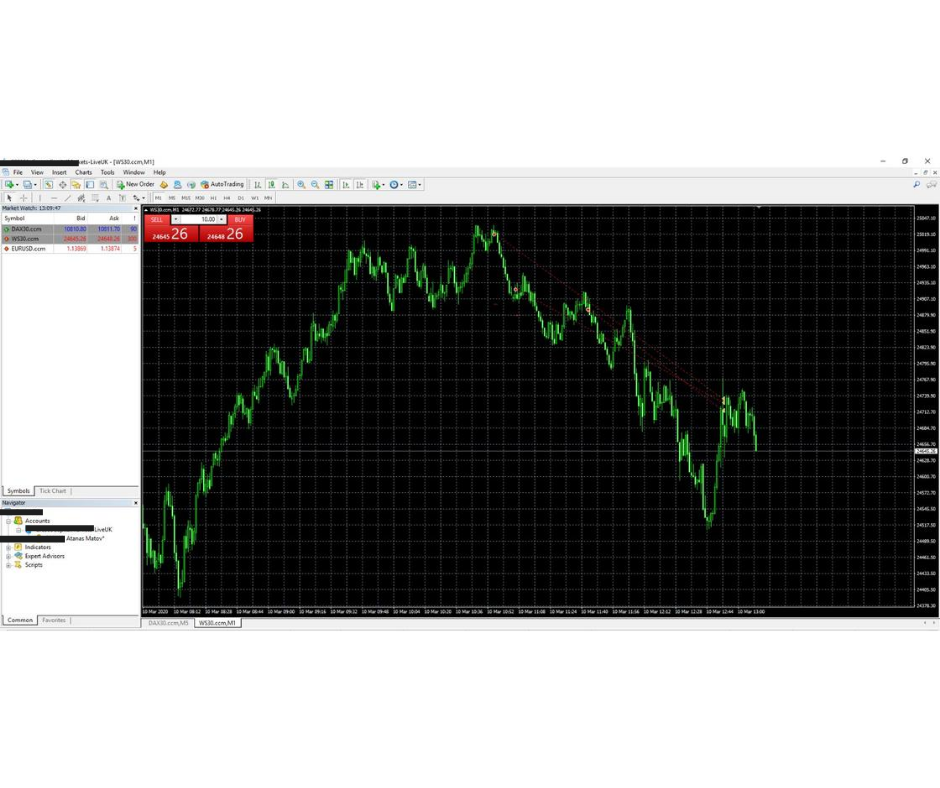

Example 1- Dow Jones day trade with late entry and late exit

The first day trading Dow Jones example is a profit of 210 points on each trade.

My entry was based on a re-test of a major level in a downtrend.

I was following the trend and was waiting for a place on the chart where I could short the Dow.

Let’s have a look at the chart now:

As you can see from the chart below, my perfect entry (point 1) was higher than my real entry (point 2).

I did not manage to enter on time and this cost me a few extra points, but experienced traders know how hard it is to enter at precisely the point you wanted to.

It is also unnecessary.

With this trade, I managed to book a few points less than I initially targeted.

I thought that the price would continue the fall, but it bounced back from my target level (major pivot point from the larger timeframes).

That gave me a clear indication that the trend is reversing and I better be safe than sorry.

As you can see later, the price completely reversed and I made the right decision.

In trading, you are only proven right or wrong later.

Keep this statement in mind!

Dow Jones day trade example 1 mistake: Did not enter and exit at the pre-determined levels

How to improve: There is very little room for improvement here. These are not major mistakes and hence this trade was almost exemplary.

Example 2- The day trade that I exited too early

In the following example of day trading the Dow Jones, I made an obvious mistake.

It only became obvious after I took the trade.

Again, there is no way that you can predict the future.

We are in the business of reading the market!

If someone is trying to sell you a system that predicts market movements is outright trying to make money from you.

In the following example, I will walk you through a trade that could have made multiples of the risk taken, but it only made a tiny profit.

Experienced traders know that these trades are more painful than the losing trades!

Dow Jones Example #2

In the above trade, you can see how perfect the entry was.

It was so good that if I trailed my stop loss at break-even point and let the trade run for a few days, I would have made more than 15 times the equity risked on this trade!

For a personal reason, I exited this trade prematurely and this was a huge mistake.

There was no obvious reason to exit this trade.

No major technical level was touched!

Neither price action signal was given to exit this trade.

Nothing!

I needed to leave the screens and instead of moving my stop loss to a break-even level or slightly higher, I decided to book a small profit and run away.

Big mistake!

Let’s have a look at where the price is currently located- a few days later.

This is almost a perfect entry point.

I am not saying that I would have held onto this trade until this moment, where our risk:reward is 1:15.

But even taking profit midway, would have netted a very decent return.

These are the types of trades that you should be looking to catch.

A quick check of the daily chart shows us that there is no reason to exit this trade at this time in case we are still long.

As you can see, we are still around 150 points away from the major resistance level at 27600!

Dow Jones day trading example 2 mistake: Exited the trade too early with no clear sign of price reversal

How to improve: Do not exit a trade because of a personal reason if the trade has not shown a sign of reversal

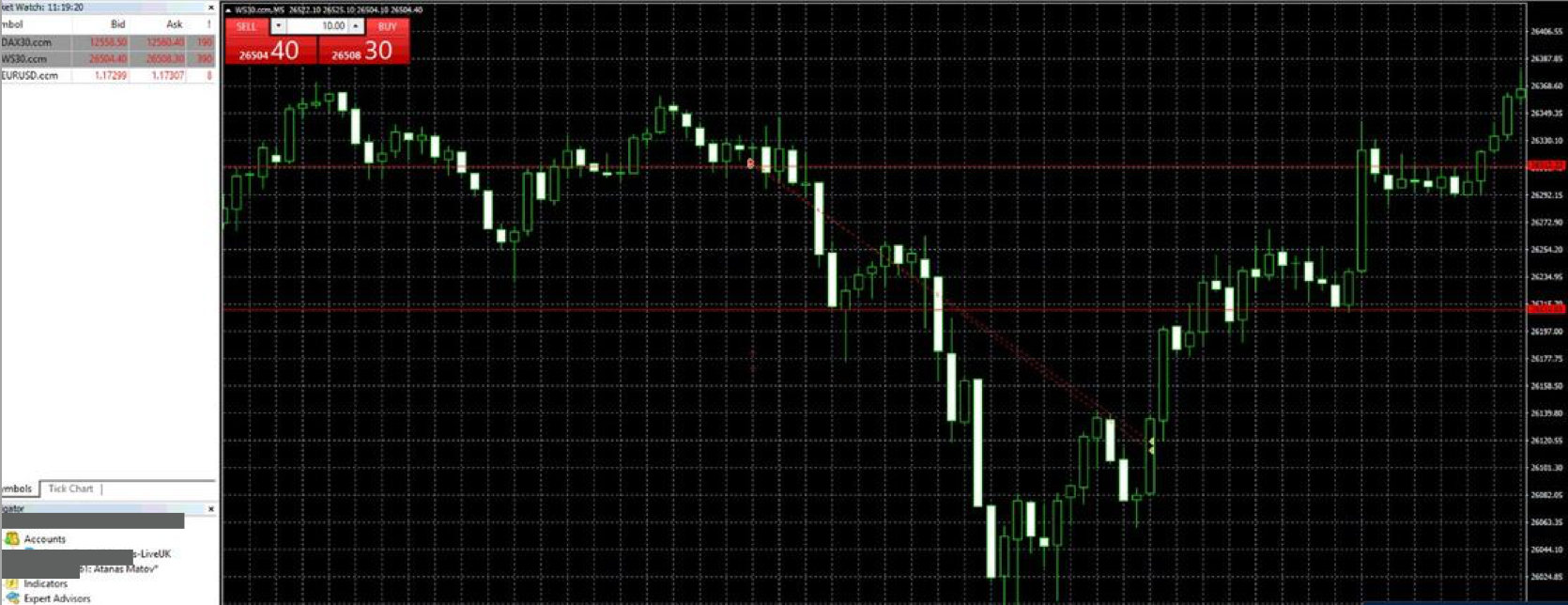

Example 3- Day Trading Dow Jones outside of regular trading hours

The following Dow Jones day trading example is taken from outside normal working hours.

I entered the trade around 3 hours after London open and closed the trade approximately 1 hour before US open.

In other words, this trade was taken when traders were usually not looking to take a trade.

Let’s have a look into the trade now.

Dow Jones Example #3

The trade was taken according to my day trading strategy.

I have been looking for a specific level, which was reached and then followed my rules to add two more positions.

In total, I had 3 trades in the same direction.

I held them open for just over 2 hours and netted between 200-300 points on each one.

This was a great trade that reached my target a lot faster than expected.

I could have been greedy and held the trade for a lot longer, but this would not have been the right decision for two reasons.

- The trade hit the initial target

- Price action was showing me that an imminent reversal is possible

Sometimes you should hold onto your trades for as long as they show signs of strength.

Other times, you should just get profits as quickly as possible and move on.

I reckon, there is just no other recipe for consistency in trading.

In other words, consistency hides in being flexible and disciplined enough to do the right thing at the right time.

As cliche as this would sound, this is about the biggest secret anyone in trading could ever share with you.

Dow Jones day trading example 2 mistake: Trade in not particularly great trading hours

How to improve: Sometimes your level would be hit outside the active trading hours, but this should not be a reason for you not to take a trade

Example 4- Day trading Dow Jones good entry and perfect exit

Let’s have a look at another recent trade that I took.

There are two positions which each netted around 230 points.

You have probably heard the saying that the exit of a trade is as important as the entry if not more so.

This trade proves that if you have the right trading strategy, discipline, and a bit of luck you can exit where I exited.

The entry could have been better, but the exit is perfect.

I want to emphasize how important is not to pay attention to perfect entries or exits in trading.

Since they are part of the “magic” of trading, I wanted to include one “perfect” trade.

Even though this is not the aim of this article, perfectness is a part of the whole picture, so here it is.

Once you have an established target, it is recommended that you see how the price is reacting to this level.

Of course, you need to reach the level first.

In my trading courses, I am going over this, so for the sake of this article, I am not going into many details.

I will just illustrate one of the ways I am checking if this is my level.

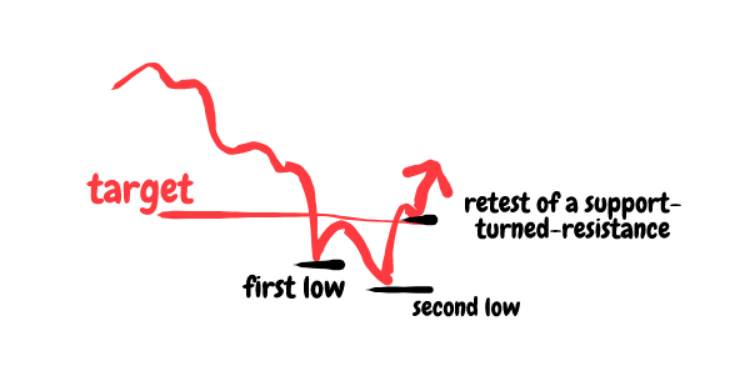

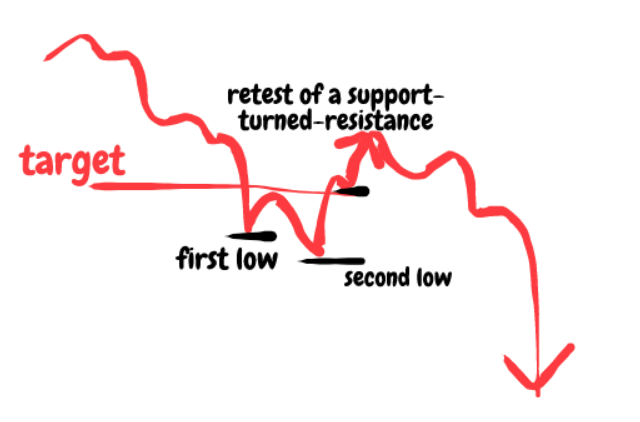

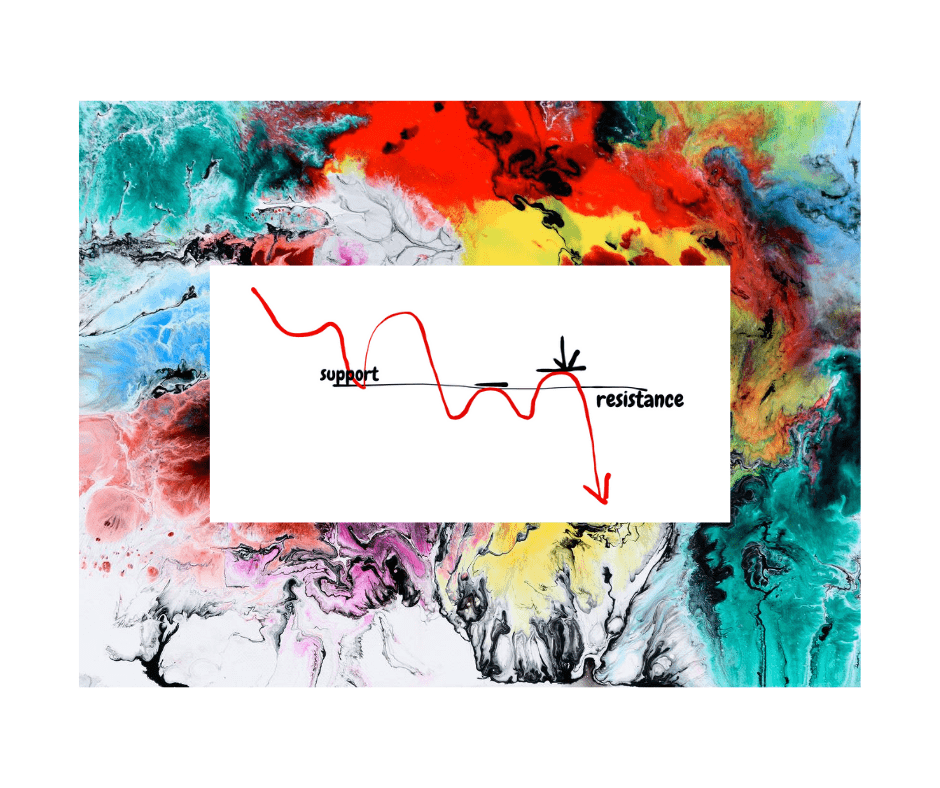

Dow Jones Trading and Targets

Here is an oversimplified version of it.

Once I reach my target I want to see a few technical aspects aligning and this is one of them.

Sometimes, in very strong trends you might see this pattern appearing near your target and only later see the major trend continuing:

There are quite a lot of variables, but usually, it is a good idea to have hard targets and make sure you cash out at least part of your position.

After all, perfect exist are as rare as perfect entries and therefore they should not be your goal!

I am much more inclined towards great risk:reward ratios.

You should be, too!

Dow Jones day trade example 1 mistake: There was no major mistake in this day trading example

How to improve: Sometimes a trade goes smoothly from point A to point B.

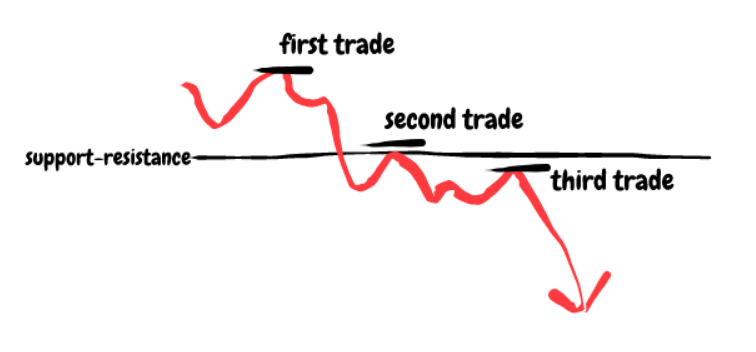

Example 5- Dow Jones and Day Trading- Mastering Stacking Positions

I am not a fan of martingale trading systems.

On the other hand, I believe that once you are proven right (and only if proven right) you should try to maximize your returns.

How do I do that?

Let’s have a look at the following Dow Jones intraday trade:

What can you see here?

Definitely not a perfect exit.

I certainly did not make 30x my risk on the trade 🙂

Each of these trades did make between 220-350 points.

This is still a very good return considering the amount risked.

What you should have noticed are two things:

- I took my profits a bit too late but still managed to make a decent return on the trade

- Took 3 different trades, which were all part of the same trading idea (go short Dow)

Why did I choose to open two more short trades at the places I did?

Day Trading and Proper Positioning

This is a classic example of a retest of a major level.

I entered into a trade precisely where I wanted to based on my trading strategy.

Then, I added two more trades at levels, which were at a good enough distance from the first trade.

In the end, I netted almost 1,000 points from this trade.

Dow Jones day trade example 1 mistake: I exited later than I should have

How to improve: There is a very thin line between taking profits at your target and giving some extra room to see if you can even squeeze more out of a trade. Always follow your plan!

Summing it up- Dow Jones and Day Trading

Successful day trading takes years to master and thousands of screen hours to reach consistency.

There is no secret way to accomplish that- just hard work, a good trading strategy, and strong discipline.

The Dow Jones day trading examples from above are some of my recent trades that I have taken based on my day trading strategy.

In trading, you will sometimes have losers, too.

Do not be misled by this article that trading is always roses and lilies.

You will have losing trades.

What matters in trading is to not take these emotionally and to try to cut your losers as fast as you can.

Having a hard stop-loss helps with that.

Want to Keep Learning? I Teach ALL my Day Trading Knowledge in my Day Trading Course.

In my day trading course, I do go into more advanced techniques and ways to share with my students how I trade the DAX and since recently Dow.

I am an active day trader, as well as a longer-term trader.

I have been day trading since 2012 when I was working for a leading London-based Prop trading firm.

If you have any questions regarding the trading strategy or day trading in general, do not hesitate to give me a shout at: admin@colibritrader.com

Good luck,

Colibri Trader

Where will i speak to you colibritrade

You can send me an email