DAX 30 Market Analysis 25.04.2022

Dear traders,

Before the DAX Market Analysis, let recap last time’s analysis on USDJPY.

My analysis shared details about a possible reversal, but we did not see a candlestick confirmation.

Price action continued being bullish and there were literally no red candles until the 20th of April.

To be honest with you, such strong trends are 😮 rare in the FX markets.

Therefore, it would be wiser to go in-line with the trend.

On the other hand, price is just above a major supply zone on the Monthly chart.

Therefore, it wouldn’t be wise to do that.

Why?

Because, even if we see price moving higher, we might see it moving LOWER FIRST to re-test the supply zone.

If that happens, we will see price going lower ⬇️

On the other hand, there is a possibility that we see a trend reversal, which will drive prices lower, as well.

There is a third option and it is that prices will continue going higher.

So far, there is no clear indication which way will price take.

Therefore, I am being neutral on this pair.

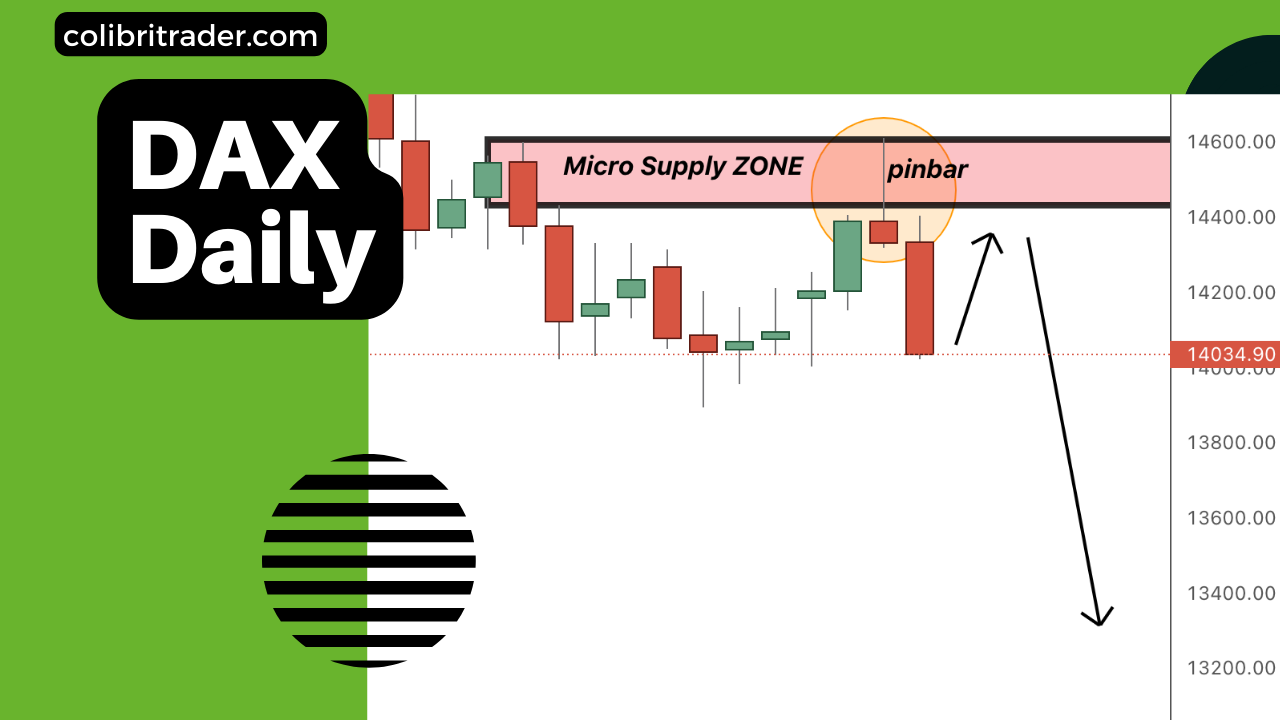

DAX 30 Market Analysis 25.04.2022

Today, I am looking at the German stock market.

There was an inversed pinbar on Thursday and prices took a serious dip on Friday.

This coincided with a minor supply zone on the daily chart (as you can see from the screenshot from above).

Is there room for more bearish advances?

Looks like price action is quite bearish and I am expecting to see even more shorting in the coming days.

I would ideally like to see price coming back up to 14,200 to re-test this level.

If this happens is great, if not I might be looking for ANOTHER BEARISH SIGN to go short.

In no way I will be 🐢 rushing this.

If I get a confirmation from both Daily and 4H chart I might consider going short.

If not, I will just wait for another opportunity.

Trading is a GAME OF PATIENCE.

If you want to last in it, you will need to practice more of that 😤

Happy Trading,

Colibri Trader

P.S.

Have you checked my article on this 👉🏽 Less Known Candlestick Pattern?

P.P.S.

Do you want to learn 👉🏽 How To Trade Like The Legendary Turtles? Check this out