1:26 risk-to-reward ratio trade closed and Daily DAX Trading Analysis 01.02.2024

Dear traders,

The last time I wrote about DAX.

Since then, DAX has been trading in a range.

Initially, it went in the anticipated direction, but it has hesitated since then in a tight range.

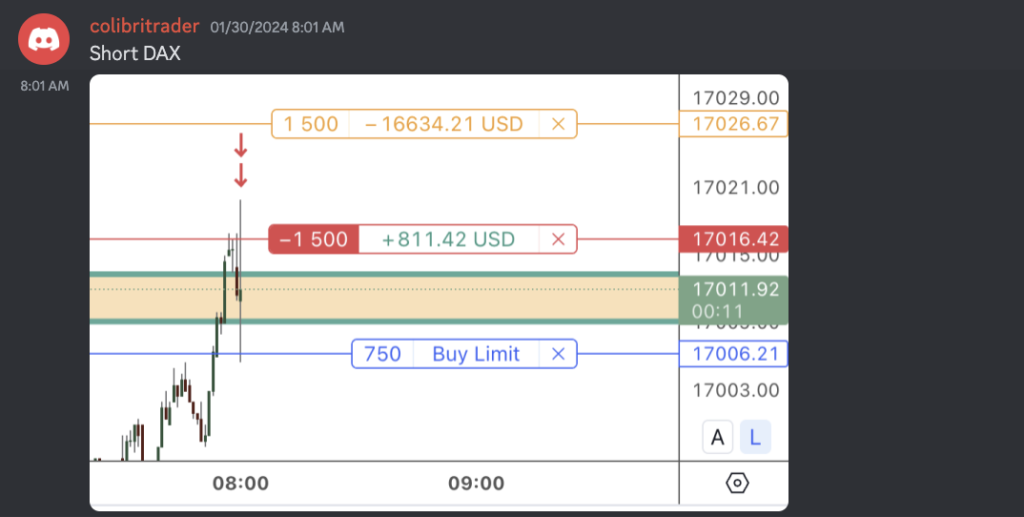

A few days ago I took a short day trade in the trading room, which turned out to be a 3-day trade, which I only closed today.

Here is how the trade looked when I took it:

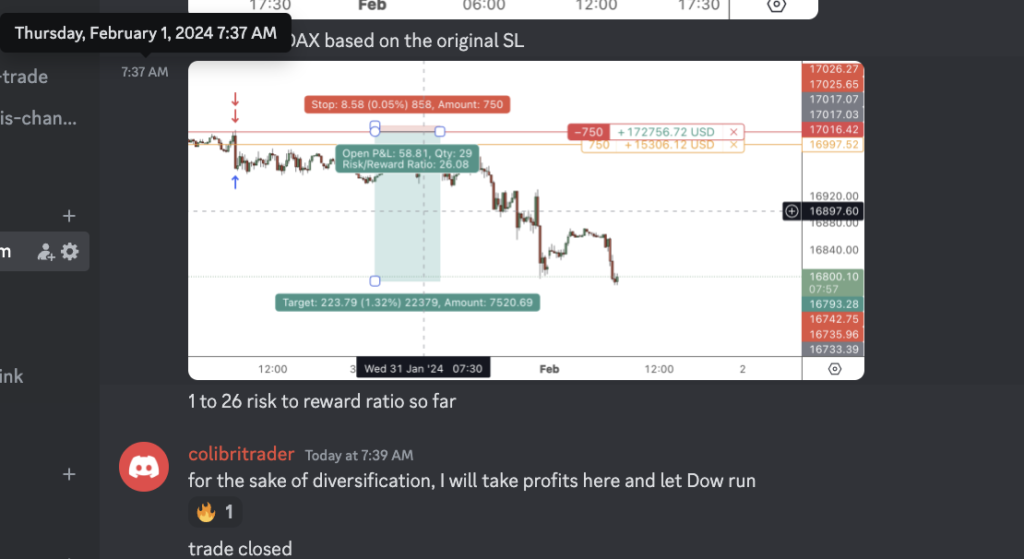

200 points and 3 days later, the trade looked like that when taking profits:

This was a 1:26 risk-to-reward trade, which made some of us really happy.

On the other hand, we are still in a short Dow trade that was taken just after the FOMC announcement last night.

It is also a double-digit returning trade.

All in all, January has been one of the better months on track record.

Let’s see what DAX has to offer us.

Daily DAX Trading Analysis 01.02.2024

Today, I am also looking at DAX and that it might offer us another shorting opportunity from a longer-term perspective.

There is a major supply zone on the daily time frame.

I am seeing a two-day bearish engulfing pattern, which gives additional confirmation that the price might find more sellers than buyers.

With that in mind, I will be looking for a small retracement back to 16,900 area and if the 4H chart confirms this bearish outlook, I might take a short trade.

Until then, I will be patiently waiting.

Happy trading,

Colibri Trader