Daily Comment + Trading Signal (Post Draghi)

Daily Comment + Trading Signal (Post Draghi)

by: Colibri Trader

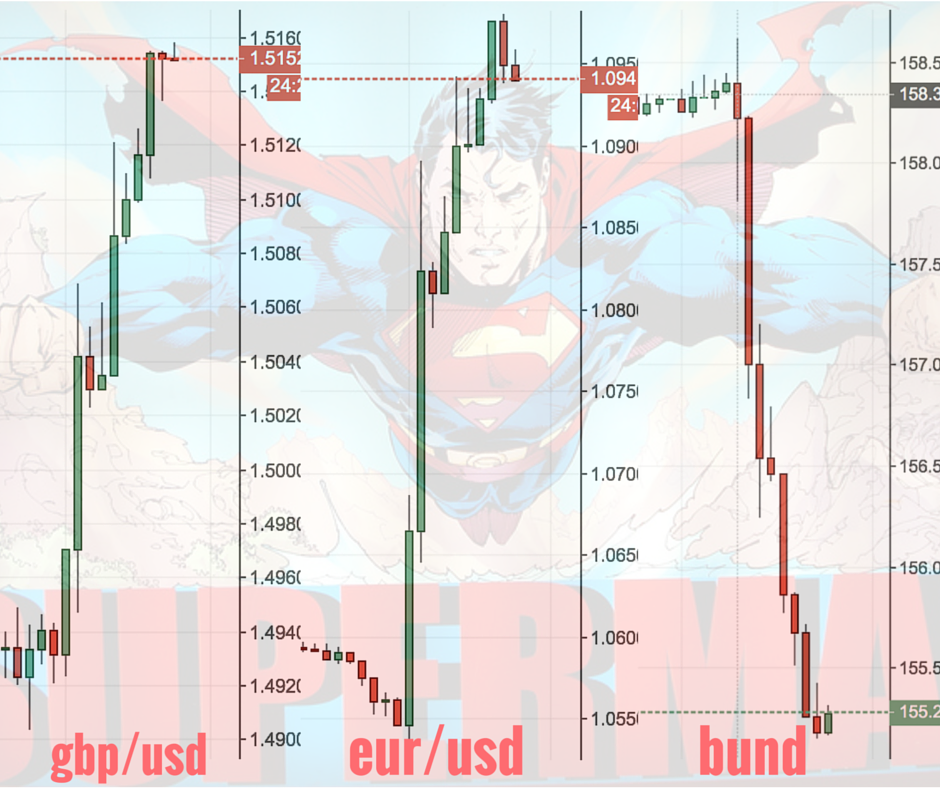

The ECB reduced the deposit-rate by 10bp, while extending the duration/scope of the asset-purchase programme. The reaction of the public (traders) reflects that they were expecting a more aggressive easing program. We are still in a downtrend for the EUR/USD, but the big market reaction from a price action point of view is leading us to believe that we might be expecting a trend-reversal. For the ones of you that are following my trading posts, or have subscribed to my website know that I don’t like counter-trend trades. I do take them sometimes, but most of the times I have done that, it hasn’t reflected in a positive P/L. This time the scenario might be different.

The trade for the day is coming from a major currency pair- GBP/USD. It experienced a sharp rise related the fundamental sparkle of the day. From a price action point of view I can see two thing:

- Major support level below the psychological level of 1.5000

- Bullish engulfing candlestick pattern on the Daily timeframe

These fundamental+technical signals are giving me a reason to be looking to enter in a long GBP/USD trade. I will be looking to go long around the level of 1.5100. My stop would be placed just under 1.4990. My initial target is the level of 1.5300. From then on it will come down to price action again.

Happy Trading,

Colibri Trader