Cypher Pattern Pros and Cons

I wish I could tell you trading the cypher pattern will make you a profitable trader.

I am not sure I can do that neither for the whole harmonic patterns trading methodology.

Harmonic patterns are very tricky for beginner traders to grasp.

Even later, as you understand the big picture, it requires more effort than other technical tools to master.

You probably already know by now, the cypher pattern is just one of a dozen harmonic patterns such as the bat, shark, ABCD, and others.

The cypher pattern specifically caused some disagreements among harmonic pattern traders.

There is an evident lure to pattern trading and even more disagreements about how they should be traded.

Not to mention the tug of war between the traders that do not follow pattern trading and those that do.

Some disclose 80% win rates using the cypher while others bash harmonic patterns altogether as a fool’s errand.

Anyways, let us start with harmonic pattern trading theory so you can see what makes it so pretty and so complex.

Contents in this article

- Cypher Patterns with Supply and Demand

- Setting SL and TP with The Cypher Pattern

- The Cypher Pattern Risk to Reward Ratio

- The Cypher Pattern- Opinions

- Cypher Patterns and Trends

- Cypher Patterns Can Be Traded Differently

- The Inventor of Harmonic Trading

- Cypher Pattern Pros and Cons- Summary

- My Take on the Cypher Pattern

The Idea Behind The Harmonic Patterns

Similar to our previous article topic about head and shoulders, harmonic patterns follow a similar idea.

- Some patterns repeat before a price move so we have an edge for our trading.

- All trading theories aim to predict where most likely the price will go.

- Fundamentals play a role, but harmonic patterns are pure technical analysis.

- Harmonic patterns are more rigid than other chart patterns.

When I say more rigid, I mean they have exact measurements between the points that form the pattern.

If all the measurements do not align with each structural point, we do not have a valid pattern.

Cypher pattern is not an exception, the ratio between the points has to match or we do not take the trade.

This leads us to the first con of the cypher pattern:

Harmonic patterns require specific structural ratios between points making them appear less often on any chart.

Trading the Cypher Pattern

Now, since we have to follow the construction rules, it also makes them harder to trade.

Here is what I mean:

- You will have to watch the charts and measure if a new candle formed a new pattern.

- Imagine now you trade on more than one market given the nature of harmonic pattern’s rare appearance.

- There are several patterns.

- If you trade on lower timeframes, this will be almost impossible.

- If you are trading the daily timeframe, you would certainly need a few hours to go through all of the harmonic patterns on all 28 non-exotic forex pairs.

- Then, since the candles change while you work, some of the patterns will be obsolete by the time you finish.

Some will say you do not have to repeat the same work every day, however, when compared with other trading methods, this is a chore.

So, we are facing another con:

Harmonic patterns are difficult and demanding to trade, especially on lower timeframes.

All this requires long skill-building you have to be ready for if you choose to trade the patterns.

It is a lot of work while, at the end of the day, harmonic patterns may not be superior to other trading methods at all.

Cypher pattern compared to the head and shoulders requires exact construction ratios.

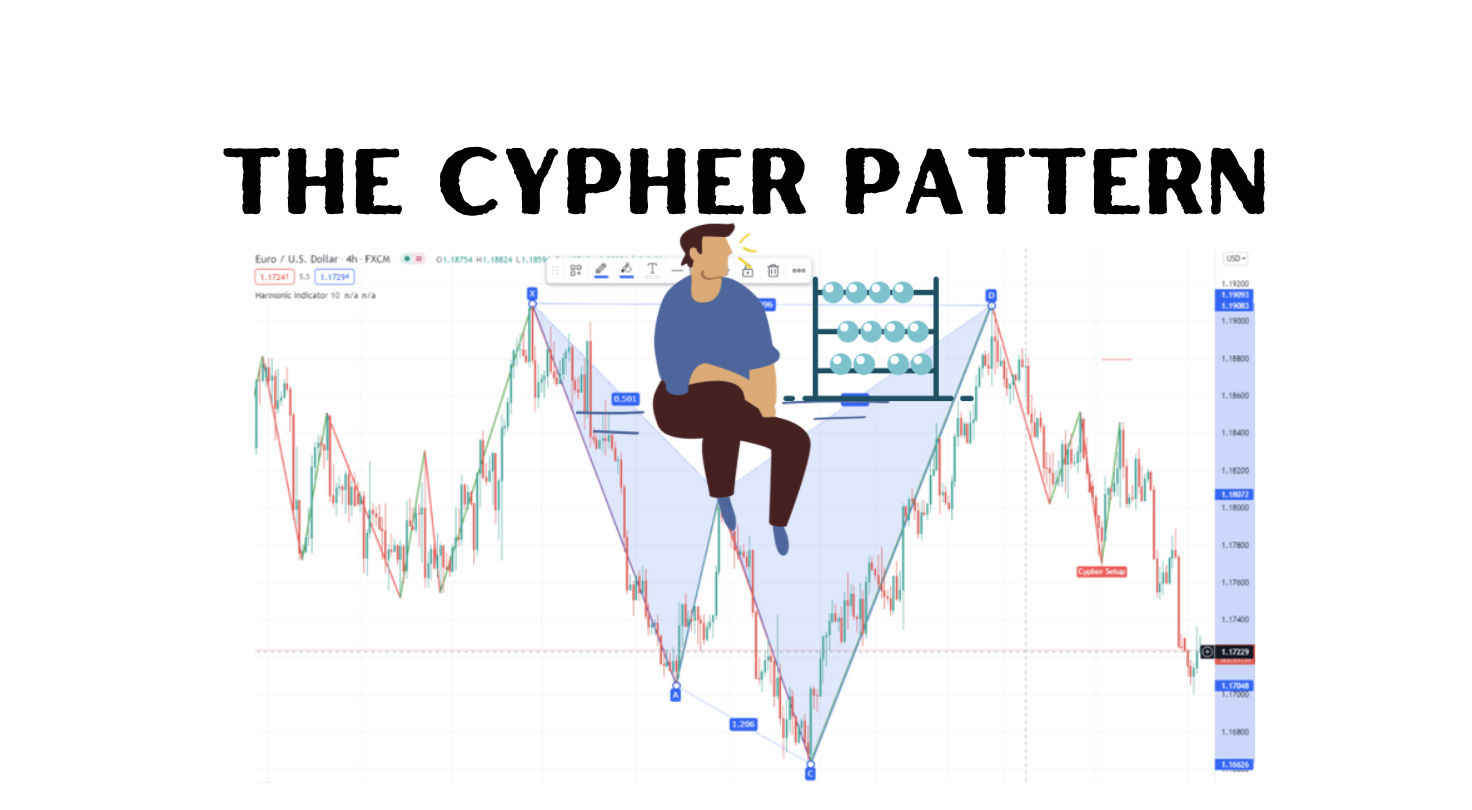

Notice the ratio numbers between the X and B, D, A and C, and B and D points when we draw the cypher pattern using Tradingview tools:

Harmonic Patterns’ Reliability

Do those Fibonacci ratios make the cypher more reliable?

I can conclude the same as with other chart patterns.

Guided by the research on the patterns from the head and shoulders article, cypher patterns come from the same theory type.

We make sense out of the randomness by making bats, crabs, sharks, cyphers, and other shapes.

Does the market really move when you make one?

Science says none of the results concludes there is a very strong correlation.

Does this mean there is no value to traders?

Well, all I can say is that if it works for you, keep doing it.

Cypher pattern and other pattern trading might not have scientific value, but can be the decision-making tools you need.

Drawing the Cypher Pattern

Also called the advanced patterns of Fibonacci technical analysis, harmonic patterns are closely tied to the Fibonacci levels.

Of course, Fibonacci ratios are as mystic as this pattern so it is natural to go in hand.

I will not trouble you with hows and whys about this but skip to the drawing.

Drawing starts with the X to A movement.

A cypher is a reversal pattern, so it can be found during both bullish and bearish trends.

In the picture above we see a bullish cypher example.

Here is step by step explanation with screenshots:

This bearish cypher pattern recently appeared on the EURUSD, 4H timeframe. The X starts at the highest point then (also called impulse leg).

1. Use the TradingView pattern drawing tool on the left and choose Cypher.

2. Click on the lower low and set the A point.

3. Now set the B point at the next high.

4. As we set up the C at the next low, notice ratio numbers emerged.

5. The final D point at the next high completes the pattern.

6. We have used an indicator called “Harmonic Indicator” that facilitates our search for cyphers.

The red short horizontal line above the “Cypher Setup” marking marks the entry point.

The good news is even though cypher patterns’ scanning is tiresome, there are free indicators that can help.

This also makes harmonic pattern trading less subjective, just be sure to use the same settings everywhere.

When I think about it, the ZigZag indicator is also a great tool for picking the right points, similar to the head and shoulders.

However, I will expand on the dark side of harmonic patterns in the next chapter.

Harmonic Patterns and the Internet

People that play hidden object games will definitely like harmonic patterns.

Finding patterns carries the same excitement as finding a secret way to the holy grail of trading.

This is a perfect setup for scams.

Unfortunately, harmonic patterns have characteristics scammers like:

- The results are variable and there will always be an excuse why your cypher pattern has failed

Scammers will then sell you the “right way”.

- Harmonic patterns are harder to find.

Sellers will then pitch you their scanning software (not necessarily a scam, however, there are already free indicators out there).

- Confluence with other tools to make your patterns better.

Again, a great lure to sell you some tools, even though they are not better than free versions on the internet.

- There are so many ways to trade harmonic patterns, even traders who use them fight which way is the “right way”.

Unfortunately, this will just confuse beginners so they have to sign up for some harmonic pattern course.

- Combine all this with an interesting, mystic way of trading and sellers have a great reason to open a business, fake or not.

Harmonic Patterns’ Typical Scam

Unfortunately, this left a stain on harmonic pattern trading in addition to the inconclusive value they provide.

If you are a scammer, you can get away with it.

Social networks made this a possibility.

Everyone can hide behind a fake account and post various trading secrets that make sense with harmonic patterns.

All you need to do is to post a successful prediction and get some followers, then sell your signals.

The price can go up, down, or sideways.

When it works just post the image so beginners will see you as legit.

Even with bad results, never face consequences, just like astrologists that miss predictions.

When it is not working anymore, just open a new account.

Beginners are optimistic, they see when it works and forgive when it does not.

Of course, this kind of “business” is almost risk-free, and when you draw pretty harmonic patterns, you will get noticed.

Cypher Patterns with Supply and Demand

Now that you know how to draw the cypher, it is interesting how it resembles a W for bullish and M shaped pattern for bearish expectations.

The W bottom levels are defined by a Fibonacci retracement or a demand zone.

Vice versa, the M tops are what most price action traders would regard as a supply zone.

Here is a new EURUSD 4H chart with multiple cypher patterns:

Notice the purple trendline that matches the first two cypher patterns.

Both of the bearish cyphers are successful but the third one did not complete, the price never reached the D point.

Disregard it, we never know if it will complete.

Yet, one could wonder, if it is the law of supply and demand that worked here…

Or is it the cypher pattern?

Possibly it could also be the trendline or the horizontal supply zone just above the X points?

What about the key Fibonacci levels that the harmonic patterns rely on?

The main takeaway is cypher and other patterns should be used in confluence with another type of analysis for best results.

The probabilities increase this way, and you should use other trading tools regardless of the success rate of the cypher.

You can always test what tool or tools made your trading better.

Stop using the cypher pattern and see if your results are better in back and forward tests.

At the end of the day, maybe the harmonic patterns are just a fun way to introduce trading to the masses using the right approach.

Setting SL and TP with The Cypher Pattern

Cypher and other harmonic patterns show where to put you stop loss and take profits.

As with all trading methods, having somewhat precise risk management (money management) pointers is of paramount importance.

This is the right approach, even if you have a 50-50 win rate with cypher, risk management will set you in the money over the long run.

With the cypher, stop loss should be placed above the XA leg.

The pattern is considered invalidated if the price moves past the X level, so using a stop loss makes sense.

Now, the take profit levels can be set up as a scaling out method if you like, since Fibonacci levels already define them.

Here is another example on the Gold daily chart:

This is a failed cypher, however, another pattern emerged.

It is a possible head and shoulders we discussed in our previous article HERE.

Even though this cypher pattern was not complete, it could have been used in addition to another trading tool.

But, more importantly, the picture above demonstrates how and where to put stop loss and take profit orders.

The red horizontal line sits just above the X, which marks a proper stop loss level.

The green horizontal lines are take profit levels placed at the Fibonacci 0.5, 0.382, and 0.236.

This is how you can use it, however, you can use a reversal indicator for exits, such as the RSI.

The Cypher Pattern Risk to Reward Ratio

Now, if you draw your short trade entry starting at the D point down to the last take profit, take a look at the risk-reward ratio:

The cypher pattern also considers optimal risk-reward ratio and scaling out options.

These lines are also important supply and demand zones.

Here is another recent example on the TLM crypto daily chart where we combine stochastic indicator as an additional confirmation:

If the price breaks through the X level (gray horizontal line), our bullish cypher gets invalidated.

Notice where the stop loss and take profit levels are.

Also, the risk-reward ratio is great, even at the current D point.

Note that the D point is not yet defined, so we’ll need to see the current price fall halting to a stop prior to that.

To confirm that, we could use the stochastic indicator.

The Cypher Pattern- Opinions

The following pros and cons come from traders that have used harmonic patterns as their main trading method.

It is interesting how harmonic patterns make a divide between traders even amongst those who follow this theory.

This is also a conflict between Fibonacci traders and those that do not rely on a “pattern” type of trading strategies.

Some traders that keep an open mind would like to see price testing the Fibonacci ratios to make sure they work and they are not just a myth.

Cypher Patterns and Trends

What about markets with steady, long trends?

This is the SPX index on a daily timeframe with the harmonic indicator on:

The free indicator I have used in this example found only one pattern since the COVID-19 pandemic breakout.

And it is not the cypher pattern.

You probably missed several pullback opportunities to get back into the now-famous bullish trend.

Some traders believe that the cypher and other patterns work only in ranging markets.

The cypher pattern is a reversal trading pattern after all.

On the other hand, certain traders call for a trend direction.

Trade only bullish harmonic patterns in an uptrend and trade only bearish on a downtrend, as they say.

So then, should we trade the reversal after cypher or the bounce back into the trend?

Or is the cypher a double move trade indication?

According to the traders’ opinion, the cypher can be a double move trade.

If this gives you any value, then go ahead and test it out on your own.

Cypher Patterns Can Be Traded Differently

As we move on I have also noticed some traders pick the C point as the trade entry.

This is confusing and also makes trading patterns sound like random picks.

However, it seems patterns reflect what you believe in, and I can only believe test results in my book.

One of the most interesting opinions is that the cypher pattern has the worst win rate of all patterns.

According to one source, cypher patterns have a 40% win rate at best.

But what take profit levels, market conditions and timeframes are taken into consideration…nobody knows.

It seems it is another personal opinion applicable only to one trading system.

But this just adds to the ambiguous nature of harmonic patterns.

The Inventor of Harmonic Trading

While we explore harmonic patterns we must mention Scott M. Carney.

Carney’s teachings require a lot of focus and are not completely free.

Scott Carney presents himself as the creator of harmonic patterns.

Interestingly, the cypher pattern is not in Scott Carney’s collection of harmonic patterns.

If you are really into harmonics, you should probably see what he has to offer.

Conclusion

The majority of harmonic traders agree, trading the cypher pattern alone might not work.

From my perspective, this statement is somehow incomplete.

Where should you place your take profit and stop loss orders?

Following the ambiguous cypher rules, you supposedly can reach a good risk:reward ratios, but is this really the case?

Does it mean the cypher pattern cannot be trusted`?

A trade is only profitable when it hits your target, or when you exit in the money, isn’t it?

This means you will have to find out what levels would work in your case.

Keep in mind that if you stumble on a terrible strategy that loses most of the time, all you need to do is to just flip it.

It then becomes a good one.

`Looking from this angle means that even bad strategies have value.

Looking from another, knowing how the cypher pattern works gives you meaningful insights into the trading mentality of pattern traders.

Cypher Pattern Pros and Cons- Summary

Now let’s summarise all of the pros and cons:

- Cypher pattern and other pattern trading might not have scientific value, but can be a good addition to other trading tools.

- The good news is even though cypher pattern scanning is tiresome, there are free indicators that can come handy.

- This also makes harmonic pattern trading less subjective, just make sure to use the same settings everywhere.

- The main takeaway is cypher and other patterns should be used in confluence with other trading tools for best results.

- Cypher and other harmonic patterns show where to put you stop loss and take profits.

- The cypher pattern also considers optimal risk-reward ratio and scaling out options.

- According to most traders using it, the cypher can be a double move trade.

- Harmonic patterns require specific structural ratios between points making them appear less often on any chart.

- Harmonic patterns are difficult and demanding to trade, especially on lower timeframes.

- Unfortunately, harmonic patterns have characteristics scammers like.

- Results show Fibonacci levels do not have any significance, then why would the cypher or any other harmonic pattern have any significance?

- Some traders concluded that the cypher and other patterns work only in ranging markets.

- One of the most interesting opinions is that the cypher pattern has the worst win rate of all patterns.

- Finally, the cypher pattern is not in Scott Carney’s collection of harmonic patterns.

My Take on the Cypher Pattern

My opinion is that the cypher pattern can teach beginner traders about good risk management.

Also, the cypher pattern could be useful to understand supply and demand, breakouts, and patience.

Probably the most important of all is the fact if you want to be successful you need to puts in the work to see what works best in your case.

However, the pros and cons above should set you right up if you want to pursue this trading theory.

Expectations are high and yet the cypher pattern might have worse P/L records than using a simple moving average.

Moving averages are simple, always visible, and are easily combined with basically any trading tool.

Harmonic patterns are not simple, invisible, and have a rigid structure.

Not to mention you also have to learn how to draw and use them.

To some this is enough not to ever try harmonic patterns and rely on proven concepts such as trading with the trend, or using moving average crosses, and so on.

In my opinion, a trader should have an open mind and still try somewhat esoteric pattern trading, but only after having experience with other systems.

Traders should never stop improving.

Without trying different approaches traders never advance their level.

Have you tried trading harmonic patterns yet?

If so, please share your experiences in the comments below.

Happy trading,

Colibri Trader