Crude Oil Trading Idea

Crude Oil Trading Idea

by: Colibri Trader

The trading idea from last time started to go in our direction, but then closed the day just below the resistance area at 0.7550. The candle that was formed was a bullish rejection, which showed that traders were not ready to conquer new highs. I have shown this on the screenshot on the right hand side. You can see the market hesitance and the following red candle taking stops out of the long traders. I was stopped out at 0.7440. This was not the best trade I have taken, but at least good enough to keep up awake and ready for challenges.

Crude Oil Trading Idea

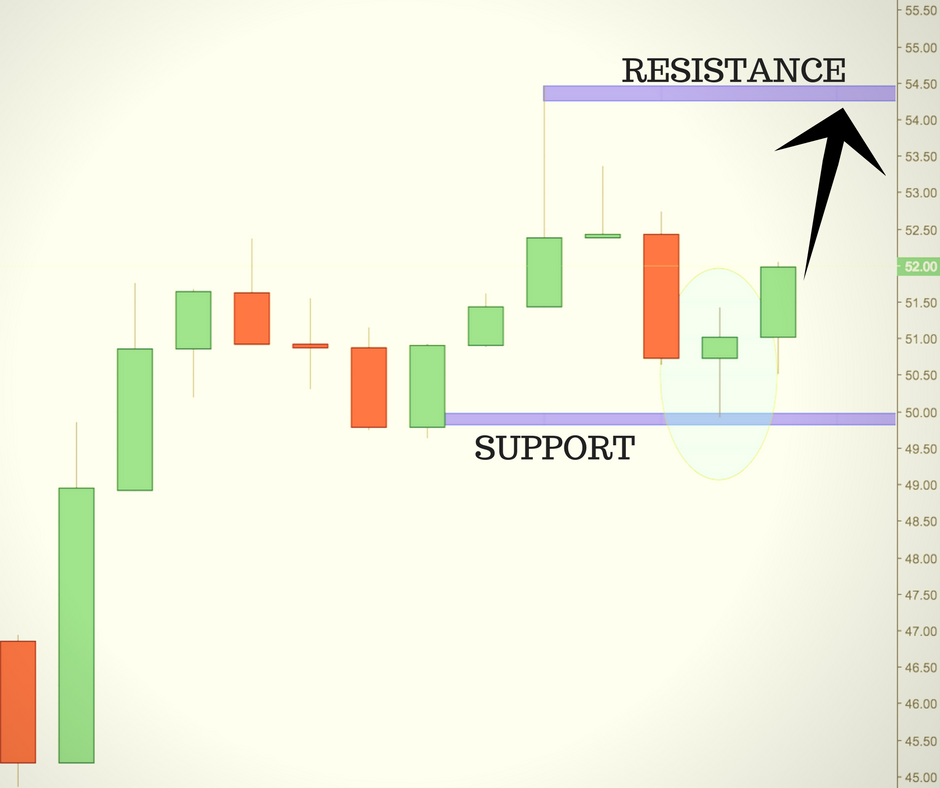

Today’s trading idea is coming from crude oil. As you can see on the picture on this post, crude has taken a small correction and now more buyers are showing on the scene. If you remember, in the past few weeks, I have written about crude oil and so far all trades have been extremely profitable. For the ones amongst you that are following my trading strategy, these trades might have been even more profitable. There were great setups on the 4 Hour chart, but here I will just stick to the daily. On Thursday, there was a bearish rejection candle that led to further gains on Friday. Now, I am looking for a long entry at around 51.50. My stop-loss would be placed just under 50.00, where the psychological support level is located. My first target is the level of 54.50. My secondary price target is the level of 60.00, as outlined in the previous articles.

Happy Trading,

Colibri Trader

p.s.

To check out my first article where I started building a position in this market, click HERE

Hi colibritrader,

I glanced at WTI Crude seeing if there was anything concrete in the way for along trade.

So far nothing except it is approaching 48.00 support and 4 days prior on daily TF has printed a strong pin. Now price is hovering at the 50% of the pin. I have seen patterns like this before just before a reversal in direction.

BUT price needs to confirm.

This has the potential makings of a long trade building imho.

Of course nothing concrete and more evidence required.

I’m posting this to make a record of my level of intuition as well. IE Am I on to some thing or am I way off.

This is some thing you some times comment on, I consider you as a type of mentor.

I think you reply as a type of mentoring.

What if the student wanted more interaction wth his mentor ?

Would you offer a mild form of it if the individual showed promise ?

I am seeking to reach higher levels and to be in a traders enviornment, can you advise me on the best way to accomplish this ?

I have access to considerable capital but I won’t risk any unless I can achieve a certain level of consistency and market understanding. I know I have your course but I want to be more immersed in the trading world

I wanted to know more about your KBC trading competition, I have googled it but could not find any information on it.

Thanks for any consideration

Hi Dan,

It is a good anticipation. I am looking at WTI, too. What I would like to see is for the price to dive down below 47.00. Then, I will be looking for a price confirmation and if one shows up, I will be happy to take a long trade. Regarding your other question, it is quite hard to break into an environment like that. There are also a lot of companies out there that are promising you the world, but in the end they are not delivering. So, it would be quite hard advising you on something like that. One thing I can tell you is that everywhere you go, they will ask you for track record- at least 12 months. There is a tendency now that they also require you to have a few programming languages and have a Math Degree or Physics MSc. The best way to check that would be to google trading jobs or go to for example efinancialcareers.co.uk and check what are some of the requirements for a trading related job. If you want, send me a PM to admin@colibritrader.com. The KBC competition is not live anymore. They have suspended it a few years ago I think.

Hi colibritrader,

(dailyTF)

The 50% area has attracted buyers, this bull candle forming has not closed yet

It has 9 hours to close.

Falling wedge pattern too (bullish)

I think it would be wise to wait for RSI to cross 50 line to confirm if trend change has occurred

low risk atm though

Good support is actually lower near 48.15 at the least … will be waiting

Maybe I’m waiting for too much confirmation

Will see tomorrow morning as candle will close while i’m asleep

Regards

Hi Dan,

I am looking for a dip below the 47 area and then might consider going long if price action confirms my anticipation. There is a small falling wedge, although I am not really looking into that. I am more of waiting for a confirmation according to my trading strategy- the trading course you have taken already

Hi colibritrader,

Thanks for your replies, yes following your strategy will be the best thing 🙂

Regards

Thanks Dan

Hi colibritrader,

Yes a nice pin bar has formed with a low of 43.74

Could you help me understand something, crude looks like it’s in a d trend would it be best to wait for a trade signal to form allowing to join in the direction of the trend ?

I think if one has enough experience a counter trend trade is always possible.

Thank you