Disclaimer: Any Advice or information on this website is General Advice Only -

It does not take into account your personal circumstances, please do not trade or invest based

solely on this information. By Viewing any material or using the information within this site you

agree that this is general education material and you will not hold any person or entity responsible

for loss or damages resulting from the content or general advice provided here by Colibri Trader

Ltd, its employees, directors or fellow members. Futures, FOREX, CFDs, and spot currency trading

have large potential rewards, but also large potential risk. You must be aware of the risks and be

willing to accept them in order to invest in the futures, FOREX and CFDs markets. Don't trade with

money you can't afford to lose. This website is neither a solicitation nor an offer to Buy/Sell

futures, spot forex, cfd's, options or other financial products. No representation is being made

that any account will or is likely to achieve profits or losses similar to those discussed in any

material on this website. The past performance of any trading system or methodology is not

necessarily indicative of future results.

High Risk Warning: Forex, Futures, and Options trading has large potential

rewards, but also large potential risks. The high degree of leverage can work against you as well as

for you. You must be aware of the risks of investing in forex, futures, and options and be willing

to accept them in order to trade in these markets. Forex trading involves substantial risk of loss

and is not suitable for all investors. Please do not trade with borrowed money or money you cannot

afford to lose. Any opinions, news, research, analysis, prices, or other information contained on

this website is provided as general market commentary and does not constitute investment advice. We

will not accept liability for any loss or damage, including without limitation to, any loss of

profit, which may arise directly or indirectly from the use of or reliance on such information.

Please remember that the past performance of any trading system or methodology is not necessarily

indicative of future results.

Hi colibritrader,

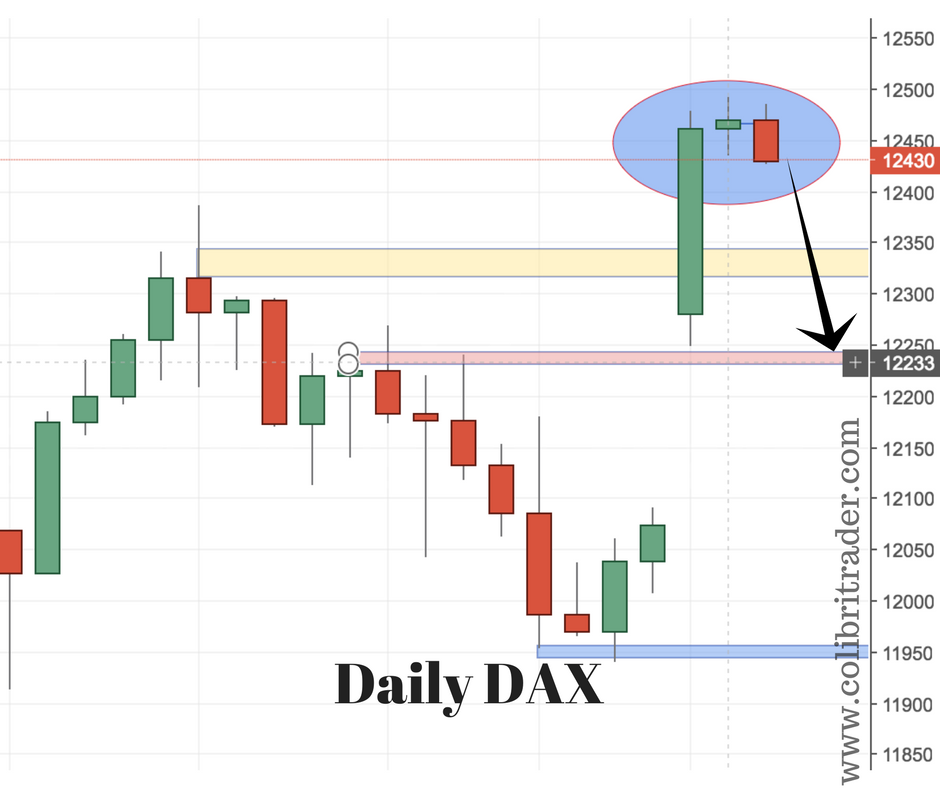

Looks good, 12500 has some “not so convincing price action” round number.

This signal could end up being the reverse of the April 19th long signal area.

Lot of longs if “feeling trapped” will sell.

Good spotting

Yes Dan- I am currently monitoring it. Although not really seeing confirmation from the 4H candle. Actually- there is a bullish engulfing forming which might change my plans. Let’s see.

Hi colibritrader,

Dax longs, look like they are still comfortable holding, Even though I am a price action trader I can’t help feeling that most markets look overvalued. Probably the wrong thinking (Human mind)

The bottom line is, “until buyers start turning into sellers” nothing else matters. IE charts /candles will reveal.

If I can borrow from the hindsight way of thinking, the correct thing to have done was to only look for longs since Nov 2016. I wonder why this time would be different ? I know you were referring to a potential pullback not a trend reversal

Why not continue looking for longs ? Why not but the next pullback into support ?

Not a direct question for you colibritrader more sharing thoughts.

I know of a trader that has automated his entries, these run 24 hrs.

Have you ever written an article on this ?

I know you are a manual trader, may I ask do you have anyone that you discuss your trade ideas with, perhaps at the prop shop you have a team that brainstorms potential trades ?

Regards

Dan

Hi Dan,

What a great feedback. I am replying a bit late, but am on a holiday and have limited access to internet and can see have already a few interesting comments from you. Well- yes- you are completely right about DAX, the best would be to go long on a pull-back. Unfortunately, sometimes price action is giving us counter-trend signals and they could be very good, as well. I said unfortunately, because I believe the best direction is with the trend, not against it. One way or another, the price action pattern is there and as a person who analyses, as well as, trades the markets, I need to cover that. So, for now I am less likely to go short, but that is hat price action has shown us recently. I would ideally want to see another rejection above the resistance level, but who am I to say. Let’s see what the market will give us. And- yes- brainstorming could be great for sharing ideas, but also could be detrimental and keep you away from executing a brilliant trade. So, it is a bit of a two-edged sword.

Hi Dan and Colibri

EURUSD is in my radar for short, will see how it closes later.

-Harry

Hi Harry,

I am currently looking at GBPUSD and it looks pretty bearish, too. Maybe another retest of the highs, but let’s see. The DAX setup has not quite formed yet, so following this one too…

Hi colibritrader,

This coming week it wouldn’t surprise me to see price move down to the 50% area of that larger bull bar.

Will watch what type of price action takes place at that point (12385 mt4 chart)

Regards

Hi Dan,

It would not surprise me too. I will be looking at the same level actually.

Hi colibritrader,

Can you believe the Dax cfd has hit 12650 !

No one would have believed you if you prophesized it months in advance.

Nothing is for sure in this world but surely these levels are climactic and not sustainable ?

I mean are we going to see 13000 and 13500 this year ?

All the problems Europe faces, debt, refugee crisis, banking. How in the name of sanity is this sustainable ?

In saying all that, No shorts until a trend change is confirmed. For me that would be in the form of a bear engulf candle on weekly or some thing almost equal in formation on daily.

I’m sure alot of ppl will be shorting on hunches but one thing I’ve learned id forget what you think as a trader trade what the chart is telling you.

Glad I wasn’t short this sucker, it really is the most bullish index out there !

Q: Does your Dax chart have bollinger bands on it ?

Regards

Hi Dan,

Thanks for the great observation. I think that the best thing to do at the moment is wait and see what will the French Elections outcome be. That will give direction to the European indices and will influence worldwide indices, too. Otherwise, my chart is clean- I only have pivot levels and am looking at the price action. Now, concentrating on NZDUSD long and USOIL long, as well. There is a pinbar forming on the daily (WTI), but am more careful, since the price is still above a major support level. Anyways, will wait until the French elections are over. Have a nice weekend!

Colibri

Hi colibritrader,

The DAX keeps on powering along, so far it has respeced all support and all swing points on daily and 4 hr.

Until it breaches these then the uptrend is by definition intact.

Very close to 13000 now.

Hi Dan,

That is absolutely right. I am currently looking at a potential short EURUSD. It is in the resistance zone, so might be a very good R:R trade, but let’s see. I have posted on Twitter btw:

https://twitter.com/priceinaction/status/864379927134695424/photo/1

Hi colibritrader,

Do you foucus on turning points or joining an established trend ?

Have you ever written a piece on identifying trend reversals or confirmed turning points ?

Your course focuses on entering and adding into an est trend.

Correct me if I’m wrong

Thanks and Regards

Hi Dan,

The best way to trade is to trade with the trend. Sometimes, the market is in a range and is difficult to always be with the trend. It also depends on what you define by the trend- is it the megatrend or the most recent trend. If you are pointing my attention to the most recent NZDUSD trade, it was against the minor trend, but still in line with the big trend. I am looking at the pivot levels from the higher timeframes and then using my strategy (the one from the course) to minimise the risk. I hope that it does not sound too confusing, but the good thing is you are asking questions and we can clarify them here. That is the best way to learn. I am surprised that not much more people are taking advantage of that option, since it is free and helps learn better. Let me know if you need further clarification.

-Colibri

Hi colibritrader

Hope your are well … last post was not about about nzd/usd but wanting to know your definition of what makes up a trend reversal and what makes up a tyrning point.

To be confirmed in both cases.

I’ve heard you use pivot levels twice now but this is not covered in the course correct me if I’m wrong (or do you mean support and resistance)

Are these levels daily, weekly or monthly.

I was a bit surprised you decided to trade nzd/USD long when they were better opportunities out there I think another important thing to take into consideration is market sentiment this can be an over riding factor because you can have a good t/a signal that fails.

Michael Marcus once said when the technicals, fundamentals and the market mood aligns you have to make money, he is someone that I have not been able to find much information about I would really like to know more about him.

You’re right not many people post here, the problem is that there are so many sources out there that even if you are a sincere truthful option you may never get discovered because of all the other better marketed fakers around namely the ones that I mentioned to you in a few posts a go.

It may have not have been the best time to ask you but they are from England that’s why I asked you not because I was looking into following them in any way I don’t know if traders in England know much about each other

Are you still working in the prop firm where Mr Redmond is.

I’m surprised you didn’t write a piece about the dax topping out looking back I should have picked up on the 4 hour divergence and the small ranging insode candles at the very end on the second top.

Once again looking at too many opportunities and missing the good ones.

I sold gold last night, decided to book profits. 1227 to 1262

chat soon

Hi Dan,

First, by pivot points I mean Support and Resistance from the higher timeframes (anything > Daily). Regarding Michael Marcus (a great trader btw), I think you can read more about in the Hedge Fund Market Wizard by Jack D. Schwager. Regarding the “fakers”, they are everywhere, not only in finance/trading. That is why in my opinion the most important thing for new traders is once they discover something that works to stick to it. Regarding Mr. Redmond, he is doing great. Not working together anymore, but we both went in our ways. He is probably the most amazing trader I ever met! Regarding DAX topping, I wrote a guest article for Investing.com here:

https://www.investing.com/analysis/is-dax-topping-out-200189075

I was just not able to rewrite it here, due to time limitations. Pretty much the same as my Twitter account discussion we had before. You can follow me there, sometimes I do share other potential setups. It is just too many things and only two hands. Regarding Gold- I think there might be more to see, but let’s wait for daily close. I was looking at a bullish engulfing potentially forming on the Daily. Gotta go now

Later,

Colibri

Hi colibritrader,

12700 has been a great place to take shorts, when you mentioned it I also had that R level noted.

Hope your well, I’ve been laying low, holding short on oil, short AUD and intraday on Dax scalps.

That’s been helping to pay the bills 🙂

Regards

Hi Dan,

Oil has been rising steadily- be careful with this beast. The next level is 55, so watch out! Same thing with AUSUSD- it might correct slightly, but at 0.7430 I will be looking for the bulls 🙂 Regarding DAX- I think only time will show, but am pretty bearish at the moment…

Hi colibritrader,

Dax printing various buy tails on daily

12500 / 12550 S being respected

Looks-like it will now ascend toward 13000, juicey round number ! 13 an omen ?? 🙂 ??

Fortuantely I’m not supersticious

S&P keeps moving higher … low int rates are key to this US rally

European economy / debt doesn’t look too healthy but I’ll stick to trading the chart b4 betting on fundamentals

Depeche Mode a great band been listening for years, Smiths etc

Thanks for all your time m8

Hi Dan,

I was thinking the same about DAX- especially when we are in an uptrend. I might write a post about it this weekend. Regarding 13K- that’s probably where we will see it next, but the daily setup from Friday is definitely a bullish one.

Depeche Mode… you’ve already said it:)

Hi colibritrader,

(Self talk) Something that I have to remind myself at times is “what makes a trend or what is trend”

All strong trends as DAX has been in, will have pb’s or slight corrections. It is to be expected and well deserved healthy infact.

But as our hard wiring thinking has proved, humans interpret these pb’s / slight corrections as trend changes.

Subconsciously all we are trying to do is be right when this view is taken. This is one important thing that is not taught in most trading courses, and that is how to filter for a trend change, how to confirm it properly.

(not directing anything at your course or teachings)

Just a thought that I hope will resonate with some readers.

Regards 🙂