DAX Trading Analysis 06.03.2025

Dear traders,

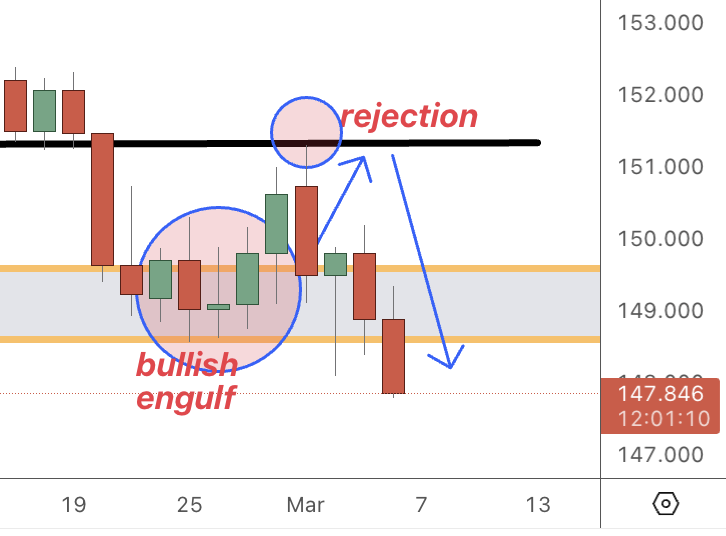

Last time I shared with you my thoughts on USDJPY.

In the end, I did not end up taking a trade and this was the right decision.

The price was rejected by this resistance level:

Even though we had the initial momentum build-up, it was not enough to propel the price past the imminent resistance.

This led to a short-term sell-off.

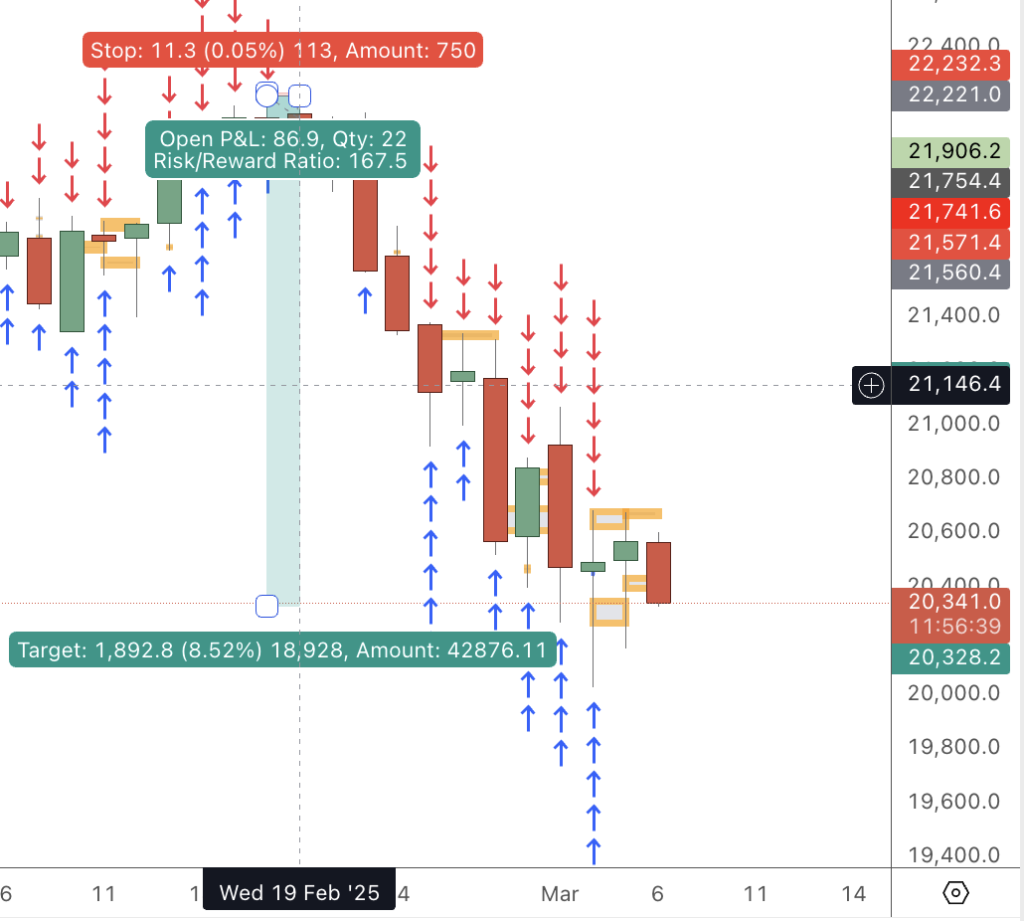

In the meantime, the NASDAQ setup I wrote about a couple of weeks ago is still playing out as expected.

I booked my profits at 1:54 risk:reward ratio, but had I left my trade still on, I would have made over 1:167 risk-to-reward ratio.

Above is my trade taken in the trading room.

Below is where the price is trading right now:

I don’t feel any regrets, because the return I made on this trade was still astronomical.

A 54X trade is not a small feast.

But enough about that.

Dow Jones Trade

I am currently holding a Dow Jones trade, which I entered this morning (06th of March, 2025).

Here is the trade:

Bear in mind this is a day trade and as such I am using a very tight stop loss.

The trade is based on my Day Trading Strategy.

My strategy allows me to find some very high-quality trades like this one and risk very little upfront.

So, for now, I am still running this trade at 1:15 risk-to-reward ratio.

Let’s see what else I am expecting to happen and possibly take a position based on my swing trading strategy.

DAX Trading Analysis 06.03.2025

Today, I am looking at DAX.

I can see a very strong rejection at a major supply zone.

Here is the chart:

A possible inverted pin bar is forming on the daily chart.

I am also spotting this in combination with a possible rejection of this supply zone.

If we have a firm close today, I will be possibly looking for short trading opportunities.

This aligns with an all-time high, further strengthening the case for more sellers to step in

What I will be looking for:

- Firm close on the daily chart

- Confirmation from the 4H chart

- Candlestick pattern further confirms the price action on the 4H chart

If all of these criteria are met, I might consider taking a short position.

But let’s see how all this will play out.

Happy Trading,

Atanas

p.s. All spots for the Day Trading Program are currently filled. If you’d like to check the next availability, you can book a call with our team.