Disclaimer: Any Advice or information on this website is General Advice Only -

It does not take into account your personal circumstances, please do not trade or invest based

solely on this information. By Viewing any material or using the information within this site you

agree that this is general education material and you will not hold any person or entity responsible

for loss or damages resulting from the content or general advice provided here by Colibri Trader

Ltd, its employees, directors or fellow members. Futures, FOREX, CFDs, and spot currency trading

have large potential rewards, but also large potential risk. You must be aware of the risks and be

willing to accept them in order to invest in the futures, FOREX and CFDs markets. Don't trade with

money you can't afford to lose. This website is neither a solicitation nor an offer to Buy/Sell

futures, spot forex, cfd's, options or other financial products. No representation is being made

that any account will or is likely to achieve profits or losses similar to those discussed in any

material on this website. The past performance of any trading system or methodology is not

necessarily indicative of future results.

High Risk Warning: Forex, Futures, and Options trading has large potential

rewards, but also large potential risks. The high degree of leverage can work against you as well as

for you. You must be aware of the risks of investing in forex, futures, and options and be willing

to accept them in order to trade in these markets. Forex trading involves substantial risk of loss

and is not suitable for all investors. Please do not trade with borrowed money or money you cannot

afford to lose. Any opinions, news, research, analysis, prices, or other information contained on

this website is provided as general market commentary and does not constitute investment advice. We

will not accept liability for any loss or damage, including without limitation to, any loss of

profit, which may arise directly or indirectly from the use of or reliance on such information.

Please remember that the past performance of any trading system or methodology is not necessarily

indicative of future results.

Hi colibritrader,

I started a post yest but deleted it, I was going to alert that Dax has hit the last months close and that the down move could halt at least for last session.

I was short right from 12801 (cfd chart)

BUT I have an unnatural problem, I cannot hold a large gain and add, instead I take close and take the profit.

Last night was just shy of 2000.00 AUD

It seems I physically cannot let run or add more.

I will never achieve my goal of compound position trading, this is where I am and may need psych training

Even though I made $ I’m not happy

Hi Dan,

If trading consists of 4 levels of experience, I think you have reached the second/third level. You are making profit, but you are not happy with the results. You cannot overcome the natural human instinct of taking profits as eliminating the fear/greed factor. This is absolutely natural. From what I am hearing, it seems like you have reached a place where a lot of traders dream to be at. You are also realising about our natural limitations and you are actually trying to get to the next level. That is actually really praiseworthy and you should be proud. Just make sure you don’t become too euphoric and start doing some unreasonable things. Usually, after a good run, you’d better take a break. The same as when you have lost some- just to clear your mind. Good luck to reaching the 3-4 levels- I am here to help if needed 🙂 The more you try, the better you become 😉

-Colibri

Hi colibritrader,

I did some reasearch today on the holding a profitable trade subject or closing too soon syndrome.

Apparently it’s all in your mind, we have 2 styles of thinking, analysis and survival. The 2 clash constantly during a hold a trade exercise.

There are other factors too … confidence, believing in your edge etc.

I think it’s a case like quitting smoking, quiting cold turkey is the best way imo.

Just do it .. block the other thinking during trading and stay focused on your original thoughts.

Anyway if you have anything to add it would be great to hear it 🙂

Regards

I would just add- easier said than done 🙂

It usually takes years of experience to reach to that stage where you can eliminate those side thoughts. I have only seen one or two people that are able to reach that stage earlier than that. I wish you to be the next one, but make sure that discipline and good risk management are essential. Maybe try reducing the trading size if you don’t feel comfortable enough where you are 🙂

Hi colibritrader,

I appreciate your input,

I’ll keep you posted on the progress.

Thanks

Hi Dan,

I have just posted a brand new article which was inspired by what you said earlier in this discussion! Hope you guys enjoy it 😉 #nevergiveup

Hi colibritrader,

Re-reading posts here, yes easier said than done … I am looking forward to taming these tendancies through deleberate consious thought.

Breaking these habits will take me to the next level and that is where I truly want to be so it must be done.

Thanks for your input cheers

Hi Dan,

I am not sure how long it took me to reach this level (I hope I have reached it), but it was definitely some time. I believe the hardest of all to fight is our own nature. Once we find a way how to tame it, things go slowly back in place. Thanks for your comments- a community is worth nothing without its members!

Hi Dan,

Maybe can try by lowering size to get used to it? I see myself with more pips when using small size, and less pips with more size.

Enjoy weekend!

-Harry

Hi Harry,

How have you been and how has trading been going ?

I thought to take this opportunity to share with you my view on trading.

For me it is not a hobby, it is a profession where i NEED to reach the elite level. This will involve stepping out of my comfort zone. I need to constantly explore the limits of the market and myself. I live the index market 24/7 and constantly go over screen shots to see where i could have done better. It could be Christmas morning it could be New Years day, it doesn’t matter I need the immersion and to see price action from every perspective.

Being uncomfortable is where I need to be, it is only then I know I’m making progress.

This will sound strange to most traders that are happy to have it serve as their hobby.

To me progress is measured in my PnL, if I look at a chart after the fact and I’ve left 70% of potential on the table before a real exit signal was given it is not acceptable to me.

So far everytime I make a big mistake I make considerable progress, the Dax has been the best teacher to date.

Overe here some call it the “widow maker”

Do you trade it ?

Regards

Hi Dan,

I don’t push myself too hard as you on trading I guess, I mean the more I try hard, the harder it seems for me.

For example I short EURUSD earlier (all check boxes ticked) and got stopped out 2 days ago (I had raised the SL to +5pips – thankfully) because of the FOMC news. I just retake the short EURUSD.

As long as my check list are all ticked, I set it and forget it – just check once a day if need to raise SL while in positive territory or close anything which seems to be not as calculated.

I check this website more often than I check my open positions. Now am watching to long AUDNZD and short NZDUSD.

I haven’t taken Dax as the margin is a bit big using my broker, I do read the post and try to see if the check list are all ticked or not – just so my brain is not rusty.

-Harry

-Harry

Hi Harry,

Hopefully one day I won’t have t push so hard.

Nice to hear your trading as you want.

It can be such a hard gig some times, then on some trades your in profit straight away.

I think colobri mentions resilience is required, boy isn’t that the truth.

Have a good weekend

Check out the latest article I have posted Harry! Hopefully it can be useful for you to understand better the way I look at the markets. I wish you and Dan a great weekend!

Until next week 🙂

Hello colibri,

I see 12665 as the next R level but in round numbers 12700.

Is the Dax at a critical decision level ? It is also at the 50% fib level for the total move range.

It seems so, all thats missing is price action to confirm an impending bearish move.

(Note: I am not making any calls here and am not alluding to what my intentions are just had some time for some running commentary hope no one minds)

On the complete and opposite side of the coin, “the case for longs”.

Exactly 1 year ago the Dax entered a 3-4 month consolidation which resulted in a massive up move. The US election the catalyst.

The largest recent bear candle June 29th has a high of 12727, one might use that as a LIS for shorts. Strong P/A with momo above that and the Dax most likely has the strength to test highs again.

In closing nothing will surprise me, one things for sure get your entry and trade parameters right on this index and it seems to have the most potential for gains out of all of them. By getting it right and to find out how, you’ll have to take the colibri course !

The sky is the limit.

Hi colibri

Hi colibri,

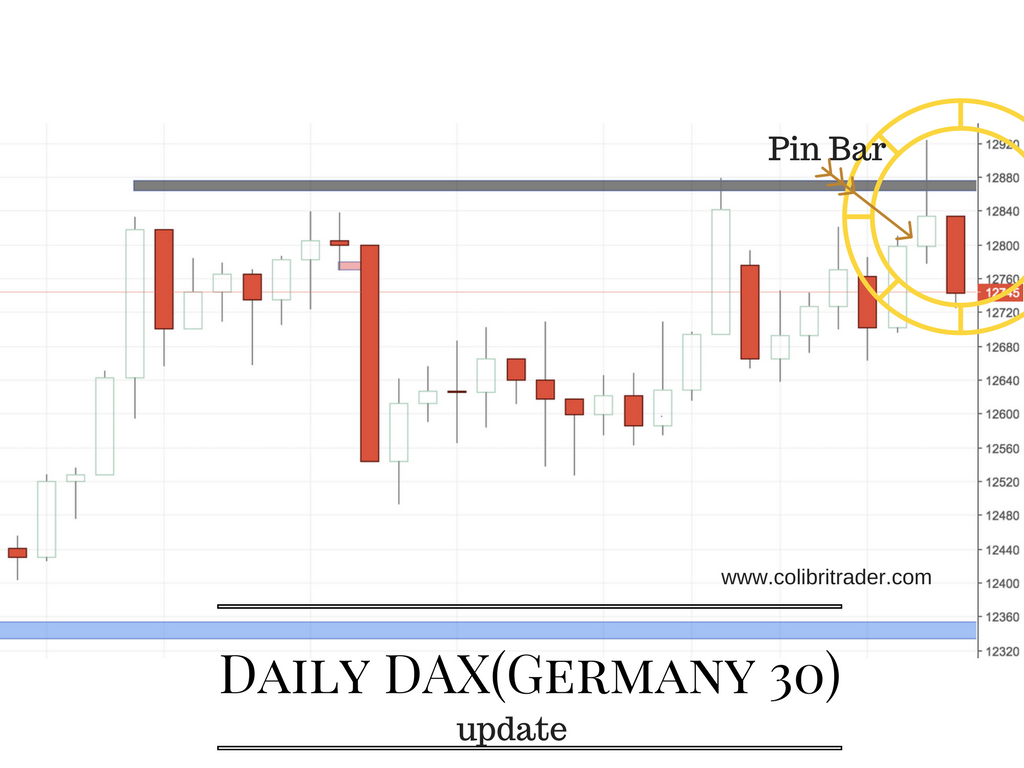

(all daily candle analysis)

2 days ago saw a strong bull bar, fridays sessions saw a pin bar with buying support at the 50% of that big bull candle mentioned

This is a buy setup imho

Colibri what do you think, I imagine you’ve long closed your short positions out, perhaps during that big bull session.

Are you willing to entertain Dax long trades with US indicies at all time highs essentially resistance in a form ?

Regards

Extremely low risk short with 1 hour twin pin bars, confirmed with momentus p/a

That is another tell tale sign for a good entry, when tracking a trade entry for longer term opp via intraday session watching p/a “how was the momentum during the move”

Not 100% true in every case but better yes then no

market tone is negative upper limit for shorts 12670, above this and current pa would have to be negated however pa formation on daily starting to look like the final bull flag no one knows for sure but from bullish pins a few days ago to present is an about face

See if todays session brings lower numbers, a likely target if current pa becomes dominant is 12000

12400 at current, lovin this game

Dax can be the beauty and the beast all in one, the trick is to stay on the right side of her

Your time could be well compensated for if you just watched price action for as long as it takes until all check list aligns before trading this wonderful instrument.

I have no doubt if you take trading seriously have a professional trading methodology and believe in yourself you can become the trader you want to be !

12000 getting closer

Hi Dan,

I am back from a short holiday and can see you and Harry have been quite active, which is great! Regarding DAX- it is definitely a beast and the best thing with it is to have even stricter risk management rules. For now, I am out of all positions. Every time I cannot be in front of the computer, I close all positions and try to switch off from the markets completely. That has positive effects not only on my P/L, but also on my holiday. I can tell you that a holiday with open positions running is not a holiday at all. But enough for that- I think I am still in a vacation mode. Regarding DAX, there was an inside bar on the daily yesterday, which was definitely not a bullish indication. Now, I will be waiting for a price action indication form the daily chart. It might take some time before it forms- seems DAX is entering in a choppy range, but let’s see.

Hi Colibri,

Welcome back, I’m glad you were on a short holiday with no positions than on a long holdiay holding a short.

As you can see the dax found some footing around 12400 and moved up.

Interesting that the low of 12300 was the top of the gap left on April 24th 2017 always uncanny when levels match up to the tic, or is that how the algos work ?

I’m trying to think and think hard as to what IS the dominant trend here.

Are we in a counter trend move or a continuation of price action in trend which is up.

One last question and at the risk of it being a repeat of info provided, what would be “your” favorite or most reliable price action signal.

You could use the Dax as an example if you want to point it somewhere MT4

Regards

Haha- that was nicely said- “I’m glad you were on a short holiday with no positions than on a long holdiay holding a short”… really made me laugh. At the moment, I am still not in a trade. I am looking at crude, but nothing yet. DAX on the other side seems to be in a tight range and I am not even coming close to it at the moment. Waiting for a more clear sign. Let’s not forget the Daily timeframe, where all the major setups start. Regarding the major trend- we are still in an uptrend. Officially, a trend is over when price moves more than 30% in the opposite direction. We still have not experienced that, therefore it is still an uptrend. Maybe a downtrend could be initiated if we see a lower low on the daily. This means a lower value of 12300. As of the perfect trade setup- this for me is a perfect setup in terms of risk:reward. This only shows up after you are in a trade and riding a trend. There is no way you can predict that straight ahead. Although, if you are asking about price action, that would be a price action setup that forms just below/above a major support/resistance level. It is pretty much a failed breakout. These have been turned into some of my best winners.

-Colibri

Hi Colibri,

Glad your smiling …

Thanks for your input on trading, it is more helpful than you can imagine.

Regards

Regarding DAX, there was an inside bar on the daily yesterday, which was definitely not a bullish indication

Hi Colibri,

I wanted to ask you about this comment you posted.

Are inside bars not part of turning point or contnuation signals ?

I’ve found them to be as in the case of gold seen on daily time frame. Amoung other time as well.

Interested in your reasoning, much appreciated and wanting to learn some thing by asking.

Thank you

Hi Colibri,

Dax made a low so far of 12214, man that was fast !

Trading it in a controlled, methodical manner can set a trader up for life.

It has immense potential, one has to remember that once the ball is set in motion it will stay in motion.

The moves along the way are nothing more than distractions to the non believers.

Hi Dan,

I totally agree. But one needs to be extra careful, because sometimes choppy markets can take longer than expected. Anyways, it was a great day for the short sellers. Seems like Oil is already in the money:) Could be the beginning of a great move, but let’s see.

Hi Colibri.

Daily Dax has printed a pin, almost closed that long term gap from April 21st 2017

More confirmation needed for a long position but evidence starting to mount (reversal signs)

12180 LIS for this theory MT4

I repeat more confirmation needed.

I will start watching correlated instruments Yen Gold S&P

RECAP: NO CONFIRMED BULLISH EVEIDENCE YET

Heads up is all for anyone that trades this

Hi Dan,

I am not sure about the bullishness here. I am actually more prone to see a bearish rejection and a continuation of the downtrend. Let’s see what the price action has for us

Hi,

Seemed to like a wonky move upward today.

We shall see, as one great trader once said ” time knows better”

12185 area LIS for anyone long imho

Would one day luv to know how to spot whether an up move is short covering or buyers accumulating.

Virtually impossible but I would still like to know how to decipher.

Have a nice day

Hi Dan,

You can look for DOM (Depth of Market). The thing is that I don’t think the CFD brokers provide reliable data. What professional traders use is called a ladder- it is mostly used on the futures markets and is showing you where the big orders are. Unfortunately, this is not working as good as it used to work due to spoofing. I am sure you have heard about this term

Hi,

Yes I know about this tool and what it’s used for.

Much like yourself it doesn’t appeal to me as your method of trend trading offers much more R to R for a trader.

Nothing beats compounding positional gains in a trend !!!

Granted opportunities don’t come everyday, and requires much more character but thats the challenge in itself.

The chance to overcome and work on one limitations.

Much more satisfying than the short lived adrenalin highs and lows of scalping.

I cannot agree more with you than that! It is mostly used by day traders, but as you said, it is a short-lived way of seeing the markets. Therefore, there is nothing better than a good money management combined with longer-term trading strategy. Glad we are sharing the same point of view 🙂