Is Contrarian Trading or Going against the Trend Good for You?

What is Contrarian trading?

In general, contrarian trading consists of taking speculative trading positions that are opposed to the prevailing directional trend.

This sort of strategy is also known as “swing trading” or “counter-trend trading”.

Some contrarian traders also seek to trade against a strong bias in market sentiment.

When it comes to trading stocks, the contrarian strategy can also be considered a form of value investing.

That is where the trader or investor typically looks to buy undervalued assets.

Those assets’ prices are showing signs of reaching a significant low point in order to sell them when they later appreciate.

A contrarian trader might also look for overvalued assets whose prices look set to turn significantly lower in order to short such assets.

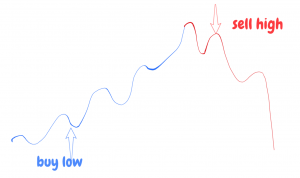

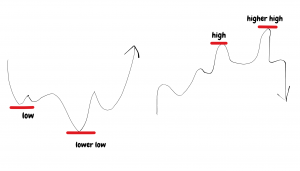

Rather than following the trend, as most novice traders are taught to do, the overall goals of contrarians are to do the opposite.

They either buy tradable assets cheaply and then profit after their undervalued market reverses correctively.

Or alternatively sell them while expensive and buy them back at a cheaper price.

This tendency therefore makes contrarian trading more of a “buy low, sell high” type of trading strategy.

Contents in this article

- Chapter #1: Why Traders Use Contrarian Strategies

- Chapter #2: Common Momentum Indicators Used by Contrarians

- Chapter #3: Using Momentum as a Contrarian Trader

- Chapter #4: Using Market Sentiment as a Contrarian Trader

- Chapter #5: How Contrarian Traders Play Crowded Markets

- Chapter #6: Setting Stops as a Contrarian

- Chapter #7: Why I Prefer Trend Trading to Contrarian Trading

Chapter #1 Why Traders Use Contrarian Strategies

If you were told when learning to trade that “the trend is your friend”, then you might be curious as to why some people do not follow this traditional advice.

Instead prefer to engage in contrarian trading.

Certain market participants prefer contrarian trading because they can make money when the market moves or swings both with and against the prevailing trend.

Such traders may be fine with a more active trading style where they have to watch the market closely during busy periods.

Like trend traders, traders using contrarian strategies typically need to be comfortable taking overnight positions.

This distinguishes them from day traders and scalpers who generally only take positions on an intra-day basis.

Furthermore, contrarian traders tend to believe that they can predict peaks and troughs in the market with reasonable accuracy using technical analysis methods.

They may also base their contrarian trading strategy on the idea that the market tends to revert to its mean or average value over time.

This so-called mean-reversion theory suggests that if a market rises too far, it needs to fall, while if it falls too far, it needs to bounce.

In practice, however, markets can trend for a considerable time in one direction and stray far from their average value.

Assuming a market will revert to its mean can therefore be potentially problematic.

If you do not have a very well-funded trading account that you are willing to tolerate substantial unrealised losses in this might be an issue.

Even if the market reverses to conform to this theory eventually.

Contrarian traders also want to avoid being too early in calling a market reversal.

If they buy too soon during a crash, the market may never bounce enough for them to get out profitably.

Similarly, if they sell too soon into a rally, the market may not pull back sufficiently to make their trade a winner.

Chapter #2: Common Momentum Indicators Used by Contrarians

In the financial markets, momentum refers to a market’s ability to sustain a rise or fall in prices over time.

Contrarian traders often look at momentum-based technical indicators that can tell them when a trending market’s momentum is starting to wane.

Although a discussion of the computation and merits of the most common momentum indicators used by contrarian traders is outside the scope of this article, they include:

- The Relative Strength Index (RSI)

- Bollinger Bands

- The Momentum Oscillator

- The Moving Average Convergence Divergence (MACD) indicator

- The Average Directional Index (ADX)

Most of these popular momentum indicators provide objective contrarian trading signals.

These can be included in a trading plan and used by contrarians to establish positions against the prevailing trend.

Chapter #3: Using Momentum as a Contrarian Trader

Contrarian traders typically look at one or more of the technical indicators mentioned in the previous section to tell them when market momentum is waning.

Once they see that the momentum of a trend is waning, that condition signals to them that the upwards or downwards trend is losing steam.

It is therefore prone to correcting in the opposite direction.

While virtually nothing is guaranteed in the financial markets, this probable scenario plays very well into the average contrarian trader’s game plan.

Thus, if an uptrend shows waning momentum, the contrarian will typically look for levels to sell into it.

If a downtrend shows waning momentum, the contrarian will look for an opportunity to buy into it.

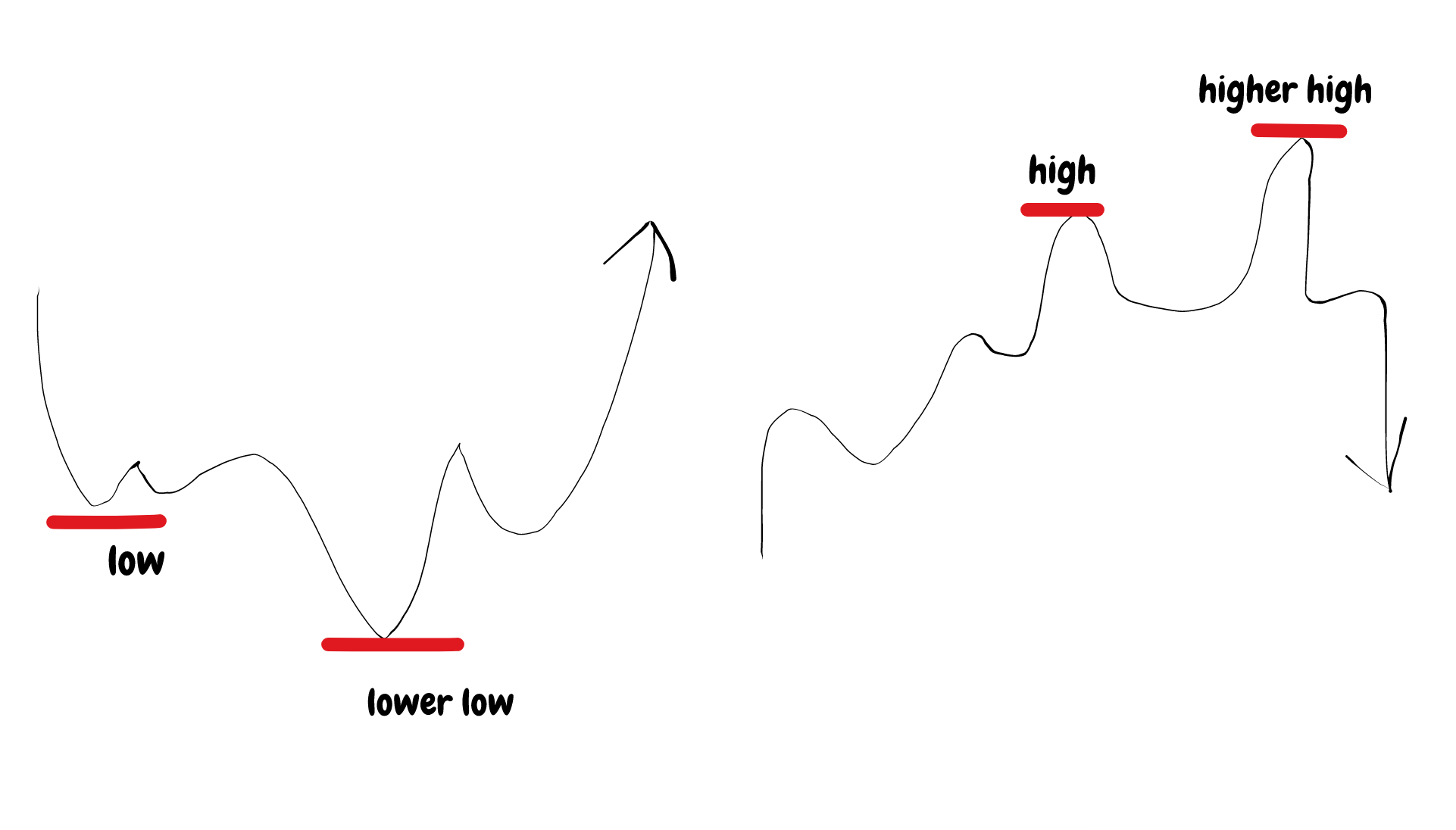

For example, a contrarian trader might see bullish divergence on the RSI in oversold territory after a substantial downwards trend.

This classic reversal signal occurs when the RSI reads below 20 on two successive dips in the market price of an asset.

On the other side, while the price makes a new low, the RSI does not.

Contrarily, bearish divergence occurs when the RSI reads above 80 on two successive peaks in the rising market price of an asset, but while the price makes a new high, the RSI fails to.

Both of these classic signals suggest the momentum of the underlying trend is waning so a market reversal could be imminent.

Chapter #4: Using Market Sentiment as a Contrarian Trader

In addition to using momentum indicators, contrarian traders might look for situations when market sentiment becomes excessively biased.

A popular way of looking at market sentiment and dynamics in a variety of asset classes is to review the Commitment of Traders (COT) report.

This report is put out on a weekly basis by The Commodity Futures Trading Commission (CFTC).

The report includes each market where the open interest includes 20 or more traders who have positions at or above the CFTC’s established reporting levels.

If the COT report shows that market sentiment for a particular asset has become excessively directional, then that tends to be seen as a contrary indicator for the asset.

Thus, if the market sentiment is too bullish or optimistic, the market is ripe for a correction lower, so a contrarian trader would look to sell.

Alternatively, if the market sentiment is too bearish or pessimistic, then the market is seen by a contrarian as ready for a corrective rally, so they would look to buy.

In the U.S. stock market, the American Association of Individual Investors (AAII) Sentiment Survey measures what percent of personal investors are bullish.

It also measures the neutral or bearish on the stock market over the short term.

Members are polled via the AAII’s website each week.

Since retail investors are typically the last to take part in a market trend, the market is often already losing momentum and getting ready to reverse.

Chapter #5: How Contrarian Traders Play Crowded Markets

A market characterised by overly-directional sentiment is known colloquially among traders as having “crowded longs or shorts”.

This depends on whether market sentiment is respectively overwhelmingly bullish or bearish.

Remember: Such crowded conditions are seen as ripe for corrections because of the tendency of traders to place stop-loss orders. This protects them from losses they cannot comfortably stomach.

Also, the popularity of trading using technical analysis means that many traders are looking at the same charts.

They are drawing similar conclusions as to the levels where their stops should be placed.

This tends to create a strong concentration in the market of stop-loss orders that are situated at or near particular key levels and can be triggered as a group.

Large and sophisticated players can also look at the charts to know roughly where these orders will be placed.

Furthermore, they know that these orders can be readily triggered when they trade in large size against a strongly-directional market that is not expecting such hefty opposition.

NB: Such traders are contrarian in nature!

They take sizeable short-term positions with the aim of profiting from the strong resulting counter-trend move once the stops of unsuspecting technical traders are triggered.

Once that anticipated move has happened, the large players typically cover their positions at a profit.

Chapter #6: Setting Stops as a Contrarian

Most trend-following traders have a good sense of where they need to put their stops in case the market reverses.

In contrast, contrarian traders can vary substantially in how they cut their losses to protect their trading account.

One rather risky contrarian strategy used by some traders involves scaling into a counter-trend position by increasing their stake as their losses increase.

This is the infamous “averaging” strategy that can ultimately lead to very uncomfortable losses.

If a trader does not have suitably deep pockets and enough patience to wait for the expected market reversal to materialise this might mean trouble.

Another more conservative and predictable stop-loss strategy used by contrarians involves choosing a percentage move.

It should be in the direction of the trend beyond which they will admit that their counter-trend position was incorrect. They will seek to cover it.

Thus, if their planned stop percentage was 1 percent, and a market they shorted rose by 1 percent, they would then buy back their short position at a loss.

Chapter #7: Why I Prefer Trend Trading to Contrarian Trading

Overall, while contrarian trading is definitely popular with some people and can show promising results, at least initially, I generally prefer to stick to following the trend myself.

Cost effective: this helps reduce my transaction costs, as well as the time I need to spend watching the market.

Trend trading also lets me take a more considered, hands-off and disciplined approach to trading the market once a trade has been initiated.

Instead of watching indicators closely for signals, I can just enter stop-loss and take profit orders into the market to automatically close my position out.

Then, one of them gets executed and then step away from the trading screens.

Another benefit of trend trading is that it helps me avoid the many risks involved in trying to pick market tops and bottoms

This includes possibly having to tolerate substantial unrealised or actual losses.

As the rather amusing trading adage goes, “A trader who tries to pick bottoms gets a handful of crap”.

This is exactly what happens when what looks like a “cheap” asset to a contrarian trader gets even cheaper.

That analogy illustrates why contrarian trading may not be the best strategy for you in the long run if your goal is to make money trading on a regular basis.

p.s.

Have you checked my recent article on Day Trading?

Well explained.

Thank you sir.

My pleasure. Let me know if you have any questions 🙂