DAX Trading Analysis 06.02.2025 [VIDEO Bonus]

Dear traders,

In my last analysis, I walked you through 2 possible trading scenarios.

I did not manage to get into a longer-term trade on DOW.

The price has not yet broken through the supply zone.

Therefore, I have not acted upon it.

I managed to get to a 20X trade on Gold, which I have shared with my day trading program students.

Here is a screenshot from the trade we took:

I also wanted to share with you my latest video on one of the main trading traps that traders are experiencing.

It will also help you better understand what I was looking for in the Dow Jones setup from last time:

Let’s have a look at what I am looking for today…

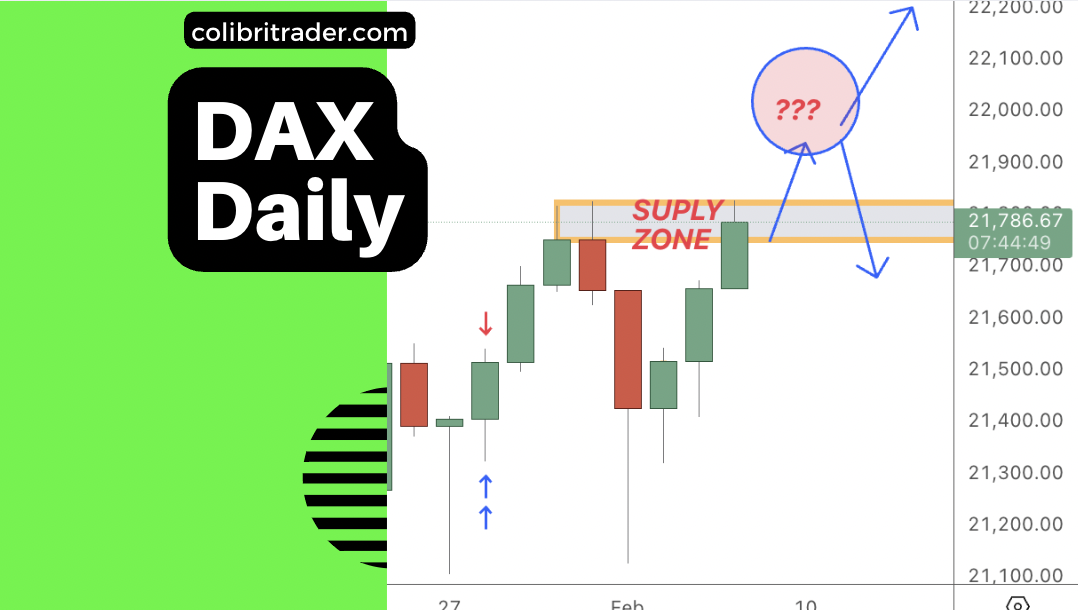

DAX Trading Analysis 06.02.2025

Today, I am looking at a potential reversal on DAX.

The price has entered into a new supply zone and by the looks of it, this might be a good shorting opportunity if the price rejects this level.

I will be looking for a bearish candlestick formation during the next few sessions.

If I see an inverted pin bar or a bearish engulfing pattern, I might decide to short at this level.

The potential is great since we are at an all-time high.

If we see a correction here, it might be a major one or even something bigger.

This might give us a multiple R trading opportunity.

Let’s see if the market will give that to us in the coming sessions.

Very exciting times, indeed!

Happy trading,

Colibri Trader